Share

0

/5

(

0

)

In the 21st century, time is the most precious and vital thing. A business that manages to operate 24 hours a day is at least one step ahead of its competitor, which lacks this capability. The foreign exchange market is the world's giant financial market, facilitating the continuous trading of currencies.

Unlike stock exchanges with designated opening and closing hours, Forex boasts a unique feature – it operates 24 hours a day, five days a week. However, this doesn't equate to equal activity throughout the day.

Understanding Forex market hours and their impact on trading conditions is paramount for competent Forex traders. In this article, we'll explore Forex market trading hours, the importance of market sessions, and how to deal with holiday hours to make smart trading decisions.

Key Takeaways

The Forex market operates 24/5, but specific sessions offer higher liquidity and volatility, impacting trading strategies.

Understanding the four major Forex market sessions (London, New York, Tokyo, Sydney) is crucial for informed decisions.

Consider factors like economic data releases and holidays when planning your Forex trading activity.

By strategically aligning your trading with active sessions and avoiding less liquid periods, you can potentially maximise profits and minimise risks.

Understanding Forex Market Hours

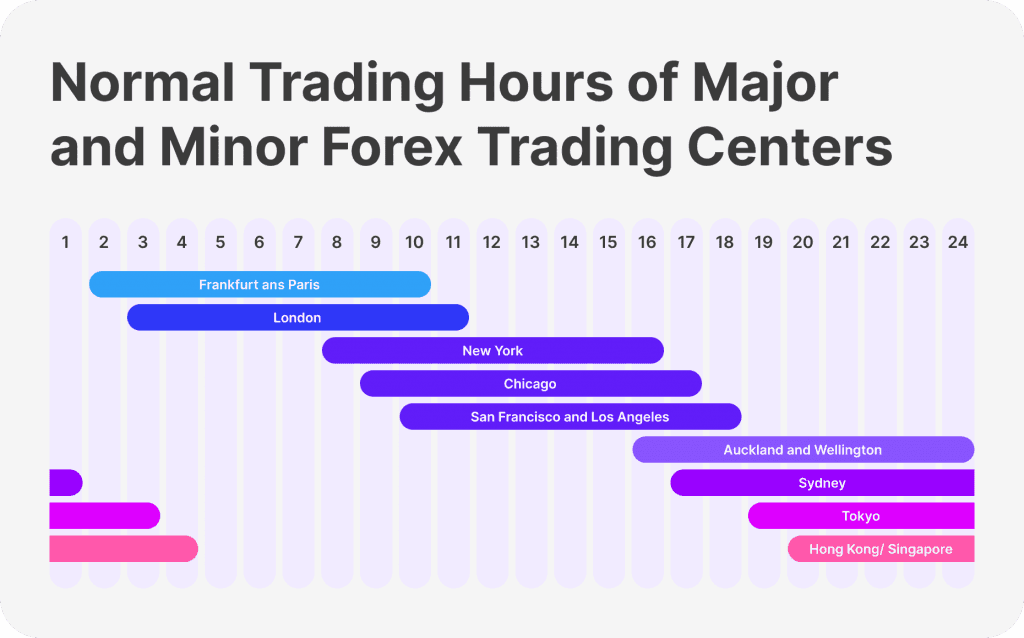

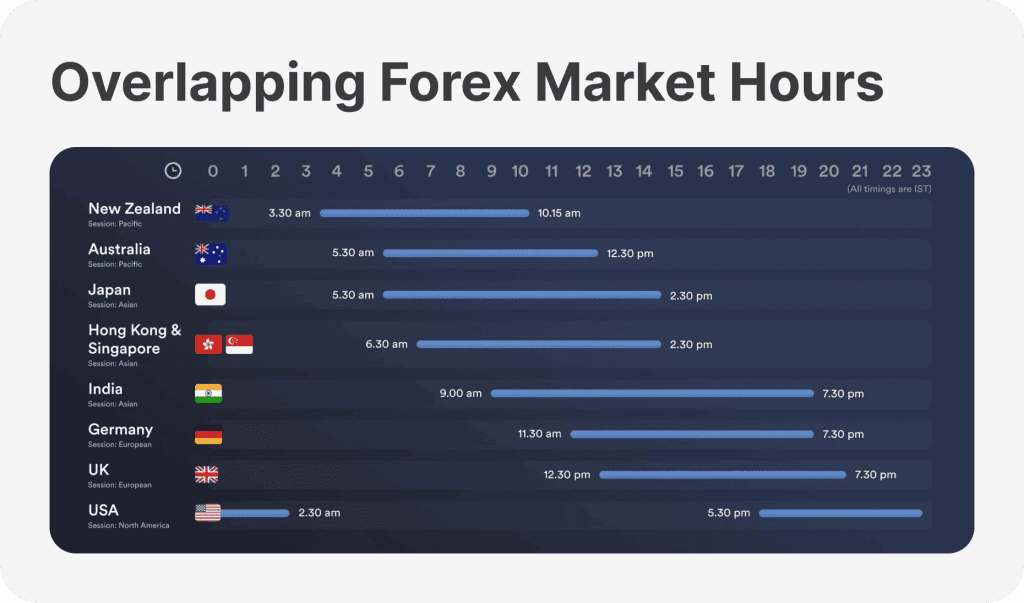

The Forex market is decentralised and operates across various financial centres worldwide. As a result, trading occurs continuously from Monday to Friday, with market activity moving from one major financial hub to another as the day progresses. The primary financial centres where Forex trading occurs are in London, New York, Tokyo, and Sydney.

Forex trading hours are split into four major sessions:

Sydney Session (5:00 PM EST – 2:00 AM EST)

The Sydney session is the first to open the Forex week, setting the initial tone for market sentiment. Australian and New Zealand banks are key participants, with the Australian dollar (AUD) and New Zealand dollar (NZD) being influential.

Due to its early start and relatively more minor trading volume than London and New York, the Sydney session can exhibit wider spreads and slower price movements. However, it can be a good entry point for traders looking to anticipate trends for the upcoming sessions. During this session, economic data released from Australia and New Zealand can impact currency pairs.

