Top 5 White Label Trading Platforms in 2023

In the development of electronic trading, on the one hand, many opportunities for diversification of investment activities for retail and corporate investors have appeared. Still, on the other hand, the competition has also increased, which has become a challenging test for many companies. To enter the market and provide their services, many players of both Forex and crypto markets today use white label solutions, among which one of the most popular are trading platforms.

This article will help you understand what a white label trading platform is and what benefits it offers. We will also take a look at the 5 most outstanding white label trading platforms in 2023.

KEY TAKEAWAYS

- White label trading platform is a complete solution for electronic trading which is often used by new Forex brokers.

- WL trading platforms find their application in any financial markets, but most often they are used in the field of Forex.

- One of the most important advantages of WL trading solutions is the ability to fully customize the appearance and functionality of the platform to meet business preferences.

What is White Label Trading Platform?

Before delving into what a white label trading platform is, it is necessary to highlight a few facts about the history of such solutions. Being a highly competitive niche, the Forex market (and today, the crypto market) plays a vital role in the financial system providing incredibly high liquidity for a large volume of different currencies, increasing the interest of many private and institutional investors in trading activities for profit. The high popularity of electronic trading contributed to the rapid increase of companies that not only create their own systems for trading, but also offer white label solutions as a service to financial institutions.

Since initially any trading platform is a multifunctional system, integral elements of which, in most cases, are the user interface and space with trading modules and tools, a white label solution of such an important component of electronic trading provides all advantages for Forex brokers as well as for financial institutions from other areas to provide their clients with a full, reliable and easily customizable ecosystem for working on global markets.

White label trading platforms have a full range of attributes necessary for trading, which help to conduct comfortable trading of any type and on any financial assets. Among them there are risk management tools, trading instruments in the form of charts, signals, indicators, advanced charting tools and systems for monitoring trading volumes, volatility, spreads, and other indispensable indicators.

Among other things, white label trading solutions allow you to connect different compatible models that provide an additional level of informativeness and convenience of trading. Among such solutions, very often there are different analytical resources providing comprehensive information on the state of global financial markets, payment solutions for processing funds connected by secure protocols, as well as connecting solutions to ensure the safety of both registration and trading process. Generally speaking, a branded trading platform is a powerful tool to work on any capital market, and it is in high demand among both novice brokerage firms and many professional players, and sometimes even among the pioneers of the industry.

Because there is tremendous competition among companies that offer white-label trading platforms as a solution for beginners in any financial industry today, their diversity implies the option of selecting a solution that will match the specific aims and demands of the business. With broad functionality and powerful software, the trading platforms on the WL model can become a first-class experience in a single trading sphere for companies that are just mastering the basics of electronic trading.

FAST FACT

- The trading platform is a large ecosystem that allows you to connect payment modules, integrate third-party services and applications, as well as create unique combinations of trading strategies within the existing analytic tools.

5 Most Outstanding White Label Trading Platforms in 2023

White label trading platforms are an excellent solution for brokers and exchanges who want to offer their services to the market but lack the experience or funds to stay afloat among numerous competitors. With their numerous advantages, these solutions have gained astounding popularity among crypto players and Forex brokerage firms, not to mention other financial markets. Today, there is a wide range of white label trading platforms, each with distinctive features and characteristics. Below are the 5 best WL trading platforms in 2023.

