Share

0

/5

(

0

)

The Internet and digital revolution made trading much more accessible and feasible. It also motivates many entrepreneurs and startups to set up a brokerage firm, integrating advanced software and technologies that align with the ever-changing user preferences.

However, if you want to launch your brokerage business, you must carefully consider the trading server, offered services, market trends, and future perspectives.

Having these in mind saves costs and ensures that you are ready for upcoming challenges and changing industry conditions. Let’s review the best CFD trading software that your brokerage firm needs.

Key Takeaways

CFD brokers offer trading opportunities that do not involve ownership transfer, asset custody, and settlement cycles.

Contracts for differences are rising in popularity due to their hassle-free approach compared to traditional spot markets.

Choosing a suitable CFD trading software requires careful research to find a provider with customisable features, scalable platforms, real-time analytics, and advanced trading options.

How CFD Trading Platforms Work?

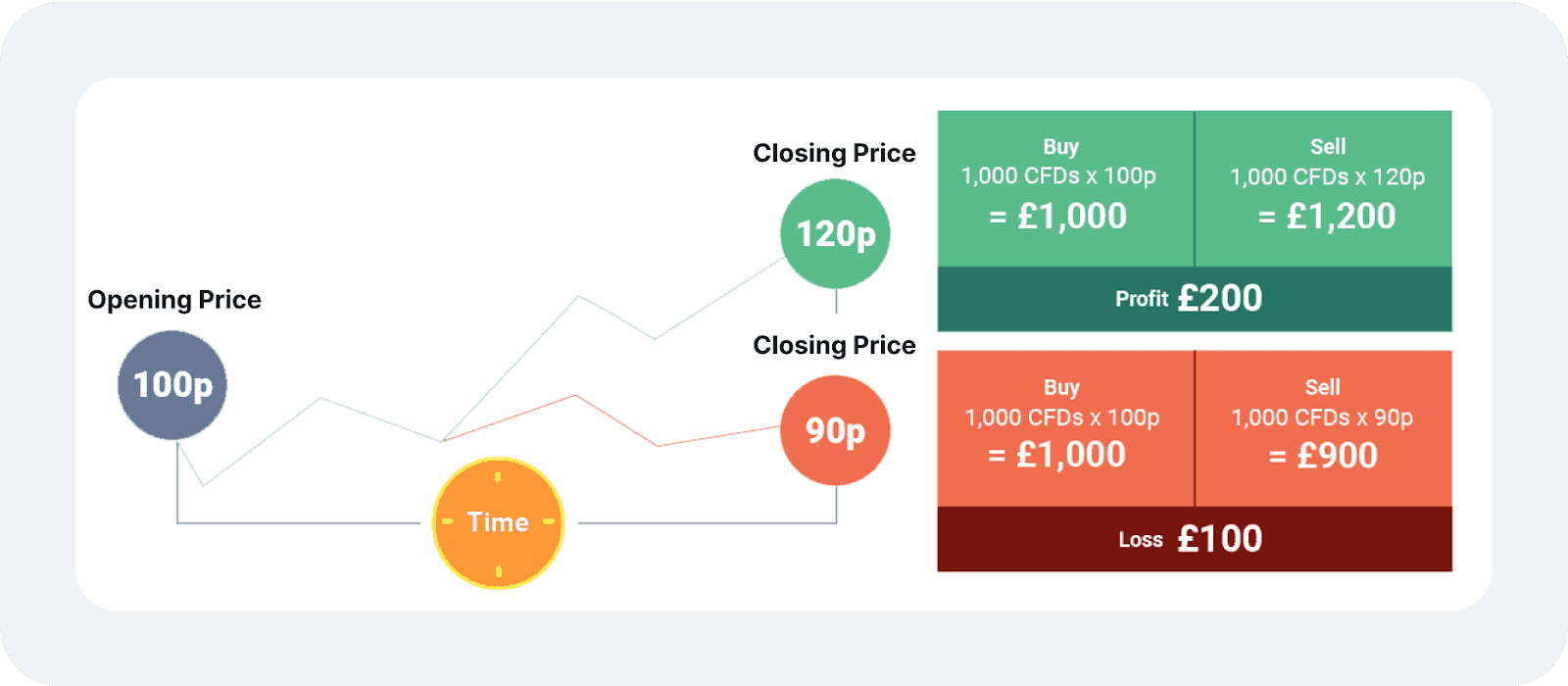

CFD stands for Contracts for Difference, which is a more innovative and accessible way to invest in financial markets and trade assets without the burden of physically holding them, real ownership transfer, or dealing with paperwork regarding custody.

