AI in CRM – How Chatbots Improve Fintech Customer Service?

Artificial intelligence has been teased as the next big thing for several decades, since the 1980s. Slowly but surely, AI solutions have penetrated many facets of the digital world, helping companies and individuals automate their routine work and focus on their decision-making obligations.

In 2023, AI tools can do complex tasks of fundamental data analysis, problem-solving, research, and much more, allowing fintech companies to elevate customer experience to unprecedented heights. So, let’s discuss how AI in CRM have the potential to reshape the contemporary fintech sector and produce a Pareto improvement for all parties involved.

Key Takeaways

- AI solutions have become one of the most efficient tools in automating routine tasks and increasing customer satisfaction.

- Fintech and finance companies are integrating AI tools to optimise their resources and efficiently analyse customer information.

- AI also allows fintech companies to improve personalisation without spending massive resources and provide timely support to their impatient customers.

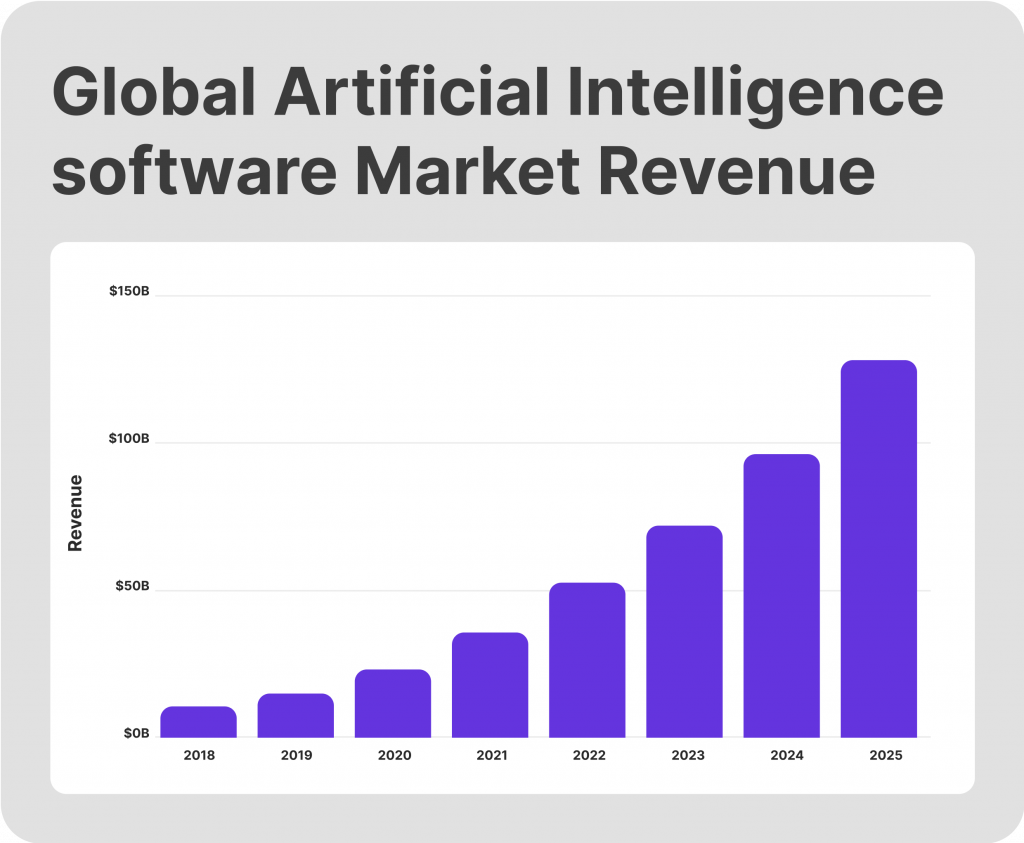

The Rising Tide of AI-Powered Solutions

First, it is crucial to understand the extent of the AI revolution in 2023. The invention of ChatGPT and the subsequent wave of AI-powered tools has significantly shifted the status quo for numerous industries. It is no longer logical to waste time on routine and redundant tasks, as they can be automated at a fraction of the cost. This is also excellent news for the workforce since they get to focus on complex, analytical tasks instead of dealing with mind-numbing routines.

.b2b__article img.wp-image-7872 { max-height:unset; height:auto; }

Thus, AI is here to change the working standard, letting companies cut down on their expenses and utilise their workforce more effectively. Conversely, individuals can escape the redundant work and strive to solve complex problems instead. Ultimately, AI is also here to transform one crucial aspect of managing a business – customer satisfaction.

Previously, helping customers on digital platforms was conducted entirely manually. Service agents and specialists handled customer interactions, spending up to an hour per single customer and delivering subpar assistance. The customer service automation introduced by AI-powered tools can completely disrupt this process, allowing businesses to transform their customer retention figures.

How AI Tools Improve The Financial Services Industry

The fintech and finance industries are all about providing seamless and convenient financial services. One important factor about this industry is that most financial offerings are standardised. This means that interest rates, loan and bank guarantee options, deposit offerings, and mortgage options are all roughly similar. Thus, financial institutions need to stand out with their quality of services instead, providing a smooth user experience, simplifying all digital activities and letting customers conduct everything without hassle.

