مشاركة

0

/5

(

0

)

توسعت عالم الوساطة المالية بشكل كبير مع ظهور منصات التداول عبر الإنترنت، التي انتقلت بالاستثمارات من رواد الأعمال ذوي رؤوس الأموال الكبيرة إلى أي شخص تقريبًا لديه اتصال بالإنترنت.

أنشأ ذلك أنواعًا مختلفة من الوسطاء تلبي احتياجات مختلفة، مثل وسطاء التنفيذ، والمشغلين الماليين الشاملين، وشركات الوساطة المخفضة.

تدفع الحواجز المنخفضة للدخول في التداول أي شخص للدخول في الأسواق المالية، مما يتيح لهم استكشاف مصادر دخل إضافية مع أموال و استثمارات أولية محدودة.

لذلك، الوسيط المخفض هو أفضل رهان لك إذا كنت ترغب في بدء تجربتك الأولى في الاستثمار. دعونا نستكشف كيف يعملون وما الذي يجعلهم فريدين.

نقاط أساسية

يركز الوسطاء المخفضون على معالجة أوامر الشراء/البيع من خلال منصات الإنترنت.

تُعتبر الوساطة المخفضة فعالة من حيث التكلفة وأكثر بساطة، تتماشى مع المتداولين ذوي الخبرة ورأس المال المحدود.

يعمل الوسطاء الشاملون بشكل مختلف، حيث يقدمون مجموعة واسعة من خدمات الاستشارات، والاستشارات الضريبية، والتخطيط المالي، وغيرها بأسعار مرتفعة.

فهم الوساطة المخفضة

الوسيط المخفض هو مشغل مالي يساعد المستثمرين في تلبية طلباتهم التجارية و معالجة أوامر الشراء والبيع. من خلال حساب الوساطة المخفض، يقدمون وسائل تقنية للوصول إلى أماكن الاستثمار والأسواق والبحث عن الأوراق المالية والأصول و المراكز المفتوحة.

يأتي اسم "مخفض" من النهج الاقتصادي لقطع الخدمات الإضافية مثل الاستشارات، وإدارة الأصول، وخدمات الحفظ وغيرها من الأنشطة التي تزيد التكاليف. في الواقع، يعمل معظم الوسطاء المخفضين افتراضيًا بدون مكتب مادي، مما يقلل من تكاليف التشغيل ويقدم حلول تداول بأسعار معقولة لعملائهم.

تتوفر خدمات مشابهة بأسعار مخفضة في صناعات أخرى، مثل استثمارات العقارات (قوائم الملكيات) وشركات التأمين (بيع السياسات).

[اقتباس aa-عالمي]

حقائق سريعة

يُعتقد أن الوساطة المخفضة بدأت في عام 1975 عندما أمرت لجنة الأوراق المالية والبورصات (SEC) الوسطاء بالاتفاق على العمولات بدلاً من تطبيق سعر ثابت.

[/اقتباس aa]

هل الوسيط المخفض والوسيط التنفيذي نفس الشيء؟

يقدم الوسيط المخفض و الوسطاء التنفيذيون خدمات مشابهة. ومع ذلك، لديهم اختلافات أساسية.

التشابهات: يعمل كلا المشغلين كوسيطين بين المستثمرين والأسواق المالية، مما يوفر الوصول إلى التكنولوجيا والتفاعل مع أماكن التداول ومصادر السيولة.

الاختلافات: يركز الوسطاء التنفيذيين على معالجة أوامر الشراء/البيع نيابة عن العملاء الأفراد أو المؤسسيين. إن مهمتهم الرئيسية هي "جعل الصفقات تحدث" مع تقديم خدمات مساعدة أخرى.

على النقيض من ذلك، يوجه الوسطاء المخفضون نحو المستثمرين الأفراد. يقدمون منصات عبر الإنترنت تتيح التداول المدعوم ذاتيًا، وغالبًا بدون استشارات أو خدمات إضافية.

نظرة عامة على الصناعة

ستستمر صناعة الوساطة المخفضة في النمو مع وصول المزيد من المستخدمين إلى الإنترنت وزيادة معرفتهم بممارسات التداول واستراتيجيات الاستثمار الأفضل.