CFD trading makes it easier and faster to earn from market activities and changing asset prices, allowing traders to place buy and sell orders effortlessly.

Trading platforms that offer CFD assets allow users to gain from the rising and falling prices of stocks, commodities, FX currency pairs and cryptocurrencies. They establish connections with liquidity providers to source securities, instruments, and rates and deliver them to traders who see them on their dashboards and price charts.

However, building a CFD brokerage of your own requires a complete understanding of traders’ needs. You must provide features and services that facilitate trading, analysing, account management, transacting, research, education, and more to ensure optimum user experience.

Administrators need comprehensive customer relationship management software (CRM) and a back-office solution that allows them to oversee traders’ activities, organise user details, analyse platform performance, and measure financial outcomes.

[aa quote-global]

Fast Fact

CFD was invented for the first time in 1990 by Jon Wood and Brian Keelan, two traders at the Smith New Court investment firm in London, who designed them to hedge positions while avoiding UK stamp duty (0.5% tax applied to purchasing shares in UK companies).

[/aa]

CFD vs Spot Markets

CFDs work opposite traditional trading markets, or spot markets, which entail real asset ownership and complex settlement procedures.

In spot trading, traders buy and sell actual assets, such as stocks or commodities, taking direct ownership. This approach may appeal to traditional investors who prefer custody of their stock portfolio, bond certificates, or cryptocurrencies.

However, the additional hassle of transferring the underlying asset can be challenging, costly or time-consuming.

Conversely, CFD trading allows traders to speculate on price movements without owning the underlying asset, enabling higher leverage and short-selling opportunities. This flexibility attracts traders looking for diversified strategies.

Brokers offering CFDs have better chances to enhance customer engagement and expand their product portfolio, providing exposure to various global markets with lower capital requirements.

Industry Overview

Previously, brokers mainly operated through traditional stock exchanges and investment banks, requiring traders to physically own assets. This process had high capital requirements and limited flexibility, requiring brokers to establish offices and a real entity to serve their customers.

