White Label Broker vs Introducing Broker: What’s the Difference?

Attracting new clients is one of the most challenging tasks after opening a brokerage firm. This can be achieved by marketing tools such as advertising, email marketing, SEO optimisation, participation in trade shows and other lead generation tools.

However, a Forex broker can also increase revenue by working with Introducing Brokers and White Label brokers. Both options offer the primary broker the opportunity to expand the number of his clients and increase his revenues in a shorter time and with less effort.

This article will guide you briefly into the world of White Label brokerage and Introducing Brokerage business models. It will explain what they are and the fundamental differences between them.

Key Takeaways

- White Label Forex broker is a company that provides access to ready-made infrastructure and solutions to help startups launch their FX business and enter the market faster and more efficiently.

- Introducing Broker is a company that attracts clients to a partner broker’s trading floor and motivates existing clients to trade more actively, thereby generating revenue from each market deal the client performs.

What is a White Label Broker?

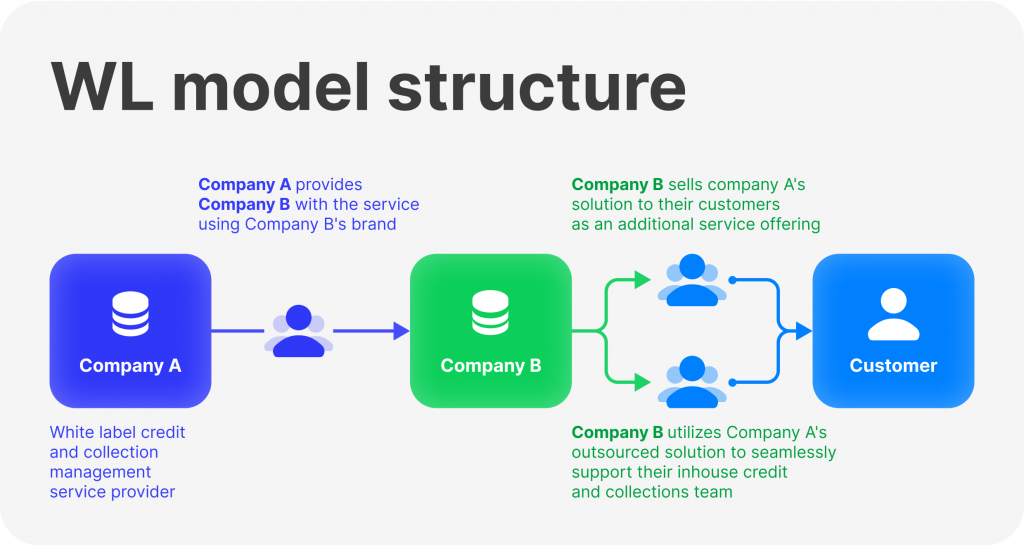

A White Label brokerage is a foreign exchange brokerage firm that offers its services to other firms or companies that can rebrand them under their own name. Essentially, a White Label Forex broker allows its partners to offer trading services while benefiting from the robust technology of an established brokerage firm.

By partnering with a white-label brokerage, companies can leverage an experienced brokerage firm’s expertise and resources to enhance their brand and expand their offerings. This arrangement can benefit firms needing more resources or expertise to build their in-house trading capabilities.

In addition, White Label brokerages can provide their partners with a range of support services, including account management, customer support, and technology infrastructure, to help them succeed in the highly competitive foreign exchange market.

According to the legal terms and conditions, the broker becomes a licensor and is only responsible for licensing its technology to customers who wish to establish their currency trading business under their brand name. The customer fully controls their newly established company, including all associated risks.

A White Label Forex provider enables companies or entrepreneurs to establish their currency trading business without any upfront investment, implementing Forex white label services. This approach is particularly beneficial for firms that intend to enter the currency trading market without developing a trading platform.

With this method, they can access the same markets and clientele as established Forex brokers, but with a minor variation: they use their brand name instead of the brokerage firm.

