Iceberg Order: What Is It And How Does It Work?

In capital markets, large trades can profoundly shape the price of a stock or asset, leading to sudden volatility and unfavourable price shifts. To avoid these disruptions, traders often rely on advanced order types, such as the “iceberg order”.

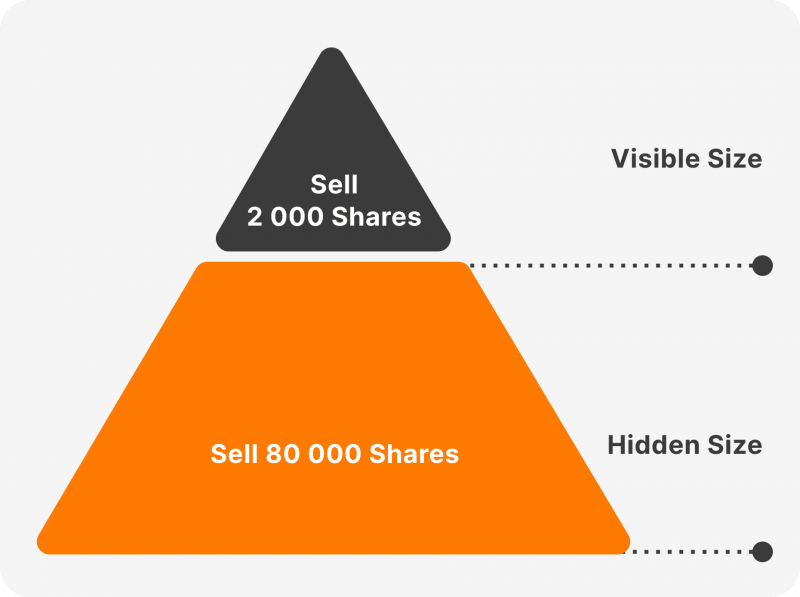

Named after the way an iceberg’s tip is visible while most of it remains hidden beneath the surface, an iceberg order allows traders to execute large trades without revealing the full size of the transaction to the market.

By keeping most of the order concealed, this strategic tool helps minimise market impact, ensures smoother execution, and prevents other traders from reacting prematurely to large transactions.

This short guide will shed light on an iceberg order, how it works, and what types of investors use it in their trading practices.

Key Takeaways

- Iceberg orders are large trades broken down into smaller, more manageable limit orders consisting of visible and hidden portions, with the hidden part becoming visible only after the visible portion has been executed.

- Typically used by large institutional investors, iceberg orders help prevent market disruptions that could occur from placing a single, massive order.

- Savvy traders can capitalise on iceberg orders by purchasing shares just above the price levels supported by the initially visible portions, anticipating the gradual execution of the larger hidden order.

What Is an Iceberg Order?

An iceberg order is a type of large trading order divided into smaller, more manageable portions, with only a small part of the total order being visible in the public order book at any given time.

The metaphor comes from the idea of an iceberg, where only a small portion is visible above the water’s surface while the majority remains hidden beneath.

This order type is primarily used by institutional investors and traders who want to carry out large trades without seriously jeopardising the market price. By revealing only a fraction of the total order, the trader can prevent other market participants from reacting to the full size of the order, which could lead to unfavourable price changes or market volatility.

Iceberg market orders are particularly effective in minimising market disruption, as they help maintain price stability by preventing sudden shifts caused by large orders being placed all at once. Without an iceberg sell order, a large buy or sell order could cause a significant move in the asset’s price, either driving it up or pushing it down sharply.

Fast Fact

Iceberg orders are not supported during pre-open & post-market sessions on any capital market.

How Does an Iceberg Order Work? — Step-By-Step Breakdown

Iceberg order has a special purpose in any market, especially in volatile periods, and helps to balance the imbalance between the level of supply and demand to avoid a sharp jump in the price of a particular asset. Here is how such an order is executed:

Order Placement

The trader decides to place a large order (either to buy or sell a security) but does not want to reveal the entire order in the public order book. The trader divides the large order into smaller segments and uses an iceberg order to manage this. The trader specifies the total order size and the visible portion (the part that will appear in the order book).