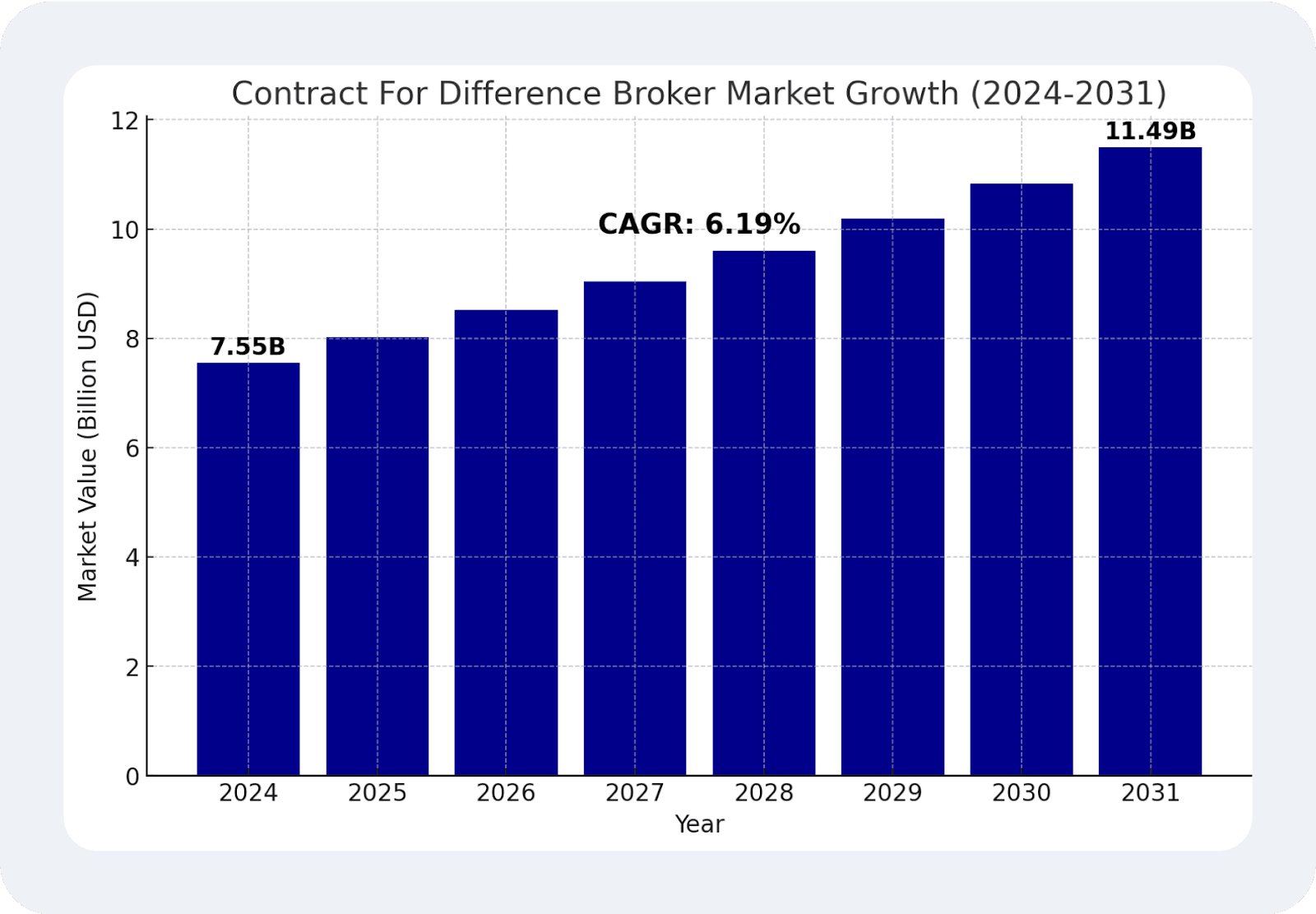

However, CFD trading has attracted retail traders seeking lower entry barriers and higher market accessibility, leading to substantial market growth on the traders’ and brokers’ levels.

The Contract for Difference (CFD) Brokerage Market size was estimated at $7.5 billion in 2024 and is expected to grow at a CAGR of 6.19%, reaching approximately $10.8 billion by 2031.

This shift empowered brokers to offer trading across Forex, stocks, indices, commodities, and cryptocurrencies on online platforms without requiring asset ownership.

These trends align with the growing popularity of mobile trading and algorithmic strategies that raise the demand for cutting-edge brokerage platforms.

Today, the best platform for CFD trading must support automation, multi-asset trading, real-time analytics, reliable risk management tools, and personalised trading experience.

How to Choose Trading Software: Key Features

Selecting the right CFD trading platform provider is crucial, especially if you want to ensure a sustainable experience, scalability and compatibility with advanced technology and changing market conditions. Therefore, you must create a checklist for the key characteristics you must find.

Multi-Asset Trading: The software must support liquidity and trading across multiple markets, including Forex, stocks, indices, commodities, and crypto CFDs, to attract a broad trader base.

Advanced Charting Tools: Ensure providing real-time market data, detailed analysis, customisable indicators, and other technical tools essential for informed trading decisions.

Risk Management: Features like negative balance protection, stop-loss orders, and margin monitoring help brokers mitigate risk exposure and are used by many professional and retail traders.

High-Speed Execution: Ensure having a low-latency engine, supporting tight spreads and minimum slippage and offering favourable trading conditions for your users.

Reliable Liquidity Streams: Review liquidity sources and stability, and ensure proper aggregation and distribution models across all supported markets.

Automation: Algo-trading and trading bots are becoming increasingly popular, requiring a sophisticated API infrastructure and reliable expert advisors to offer copy trading and auto-trading.

Intuitive Interfaces: Traders are attracted to well-designed website pages and a user-friendly onboarding experience, which boosts retention and long-term customer loyalty.

Compliance and Security: You must provide solid regulatory compliance, KYC/AML features, data encryption, and multi-factor authentication to ensure legal operation and safeguard user data.

Mobile and Web Trading: Mobile trading is on the rise, and you must provide a robust mobile app that offers similar services to those on the web interface, with cross-device functionality.

