Best API Integrations For Crypto Exchanges

Cryptocurrency exchanges are a vital piece of the industry. They offer a pool of currencies and digital assets where crypto traders can buy and sell coins to store them or trade them and make a profit. However, if you are running a crypto exchange business, you need to know how to use APIs to make your platform interactive, streamline cryptocurrency data, simplify login and security protocols, and provide real-time market data.

Make sure you read until the end to learn more about APIs and find the best crypto exchange APIs.

Key Takeaways

- APIs – application programming interfaces – allow data sharing between different websites, enabling websites to work efficiently.

- Crypto exchanges use APIs to retrieve market data, smoothen the user experience and set different compliance, security, and activity standards.

- API key is triggered by different actions, like providing prices to airlines and travel websites, showing the weather forecast, and processing payments.

Understanding APIs

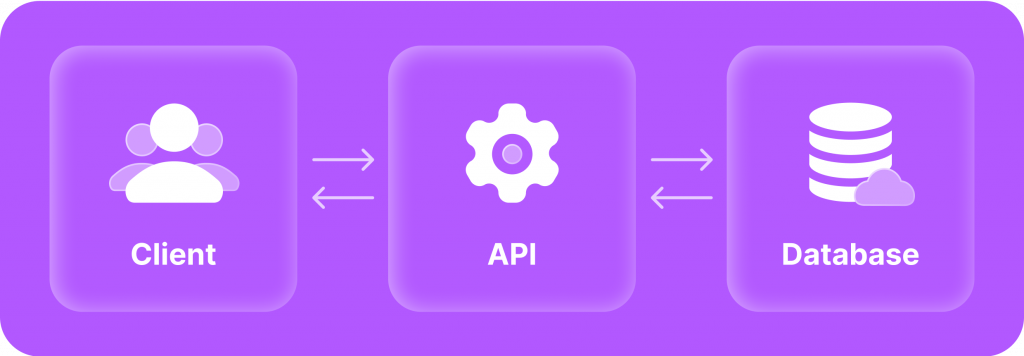

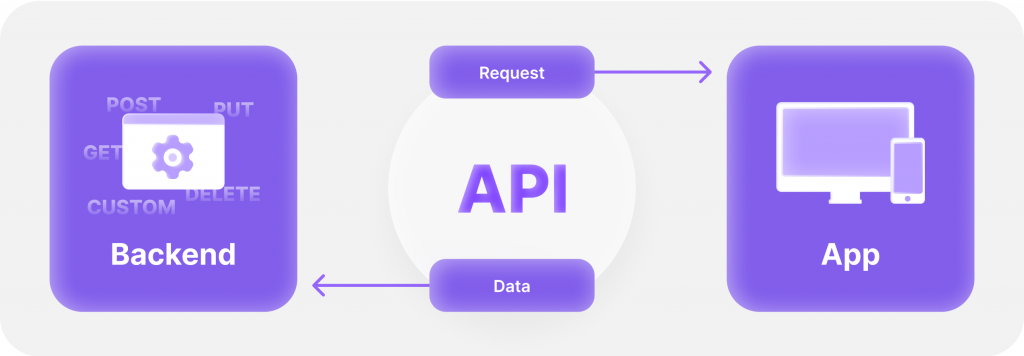

Application Programming Interface (API) refers to the set of protocols and software that allow data transfer and communication between different applications.

APIs work as intermediaries between two or more applications, setting a common language between these sites to trigger some actions or perform tasks smoothly. The protocols include API endpoints or rules that dictate how the application reacts when specific conditions are met.

For example, the weather display on the Google search engine uses APIs. Since Google is not a weather website, if you look up the weather in your country, you will see a boxed display of the weather, which is triggered using API protocols from weather websites and sources.

API Functions

APIs serve different purposes depending on how they are used, the type of API, whether private or free API and the functions they trigger.

Private APIs are used for internal teams like the HR department and sales teams to perform specific functions, while open source is a free API for the public, where developers can use them to integrate different websites or enable widgets on their applications.

API codes are used to provide airlines and travel websites with prices and travel details. APIs are also used to embed a YouTube video clip on a website or to process transactions while paying online.

Why You Need A Crypto API For Your Exchange

Like any website or application, exchanges utilise APIs to define users’ journey from registration to signing in and trading activities.

Crypto API keys are triggered to enable users to log in successfully to their trading account, view the trading platform, check updated prices, and analyse historical market data.

Additionally, traders can apply many functions and user-management tools to their accounts with crypto APIs automatically triggered by user entry data.

Best Crypto APIs For Your Crypto Exchange

Cryptocurrency exchange API involves keys and codes that serve their purposes differently. Also, exchanges may use different crypto APIs according to the sources from which they get their market data and prices.