The White Label Forex broker business model can be classified into two distinct types:

Full White Label

When opting for the Full White Label (WL) service, clients get access to a trading platform branded under their name. This platform offers transaction functionality and enables clients to receive deposits and make direct withdrawals.

Furthermore, Full WL clients are entrusted with managing their customers’ accounts, wagering requirements, and other associated terms.

Partial White Label

When a broker offers a partial white label technology, it is a rebranded version of the principal broker’s platform but with certain restrictions. For instance, a limited WL may have limited facilities for clients and fewer options for flexible operations.

One of the most significant restrictions is that a partial WL cannot accept deposits. Therefore, when considering using a partial WL platform, it’s necessary to be aware of these limitations.

Fast Fact

Both WL brokerage business model and introducing brokers, despite their differences, offer services to develop a client base and increase trading turnover on the platform.

What is Introducing Broker?

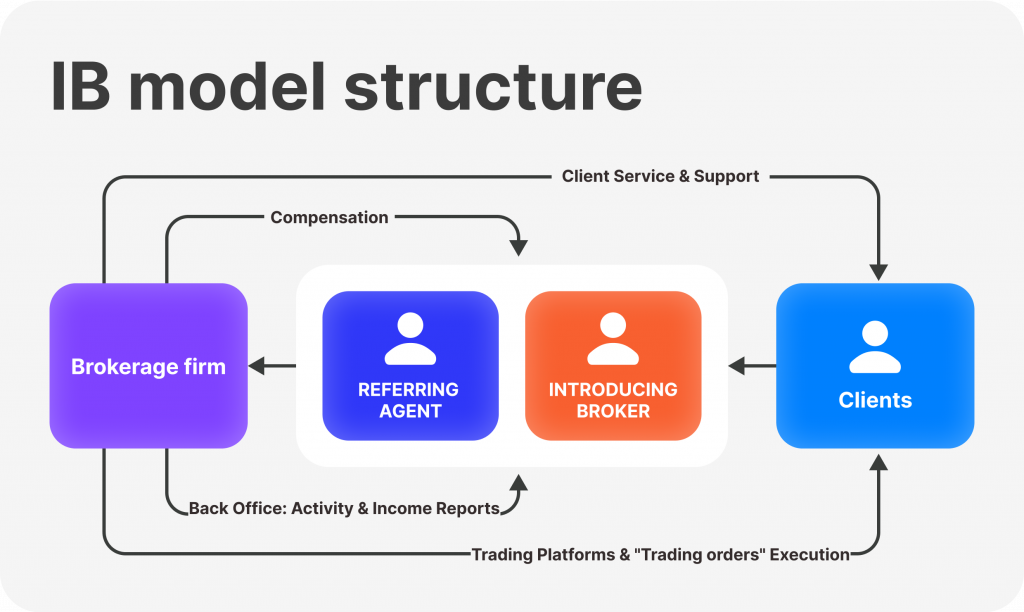

An Introducing Broker (IB) in Forex is a business entity that typically refers potential clients to a brokerage firm. The IB earns a commission from the brokerage firm for each new client and open account. The IB does not offer investment advice or execute trades on behalf of its clients. Instead, their role is to introduce potential clients to the brokerage firm.

This allows the brokerage firm to expand its client base through the IB’s network and marketing efforts. It is important to note that the IB does not hold any regulatory authority in the financial industry and is not responsible for the actions or performance of the brokerage firm.

Foreign exchange brokers, stock brokers, and Futures Commission Merchants widely use the introducing broker program. Interestingly, this model is also relatively standard in the insurance industry.

Introducing brokers is crucial in facilitating communication between clients and various financial institutions. They help clients navigate complex financial markets and connect them with the right service providers. By doing so, introducing brokers enables clients to make deliberate decisions and achieve their financial goals.

IBs typically receive commissions through various popular reward structures, which include:

Fixed Fee Returns

When it comes to generating revenue on a platform, one common strategy is to offer a fixed return for every new customer brought in. However, it’s important to note that the revenue generated may also depend on other factors, such as the type of account and the size of the initial deposit.

By taking these factors into account, platform owners can better understand their revenue streams and optimise their strategies accordingly.