Customisation and Branding: White-label CFD platforms are crucial to creating your own digital identity and integrating needed features and services without a significant investment.

10 Best CFD Trading Software

With the plethora of online CFD trading platforms, we curated a list of the top 10 platforms that provide robust features, high-speed processing, and multi-asset trading. Each offers unique advantages and services that cater to your unique needs and business needs.

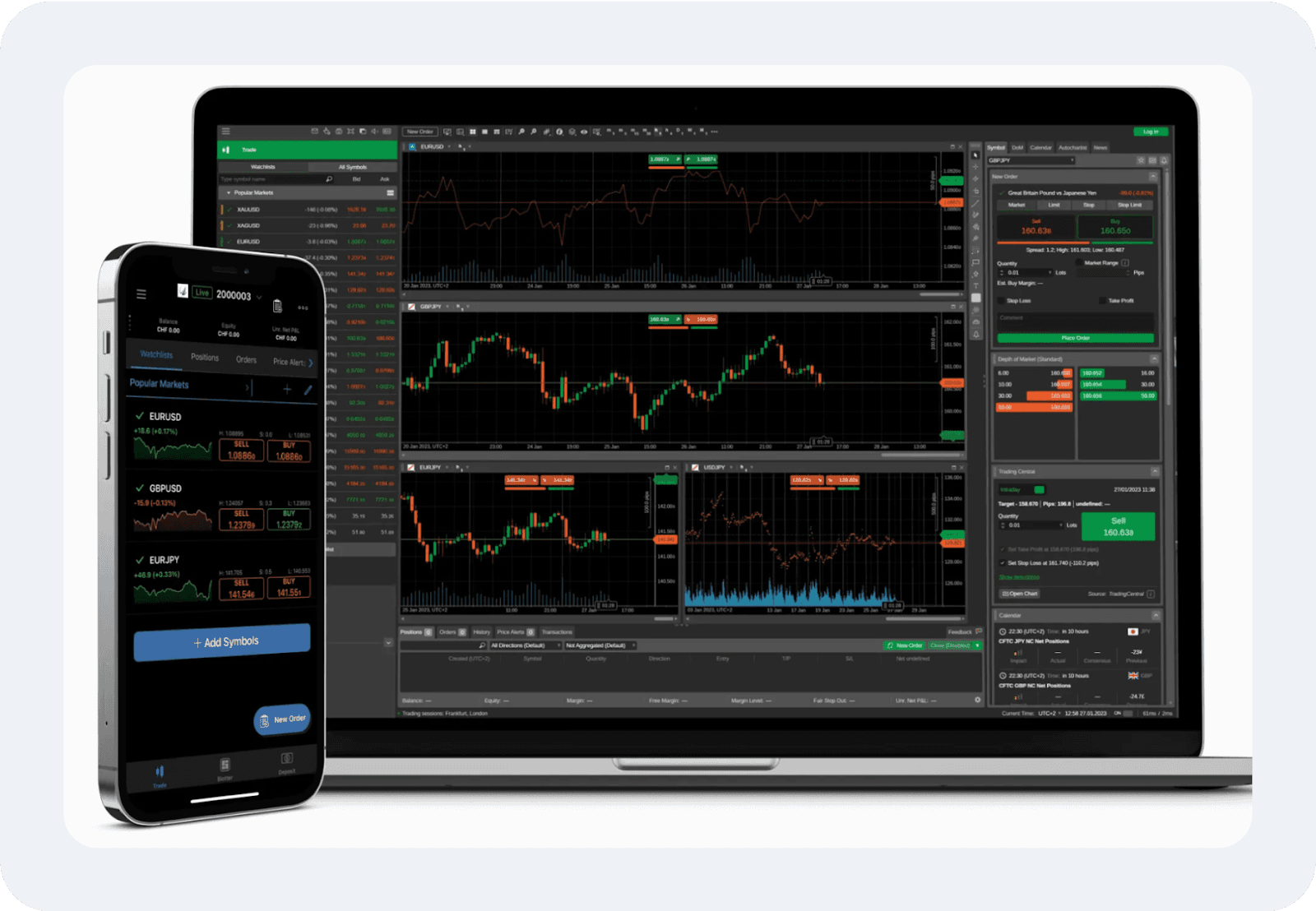

B2TRADER

B2TRADER, developed by B2BROKER, is a high-performance trading platform equipping brokers with multi-asset, multi-market liquidity, trading securities, rates, and technology. It is designed to provide ultra-fast execution, advanced liquidity aggregation, and institutional-level trading on spot and CFD markets through a single account. It offers trading across over 3,000 assets, including Crypto spots, Crypto CFD, Forex, Metals, Equity, Indices, Commodities, NDFs CFD, Equity CFD, and ETF CFD.