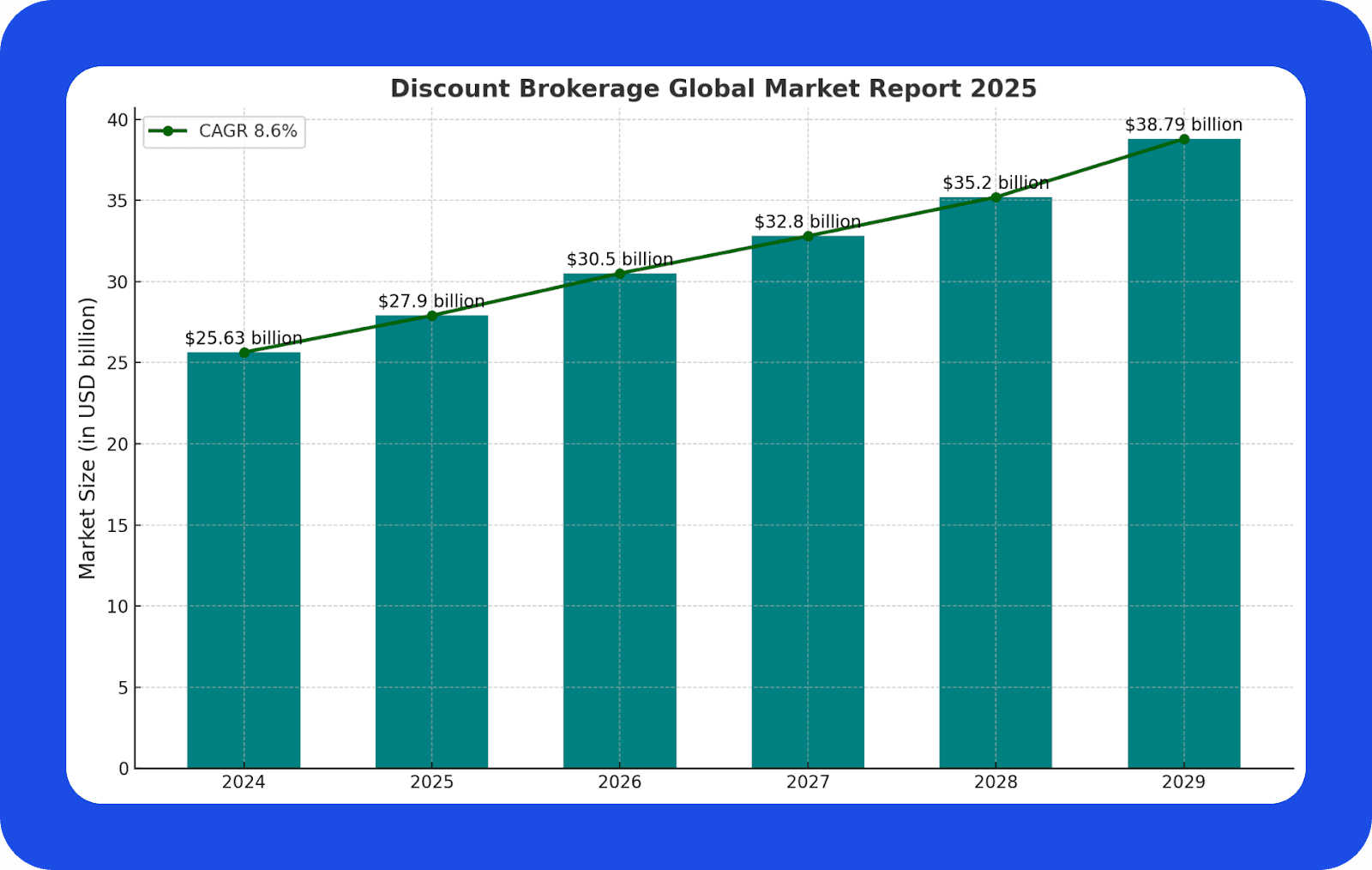

وفقًا لـ شركة أبحاث الأعمال، تم تقدير حجم سوق الوساطة المخفضة بأكثر من 25 مليار دولار في عام 2024. ومن المتوقع أن تصل هذه الاتجاهات إلى معدل نمو سنوي مركب قدره 8.9%، أقل بقليل من 28 مليار دولار في عام 2025.

من المتوقع أن يستمر هذا النمو بمعدل نمو سنوي مركب قدره 8.6% بحلول نهاية العقد، ليصل إلى أكثر من 38 مليار دولار في عام 2029.