Visible Portion of the Order

Only the visible portion is shown in the market’s order book when the order is placed. For example, if the total order is 10,000 shares, the trader may make only 500 shares visible to the market. This makes the visible order look like a small, regular trade, helping to avoid attracting attention.

Execution of the Visible Portion

As the visible portion (500 shares) is executed by other market players buying or selling, the order book updates to reflect that a part of the trade is filled. The remaining visible portion remains in the market until it is fully executed.

Replenishment

Once the visible portion is filled, the system automatically replenishes the order by revealing another 500 shares from the hidden portion. This new portion is placed in the order book as if it were a new order, maintaining the appearance of small, regular trades rather than one significant transaction.

Repeat Until Completion

This process of replenishing and executing continues until the entire order (10,000 shares in this example) has been filled. A new portion is revealed each time a portion is executed until no shares remain hidden.

Final Execution

Once the total size of the order is completed, the trader’s iceberg order is fully executed, and the large trade is processed gradually without revealing the complete size at any one time, thus avoiding massive market disruption.

Who Typically Uses Iceberg Orders?

Today, the iceberg order is a multi-purpose and universal tool for stabilising the trading process due to market volatility and other factors strongly influencing the dynamics of changes in the value of a particular asset. Therefore, many types of investors use it, and among them there are the following groups:

Institutional Investors

Institutional investors commonly use iceberg order indicators, such as hedge, mutual and pension funds. These institutions often deal with large volumes of assets, and placing such sizable orders in the open market could lead to significant price fluctuations. By using iceberg orders, they can conceal the full size of their trades, reducing market impact and achieving better execution prices.

High-Net-Worth Individuals

Wealthy individuals who manage large portfolios or execute high-volume trades may also use iceberg orders. Since their trades could cause noticeable price changes, iceberg orders help them avoid driving prices against their interests, ensuring their large trades are executed efficiently and discreetly.

Algorithmic Traders

Algorithmic traders, who rely on sophisticated trading strategies and automated systems, often use iceberg orders to break down their large trades into smaller parts. This is especially useful in high-frequency trading, where executing large orders simultaneously could disrupt market conditions or trigger reactions from competing algorithms.

Corporate Traders

Corporations buying or selling large amounts of stock for mergers, acquisitions, or stock buybacks also benefit from iceberg orders. By masking the size of their trades, corporations can prevent other market participants from anticipating their actions, which could lead to volatility or unfavourable price moves.

Market Makers

Market makers, whose role is to provide liquidity by placing buy and sell orders, might use iceberg orders to manage their inventory without exposing the full scope of their positions. By hiding the true size of their trades, they can balance supply and demand without significantly impacting the market or revealing their trading strategies to competitors.

Conclusion

Iceberg orders are a valuable tool for traders and investors who need to conduct large trades without revealing the full scope of their transactions. By breaking down a large order into smaller, visible portions, traders can minimise market impact, prevent significant price fluctuations, and achieve better overall execution.

Used primarily by institutional investors, high-net-worth individuals, and algorithmic traders, iceberg orders provide a strategic advantage in maintaining discretion and avoiding adverse market reactions.

FAQ

What is an Iceberg Order?

An iceberg order is a type of large trading order split into smaller parts. Only a tiny portion of the order is visible in the market at any given time, while most remain hidden. This helps traders execute large trades discreetly without impacting the market price.

Why is it called an Iceberg Order?

The term “Iceberg” is used because, like an iceberg, only a tiny part of the order (the tip) is visible above the surface (the public order book), while the majority remains hidden below.

Why do traders use Iceberg Orders?

Traders use iceberg orders to avoid revealing large trades, which could cause dramatic price swings. By displaying only a small portion of the total order, they can prevent the market from reacting to the full size of their transaction, thus achieving a better average execution price.

How does an Iceberg Order work?

An Iceberg Order operates by displaying a small, predetermined part of the total order in the order book. As this visible portion is executed, another small portion from the hidden part is unveiled. This sequence repeats until the entire order is fulfilled.

Who typically uses Iceberg Orders?

Iceberg orders are primarily employed by large-scale investors, such as hedge, pension and mutual funds, as well as high-net-worth individuals, algorithmic traders, and corporations dealing with substantial stock or asset volumes.