مشاركة

0

/5

(

0

)

لقد أعاد التداول الاجتماعي ابتكار قطاع منصات الاستثمار، مما يسمح للمتداولين بالتعاون والتعلم وتحقيق الأرباح من خلال الاستراتيجيات المشتركة. أدى الطلب المتزايد على التداول بالنسخ وحسابات PAMM إلى تعزيز نضج سوق خدمات التداول الاجتماعي، حيث يقوم الوسطاء بدمج برامج التداول الاجتماعي المتقدمة لتحسين تجربة المستخدم.

يستكشف هذا الدليل أفضل 5 منصات تداول اجتماعي بارزة للوسطاء في عام 2025، مع تقديم رؤى حول ميزاتها ونقاط قوتها وأحدث الاتجاهات التي تشكل الجيل القادم من التداول الاجتماعي.

أهم النقاط

يتطور برنامج التداول الاجتماعي من خلال الأتمتة المدعومة بالذكاء الاصطناعي، مما يجعل التداول بالنسخ أكثر تخصيصًا وكفاءة.

يتوسع سوق منصات التداول الاجتماعي ليشمل العملات الرقمية وصناديق الاستثمار المتداولة (ETFs) والأصول المرمزة، إلى جانب الفوركس والأسهم.

تحظى حسابات PAMM والتداول الاجتماعي المؤسسي باهتمام متزايد، مما يجذب مديري الأموال المحترفين وصناديق التحوط.

دور التداول الاجتماعي في منظومة الأعمال الحديثة

برز التداول الاجتماعي كمفهوم ثوري في الأسواق المالية، حيث يغير طريقة تفاعل المتداولين وتعلمهم وتنفيذهم للصفقات. على عكس التداول التقليدي، حيث يعتمد الأفراد فقط على تحليلهم وكفاءتهم، يدمج التداول الاجتماعي رؤى المجتمع، مما يسمح للمتداولين بمشاركة الاستراتيجيات ومناقشة تحركات السوق وحتى تكرار صفقات المستثمرين الأكثر خبرة.

أحد الأدوار الأكثر أهمية للتداول الاجتماعي في بيئة التداول الرقمية هو قدرته على سد فجوة المعرفة بين المتداولين المبتدئين والخبراء. من خلال المنصات التي تسهل التداول بالنسخ، يمكن للمبتدئين تكرار صفقات المستثمرين الناجحين تلقائيًا، مما يقلل من منحنى التعلم ويحد من الأخطاء المكلفة.

يعزز التداول الاجتماعي شفافية السوق من خلال تمكين المتداولين من عرض استراتيجيات أقرانهم في الوقت الفعلي، بالإضافة إلى مؤشرات الأداء وأساليب إدارة المخاطر. وعلى عكس صناديق الاستثمار التقليدية التي تتخذ قراراتها بسرية، توفر برامج التداول الاجتماعي وصولًا عامًا إلى سجلات الصفقات وتقييمات المخاطر وإحصائيات النجاح.

لا يقتصر التداول الاجتماعي على إفادة المتداولين الأفراد فحسب، بل يمتد تأثيره ليشمل الوسطاء والمؤسسات المالية. من خلال دمج ميزات التداول الاجتماعي في منصاتهم، يمكن للوسطاء جذب جمهور أوسع، وزيادة تفاعل المستخدمين، والحفاظ على العملاء لفترات أطول.

[aa quote-global]

معلومة سريعة

تعد منصة eToro أكبر منصة تداول اجتماعي، حيث تضم أكثر من 30 مليون مستخدم مسجل، مما يجعلها واحدة من أكثر منصات الاستثمار استخدامًا على مستوى العالم.

[/aa]

معايير اختيار أفضل أنظمة التداول الاجتماعي

يعد اختيار منصة التداول الاجتماعي المناسبة أمرًا بالغ الأهمية للمتداولين الأفراد والوسطاء على حد سواء. يمكن أن تعزز المنصة المصممة جيدًا كفاءة التداول، وتحسن الربحية، وتؤسس شبكة اجتماعية قوية للمتداولين.

فيما يلي المعايير الرئيسية التي يجب مراعاتها عند اختيار أفضل منصة تداول اجتماعي:

واجهة سهلة الاستخدام وإمكانية الوصول

يجب أن تكون منصة التداول الاجتماعي سهلة الاستخدام وسلسة التنقل، بحيث تلبي احتياجات كل من المبتدئين والمتداولين ذوي الخبرة. تساهم لوحة التحكم المنظمة جيدًا في تحسين تجربة المستخدم من خلال توفير رؤية واضحة للصفقات وتتبع الأداء والأدوات الأساسية.

