Forex Expert Advisor: How It Works and Why You Should Use It

Robots might be thought of as a thing of a distant future, but in fact, they are already helping us in various spheres, including Forex trading. Forex robots, or Forex expert advisors, are designed to make trading more efficient and easier. These robots can trade around the clock without interruptions, allowing for quick trade initiation and execution execution.

Traders who do not use these features may struggle to analyse and compare numerous charts, technical indicators, and market moves simultaneously. In this article, we will have a closer look at what EAs are, how they work and how to pick the best one for your needs.

Key Takeaways

- A Forex EA is a trading program that helps traders make informed decisions.

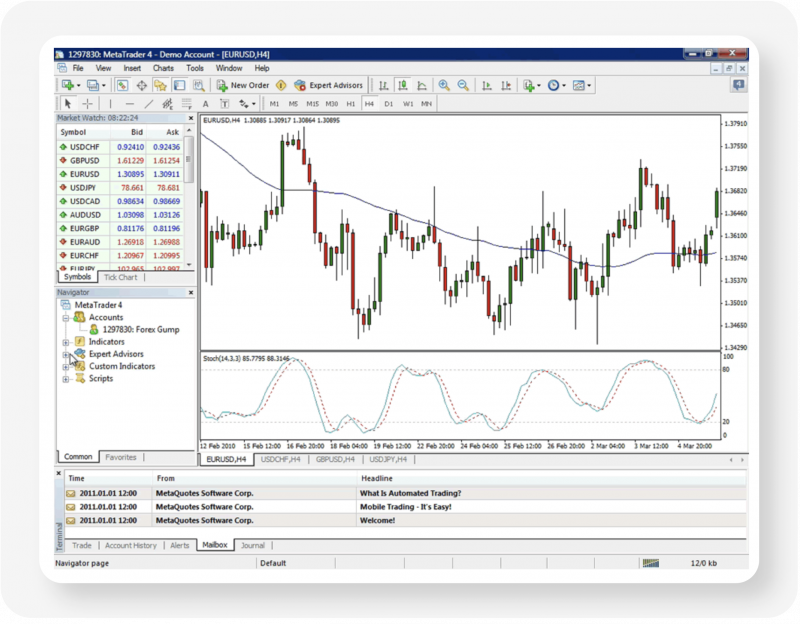

- EAs are programs based on the MetaTrader4 (MT4) platform built with MQL programming language.

- EAs use a combination of set-up rules to execute trades automatically; they can be used in combination with other trading tools.

Understanding Expert Advisors

A forex trading robot, also known as an expert advisor (EA), is a fully automated trading program that helps traders make informed decisions about buying or selling a specific currency pair. EAs are programs based on the MT4 platform that are built using MQL scripting language.

These robots use algorithms to monitor and trade financial markets. They find opportunities based on set parameters and can notify or open positions automatically. EAs can add close conditions like stops, trailing stops, and limits.

They can monitor Forex markets or open multiple positions daily with minimal human input. Each expert advisor is unique and is created in accordance with the preferences of the trader.

EAs are fatigue-free, do not trade based on emotions, lose concentration, or make mistakes. They can trade at a speed no human can, considering variables for multiple currency pairs and making trades at a constant pace, remove trading psychology from the equation, which can sometimes negatively impact a trader’s performance. However, this is not a foolproof strategy, and caution is always advised.

How To Use Expert Advisor in MT4

Installing and using EA on MT4 is simple. You need to proceed with the following steps to start using the advisor on the trading platform:

- To install an EA, create or download it, then copy and paste it to the Expert folder located in the MetaTrader4 folder on your device.

- Launch your MT4 platform.

- Click the “+” sign under the Navigator panel in the Expert Advisors section, then drag the selected EA onto one of the charts on the platform.

- Set up your EA in the pop-up box showing the settings and click OK.

- Restart MetaTrader 4 for your changes to take effect.

Now, your EA monitors and executes trades based on the set-up criteria.

Who Should Use EAs?

EAs are widely used in FX trading, with some traders exclusively using them and others diversifying their usage with manual strategies. The suitability of EAs depends on a trader’s personality.

Expert advisors may be worth trying for those struggling with decision-making and feeling emotionally overwhelmed when trading using a manual trading strategy. However, those seeking control may struggle with EAs frequently and may not feel comfortable using them for extended periods.

A demo account can be a good option to test EAs in a risk-free environment and decide if this trading aid is suitable for you.

EAs can be really helpful, especially for beginner traders. However, it is crucial to bear in mind that there is no perfect automated trading system, and even profitable bots can stop working abruptly due to market conditions.

