CRM, Client Cabinet, and Back Office

For Brokerages, Crypto Exchanges, Currency Convertors and Wallet Storage

Crypto Broker

Crypto margin trading has grown phenomenally and has become the most dynamic segment of online trading. Setting up as a cryptocurrency broker is another excellent way to capitalise on the growing crypto trend by offering your customers trading in digital assets which are on track for an even bigger future

Forex Broker

Forеx is one of the largest and most profitable financial markets today. For this reason, a Forеx broker business model is a very popular route, and with the advantage of being easy to setup, is the number one choice among our clients looking to start a successful revenue-generating business

Crypto Exchange

As сrурtо assets continue to produce substantially higher returns than traditional markets, сrурtо businesses present real revenue-generating opportunities. The solution is completely customisаble, making it an ideal, quick and cost-effective way for setting up a сrурtосurrеnсу ехсhаnge

Web-Wallets

A crypto hot wallet (or web-wallet) is a type of digital wallet that stores cryptocurrency in an online environment, giving users quick and convenient access to their funds.

Wallets module

Gain easy access to all the most popular fiat currencies, cryptocurrencies and stablecoins. An unlimited number of wallets are available as per your needs

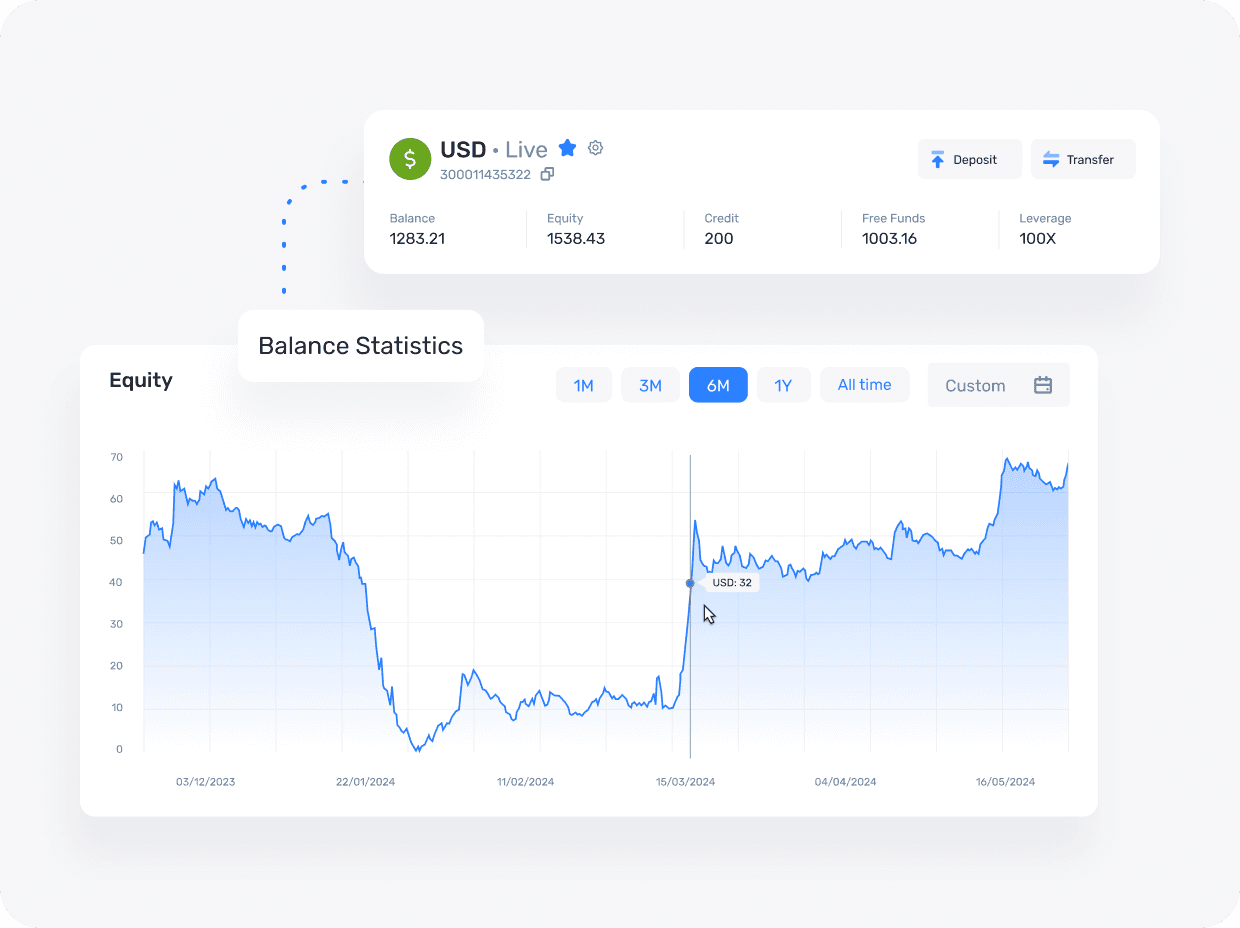

Funds module

Explore our efficient and secure payment systems designed for effortless deposit and withdrawal processes. Experience unparalleled ease in managing your financial transactions. For more information, click here.