تساعد خيارات التخصيص، مثل إعدادات التداول القابلة للتعديل والإشعارات، المستخدمين على تخصيص تجربتهم. كما أن إمكانية الوصول عبر الأجهزة المتعددة أمر بالغ الأهمية، مما يسمح للمتداولين بتنفيذ الصفقات ومراقبتها بسهولة على الويب والجوال والأجهزة اللوحية.

إمكانيات التداول بالنسخ

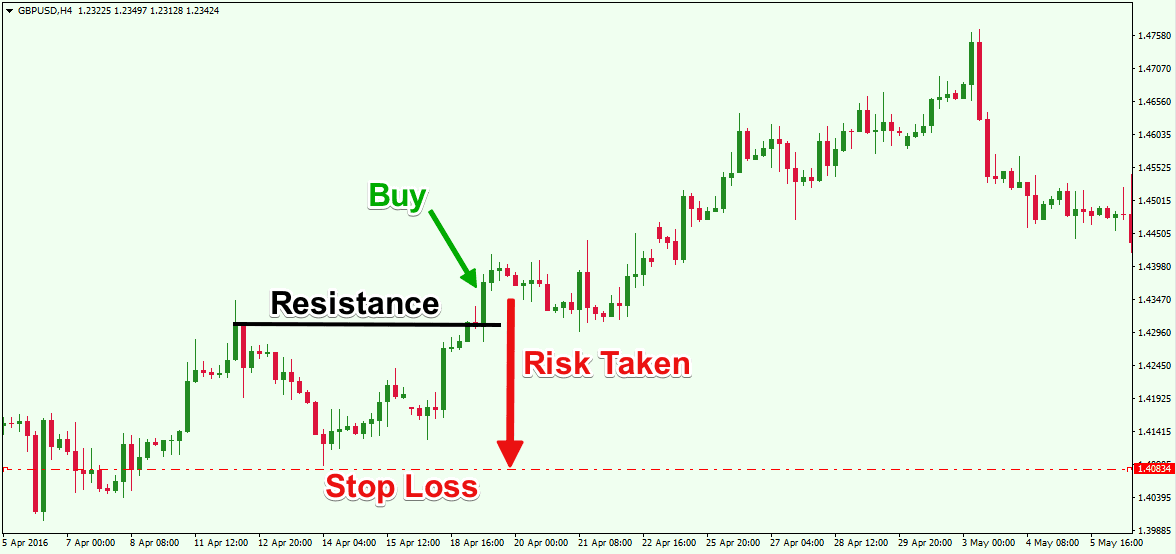

يعد التداول بالنسخ أحد السمات الرئيسية للتداول الاجتماعي. يجب أن توفر المنصة الرائدة إمكانية تنفيذ الصفقات بنقرة واحدة، مما يتيح للمستخدمين تكرار الصفقات فورًا. كما ينبغي أن توفر إعدادات مرنة لأحجام الصفقات ومستويات وقف الخسارة وإدارة المخاطر، بحيث يتمكن المستخدمون من تخصيص استراتيجياتهم وفقًا لتحملهم للمخاطر وأهدافهم المالية.

الشفافية هي المفتاح — يجب أن يتمكن المتداولون من الوصول إلى الملفات الشخصية التفصيلية وإحصائيات الأداء وتقييمات المخاطر لمقدمي الإشارات قبل اختيار من يتابعونه.

مجموعة الأصول القابلة للتداول

يتيح التنوع في الأصول القابلة للتداول للمتداولين بناء محفظة متوازنة جيدًا. تدعم أفضل منصات التداول الاجتماعي تداول الفوركس بمجموعة واسعة من أزواج العملات، وتداول الأسهم والمؤشرات للمستثمرين في الأسهم، وأسواق العملات الرقمية لأولئك الذين يرغبون في تداول الأصول الرقمية مثل البيتكوين والإيثريوم.

بالإضافة إلى ذلك، فإن إتاحة الوصول إلى السلع مثل الذهب والنفط وصناديق الاستثمار المتداولة (ETFs) تضيف المزيد من فرص الاستثمار، مما يمنح المستخدمين إمكانية تنويع استراتيجياتهم.