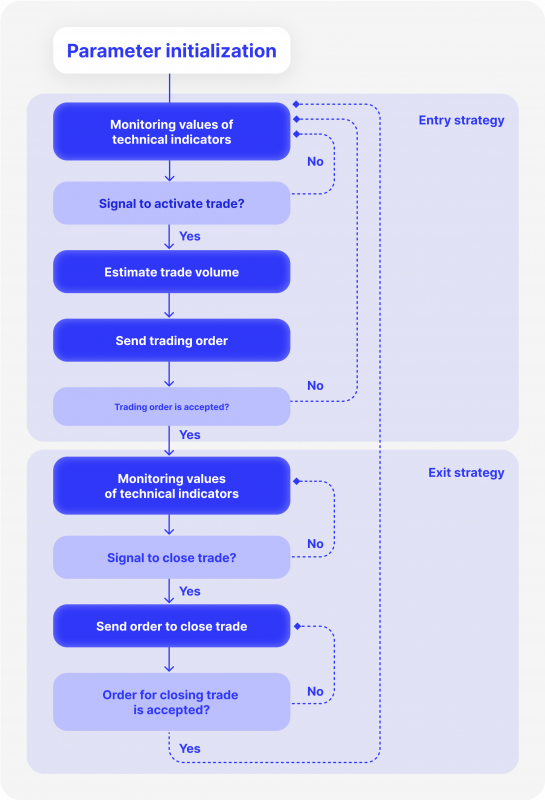

How Does a Forex Expert Advisor Work?

EAs enable traders to set parameters for opportunities and positions opening and closing using yes/no rules. They can be built or imported, and by combining multiple rules into a complex mathematical model, EAs can execute sophisticated trading strategies, making decisions and acting on them almost instantly.

EAs can be used alone or in conjunction with other trading software like charting platforms. Most EAs require customisation, setting parameters like risk per trade, asset types, and trading timeframes.

Once customised, EAs can trade independently or generate trading signals for users. Regular monitoring and adjustments are crucial for EA performance, as it helps ensure smooth trading decisions.

MQL4 and MQL5 are programming languages used for creating trading robots, custom indicators, and scripts for MT4 and MT5 platforms. Supported by MetaQuotes, there is a large community of developers sharing EAs on forums.

You can download and install a free Forex expert advisor, or if you know the MQL programming language, you can create your own EA from scratch. After developing your trading robot, it is recommended to backtest it and run it in a demo environment before going live. This will help you understand the logic behind the EA better and make necessary adjustments when needed.

How to Choose the Best Forex EA

Finding the right EA can be challenging, and there are downsides to consider. Nevertheless, here are some factors you should take into account to make the right decision for Forex EA.

Back-Testing Against Historical Data

Forex EAs should be able to back-test their trading ideas or strategies against historical data and provide a verifiable track record on platforms. It is essential to choose robots with results you can trust and that display live trade results rather than simulated ones.

Fees And Expenses

Fees and costs should be considered when choosing a Forex EA, with some offering monthly subscriptions and others requiring one-time subscription payments. Drawdown, which measures the volatility of trading systems, should be low, with 25% or lower being a good guide.

Most automated forex traders offer common payment methods, including wire transfer, credit card, PayPal, and Bitcoin. Deposit and withdrawal limits vary between service providers, with some robots requiring a minimum investment of $100 or more.

Reputation and Security

A good reputation is crucial when choosing an EA, as online testimonials and genuine reviews can help make a well-informed decision. Security is also important, as the software program will be installed on your computer or laptop hard drive, allowing access to your private financial history and personal information. It is essential to check if the service provider offers encryption and keeps your trading history hidden.

User Interface

The user interface should be simple and easy to navigate, and signing up for a demo account is recommended before trading with real money.

By carefully considering these factors, you can make an informed decision when choosing a forex EA.

Top 3 Forex Expert Advisors

If you have read all the recommendations for picking a perfect EA and still have doubts about selecting one out of multiple Forex expert advisors, here’s a list of the most popular and well-liked EAs you can choose from.

Waka Waka

Waka Waka is a Forex Expert Advisor with a world record of +6450% account growth and 59 consecutive months of profit. Developed by Valeriia Mishchenko in June 2018, it has verified track records on live accounts for +4.5 years. Waka Waka is a powerful grid trading system that exploits market inefficiencies rather than fitting historical data. It is fully customisable and can be integrated with both MT4 and MT5 platforms.

Moreover, it offers outstanding customer support. The EA supports currency pairs AUDCAD, NZDCAD, and AUDNZD, offers three risk profile settings, is insensitive to slippage and spread, and requires only one chart for trading all symbols.

However, Waka Waka uses a martingale strategy for risk and is more expensive than other bots.

Coinrule

Coinrule is an automated FX robot that can analyse the Forex market, send trading signals, and execute trades for users. Users can create their own rules or choose from over 150 provided rules. Coinrule is easy to use and suitable for beginners and advanced Forex traders. It also functions as a crypto trading robot. Coinrule offers various subscription tiers, from a free starter account to a $449.99 monthly professional account, suitable for professional traders.

However, the starter trading account lacks features, making it a less suitable option for beginners.

Forex Gump

Forex Gump is a beginner-friendly automated Forex robot software that offers a demo account for practising profitable trades. It offers nine currency pairs and two accounts, one priced at €199 and the other at €399, with multiple live and demo accounts to use on the more expensive account. This EA also offers a demo account to practise your trades and test your strategies before you put them into effect with real money.

However, Forex Gump only offers nine currency pairs. Also, both accounts offer a 30-day money-back guarantee and a minimum deposit of $4,000 for automated Forex trading, so if you want to try automated Forex trading with a small initial investment, you may want to use a different software.

Conclusion

A Forex Expert Advisor is software that automates trading decisions and works with the MetaTrader platform. However, along with many advantages, EA trading comes with risks, so it’s crucial to understand their workings and take steps to protect your EA from hacking or offline access.