Tokyo Session (7:00 PM EST – 4:00 AM EST)

The Tokyo session sets the tone for the day, with significant participation from Japanese banks and institutions. The Japanese yen (JPY) is a key player here. This session often exhibits a continuation of trends established during the late hours of the New York session. However, liquidity can be lower compared to later sessions.

Key economic data releases from Japan, China, and Australia can significantly impact market movements during this time.

London Session (3:00 AM EST – 12:00 PM EST)

Often dubbed the "heart" of the Forex market, the London session boasts the highest trading volume and most significant price movements. Major European banks and institutions dominate this session.

Due to high liquidity, the London session offers a broader range of trading opportunities across various currency pairs. Be mindful of potential volatility spikes during the overlap with the New York session. Economic data releases from the Eurozone and the United Kingdom can influence currency valuations during this session.

New York Session (8:00 am EST – 5:00 pm EST)

The New York session rivals London in terms of trading volume and volatility. Major U.S. banks and institutions heavily participate, with the US dollar (USD) playing a central role.

The overlap with the London session creates a highly liquid and volatile environment, ideal for active traders. However, reduced liquidity can be observed towards the end of the session. As the last major session of the trading day, it is crucial for traders who follow the USD currency pairs.

[aa quote-global]

Fast Fact

Forex trading started in Amsterdam roughly 500 years ago. Beginning in Amsterdam, Forex trading then spread further throughout the whole world.

[/aa]

The 24/5 Reality of Forex Market Hours

While technically open all week, the Forex market operates in a decentralised manner across various financial centres worldwide. Trading activity ebbs and flows depending on which session is dominant at a given time. Here's the breakdown:

Sunday 5:00 pm: The Forex week commences with the opening of the Wellington, New Zealand session.

Monday: As the Asian session (Tokyo) kicks in at 7:00 pm EST, the market picks up pace.

Monday AM (London Time): The London session, known as the heart of the Forex market, opens at 3:00 am EST, coinciding with the tail-end of the Asian session.