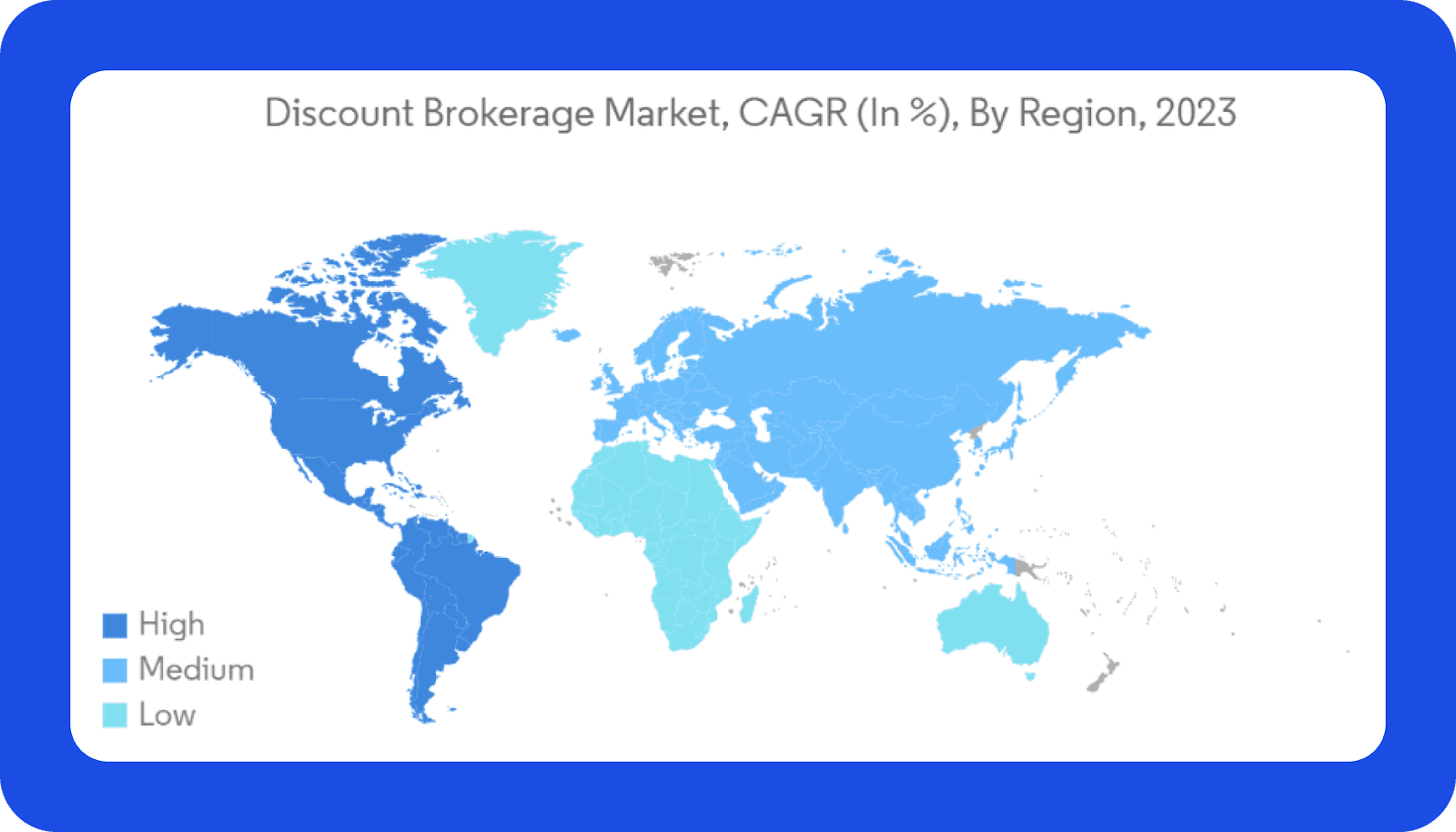

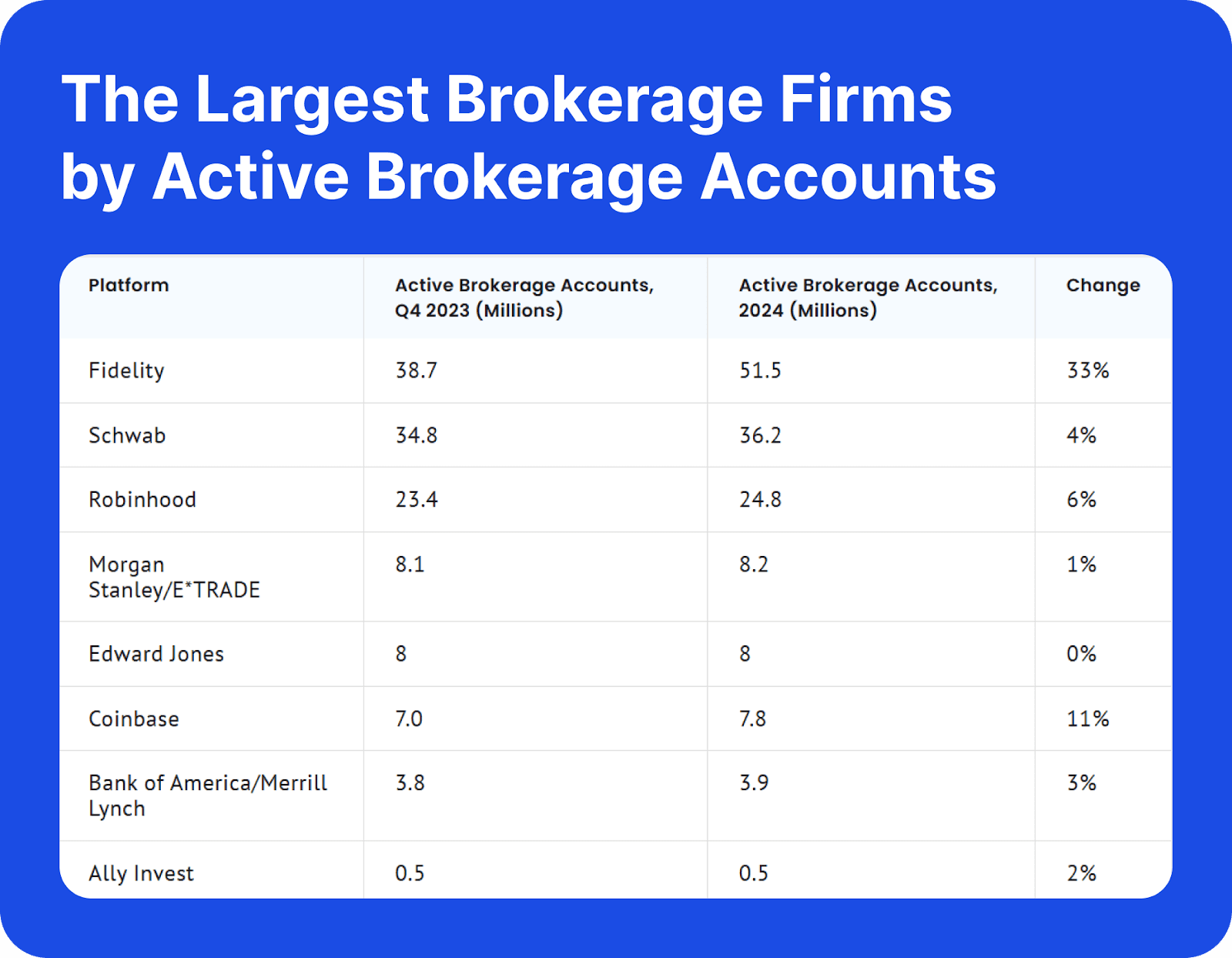

يأتي الكثير من هذا النمو من المشاركين الراسخين في الأسواق الأمريكية، حيث تقود العديد من المؤسسات المالية الأمريكية الفضاء، مثل فيديليتي للاستثمارات، وتشارلز شفاب، وإي تريد، وTD أميريتريد، وInteractive Brokers.

من ناحية أخرى، تسهم التطورات في الأسواق الآسيوية، وخاصة الصين والهند، في تعزيز التكنولوجيا المالية وتسهيل عمل شركات الوساطة. يتم استكشاف العديد من المستخدمين في هذه المناطق خيارات تنافسية للبحث عن أنشطة استثمارية بأسعار معقولة.

كيف يعمل الوسيط المخفض؟

تقدم وكالات التداول المخفضة خدمات مالية فعالة من حيث التكلفة من خلال منصات عبر الإنترنت، تستهدف بشكل أساسي المستثمرين ذوي التوجيه الذاتي. يتمكن المستخدمون من شراء وبيع الأدوات المالية مثل الأسهم، وETFs، والخيارات دون تقديم خدمات استشارية شخصية.