الأمان والامتثال التنظيمي

يعد الأمان أحد الاعتبارات الرئيسية عند اختيار منصة التداول، حيث يضع المستخدمون أموالهم في أنظمة عبر الإنترنت. يجب أن تكون المنصة الموثوقة مرخصة من قبل الهيئات التنظيمية المالية مثل FCA وCySEC وSEC وASIC لضمان الامتثال لمعايير الصناعة.

يجب أن توفر تدابير أمان قوية، بما في ذلك التشفير والمصادقة الثنائية (2FA)، لحماية حسابات المستخدمين وبياناتهم الشخصية. كما ينبغي أن توفر المنصات حسابات منفصلة وآليات لحماية المستثمرين لضمان سلامة أموال المتداولين في حالة الإفلاس أو الاحتيال.

التكامل مع أدوات التحليل والتداول

يحتاج المستخدمون إلى الوصول إلى بيانات السوق في الوقت الفعلي، وأدوات تحليل الرسوم البيانية المتقدمة، وتحليلات الأداء لاتخاذ قرارات تداول مستنيرة. يجب أن توفر منصة التداول الاجتماعي القوية موجزات أسعار محدثة، وتنبيهات إخبارية، ومقاييس أداء متعمقة للمتداولين المتميزين.

تساعد أدوات إدارة المخاطر المدمجة، مثل أوامر وقف الخسارة وعناصر التحكم في الرافعة المالية، المتداولين على تقليل الخسائر المحتملة والحفاظ على استراتيجيات تداول منضبطة.

المجتمع والميزات الاجتماعية

نظرًا لأن التداول الاجتماعي يعتمد على التعاون، يجب أن توفر المنصة بيئة تفاعلية نشطة. تتيح الميزات مثل الدردشة المباشرة والمنتديات وخلاصات التداول للمستخدمين مشاركة الرؤى ومناقشة اتجاهات السوق في الوقت الفعلي.

يساهم تقييم المستخدمين، بما في ذلك التقييمات والمراجعات الخاصة بمقدمي الإشارات، في تعزيز الشفافية والثقة داخل المنصة. بالإضافة إلى ذلك، توفر الموارد التعليمية مثل الندوات عبر الإنترنت والدورات التدريبية ميزة كبيرة، لا سيما للمتداولين المبتدئين.

التكاليف والرسوم

يعد فهم هيكل التكاليف في منصة التداول الاجتماعي أمرًا ضروريًا لتجنب النفقات غير الضرورية. يجب أن يقوم المتداولون بتقييم فروق الأسعار ومعدلات العمولة، حيث تؤدي تكاليف التداول المنخفضة إلى زيادة الأرباح.

تفرض بعض المنصات رسومًا على التداول بالنسخ، والتي قد تكون نسبة مئوية من الأرباح الناتجة عن الصفقات المنسوخة. كما أن الشفافية في رسوم الإيداع والسحب، وغياب الرسوم المخفية مثل رسوم عدم النشاط، تسهم في تحسين تجربة المستخدم.

دعم العملاء والموثوقية

يضمن دعم العملاء الموثوق حل المشكلات بسرعة حتى يتمكن المتداولون من مواصلة التداول دون انقطاع. يجب أن توفر المنصة عالية الجودة دعمًا للعملاء على مدار الساعة، نظرًا لأن الأسواق المالية تعمل على مدار 24 ساعة.

تعمل قنوات الدعم المتعددة، مثل الدردشة المباشرة والبريد الإلكتروني والمساعدة الهاتفية، على تحسين الوصول إلى الدعم. كما أن سرعة الاستجابة أمر بالغ الأهمية لمعالجة المشكلات الفنية أو الاستفسارات المتعلقة بالحسابات أو الصفقات على الفور.

السمعة وآراء المستخدمين

تعكس سمعة المنصة مدى موثوقيتها. ينبغي للمتداولين البحث في تقييمات المستخدمين على المنتديات المالية والمواقع المتخصصة لقياس مدى رضا العملاء.

أفضل 5 حلول برمجية للتداول الاجتماعي للوسطاء في عام 2025

أعاد التداول الاجتماعي تعريف بيئة التداول، مما جعله أكثر تكلفة ميسورة وتعاونًا وكفاءة لكل من المتداولين المبتدئين والمتمرسين. يجب على الوسطاء الذين يسعون إلى دمج التداول الاجتماعي في منصاتهم اختيار مزود يوفر تجربة مستخدم سلسة، وأدوات قوية لإدارة المخاطر، وخيارات أصول متنوعة.

