Why Using Business Intelligence Tools Is Essential for Your Brokerage?

The world of Forex business is a dynamic environment with constantly changing conditions of the game, where Forex brokerage companies fight for each client, offering more and more advanced methods and solutions that help to redefine the interaction with financial markets.

Thanks to advances in information technology, it has become possible not only to have high liquidity, powerful software and multifunctional trading platforms but also practical tools for working with business process analytics, the effectiveness of which directly affects the success of Forex brokerage business.

This article will help to understand what business intelligence tools are, what advantages they have, and what types of them exist on the market today.

Key Takeaways

- Business analytics tools are solutions for processing and analysing large data sets to improve business processes.

- Business analytics tools offer a wide range of applications for working with data, including analysing patterns & statistics and building future trends.

- The most popular business analytics solutions are designed to process and organise large amounts of data to build reports and pattern future trends of change.

What Are Business Intelligence Tools?

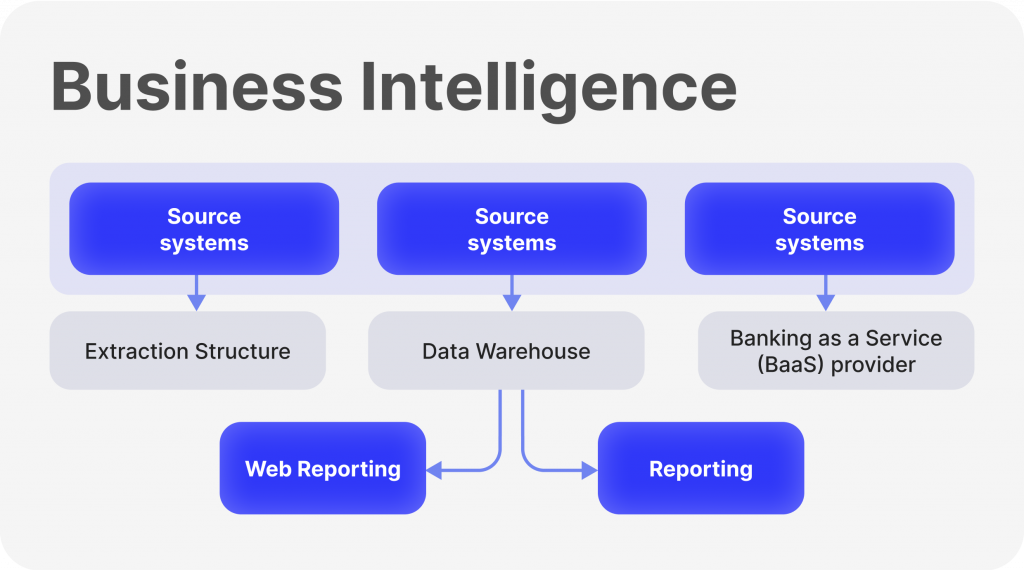

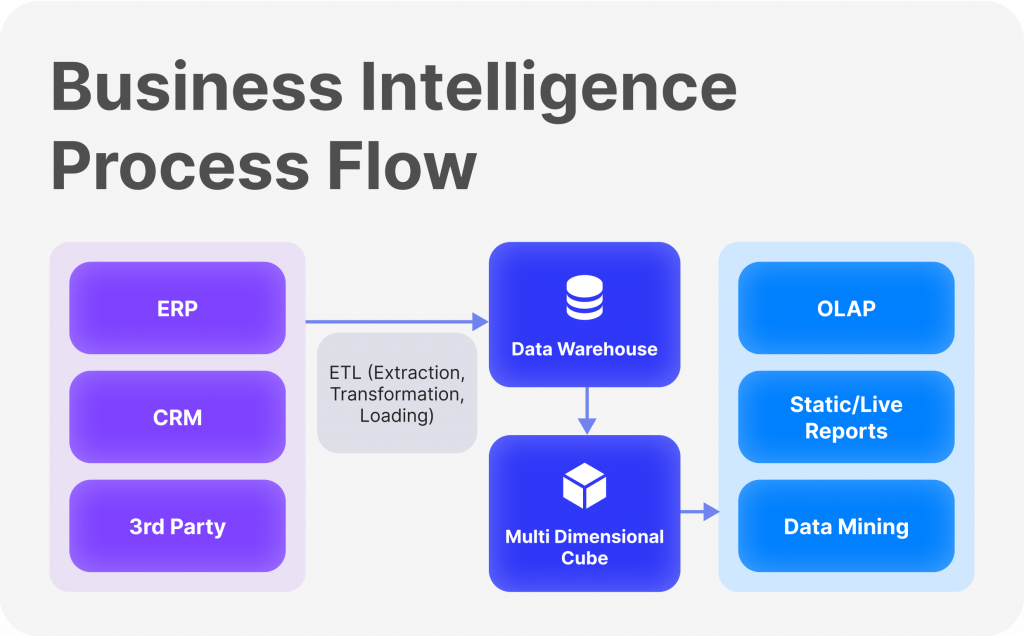

The methodological and functional expansion of the category of “business intelligence” has led to the analytical toolkit that today includes not only data extraction, transformation and loading tools, OLAP cubes, data warehouses, dashboards, and report generation applications. Practical realisation of data complexity in the Forex sphere has led to new classes of analytical software products for brokerage companies closely related to the general tasks of corporate management.