Personalisation is another significant aspect in this industry, as financial services are often tied to complex customer decisions. Thus, customers greatly appreciate advice and guidance from financial experts on how they should approach their monetary activities. Personalisation goes a long way in this case, providing significant customer benefits and gaining long-term loyalty.

With the emergence of AI, all the above outlined qualities of financial services can be improved substantially. From personalisation and convenience to proactive customer service interactions, AI can elevate almost every facet of customer engagement in the fintech field.

While AI and machine learning technologies are not fully integrated in most financial institutions, their adoption rates are swiftly rising, and it is just a matter of time before automation takes over most of the routine duties. As a result, there will be less human error in the financial services industry, and customers will enjoy greater personalisation.

The Advantages of Using AI For Financial Institutions

But how exactly does AI improve the fintech and finance workflows? From fintech chatbots, automated data filtering, customer profiling and personalisation options to lightning-fast ticket resolutions, AI in CRM can create a potent mix of customer-centric solutions. Let’s explore each of these fascinating improvements.

Enhanced Customer Data Analysis

Data has become the most valuable asset in digital commerce. In 2023, customer data dictates every aspect of marketing, customer relations, service quality, etc. Analysing the retrieved data efficiently and adequately can provide a massive boost for financial companies to understand their target audience better and tailor their entire business strategy. However, the increased flow of data has made it difficult for businesses to stay on top of data analytics, especially in the case of larger organisations.

Moreover, manual analysis can often be filled with human errors, leading to inaccurate results. Finally, it takes too much time from analytics experts. In the end, analysts take more time organising and forming databases than conducting actual analysis. The equation changes substantially with AI, as AI tools will handle all the routine processes and let analysts do their best work.

Thus, the entire customer data analysis will flow smoothly, letting businesses quickly adjust their strategies to anticipate customer needs and improve their CRM efficiency dramatically.

Prompt Resolutions for Standard Tickets

Not long ago, the customer service teams in financial companies used to rely exclusively on human agents to handle all service inquiries. The only automated solution in the support stack was the fintech chatbot system, which was also relatively limited and devoid of actual value. Naturally, the manual approach led to delays, lack of accuracy and problem resolution. It was frequent to see support specialists transferring customers between each other and escalating tickets without necessity.

With AI, the customer service landscape looks completely different now. Firstly, standard tickets no longer need to go through human operators. Instead, AI tools will handle the common complaints or confusions with tailored messaging and guidelines. Moreover, the ticket escalation process will become much smoother as the system automatically transfers complaints to the appropriate personnel.

Finally, customer support is all about the resolution speed. After all, any technical problem can be fixed. The trick is to fix them before losing the customers. With AI, the response times will be much lower, and the support specialists will have more time to focus on genuinely complex customer queries and one-off cases.

On the business side of things, automation in customer support means that fintech customer service jobs will become much more accessible, less hectic and more focused on essential cases. Companies will handle the same complaints in much less time, increasing their efficiency and optimising their budgets.

Greater Degree of Personalised Service

As outlined above, AI tools are a match made in heaven for companies that wish to personalise their offerings. This is especially true in fintech and finance, as companies can automate without losing their personal touch. The advantages of customer service automation are quite tricky – they decrease the resources needed to serve the clients but sacrifice the personalisation aspect, as automated tools can’t differentiate between different client needs.

AI once again changes the equation in this field, powering up the automation tools to provide personalisation that rivals the finest manual services. For example, AI automation can instantly identify when clients might require loan refinancing, guarantee services or deposit products.

After doing so, AI bots can automatically send push notifications and e-mails to customers, offering the above-outlined benefits and effectively predicting their unique needs. Additionally, AI tools can generate customer profiles based on their activities and provide corresponding services or rates. As a result, customers will feel appreciated and cared for without ever needing to interact with live agents.

Moderation Is Still the Key Factor in AI

After discussing all the massive benefits of modern AI, it is also crucial to mention the significance of moderation. 2023 has been a colossal year for AI achievements, with natural language processing tools taking a massive leap. However, the increased capabilities of generative AI and other solutions make them increasingly prone to mistakes.

ChatGPT and other leading AI tools have showcased impressive results in providing customer support, analysing data, and even consulting on complex topics. However, they have also shown tremendously wrong results, often presenting completely misleading or outright incorrect output. Thus, it is essential to understand that AI is a tool, not an alternative to the human workforce. Without humans, AI solutions could spiral out of control and cause irreparable damage to the reputation of financial companies.

Final Takeaways

AI has finally arrived significantly, producing game-changing solutions for numerous industries, including fintech and finance. This fascinating technology has the potential to eliminate all routine work, simplify data processing and enhance customer service quality on every level. However, humans are still very much needed to supervise, moderate and control these powerful tools.

AI is designed to enhance human efficiency and not replace it. Thus, creating a healthy balance of AI in CRM and talented specialists is crucial to getting the most out of modern artificial intelligence.