تستخدم هذه الوسطاء التكنولوجيا لأتمتة العمليات مثل تنفيذ الصفقات، وتتبع المحافظ، وتحليل بيانات السوق، مما يقلل نفقات التشغيل.

يتم فرض عمولات مختلفة أو رسوم خدمات أو نماذج اشتراك من قبل الوسطاء المخفضين. يركزون على المعاملات منخفضة التكلفة ويمكّنون المستثمرين الأفراد من الوصول إلى الأسواق المالية بشكل مستقل.

وبذلك، يركزون على القدرة على تحمل التكاليف ويزيدون من شعبيتهم بين المتداولين الذين يهتمون بالميزانية وذوي المهارات التقنية.

الوساطة الشاملة مقابل الوساطة المخفضة

تربط شركات الوساطة المستثمرين بالأسواق المالية من خلال خدمات مختلفة. غالبًا ما تقع ضمن فئتين: الوسطاء الشاملون والوسطاء المخفضون. بينما يسهل كلاهما التجارة، يختلفان في نماذج الأعمال، وهياكل التكاليف، وجماهير المستهدفين.

الوسطاء الشاملون يقدمون خدمات مالية شاملة، بما في ذلك نصائح استثمارية مخصصة، وإدارة المحافظ، والتخطيط الضريبي، والوصول إلى تقارير البحث.

يستهدفون العملاء الشركات الذين يسعون إلى توجيهات لتحقيق أهدافهم المالية. يعملون من خلال فرق من الخبراء الذين يقدمون توصيات مخصصة بناءً على تحمل المخاطر الفردية، وأفق الاستثمار، والأهداف.

يتقاضى الوسطاء الشاملون رسومًا مرتفعة مقابل خدماتهم، عادةً من خلال عمولات أعلى، ورسوم إدارة، أو رسوم صيانة الحساب. وهم مثاليون للمستثمرين الذين يقدّرون النصائح الخبراء أو المؤسسات متعددة الجنسيات التي تتطلع إلى الاستعانة بمصادر خارجية للأنشطة المالية المعقدة.

على النقيض من ذلك، تقدم الوساطة المخفضة خدمات تداول بسيطة ومنخفضة التكلفة، تستهدف أساسًا المستثمرين الأفراد. يقدمون منصات عبر الإنترنت لتنفيذ الصفقات بشكل مستقل، وغالبًا ما يوفرون أدوات للبحث، والرسم البياني، والتحليل. نادراً ما تقدم الوساطة المخفضة نصائح شخصية ولكن تقدم خدمات أساسية مثل الوصول إلى السوق في الوقت الحقيقي وتتبع المحافظ.

يجذب هذا النهج الفعال من حيث التكلفة العملاء الذين يهتمون بالميزانية والمبتدئين، مما يتيح لهم السيطرة مع الحد الأدنى من التكاليف الزائدة وتعقيدات الأتمتة.

المزايا والعيوب

الحصول على وسيط تداول مخفض هو أكثر ملاءمة للمتداولين العرضيين الذين يبحثون عن طريقة بسيطة للوصول إلى أسواق التداول. ومع ذلك، تأتي مع بعض القيود. دعونا نراجع بعض الإيجابيات والسلبيات التي تحتاج إلى معرفتها.

الإيجابيات

التكاليف المنخفضة: تجعل العمولات والرسوم المخفضة منهم مثاليين للمستخدمين المحدودي الميزانية.

منصات مدفوعة بالتكنولوجيا: تقدم الوساطة المخفضة عبر الإنترنت أدوات وحلول سهلة الاستخدام للتداول والتحليل.

التحكم والاستقلالية: يمكّن المستثمرون من إدارة صفقاتهم بدون الاعتماد على المستشارين.

قابلية التوسع: تعتبر الوسطاء المخفضون مناسبين للمتداولين المكثرين بسبب انخفاض تكاليف المعاملات.

الوصول إلى السوق: تقدم وصولًا مباشرًا إلى أسواق مالية متعددة بقدر كافٍ من السيولة ونماذج التسعير.

السلبيات

عدم وجود نصيحة مخصصة: عدم وجود تخطيط مالي أو توجيه استثماري مُعدل.