فيما يلي تحليل مفصل لأفضل 5 حلول تداول اجتماعي لشركات الوساطة في عام 2025.

1. eToro

eToro هي رائدة في مجال التداول الاجتماعي، حيث توفر مجتمعًا واسعًا من المتداولين ومنصة بواجهة سهلة الاستخدام. تتيح للمستخدمين نسخ صفقات المستثمرين المحترفين بسهولة، كما توفر إمكانية الوصول إلى فئات أصول متعددة، بما في ذلك الأسهم والفوركس والعملات الرقمية وصناديق الاستثمار المتداولة (ETFs). تجعل واجهتها الملائمة للهواتف المحمولة وأدوات الرسوم البيانية المدمجة منها خيارًا مفضلًا للمتداولين.

على الرغم من امتثالها القوي للوائح التنظيمية (FCA وCySEC وASIC)، فإن eToro لديها هوامش ربح أعلى من بعض المنافسين وخيارات تخصيص محدودة لاستراتيجيات التداول بالنسخ. ومع ذلك، يفضل الوسطاء eToro نظرًا لسمعتها القوية، وقاعدة مستخدميها الواسعة، والميزات المدمجة التي تساعد على جذب المتداولين الأفراد والاحتفاظ بهم.

2. B2COPY

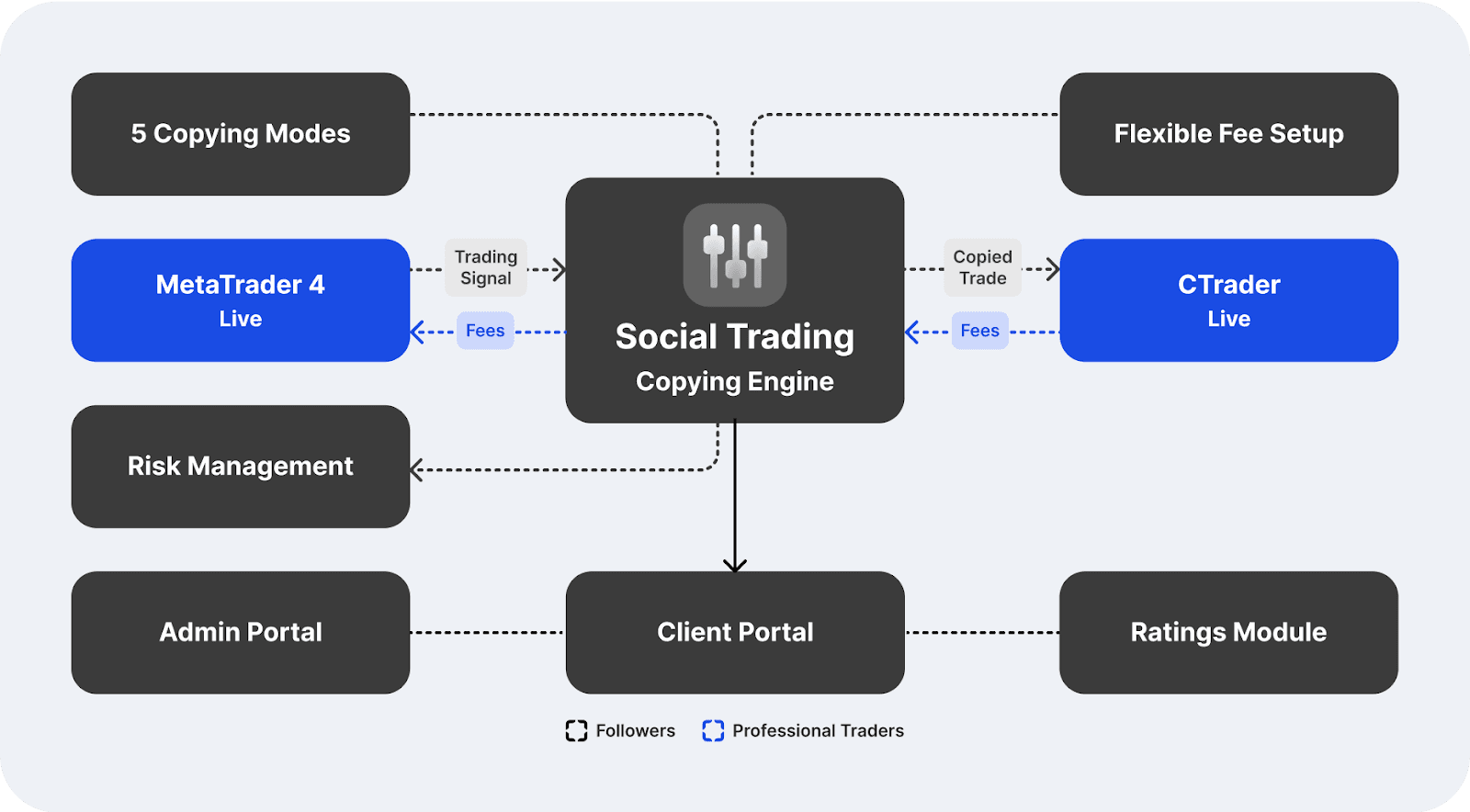

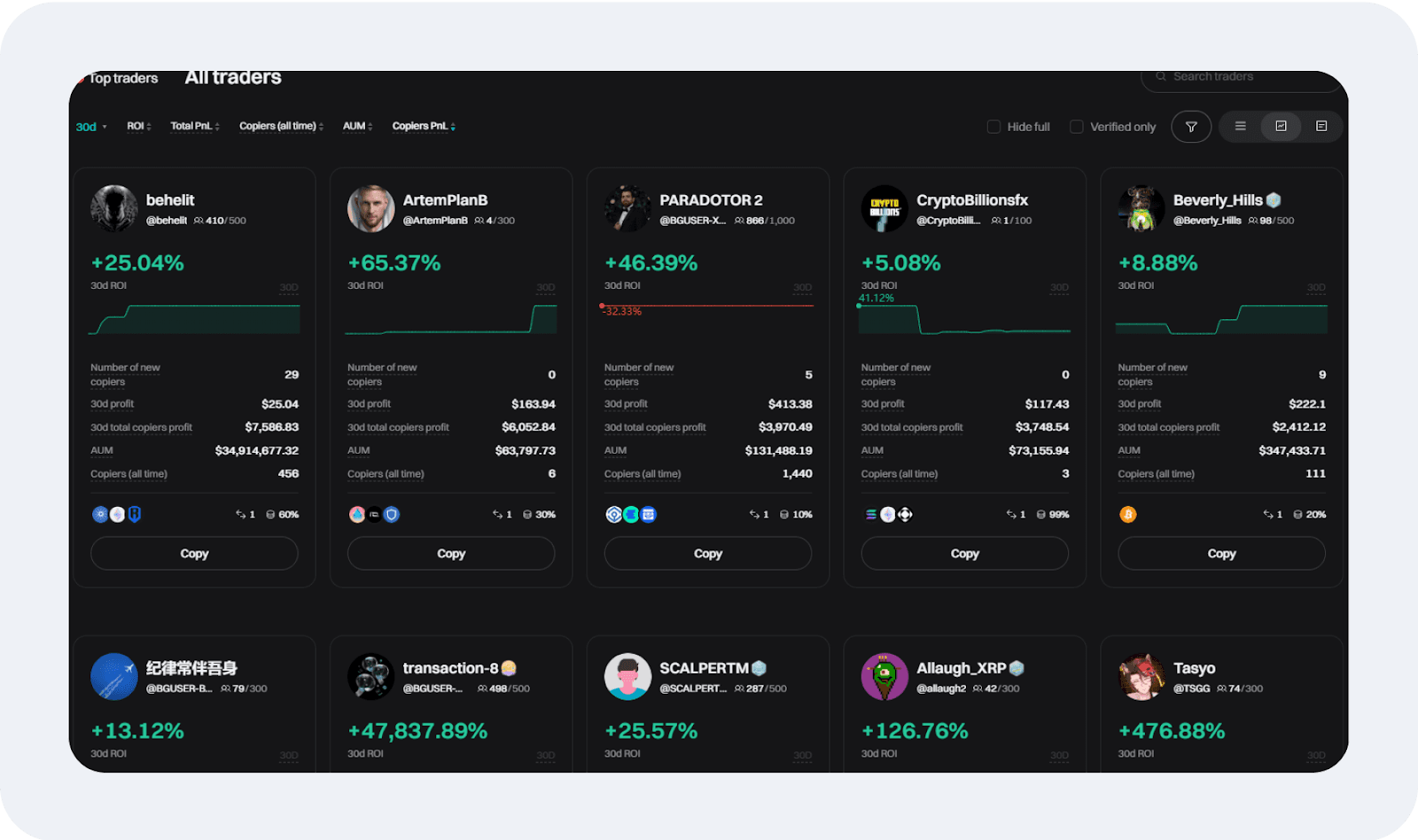

B2COPY، المقدمة من شركة B2BROKER، هي منصة تداول اجتماعي احترافية توفر حلول تداول بالنسخ قابلة للتخصيص بدرجة عالية للوسطاء. تتيح للوسطاء إدارة حسابات عملاء متعددة، وتخصيص هياكل العمولات، والوصول بسلاسة إلى حسابات MT4 وMT5 وcTrader.