However, there are elementary cryptocurrency APIs that most exchanges use to make the best use of their platforms.

Trading API

These are the most important cryptocurrency APIs for exchange platforms because they enable all the trading activities on the platform. Using a trading API, traders can execute different market orders, modify or manage their current orders and view previous orders.

These APIs enable users to apply different trading tools like stop loss/take profit orders, limit orders, and other orders that help the trader in their market activity.

Trading API keys are triggered when a trader views price or historical market data like analysis, insights, and news from other sources. They can be used to open price charts and apply different indicators.

Wallet API

Crypto wallets are important in crypto trading, where bought coins are stored, and cryptocurrency trading activity is stored. Exchanges use wallet APIs to open a wallet, create crypto data and retrieve the wallet address to receive or send payments.

These APIs are also used to integrate the wallet with the trading platform and view the wallet owner’s information and crypto data like balance and transactions.

Wallet API is triggered when a user performs different wallet activities like validating smart contract operation when doing a transaction, processing transaction fees and displaying the fee details on the checkout.

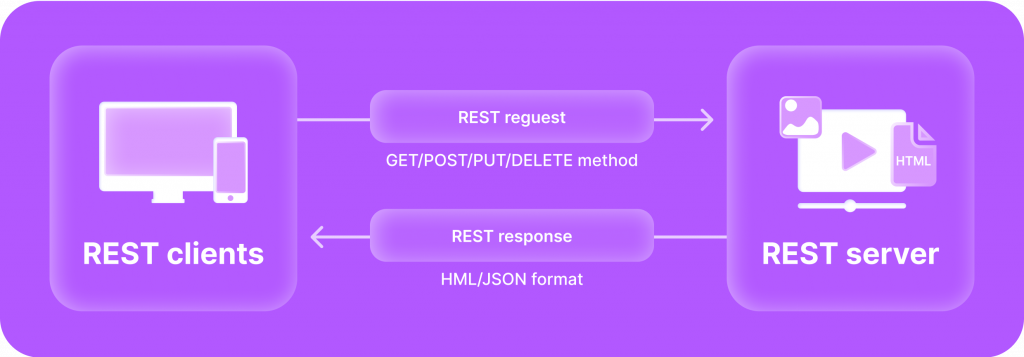

REST API

REST is short for Representational State Transfer and is one of the most used APIs by exchanges in the crypto market. REST API sets a communication standard between systems and platforms over the internet, enabling them to exchange data seamlessly and quickly.

Therefore, these REST API is used by exchanges because they are highly scalable and operate with high-volume functions, such as placing orders, analysing crypto data, getting market data APIs, and managing trades in the crypto market.

Payment Gateways

Gateway APIs are important for exchanges because they define the payment structure, including currencies, fees, processing time, and withdraw/deposit requests.

The payment gateway API key is triggered when users pay with fiat money, enabling them to deposit or withdraw money in USD, EURO, or other fiat currencies supported by the exchange.

They also set communication standards with different payment providers to manage conversion rates, settlements, transaction fees, and facilitating payments.

KYC API

KYC or Know Your Client procedures are necessary to comply with regulatory requirements and ensure the exchange does not register individuals or entities that are blacklisted or have malicious trading histories.

KYC is a part of the anti-money laundering policy to avoid scams and fraudulent schemes in the crypto market. KYC API is triggered when a user submits identity paper like a passport or an ID card, besides other requirements like proof of address and utility bills.

These APIs are triggered to manage this data, ensuring it aligns with the law in force and determines the risk level in each user’s portfolio. Eventually, this protocol promotes platform security and avoids registering any unwanted personnel.

Liquidity API

This API helps exchanges get access to multiple order books and share their own, giving access to a larger pool and high liquidity markets.

Therefore, offering competitive prices to traders provides lower market volatility and high liquidity. Liquid markets help traders execute market orders quickly and with minimum slippage time. It also helps them access a wide range of tradable instruments.

Security API

Security APIs are crucial for crypto exchanges and define the security protocols and system of the platform. They provide security mechanisms like two-factor authentication, listing IPs, and compliance with other security standards.

These APIs are also used to identify and defend against security threats like hacks, breaches, or data leaks, which promote the security and safety of the crypto exchange platform.

Conclusion

APIs, or application programming interfaces, are protocols and codes allowing data sharing and communication between websites and applications. APIs work like intermediate channels that allow different functions and enable the use of different tools.

Crypto exchange APIs help the platform execute market orders and gain information from market data seamlessly, enabling other trading features and wallet integrations. They are significantly important to create a secure infrastructure that checks the users’ background against any risk and mitigates hacks and breaches.