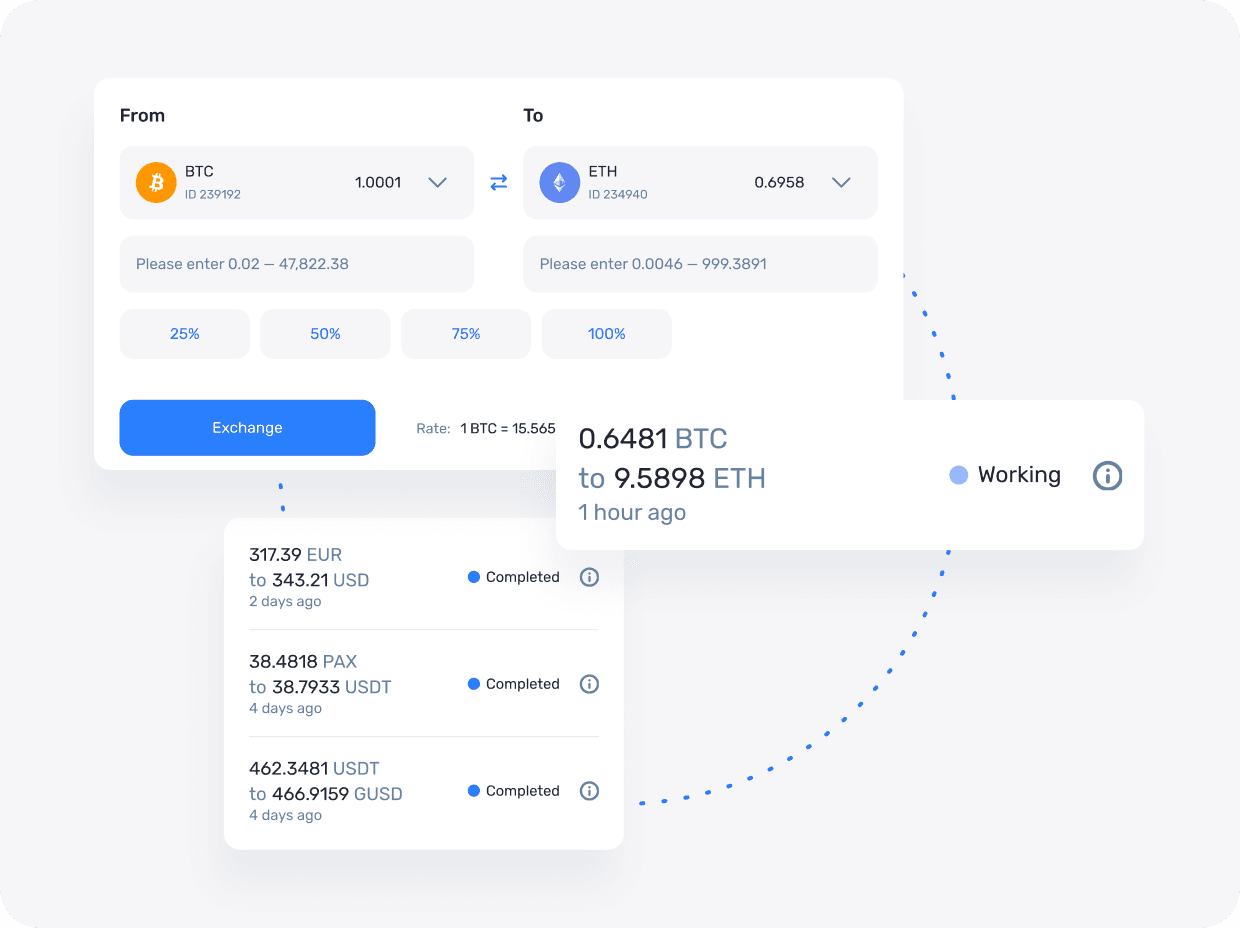

Сrурtо/Сrурtо & Сrурtо/Fiat

A web interface for the сrурtо-сrурtо / fiаt-сrурtо ехсhаngе

in a few clicks. Full customization, REST API connection to any ехсhаnges and providers.