تتميز B2COPY بمرونتها، حيث تلبي احتياجات التداول اليدوي والآلي. ورغم أنها تتطلب تكاملًا من جانب الوسيط، فإنها تعد واحدة من أكثر منصات التداول الاجتماعي القابلة للتخصيص للوسطاء الذين يرغبون في الحفاظ على السيطرة على بيئة التداول الخاصة بهم.

3. cTrader Copy

cTrader Copy هي حل تداول اجتماعي مدمج من Spotware، مصمم للوسطاء الذين يستخدمون منصة cTrader بالفعل. توفر شفافية كاملة للصفقات، مما يسمح للمتداولين بمراجعة وتحليل مقدمي الاستراتيجيات قبل نسخ صفقاتهم.

على عكس منصات التداول الاجتماعي الخارجية، لا يتطلب cTrader Copy أي برامج إضافية، مما يجعله خيارًا مثاليًا للوسطاء الذين يريدون حلًا مدمجًا للتداول بالنسخ. كما أن إعدادات النسخ القابلة للتخصيص والتكامل المباشر مع الوسيط يجعلان منه خيارًا مفضلًا ضمن نظام cTrader.

4. ZuluTrade

ZuluTrade هي منصة تداول بالنسخ معروفة عالميًا تربط المتداولين بمقدمي الإشارات، مما يسمح للمستخدمين بنسخ استراتيجيات متعددة وفقًا لأهدافهم الاستثمارية. يمكن للوسطاء دمج ZuluTrade بسهولة في أنظمتهم الحالية، مما يوفر حلاً مرنًا للتداول الاجتماعي من جهة خارجية دون الحاجة إلى تطوير داخلي.

تتفوق ZuluTrade في الشفافية، حيث تقدم سجلات أداء مفصلة لمقدمي الإشارات وأدوات متقدمة لإدارة المخاطر مثل ZuluGuard. ومع ذلك، يجب على المستخدمين ربط حساباتهم بوسطاء خارجيين، وقد يفرض بعض مقدمي الإشارات رسومًا إضافية.