Key Features:

Smart order routing to execute orders between any FX currencies.

Unbounded liquidity aggregation and distribution models.

Full API integration to enable algorithmic trading and automation.

Mobile app with end-to-end onboarding and trading experience.

cTrader

cTrader is a reputable trading platform known for its intuitive user interface, advanced charting options, and transparent execution models.

It is particularly popular among CFD brokers due to its Straight Through Processing (STP) processing, which ensures traders experience fair, conflict-free order execution with no dealing desk intervention.

Brokers integrating cTrader can offer a feature-rich, professional-grade trading environment tailored for both retail and institutional CFD traders.

Key Features:

cAlgo for creating & deploying trading algorithms and automation.

Level 2 pricing for real-time order book analysis and deep liquidity.

Mobile and web trading support for seamless accessibility.

Fast execution speeds with direct market access (DMA).

Interactive Brokers

Interactive Brokers (IBKR) is a global trading platform that facilitates direct market access and institutional liquidity across a wide range of financial instruments. It supports over 5,000 CFD securities in stocks, Forex, indices, commodities, and more.

IBKR provides access to an institutional-class trading ecosystem, ensuring deep liquidity, advanced analysis tools, and other features that traders require to make informed decisions.

Key Features:

Access to 5,000+ CFD instruments across global markets.

Low trading costs and tight spreads with competitive pricing.

Custom risk management tools for protecting traders and brokers.

Comprehensive API support for algorithmic and automated trading.

CQG

CQG is a professional trading platform designed to serve brokerage firms with an institutional and retail trader base, equipping them with advanced market analysis tools, fast execution, and ultra-low slippage.

The platform is known for its comprehensive infrastructure, extensive market data, and reliable performances, providing access to CFD markets, futures, and options.

Key Features:

Superior charting tools, technical indicators, and historical data.

Advanced order routing models with direct market access.

Aggregating liquidity from multiple brokers and liquidity providers.

Real-time portfolio monitoring with accurate reporting and tracking.

NinjaTrader

NinjaTrader is a sophisticated CFD trading platform that offers advanced charting tools, market analytics, and automation features. It covers a broad range of trading assets in spot and derivative markets, including CFDs, suiting retail and institutional clients.

NinjaTrader equips brokers with a comprehensive API infrastructure, automation tools, and diverse integration points to support multiple trading strategies and technologies.

Key Features:

Over 100+ built-in technical indicators with broad historical data.

Creating and deploying custom strategies using NinjaScript.

Supporting custom order execution, including one-click trading.

Compatibility with various brokerage and liquidity platforms.

xStation

xStation is the trading software of XTB, a global investing platform providing sophisticated financial services in the Forex, stocks, indices, and commodities markets, with hundreds of assets available.

It is designed to provide an all-in-one trading experience with a focus on speed, efficiency, and usability. It equips brokers with a visually appealing, fast, and feature-rich trading platform that suits new and professional traders.

Key Features

Ultra-low latency engine supporting instant order fulfilment.

Over 30+ built-in indicators, customisable charts, and newsfeeds.

Market sentiment tools and real-time market updates and insights.

Cross-device compatibility on desktop, web, and mobile apps.

DXtrade

DXtrade is a sophisticated CFD and multi-asset trading platform designed for brokerage firms requiring high-level customisation and unique branding that meets their business requirements.

This next-gen software was developed by Devexperts, the global tech software development company. It suits brokers looking to offer spot, CFD, and prop trading opportunities, equipping them with a seamless order management system, real-time monitoring and more.

Key Features:

Highly personalised layout, risk tools, and trading conditions.

Active tracking of orders, positions, and trading sessions.

Cloud-based infrastructure that is scalable and highly secure.

Seamless API integration with liquidity providers, CRM systems, and numerous third-party analytics tools.