Modern application modules of business analytics software solutions provide end-to-end support of such management processes as strategy development, planning, results monitoring, strategy optimisation and adjustment, and implementation of control actions. At the same time, turning raw data into visual analytics for the entire Forex organisation consists of four key steps. The first three – Data collection, analysis, and visualisation – set the stage for final decision-making. The last step is making decisions based on real-time analytics. In the past, Forex companies had to perform much of the analytics manually, but now, business intelligence solutions automate these processes, saving time and effort.

What Kinds of Business Intelligence Tools Are There?

Since Forex is one of the fastest growing areas of financial instruments trading today, the market of digital information solutions is quickly adapting and offering a wide range of highly functional tools for working with data analytics as part of business analytical processes. Let’s take a look at the main ones below.

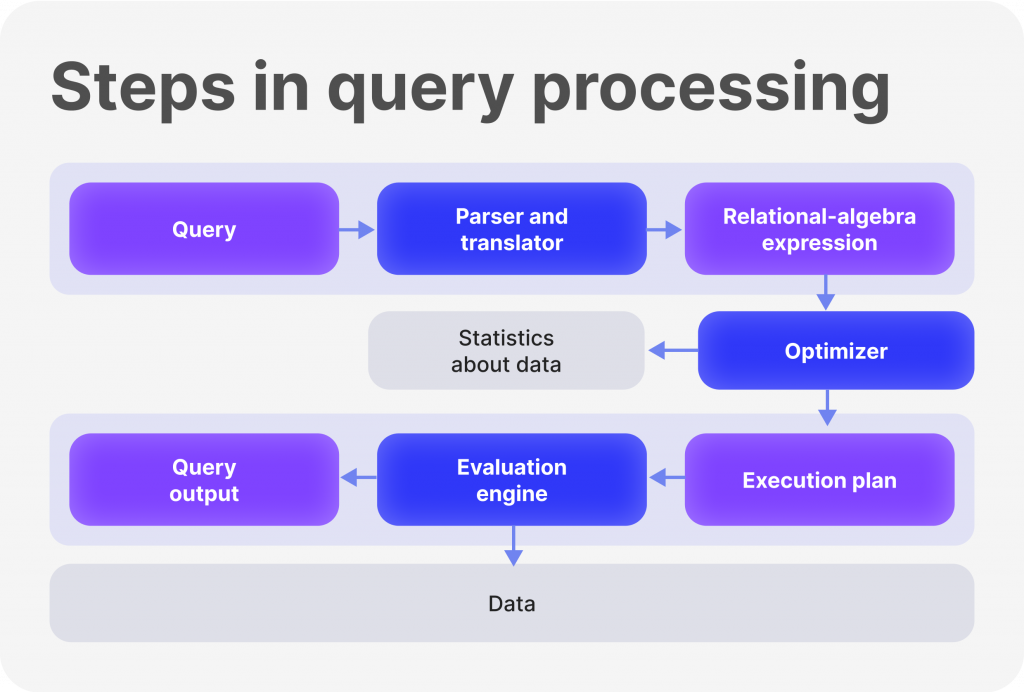

Reporting and Querying

These tools allow you to extract data from various sources and create reports based on it. Thanks to the use of high-precision solutions for analysis and systematisation of data into arrays, it becomes possible to receive detailed reports on every aspect of trading activity within the framework of Forex investment instruments trading to make a high-precision analysis of the received reports following the specified parameters and criteria, etc.