بالنسبة للوسطاء، تساعد ZuluTrade في تعزيز تفاعل العملاء وزيادة نشاط التداول دون تعقيدات بناء بنية تحتية خاصة بالتداول الاجتماعي.

5. NAGA

NAGA تجمع بين التداول الاجتماعي والابتكار في التكنولوجيا المالية، حيث توفر منصة غنية بالميزات تتيح للمتداولين نسخ الخبراء، والمشاركة في مسابقات التداول، وحتى استخدام محفظة رقمية مدمجة لإجراء معاملات الأصول الرقمية. تدعم المنصة مجموعة متنوعة من الأصول، بما في ذلك الفوركس والأسهم والسلع والعملات الرقمية، مما يجعلها مثالية لاستراتيجيات التداول المتنوعة.

ما يميز NAGA هو تجربة التداول المبتكرة التي تعتمد على عناصر الألعاب وميزة Auto-Copy، والتي تتيح للمتداولين تكرار صفقات المستثمرين الرائدين على الفور. يوفر نظامها البيئي المرن خيارًا قويًا للوسطاء الذين يسعون إلى جذب المتداولين من خلال عناصر اجتماعية وتفاعلية.

اتجاهات المستقبل في التداول الاجتماعي للوسطاء

يتطور مشهد التداول الاجتماعي بسرعة، مدفوعًا بالتطورات التكنولوجية والتغيرات التنظيمية وتحولات تفضيلات المتداولين. ومع سعي الوسطاء إلى البقاء في المنافسة، يجب عليهم التكيف مع الاتجاهات الجديدة التي تشكل مستقبل التداول الاجتماعي.