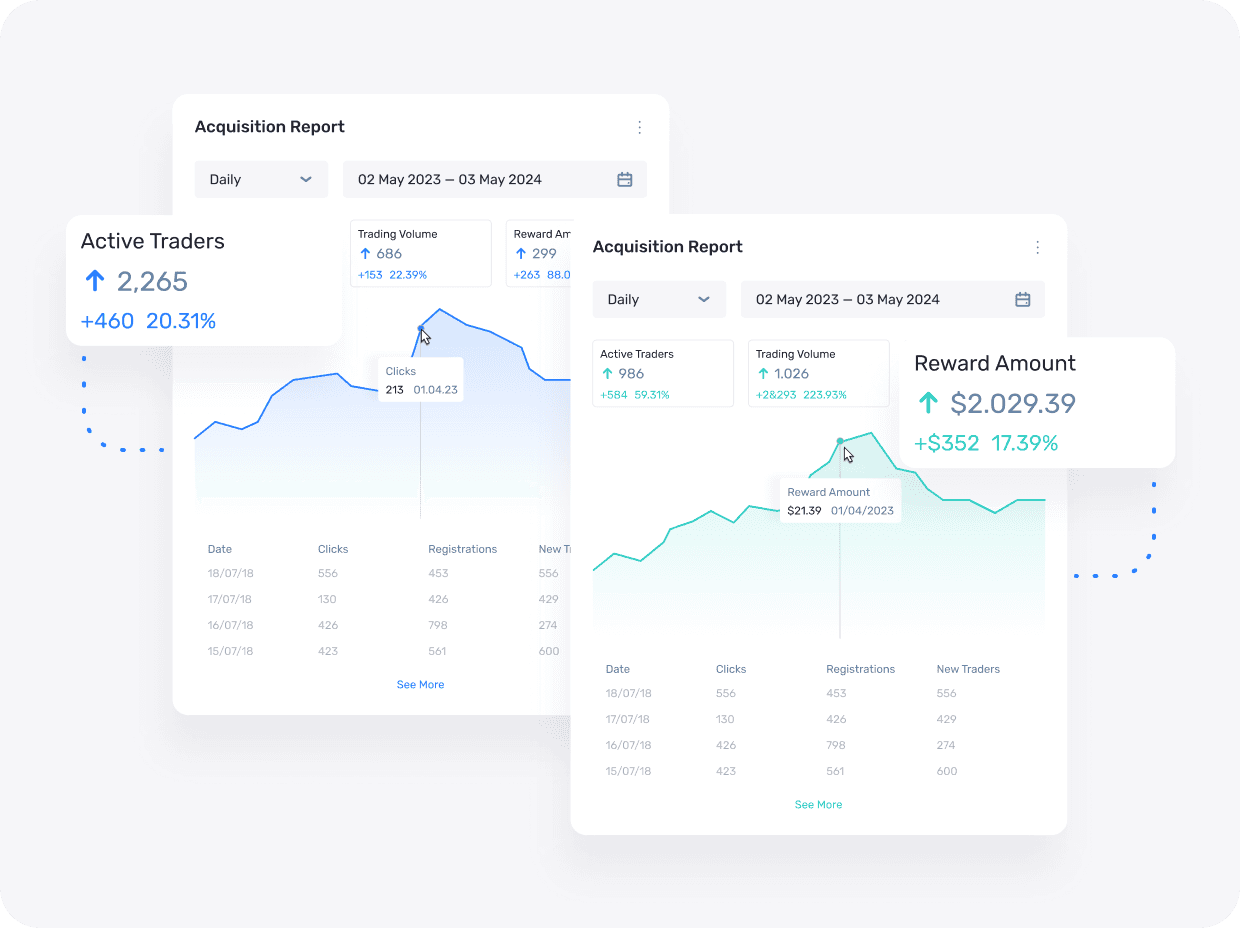

History/analytics module

Comprehensive statistics are available for brokers and traders. Deposits, withdrawals, trading activity and any other custom reports can be created and automatically sent to your email.