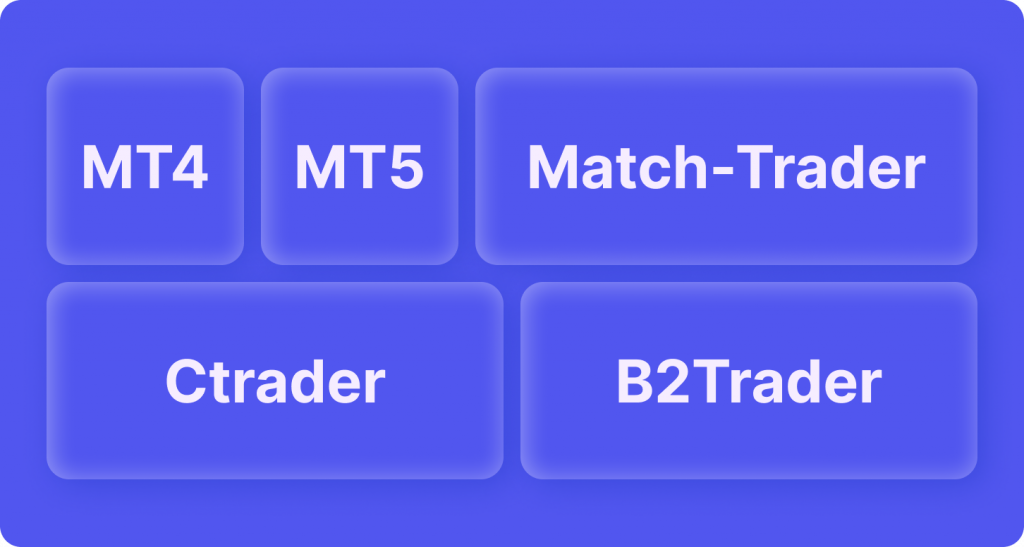

1. MT4

MetaTrader 4 is considered the most popular trading terminal among professional traders. Over 70% of brokers offer MT4 to their clients, and about 90% of the total Forex trading volume is done directly through this trading platform. MT4 has earned its magnificent reputation for extensive functionality, enabling traders to analyze financial markets, conduct trades (including those involving mobile devices), use trading advisors (robots), and much more.

White Label MetaTrader 4 is a multi-component infrastructure for forex brokerage firms that have become one of the most popular in the world due to many built-in options, among which the branding of the platform and full customization of the client part deserve special attention. Besides, such a turnkey solution gives you several other advantages in the process of launching a Forex broker, including no need to pay for Metatrader server license, server hosting, organization and maintenance of a reliable backup system, building a worldwide network of access servers, staff to configure and support the server structure on a 24/7 basis, etc.

2. MT5

Metatrader 5 is one of the most popular platforms for trading in the OTC market, second in popularity only to the earlier version Metatrader 4. The secret of its success in the Forex industry lies in the fact that it combines numerous key advantages over the previous version: the platform has a visually friendly interface, is intuitive for beginners and gives the opportunity to open transactions not only in Forex, but also in exchange derivatives markets.

White label Metatrader 5 solution offers a multi market platform from which you can trade Forex, Stocks, and Futures. It provides ample opportunities to work in all financial markets: technical and fundamental analysis, algorithmic trading, copying transactions of successful traders, as well as writing your own technical indicators and trading robots. In addition, the WL solution also includes full customization of the trading interface according to the customer’s preferences, as well as branding all elements of the platform for better brand recognition, as in the case of the WL Metatrader 4 solution.

3. cTrader

The cTrader platform is one of the latest technologies in online trading. It is designed to work with ECN accounts and combines advanced tools and features that can meet the needs of both novice and professional Forex traders. Its users are provided with the highest speed of order execution and the possibility to control the full volume of current market quotations, allowing them to conclude deals at the most favorable prices.

The cTrader terminal allows manual and automated trading of CFD contracts and Forex currencies. Platform developers created an ecosystem around it, where users exchange trading robots, strategies, and custom indicators. The platform is implemented in desktop, mobile, and web-based versions, works with API, and supports developer tools and deal copying services.

Over many years of platform development, cTrader has been integrated and supported by popular forex services, including white label solutions from many companies, which contain trading signals, analytics, independently verified reporting on trading statistics, trust management services, and liquidity.

4. Match-Trader

Match-Trade Technologies LLC is a fully integrated Forex technology provider and provides turnkey solutions for those wishing to access the retail and institutional forex markets. The company offers the latest advances in matching systems to enable forex providers (brokers, prime brokers and other liquidity providers) to participate in the next generation of transparent, distributed and independent ECN Forex.