من الأتمتة المدعومة بالذكاء الاصطناعي إلى التمويل اللامركزي، ستعيد الموجة القادمة من الابتكارات تعريف كيفية جذب الوسطاء للعملاء والاحتفاظ بهم ضمن منظومة التداول الاجتماعي.

صعود التداول الاجتماعي المدعوم بالذكاء الاصطناعي

يُعيد الذكاء الاصطناعي تشكيل مستقبل التداول الاجتماعي بجعله أكثر اعتمادًا على البيانات وأكثر كفاءة. يمكن لخوارزميات التداول المدعومة بالذكاء الاصطناعي تحليل كميات هائلة من بيانات السوق في الوقت الفعلي، مما يوفر للمتداولين رؤى تنبؤية واستراتيجيات تداول آلية.

يعمل الوسطاء بشكل متزايد على دمج الذكاء الاصطناعي في أنظمة التداول الاجتماعي الخاصة بهم لتعزيز إدارة المخاطر، وتحسين تنفيذ الصفقات، وتقديم توصيات مخصصة للمستخدمين.

كما تُستخدم نماذج التعلم الآلي أيضًا لتقييم مصداقية مقدمي الإشارات وأدائهم، مما يساعد المتداولين على اتخاذ قرارات أكثر استنارة بشأن من يتابعونه.

التخصيص والتداول بالنسخ التكيفي

يتجاوز التداول الاجتماعي النماذج التقليدية الموحدة، حيث بدأت المنصات في تقديم ميزات التداول بالنسخ التكيفي. وبدلاً من نسخ كل صفقة عشوائيًا، يمكن للمتداولين تخصيص استراتيجياتهم وفقًا لتحمل المخاطر وأهدافهم الاستثمارية ومعايير السوق.

ستستخدم المنصات المستقبلية الذكاء الاصطناعي والبيانات الضخمة لإنشاء أدلة تداول مخصصة، وضبط استراتيجيات التداول بالنسخ ديناميكيًا استجابة لتقلبات السوق.

سوف يجذب الوسطاء الذين يوفرون نماذج تداول تكيفية مجموعة أوسع من المستثمرين، بدءًا من المبتدئين الحذرين إلى المتداولين المحترفين ذوي التردد العالي.

التوسع إلى فئات أصول جديدة

في حين أن الفوركس والأسهم كانت تهيمن تقليديًا على التداول الاجتماعي، هناك طلب متزايد على مجموعات الأصول البديلة مثل العملات الرقمية والسلع والأصول المرمزة. مع صعود التمويل اللامركزي (DeFi)، يبحث المتداولون عن طرق لنسخ استراتيجيات في الأسواق القائمة على البلوكشين، بما في ذلك استثمارات NFT والتخزين (staking).

سيتمتع الوسطاء الذين يوسعون حلول التداول الاجتماعي لديهم لتشمل العملات الرقمية وصناديق الاستثمار المتداولة (ETFs) والسندات والأصول الحقيقية المرمزة بميزة تنافسية في جذب المتداولين العصريين الذين يسعون إلى فرص استثمارية متنوعة.

التداول الاجتماعي وعالم الميتافيرس

يفتح ظهور الميتافيرس آفاقًا جديدة للتداول الاجتماعي. يمكن أن تعيد منصات التداول الافتراضية، والمجتمعات التجارية التفاعلية، والمناقشات الحية في بيئات افتراضية، تعريف كيفية تفاعل المتداولين.

قد تتكامل منصات التداول الاجتماعي المستقبلية مع تجارب تداول تعتمد على الواقع الافتراضي (VR)، مما يتيح للمستخدمين تحليل الرسوم البيانية، وحضور الندوات الافتراضية، والتعاون مع زملائهم المتداولين في مساحات ثلاثية الأبعاد.

سيتمكن الوسطاء الذين يستكشفون تكامل الميتافيرس من جذب الجيل القادم من المتداولين الرقميين.

اعتماد التداول الاجتماعي من قبل المؤسسات

لم يعد التداول الاجتماعي مقتصرًا على المستثمرين الأفراد. بدأت المؤسسات المالية في استكشاف استراتيجيات التداول الاجتماعي، مستفيدة من التحليلات المتقدمة والتداول بالنسخ المدعوم بالذكاء الاصطناعي لتحسين إدارة الصناديق.