IB room

Our special module for Introducing Brokers includes supporting referral programs with up to 30 levels including real-time accruals.

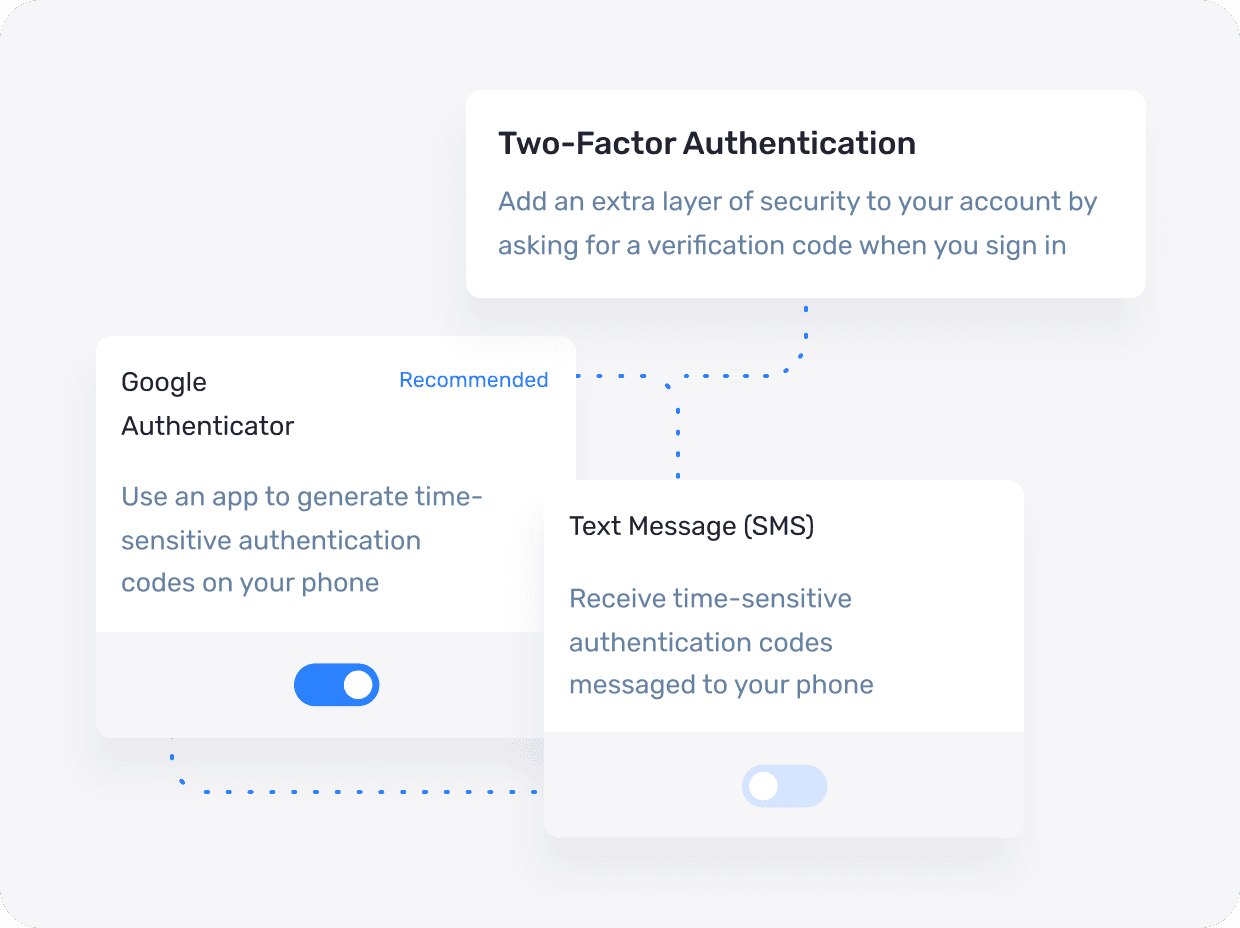

We can offer different two-factor authentication settings and providers. Nexmo, Google, SMS, and email verification methods are provided for ensuring the highest standards of security and privacy.

