How Do CRM Loyalty Programs Help Forex Businesses with Customer Retention?

The concept of loyalty programs originated in the late 1800s, with retailers issuing trading stamps to encourage repeat business. Customers collected these stamps with each purchase, redeeming them later for products or services.

In the modern reality of businesses too, customer retention is fundamental for a company’s success. Organisations are turning to Customer Relationship Management (CRM) loyalty programs to achieve high retention rates. They are instrumental in not only attracting new clients but also retaining the most valuable ones.

In this article, we’ll analyse the significance of CRM loyalty programs and how they reshape customer retention for Forex businesses.

Key Takeaways

- CRM loyalty programs are crucial in reshaping Forex businesses’ customer retention by incentivising traders to stay loyal through rewards and personalised benefits.

- Loyalty programs help Forex brokers boost customer retention, increase trading, gain insights, stand out in the market, and promote responsible trading and compliance.

- To excel in Forex CRM loyalty, brokers must segment clients, create loyalty levels, automate campaigns, monitor performance, and integrate CRM with key systems.

CRM and Loyalty Programs: a Winning Combination

CRM loyalty programs are initiatives designed to incentivise and reward customer loyalty and engagement with a business or brand. These programs use data and customer insights to offer personalised benefits, such as discounts, exclusive offers, or rewards, to encourage repeat purchases and foster stronger, long-term relationships between the company and its customers.

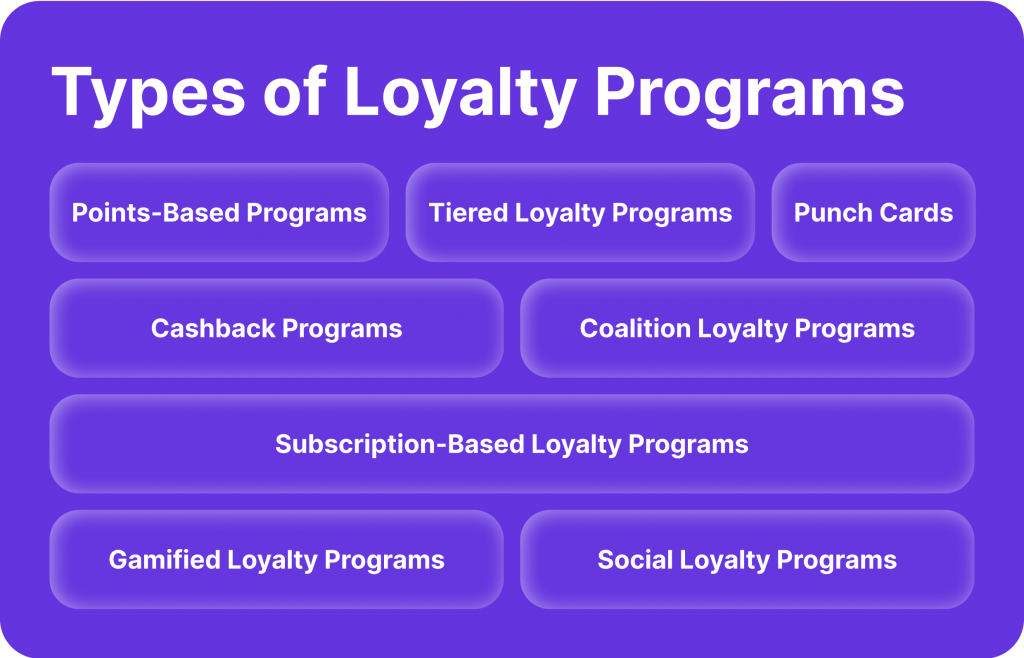

There are 10 types of loyalty programs, such as:

#1 Points-Based Programs – Customers earn points for each purchase, and these points can be redeemed for rewards or discounts. Examples include frequent flyer miles and credit card reward programs.

#2 Tiered Loyalty Programs – Customers are grouped into tiers or membership levels based on their loyalty, with increasing benefits or privileges as they move up the tiers. Hotel loyalty programs often use this approach.

#3 Cashback Programs – Customers receive a percentage of their spending back in the form of cash or credit that can be applied to future purchases. Credit card cashback rewards are a common example.

#4 Punch Cards – Customers receive a stamp or punch for each purchase, and after a certain number of punches, they receive a free product or discount.

#5 Coalition Loyalty Programs – Multiple businesses collaborate to offer a joint loyalty program, allowing customers to earn and redeem rewards across different companies within the same program.

#6 Subscription-Based Loyalty Programs – Customers pay a recurring fee to access exclusive benefits, discounts, or services. Amazon Prime is an example of this type of loyalty program.