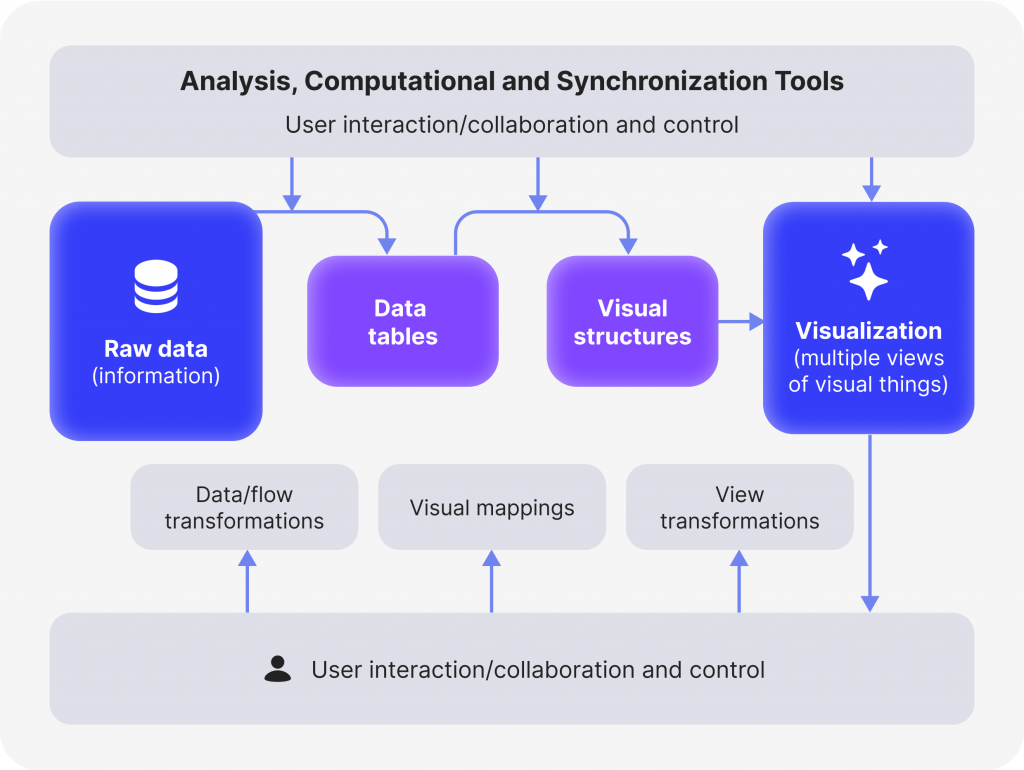

Data Visualisation

Tools and solutions for visualising data sets and reports related to trading activities of traders and investors can help to break down numbers and patterns so that the human eye can easily see the whole picture composed of multiple pieces of data based on the activities of market participants. Such tools not only simplify the creation of presentations by visualising structured information of different types, volume, and focus but also help to quickly adapt the results of data analysis by changing parameters and initial values.