Explore our comprehensive list of additional KYC providers and discover more tailored solutions here.

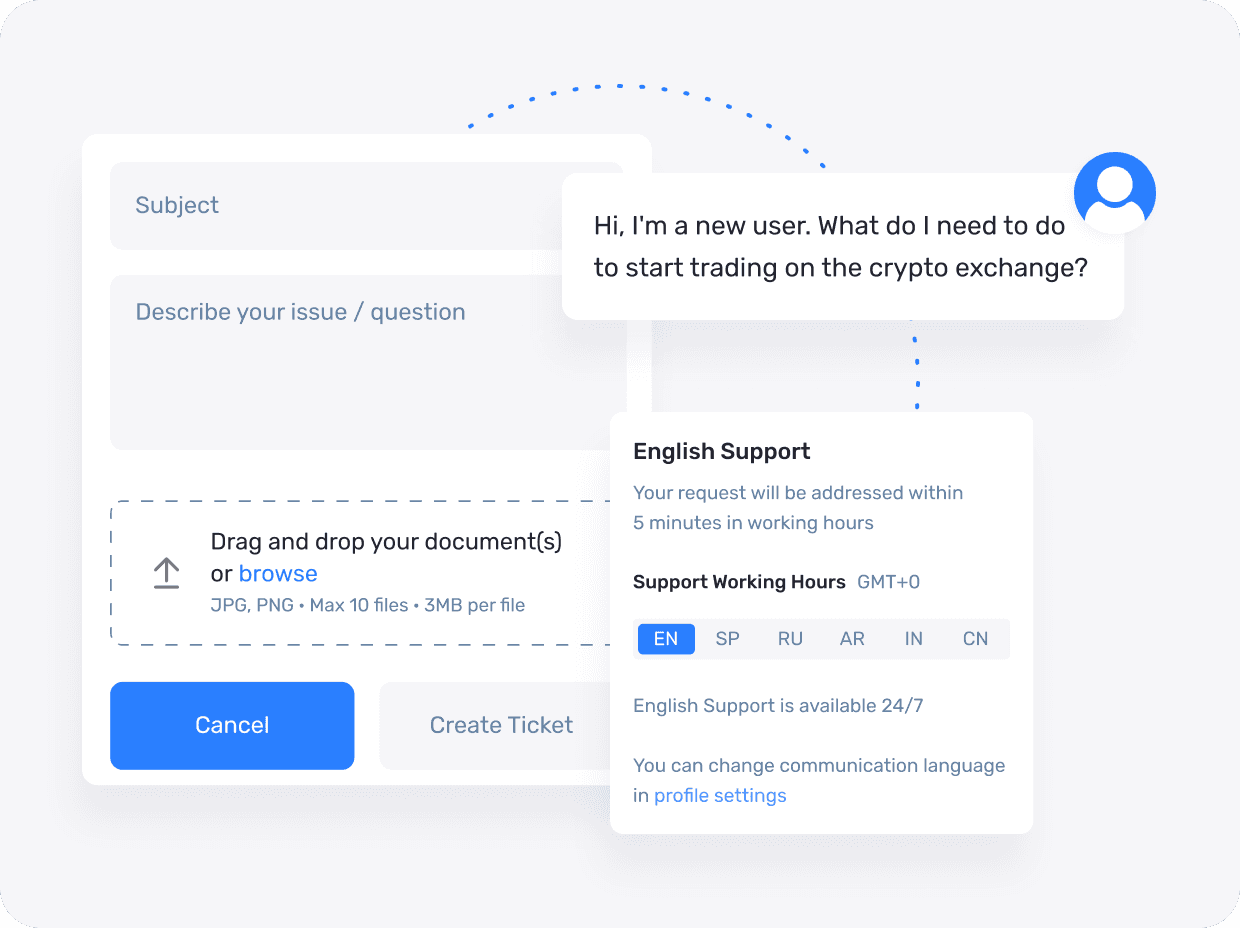

We offer a streamlined integration with the SupportPal helpdesk system and Zendesk, providing a robust solution for managing user tickets. This functionality promotes efficient customer service practices and effective response mechanisms.