خدمات محدودة: يركزون على تنفيذ الصفقات دون تقديم دعم شامل.

منحنى التعلم: قد يجد المبتدئون صعوبة في التداول بشكل مستقل.

تكاليف مخفية: تأتي الخدمات الإضافية أو الأدوات المساعدة بأسعار مرتفعة أو اشتراكات.

دعم العملاء: يشمل نهجهم الفعال من حيث التكلفة دعمًا محدودًا بعد الخدمة مقارنة بالوسطاء الشاملين.

أفضل خمس شركات وساطة مخفضة

تقدم العديد من الوسطاء المخفضين حلول تداول تناسب محفظتك الاستثمارية وتوقعات ميزانيتك. تجعل توفرها الواسع اختيارك أكثر تنوعًا، على الرغم من أنه قد يكون من الصعب تحديد الأنسب. إليك أفضل خمس شركات للوساطة المخفضة يمكنك أخذها بعين الاعتبار.

فيديليتي للاستثمارات

فيديليتي، التي تأسست عام 1946، هي اسم معروف جدًا في الصناعة المالية. إنها تقدم حلول متنوعة للاستثمار وإدارة الأصول. تشمل خدمات الوساطة المخفضة لديها تداولًا بدون عمولات للأسهم الأمريكية و ETFs، ومنصة بحث قوية، وأدوات تخطيط تقاعد. تبرز فيديليتي للاستثمارات بفضل عروض منتجاتها الشاملة، بما في ذلك صناديق الاستثمار المشتركة والسندات وصناديق المؤشرات ذات نسبة المصروفات صفر.

تشارلز شفاب

تشارلز شفاب، التي تأسست عام 1971، هي واحدة من أكثر العلامات التجارية موثوقية في الوساطة المخفضة. تقدم تداولًا بدون عمولات للأسهم وصناديق الاستثمار المتداولة، ونطاقًا واسعًا من المنتجات المالية، وخدمة عملاء ممتازة. تناسب موارد شفاب التعليمية المبتدئين، بينما تلبي خيارات الاستشارات الشاملة المستثمرين ذوي الخبرة الذين يبحثون عن إدارة مالية متقدمة.

إي تريد

إي ترييد تأسست في عام 1982 بهدف دمج التداول منخفض التكلفة مع التكنولوجيا البديهية لتسهيل الخدمات المالية لعدد أكبر من المستخدمين. تدعم منصتها الأسهم، والخيارات، والعقود الآجلة، والسندات، بالإضافة إلى أدوات الرسم البياني المتقدمة للمتداولين. تجعل واجهة إي ترييد سهلة الاستخدام واللوحات القابلة للتخصيص الوصول أكثر مرونة وسهولة لكل من المستثمرين الجدد والخبراء.

روبن هود

روبن هود تم إطلاقه في عام 2013، مما أحدث انقلابًا في الصناعة بنموذج تداول بدون عمولات واستهداف فعال لجيل الألفية والمستثمرين المتعصبين للتكنولوجيا. تُعرف روبن هود بمنصتها التفاعلية للهاتف المحمول، حيث تقدم تداول الأسهم وETFs والعملات المشفرة، وغير ذلك. جعلت بساطتها، وعدم الحاجة لإيداع أدنى، والتجربة المليئة بالألعاب منها مفضلة بين المستثمرين المبتدئين.

Interactive Brokers

Interactive Brokers هي شركة مالية تأسست عام 1978. تشتهر بانتشارها عالميًا وخدمات التداول منخفضة التكلفة عبر 150 سوقًا.

تتناسب أدوات التداول المتقدمة ونموذج التسعير المتدرج لديها مع المتداولين النشطين والمؤسسات، مما يضمن تسعيرًا تنافسياً وتنفيذًا متفوقًا.

الختام

تُعتبر الوساطة المخفضة واحدة من النماذج الأكثر شعبية في خدمات المالية، حيث تقدم حلول تداول موثوقة بأسعار معقولة. تركز فقط على معالجة أوامر الشراء والبيع في أماكن الاستثمار.

تقلل هذه النهج من التكاليف الإضافية المتعلقة بالاستشارات المالية، وإدارة الأصول، والتخطيط الضريبي، أو الاستثمار الاستراتيجي. لذا، فإنها تناسب المتداولين الجدد أولئك الذين لديهم ميزانية محدودة.

اقرأ أيضًا