The Match Trader platform aggregates the most important market events along with an assessment of their impact (Economic Calendar News) and also presents instruments with the highest difference in price during the day. The variety of indicators available on the platform makes it easier for traders and investors to analyze the market situation and follow trends, giving them the opportunity to make deliberate decisions. The built-in crypto payment gateway allows traders to instantly top up their accounts to avoid closing positions. The entire process has been automated on the Broker’s side and does not require leaving the platform.

5. B2Trader

B2Trader is a cutting-edge new trading platform with a strong matching engine that enables brokers to offer an extremely vast number of tradable assets, including digital assets, fiat currencies, forex, and stocks, among others. Numerous other advantages are also available, such as a web wallet with a variety of practical features, a three-level security system with warm, cold, and hot wallets, two-factor authentication, and anti-phishing features, as well as the necessary liquidity to draw users to an exchange.

The trading platform has all the same advantages as the above platforms, but it offers an order of magnitude more variety of options and tools, among which you can also find a back office with wide functionality for administering a matching engine of our own design, which, among other things, includes control over balances, activity users, commissions, dealing, transactions, trades, and orders. The platform also includes fully customizable workspaces for different trading styles, including scalping, intraday trading, long term trading, etc.

What are the Benefits of Using the White Label Trading Platform?

The development of trading systems designed for easy trading of various marketable assets has created an entirely new way of interacting with capital markets, and at the same time gave traders and investors the opportunity to significantly increase the quality of their trading strategies. Thanks to the emergence of the possibility to use trading platforms based on the WL model, many Forex brokers have opened up entirely new advantages, which are listed below:

Scalability

WL trading platforms are software that contains countless different systems and applications designed to ensure a smooth trading process. As it improves, the platform developer makes appropriate changes of a different nature to its infrastructure, which directly affect its functioning positively. Using the WL solution of the trading platform, all changes, and updates will be automatically applied in real time, which allows you to use the latest versions of systems, increasing their scalability, performance, and other technical characteristics.

Customization

The white label trading platform is a powerful tool designed for the most demanding Forex brokers and allows you to brand the interface of the client and server software in the corporate style of the customer. Thanks to the advanced customization options, it is possible to make the connection with the company closer with the help of feature-rich and fault-tolerant software, which will be decorated in colors and with the logo of the customer’s broker.

Branding within the framework of the WL trading platform allows you to project the image of the customer’s Forex broker onto the product without the cost of developing your own platform. This solution is a great opportunity to create a brand identity and create a unique user experience within the technological infrastructure provided by the company specializing in WL products.

Backing and Support

One of the most important advantages, which is especially attractive to newcomers in the field of Forex, is the support and full support in the operation of the platform by the company selling the WL solution. As novice brokers can be difficult to immediately understand all the intricacies and nuances of the trading platform in order to appreciate all of its advantages and disadvantages, the company selling such a solution will provide full support regarding technical and organizational issues with the platform. Such practice helps to build strong relationships between companies and prepare the ground for learning how to work with white label solutions.

Ease of Use

Any category of white label solution is famous for its ease of use due to a completely ready-to-use product. Since such solutions are developed by another company, Forex brokers who purchase them have no problems using their potential in their business activities. The convenience of using white label trading platforms is primarily due to the familiar set of tools and systems inherent in them, regardless of type. This helps to speed up the process of adaptation to the WL solution, which fully transfers the original functionality of the platform, but allows for customization in accordance with the needs of the company.

Conclusion

The WL business model has become one of the most popular tools in the Forex environment and other financial markets. It allows less experienced brokers or exchanges to build their unique brand and let their clients enjoy all the benefits of trading financial assets. Within the white label trading platform solution, you can find the possibility to use the multifunctional trading workspace to perform electronic trading based on any investment strategy.