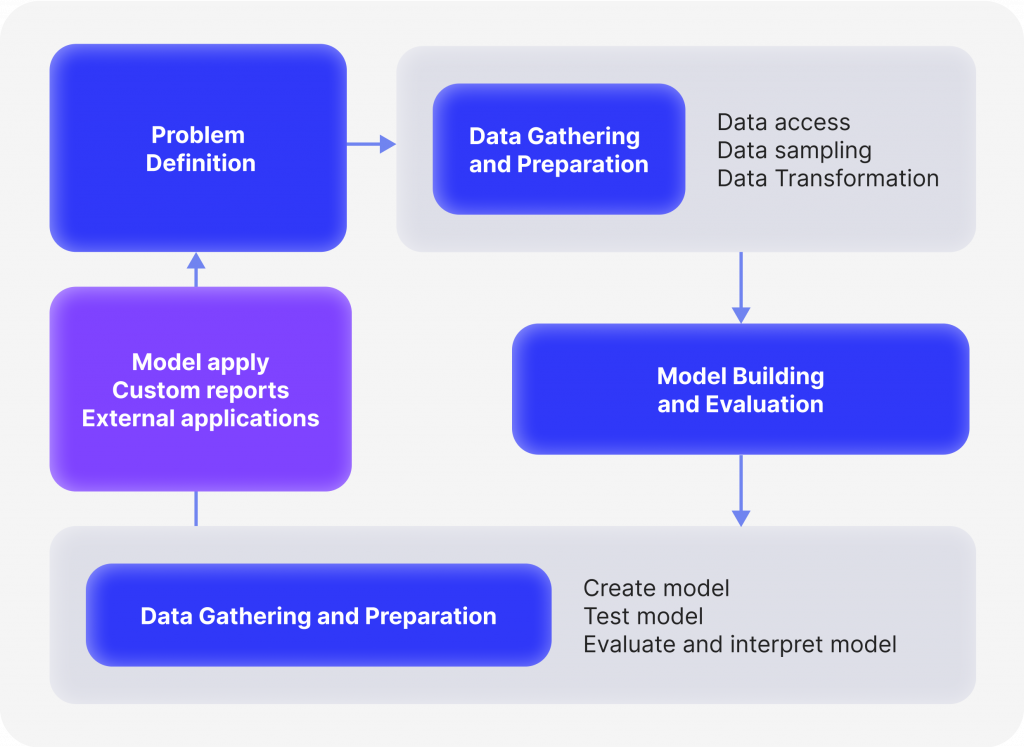

Data Mining

As part of data mining, raw data is cleaned, patterns are identified, models are created, and those models are tested to gain a deeper understanding. In addition to statistics, machine learning, and database systems, data mining projects include data cleaning and exploratory analyses, among others. For analytics or business intelligence projects, data mining specialists clean and prepare the data, construct models, test these models against hypotheses, and publish the results.

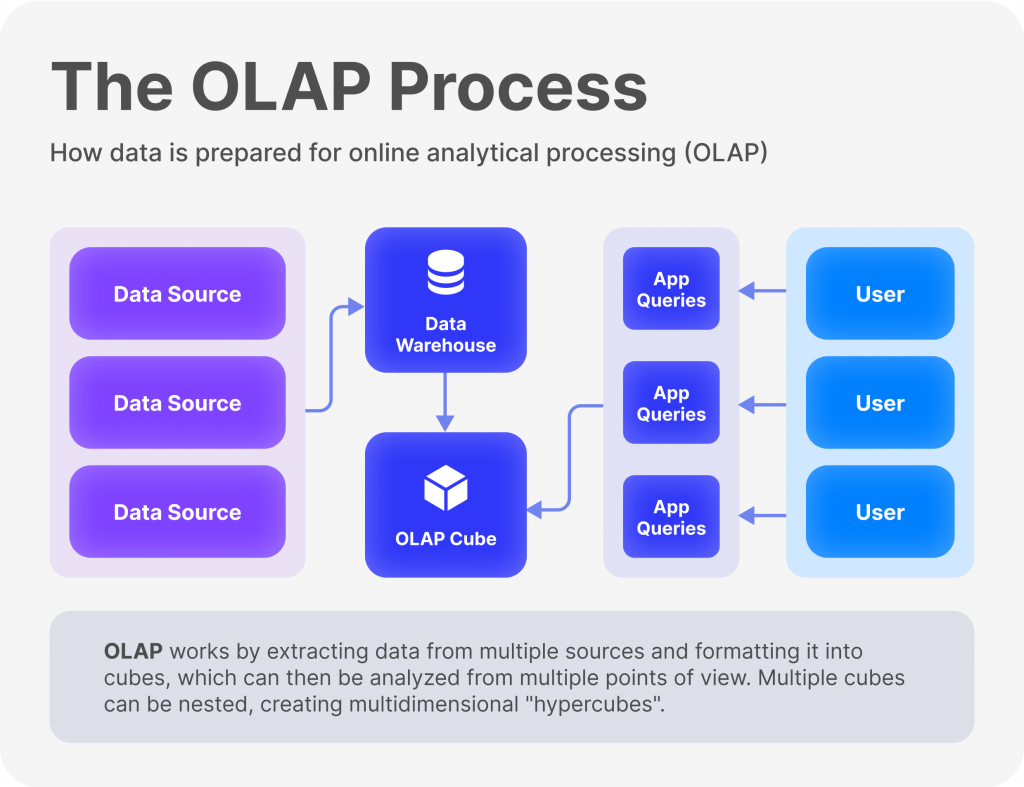

Online Analytical Processing (OLAP)

Online analytical processing (OLAP) is a software technology that can analyse business data from multiple perspectives. Forex brokers collect and store data from multiple data sources such as websites, applications, smart meters and internal systems. OLAP aggregates and categorises this data to provide actionable information for strategic business planning.