Spread Sharing Percentage

In addition to their regular commissions, brokers can also generate income through a procedure called Revenue (spread) sharing. In this process, the broker gets a share of the revenue, which is typically a percentage, based on the volume of transactions conducted between the client they’ve referred to and the broker.

This revenue-sharing method offers a financial incentive for brokers to maintain and grow their client base, encouraging ongoing business relationships.

Difference Between White Label and Introducing Brokerage

At first glance, both models of doing business in the Forex market are identical and have no noticeable differences. Still, they are completely different approaches to interacting with clients and managing finances. Let’s consider the main differences:

1. Client Acquisition and Support

Introducing brokers in the Forex trading market play a key role in marketing and securing new clients for the brokerage. Their support and assistance are invaluable, guiding clients through the account opening process and helping them understand the trading platform. On the other hand, with white label trading platforms, brokerages need to manage client acquisition and support on their own.

2. Infrastructure and Technology

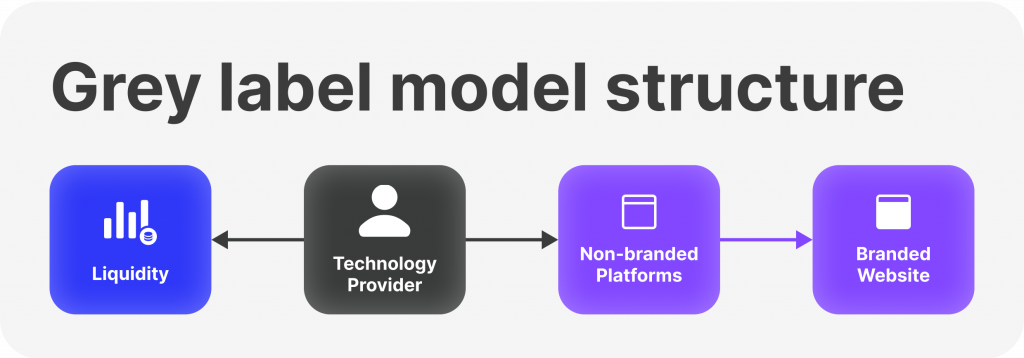

In addition to providing back-end systems, liquidity connections, risk management tools, and reporting functionality, white-label trading platforms provide a comprehensive trading infrastructure. WL brokerage firms can offer their clients seamless trading experiences as a result of this infrastructure.

Conversely, Forex introducing brokers relies on proprietary technology and infrastructure provided by brokerage firms, and their trading platforms are limited in their control.

3. Regulatory Considerations

Regulation adherence is required for both white-label trading platforms and Forex trading introducing brokers. Brokerages that use white-label platforms have to make sure that they are in compliance with all applicable financial legislation and acquire the required licences. The regulatory framework of the brokerage company they partner with frequently governs how Forex trading introducing brokers conducts business.

4. Scalability and Growth Potential

Scalability is a feature of white-label trading systems that helps brokerages develop their clientele and customer base. As their business develops, they may add additional features and functions. Brokers introducing people to Forex trading can expand their business by recommending new customers. Still, this development inevitably depends on the services and products the brokerage company provides.

5. Revenue Models and Costs

Platforms for white-label trading usually include up-front fees associated with setup, customisation, and continuous maintenance. On the other hand, white-label platform brokerages have the ability to make money straight from the trading activity of their clients.

Conversely, brokers that introduce consumers to Forex trading do not have to pay large upfront fees; instead, they get paid commissions based on the trading volume of the clients they recommend.

6. Customisation and Branding

Branding and personalisation are benefits offered by white-label trading platforms. The platform’s look, feel, and functionality may all be customised by brokers to fit their unique needs and brand identity. However, the branding and standing of the brokerage company they partner with are the main factors FX trading introducing brokers rely on.

Conclusion

White Label Broker as well as Introducing Broker are two powerful, time-tested tools designed to increase the efficiency and effectiveness of business for beginning brokers and startups in need of financial and technological support, as well as professional assistance in understanding the imperative aspects and nuances of the FX market.