بدأت صناديق التحوط ومديرو الأموال المحترفون في دمج عناصر التداول الاجتماعي، مما يمكنهم من تحليل معنويات السوق وسلوك الجمهور في الوقت الفعلي.

سيحقق الوسطاء الذين يكيّفون خدمات التداول الاجتماعي الخاصة بهم لاستيعاب المتداولين المؤسسيين ميزة تنافسية في المشهد المالي المتطور.

تكامل التداول عبر الوسطاء والمنصات المختلفة

ستدعم واجهات التداول الاجتماعي المستقبلية الاتصال متعدد الوسطاء، مما يسمح للمتداولين بنسخ الاستراتيجيات عبر حسابات وساطة متعددة. ستعزز هذه المرونة السيولة وخيارات المستخدم، مما يمكن المتداولين من تنويع محافظهم عبر منصات تداول مختلفة.

بالإضافة إلى ذلك، سيمكن دمج التداول الاجتماعي مع كل من التمويل التقليدي (TradFi) والتمويل اللامركزي (DeFi) من تنفيذ عمليات تداول سلسة بين البورصات المركزية (CEXs) واللامركزية (DEXs).

انتقال التداول بالنسخ إلى المحافظ المدارة بالذكاء الاصطناعي

من المحتمل أن يدمج مستقبل التداول الاجتماعي بين التداول بالنسخ وإدارة المحافظ القائمة على الذكاء الاصطناعي، مما يخلق نماذج استثمار هجينة.

بدلاً من الاعتماد فقط على المتداولين البشر، سيتمكن المستثمرون من نسخ المحافظ التي تديرها أنظمة الذكاء الاصطناعي، والتي تعمل على ضبط تخصيصاتها ديناميكيًا بناءً على اتجاهات السوق.

ستعمل هذه المحافظ المدارة بالذكاء الاصطناعي في التداول الاجتماعي بشكل مشابه للمستشارين الآليين (robo-advisors)، ولكن بقدرات تكيّف في الوقت الفعلي، وتحليلات اجتماعية، وميزات متقدمة لإدارة المخاطر.

الخاتمة

مع استمرار نمو قطاع التداول الاجتماعي، يجب على الوسطاء مواكبة التطورات من خلال دمج أحدث برامج التداول الاجتماعي وتوسيع عروضهم في التداول بالنسخ وحسابات PAMM. سواء من خلال الأتمتة المدعومة بالذكاء الاصطناعي، أو الشفافية المستندة إلى البلوكشين، أو ظهور التفاعل التجاري في الميتافيرس، فإن مستقبل التداول الاجتماعي يبدو واعدًا.

سوف يتمكن الوسطاء الذين يتبنون هذه الابتكارات من جذب مجموعة متنوعة من المتداولين، بدءًا من المبتدئين وصولًا إلى المستثمرين المؤسسيين، وتعزيز وجودهم في سوق برامج التداول الاجتماعي المتطور.

الأسئلة الشائعة

ما هي أفضل منصة تداول اجتماعي للوسطاء في عام 2025؟

تُعد eToro وB2COPY وZuluTrade من بين أكبر منصات التداول الاجتماعي، حيث توفر أدوات قوية للتداول بالنسخ والاستثمار.

كيف يعمل التداول بالنسخ؟

يسمح التداول بالنسخ للمستخدمين بتكرار صفقات المستثمرين المحترفين تلقائيًا، مما يمكّن المبتدئين من المشاركة في الأسواق بأقل جهد.

ما هو حساب PAMM؟

حساب PAMM (وحدة إدارة التوزيع النسبي) هو منصة استثمار مُدارة تتيح للمتداولين تخصيص أموالهم لمديري أموال محترفين.

هل تخضع منصات التداول الاجتماعي للتنظيم؟

نعم، تلتزم أفضل المنصات باللوائح المالية مثل FCA وCySEC وASIC لضمان الأمان والشفافية.

ما هي الاتجاهات الرئيسية في التداول الاجتماعي لعام 2025؟

يؤثر التداول المدعوم بالذكاء الاصطناعي، وتكامل البلوكشين، والتوسع في فئات الأصول الجديدة مثل العملات الرقمية والأصول المرمزة، على مستقبل التداول الاجتماعي.

اقرأ أيضًا