ETL (Extract, Transform, Load) Software

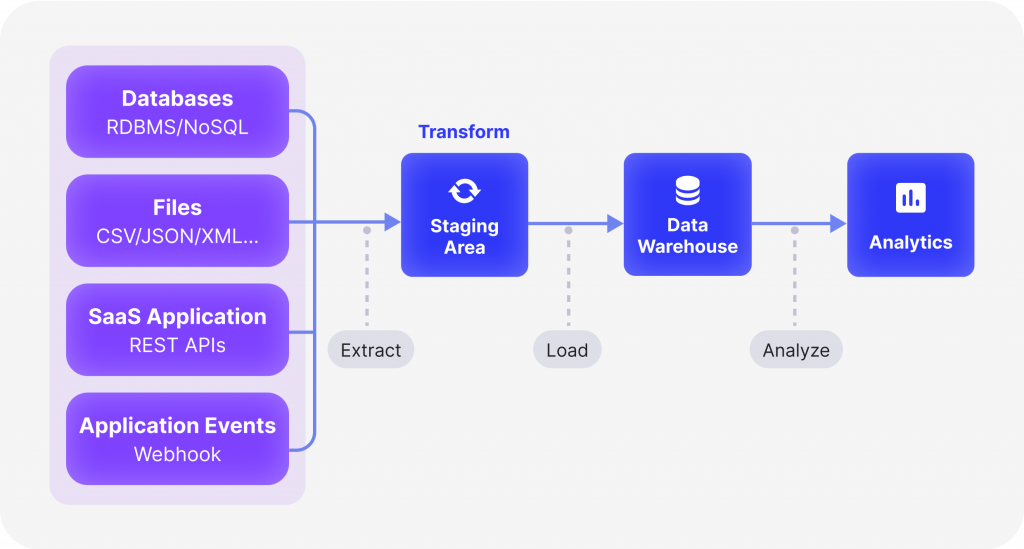

ETL is a three-step data management process, literally translated as “Extract, Transform, Load”. First, information is extracted from structured and unstructured sources, then transformed into the desired format and loaded to the destination.

Operational intelligence (OI)