ProTrader

ProTrader is a high-performance trading platform that offers unified financial services for CFD brokers, prop trading firms, investment banks, and prime brokers. It supplies them with a wide range of securities in Forex, stocks, futures, and crypto CFDs.

ProTrader is ideal for brokers seeking an advanced, feature-rich trading solution for professional and retail traders. Its trading platform suits different investment strategies and provides adequate automation tools.

Key Features:

Supports multi-asset, multi-market trading within a single platform.

Advanced market depth, custom scripting, and order flow analysis.

Integrates with algorithmic trading systems and broker APIs.

Cross-device functionality on mobile app and web trading.

ThinkorSwim

ThinkorSwim is a trading software developed by TD Ameritrade and currently managed by Charles Schwab. It is one of the most advanced trading platforms for CFD, Forex, options, and stocks. It provides brokers with a highly customisable and high-tech trading environment.

ThinkorSwim is ideal for brokerage firms targeting professional traders that require personalised experience, accurate data analysis, and advanced trading tools.

Key Features:

Over 400+ built-in technical indicators and studies.

Supports custom scripting-based trading strategies.

Available as a mobile app, web trader, and desktop software.

Live market insights, economic news, and sentiment analysis.

MultiCharts

MultiCharts is a professional trading platform built for retail and institutional CFD traders who use strategy automation and require ultra-fast processing capabilities.

MultiCharts is the go-to platform for brokers catering to algo trading, hedge funds, and investment firms, equipping them with a high-performance execution engine and advanced trading analytics.

Key Features:

Enables backtesting and custom strategy development.

Integrates with multiple brokers for deep liquidity access.

Supports industry-leading scripting languages for auto trading.

High-precision trading signals for scalping and day trading.

How to Integrate a CFD Trading Platform

Integrating a CFD trading platform requires strategic planning and technical execution. You also need to carefully research available options and pick the one that suits your brokerage style, business needs, and promised services. Here is how you can start:

1. Choose the Right Platform

Select a trading platform with multi-asset support, risk management tools, liquidity access, and API integration. Ensure the trading software is compatible with your existing systems if you have any, including payment services, CRM, and security protocols.

2. Establish Infrastructure, Compliance, and Liquidity

Set up trading servers, execution engines, and security systems to ensure a stable trading experience. Partner with tier-1 liquidity providers and financial firms to offer tight spreads and deep market depth.

To ensure legal operations, integrate with compliance applications that adhere to top-tier regulatory bodies like FCA, CySEC, and ASIC.

3. Select Services and Customise Platform

Implement white-label branding, fee structures, and trading conditions to match your brokerage needs and financial goals. Integrate APIs for automated trading, real-time market data, risk analytics, and other features required by your target audience.

4. Test Performance & Security

Conduct stress testing, latency benchmarks, and security audits to ensure smooth order execution and compliance with cybersecurity best practices. Integrate fraud detection systems to detect any vulnerabilities and avoid data breaches.

5. Prompt and Launch Your Platform

Develop a comprehensive onboarding process, educational resources, and customer support to enhance user experience. Market your brand using online promotional campaigns, social media marketing, and affiliate programs to attract and retain traders.

Conclusion

Launching a brokerage business with the best CFD trading software requires careful planning, sustainable partnerships, and broad knowledge of market needs. Core functionalities that you need for your platform include regulatory compliance, customisable infrastructure setup, risk management, and trade automation.

A well-designed platform attracts users, and offering needed features ensures retaining professional traders and institutional investors for the longest time possible.

FAQ

What is the best CFD brokerage platform?

It depends on business needs, but you must focus on a multi-asset, multi-market approach like that offered by B2TRADER, DXtrade, and ProTrader to serve a diverse user base with different investment strategies.

Is CFD better than spot markets?

CFDs support leverage and short-selling and have lower capital requirements, making them attractive for speculative trading. Unlike spot markets, they do not involve asset ownership, settlement cycles, and complex asset transfer fees.

How do you choose a CFD trading software?

There are basic features that you must find in a platform, including liquidity aggregation, automation tools, and risk management features. You must also ensure fast execution, regulatory compliance, and API integration for flexibility.

How long does it take to launch a brokerage software?

It typically takes from a few weeks to several months, depending on the provider and associated regulatory approvals, customisations, and liquidity support. Platforms like B2TRADER offer white-label solutions that can be deployed within two weeks.

Read also