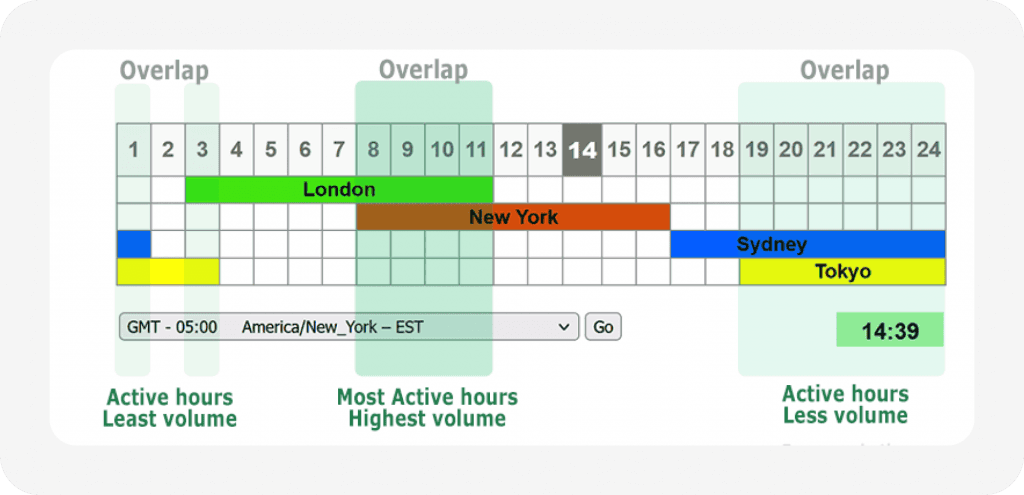

Monday Midday (New York Time): The New York session, another major player, starts at 8:00 am EST, further amplifying market activity. The overlap between London and New York sessions (usually 8:00 am – 12:00 noon EST) is considered the most liquid and volatile period in the Forex market.

Friday 5:00 pm EST: The Forex week concludes with closing the New York session.

The Importance of Market Sessions

Understanding Forex market sessions is vital for traders looking to maximise their profits. Each session has unique characteristics, trading volumes, and volatility, which can influence the success of your trades.

Sydney and Tokyo Sessions

These sessions are ideal for traders interested in Asian currency pairs such as JPY, AUD, and NZD. Although the market is less volatile during these times, opportunities arise due to the relative quietness, allowing for more deliberate trades.

London Session

The London session is the most active, with the highest trading volumes. Traders often find the best opportunities during this session due to the overlap with other major sessions and the large number of market participants.

New York Session

The New York session offers excellent trading opportunities, especially for those focused on USD pairs. The overlap with the London session creates heightened volatility, which is ideal for day traders and those looking to capitalise on market movements.

Strategic Trading During Forex Market Hours

To make smart trading decisions, developing a strategy that aligns with the specific characteristics of each Forex trading hour is essential. Here's how you can tailor your strategy to different market sessions:

Timing Your Trades

Understanding the most active trading times can help you decide when to enter and exit trades. For example, the London-New York overlap is known for its high liquidity and significant price movements, making it an ideal time for short-term traders. On the other hand, traders looking for less volatility might prefer the Sydney-Tokyo overlap.

Identifying Market Trends

Each session has distinct trends influenced by the region's economic data, market sentiment, and global events. By staying informed about the factors driving each session, you can better anticipate market movements and adjust your strategy accordingly. For instance, knowing when the London session opens, you can prepare for potential market shifts influenced by European economic news.

Managing Risk

Different sessions carry varying levels of risk. The London session's high volatility might present more opportunities but also more risks. Conversely, the Sydney session may be quieter, offering less risk but also fewer opportunities. It's crucial to align your risk management strategy with the characteristics of the session you're trading in.

Forex Market Holiday Hours

While the Forex market operates 24/5, there are times when market activity slows down due to holidays. Forex market holiday hours can significantly impact trading opportunities and market liquidity.

During holidays, especially in major financial centres like the US, UK, or Japan, trading volumes decrease, reducing liquidity and increasing spreads. Traders need to be cautious during these periods as price movements can be unpredictable.

Planning your trades around the Forex trading market opening times during holiday periods is essential to avoid potential losses. Monitoring an economic calendar and staying informed about upcoming holidays in key trading centres can help avoid unnecessary risks.