#7 Gamified Loyalty Programs – These programs incorporate gamification elements, such as badges, challenges, and competitions, to engage and motivate customers to stay loyal to a brand.

#8 Social Loyalty Programs – Customers can earn rewards by sharing their experiences or referring friends to a company through social media or other online channels.

#9 Non-Monetary Loyalty Programs – Some programs offer non-monetary rewards, such as exclusive access to events, early product releases, or personalised services.

#10 Hybrid Loyalty Programs – These combine various elements of the above types to create a customised loyalty program that suits a company’s specific goals and customer base.

Importance of Customer Loyalty Programs for Forex Businesses?

The Forex industry is known for its high competition and dynamic nature. With countless brokers and exchanges competing for traders’ attention, customer retention has never been more critical. This is where CRM loyalty programs come into play.

For Forex businesses, retaining clients is not just about offering attractive spreads or a user-friendly trading platform. It’s also about building strong, long-lasting relationships with traders. CRM systems are designed to facilitate this process, making it easier for brokers to understand their client’s needs and preferences.

For Forex brokers and exchanges, CRM loyalty programs are game-changers. By implementing them, brokers can effectively identify and reward their most faithful and prosperous customers. Let’s delve into how CRM-based loyalty programs assist businesses in this sector:

Customer Loyalty = Customer Retention

Forex trading is highly competitive, and retaining clients can be challenging. Loyalty programs can incentivise traders to stay with a particular broker or exchange by offering rewards such as reduced fees, cashback, or trading bonuses. Building a loyal customer base can enhance a Forex broker’s reputation and trustworthiness, attracting new traders who are looking for a broker with a strong track record of customer satisfaction.

Data Insights & Targeted Marketing

Loyalty programs can provide valuable insights into traders’ behaviour and preferences, enabling Forex brokers to fine-tune their services and products to meet their clients’ needs better. Furthermore, Forex brokers can encourage traders to increase their trading volume by offering rewards tied to the number of trades executed or the total trading volume achieved, boosting their revenue.

Additionally, with access to valuable customer data, Forex brokers can create more personalised marketing campaigns, tailoring their offers and promotions to individual traders or specific trading segments. It should also be noted that loyalty programs can serve as a channel for collecting feedback from traders, helping brokers understand their clients’ needs and preferences to make necessary improvements.

Referral Programs

Loyalty programs can include referral bonuses, encouraging existing clients to refer new traders to the platform, further expanding the broker’s customer base. Also, by rewarding traders for responsible risk management and adherence to trading guidelines, brokers can reduce the chances of clients incurring significant losses, which can improve the long-term profitability of both the traders and the broker.

Essential Steps to Build a Successful CRM Loyalty Program

Now, how do you get started? What are the first steps in building a successful CRM loyalty program for your Forex business?

1. Segmentation for Targeted Engagement

The first step in building a successful CRM loyalty program for Forex businesses is segmenting customers. Utilising CRM software, brokers can analyse various metrics like purchase frequency, recency, product category, referrals and more to categorise their customers into segments. These segments often include loyal, potential, at-risk, and lost clients. Segmentation helps brokers understand each group’s unique needs and characteristics, enabling them to tailor their communication and offers more effectively.

2. Creating Loyalty Tiers

The second step involves creating loyalty tiers that reflect the level of loyalty and value each client segment holds. By leveraging CRM, brokers can assign customer points or badges based on their actions, such as trading frequency and volume. The more points or badges a customer accumulates, the higher their loyalty tier. Each tier offers various rewards, from discounts to exclusive admission and personalised services, stimulating customers to remain loyal and boost their trading activities.

3. Automotive Customer Loyalty Programs

Automation is key to successful CRM loyalty programs. Brokers can use CRM to set up triggers and workflows that send customers personalised and timely messages and offers. These messages, like welcome emails, birthday offers, win-back emails, and referral requests, enhance the customer experience and boost retention.

4. Monitoring and Optimisation

With CRM dashboards and reports, brokers can closely monitor and optimise their loyalty program’s performance. Metrics like participation rates, redemption rates, customer lifetime value and return on investment can be tracked and analysed. This data empowers brokers to assess the program’s effectiveness and profitability, identify areas for improvement, and collect and act on customer feedback to adapt their loyalty strategies.

Conclusion

With the unique demands and challenges of the Forex industry, CRM loyalty programs are not just a luxury but a strategic necessity. They empower Forex brokers and exchanges to build strong client relationships, drive profitability, and stay ahead in a market that never sleeps.