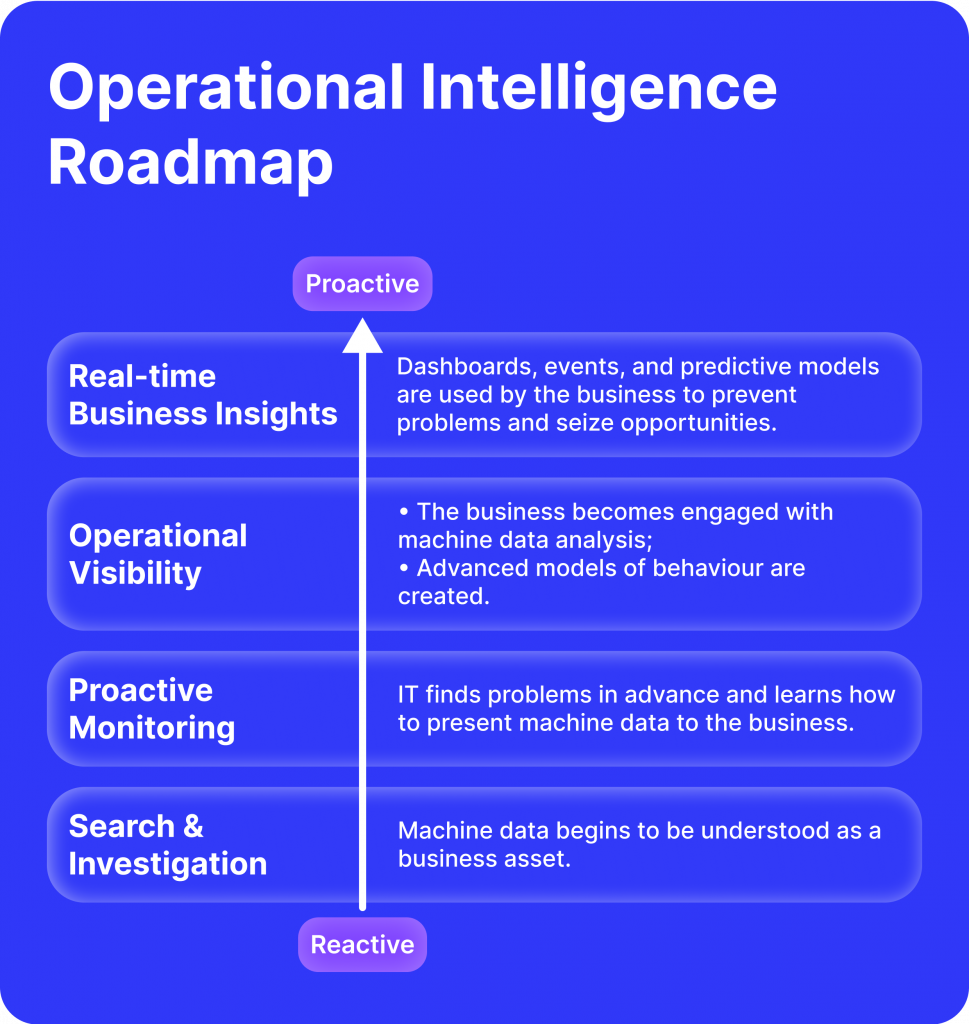

Operational Intelligence (OI) is a category of real-time, dynamic business intelligence that provides visibility and insight into data, event streams and business operations. OI solutions run queries on streaming data feeds and event data to deliver analytic results through work instructions. OI empowers forex organisations to make decisions and act immediately on the resulting analytics through manual or automated actions.

Major Advantages of Business Intelligence Tools

Business intelligence software development is a thriving field in high demand due to the digitalisation and integration of advanced information solutions in various industries, including Forex. The following are the main advantages that brokerage companies get by using business intelligence tools.

1. Data Access in Real-Time

Thanks to high-speed Internet access, business analytics tools offer the possibility of obtaining accurate information according to specified criteria in real-time, regardless of the number of connected modules and systems within the work framework with different data sources. This makes it possible to adapt other data analysis systems without delay and with high efficiency to manage the entire volume of information coming from external sources on the status of the markets as a whole, as well as the behaviour of individual users, their statistics and other important trade indicators.

2. Data Visualisation

Business intelligence software and systems can transform and restructure vast amounts of data and present it in a simple yet easy-to-understand and clear form and format. This solves two problems at once. First, the results of the analysis become easily accessible to all specialists working with them – just a few mouse clicks are enough. Secondly, when data is presented in a visual form, the process of idea generation becomes easier and faster, increasing the efficiency of Forex business tasks.

3. Possible Scenarios Modeling

Predictive analytics and data analytics tools create models for brokerage firms to see patterns and trends that will affect future trading results. Previously, only experienced data analysts were able to do this, but with business intelligence software based on artificial intelligence machine learning solutions, these models can be created within the platform. This gives forex brokers the ability to quickly customise the model by creating scenarios of possible developments with slightly different variables, and there is no need to create complex algorithms.

4. Improved Data Accuracy Through Cleansing

Increasing data accuracy is one of the most significant advantages of employing reporting BI tools. This is so because data cleansing features are frequently included in reporting tools.

The process of finding and fixing mistakes in data and structuring it so that it is ready for additional analysis is known as data cleansing. This is crucial because poor decision-making might result from using erroneous data. Businesses can ensure that their decisions are based on reliable information by purifying data before it is utilised for reporting. As a result, decisions can be made with greater knowledge, which may enhance corporate performance.

Conclusion

Advanced business analytics tools play an important role in the Forex business, allowing you to take full advantage of analytical systems to work with massive amounts of data and their processing, which ultimately increases the efficiency and productivity of work with clients and improves all business processes as a whole.