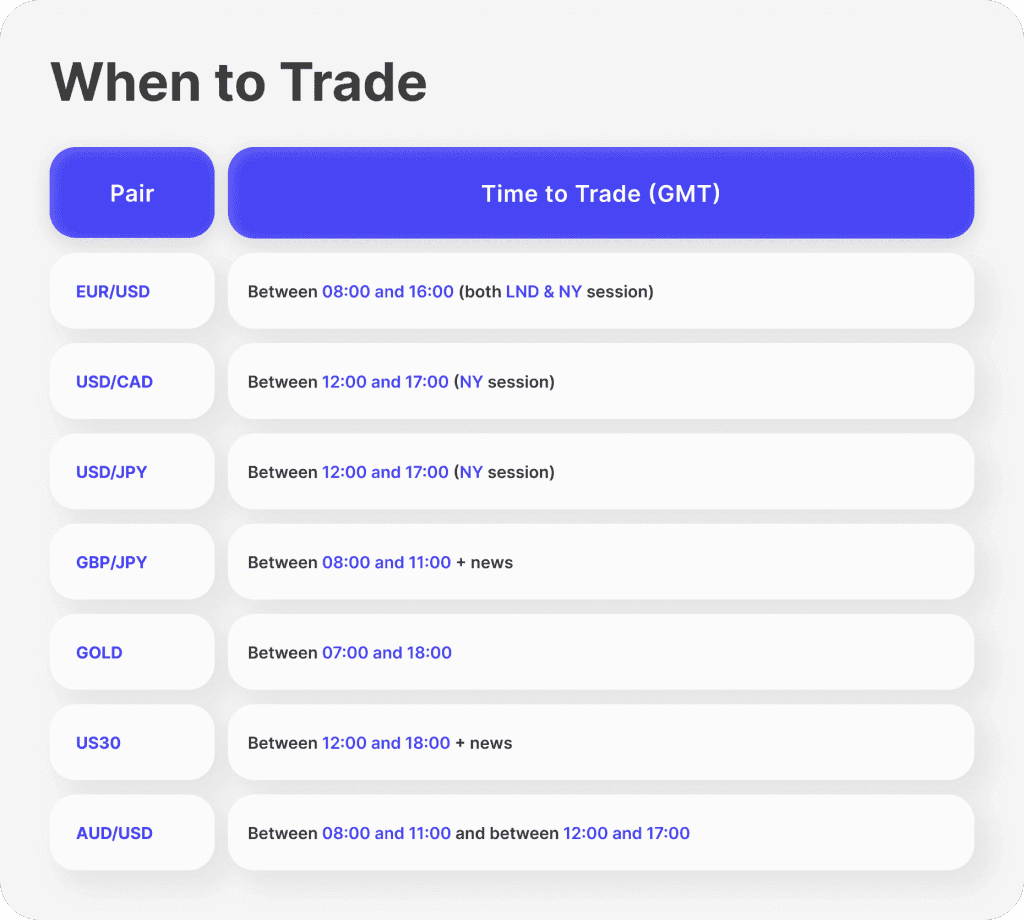

The Best Times to Trade Forex

Trading Forex effectively requires more than just understanding market trends and economic indicators; it also involves knowing the best times to trade. The Forex market's 24-hour nature presents unique opportunities and challenges, with certain times of day offering higher potential for profitable trades due to increased market activity and liquidity. Here's an in-depth look at when to trade Forex for the best outcomes:

Session Overlaps: The Sweet Spot for Forex Trading

The overlaps between major Forex trading sessions are some of the best times to trade Forex. These periods see the highest trading volumes and liquidity, leading to tighter spreads and more significant price movements. The key overlaps include:

London and New York Session Overlap:

This is the most active period in the Forex market, as the two largest financial centres are open simultaneously. The overlap generates significant trading volume, especially in major currency pairs like EUR/USD, GBP/USD, and USD/JPY. Traders can expect higher volatility, leading to substantial price swings and trading opportunities.

Tokyo and London Session Overlap:

Although shorter and less intense than the London-New York overlap, this period can still offer good trading opportunities, especially in currency pairs involving the Japanese yen and the euro. The transition from the Asian to the European trading day often results in noticeable market movements.

High-Volatility Periods: Capitalising on Market Movements

Volatility is a double-edged sword in Forex trading - it can lead to both great profits and significant losses. High-volatility periods often coincide with the release of primary economic data and news events. These periods are ideal for traders looking to capitalise on sharp price movements:

Economic News Releases:

Major economic indicators such as GDP growth rates, employment figures (like the U.S. Non-Farm Payrolls), inflation reports, and central bank interest rate decisions can significantly impact currency values. Traders who follow an economic calendar can time their trades to coincide with these events, taking advantage of the resulting volatility.

Central Bank Announcements:

Statements and decisions from central banks, like the Federal Reserve, the European Central Bank, or the Bank of Japan, can lead to substantial market moves. Trading during these announcements can be highly profitable but also risky, requiring a solid understanding of monetary policy and its implications.

Low-Volatility Periods: Strategies for Quieter Financial Markets

While many traders prefer high-volatility periods, there are also opportunities in quieter market conditions, typically found during the Sydney and early Tokyo sessions:

Range Trading:

During low-volatility periods, the market often moves within a narrow range, making it suitable for range trading strategies. Traders can buy at support levels and sell at resistance levels, capitalising on the predictability of price movements.

Scalping:

Scalping involves making small profits from minor price movements, typically in low-volatility environments. This strategy requires quick decision-making and a disciplined approach to managing risk.

Avoiding the Worst Times to Trade Forex

Not all times are equally suitable for trading. There are periods when the market is less active, spreads widen, and price movements are unpredictable. These include:

The Weekend Gap:

Forex markets close on Friday evening and reopen on Sunday evening. During this period, any significant geopolitical or economic developments can lead to a price gap when the market reopens, which can be challenging to trade.

National Holidays:

Major financial centres often close on national holidays, reducing trading volumes and liquidity. Trading during these times can result in unexpected market behaviour and less favourable trading conditions.

How Forex Market Hours Impact Trading Decisions

Forex market hours are crucial in shaping trading strategies and decision-making processes. Understanding the dynamics of different trading sessions and how they influence market behaviour can help traders optimise their strategy, manage risk, and make informed decisions. Here's how Forex market hours impact trading decisions:

Tailoring Strategies to Specific Sessions

Each Forex trading session has its own unique characteristics, and understanding these can help traders develop and tailor strategies that align with the market conditions of a particular session. Let's examine session-specific strategies:

London Session: Known for high liquidity and volatility, the London session is ideal for trend-following strategies. Traders often capitalise on breakouts and sustained movements that are more likely to occur during this period.

New York Session: The New York session overlaps with the London session, creating one of the most volatile trading periods. News releases from the US and economic data can trigger sharp price movements, making it a favourable time for momentum trading strategies.

Tokyo Session: Characterised by lower volatility, the Tokyo session is suited for range trading strategies. During this session, currency pairs like AUD/JPY and NZD/JPY often exhibit stable price ranges, providing opportunities for traders who prefer less aggressive price action.

Time-Sensitive Strategies: Some strategies, such as news trading or event-driven trading, are highly time-sensitive and depend on the precise timing of economic data releases or geopolitical events. Forex market hours dictate when these events have the most impact, guiding traders on when to execute their trades.

Managing Risk

Forex market hours also play a critical role in risk management. The time of day can influence market volatility, liquidity, and the effectiveness of risk management tools such as stop-loss orders.

Volatility Management: Understanding when the market is most volatile helps traders manage their exposure to risk. For instance, trading during the London-New York overlap requires careful risk management due to the increased volatility. In contrast, trading during quieter periods may involve lower risk but also lower reward potential.

Stop-Loss and Take-Profit Levels: The effectiveness of stop-loss and take-profit orders can vary depending on market conditions influenced by trading sessions. During high-liquidity periods, such as the London session, these levels are more likely to be honoured due to consistent price action. However, during low-liquidity periods, there is a higher risk of stop-loss orders being triggered by short-term price spikes.

Avoiding Market Noise: Market noise refers to random price movements that do not reflect underlying fundamentals. This noise is often more pronounced during less active trading hours when liquidity is low, making it harder to differentiate between meaningful price movements and short-term fluctuations. Traders can avoid unnecessary losses by focusing their activities during more predictable and liquid periods.

Adapting to Changing Market Conditions

Market conditions can change throughout the trading day as sessions open and close. Awareness of these shifts allows traders to adapt their strategies and make real-time decisions that align with current market dynamics.

Session Transitions: The transition between trading sessions, such as the handover from the Tokyo session to the London session, can result in market sentiment and direction changes. Traders anticipating these transitions can adjust their positions or enter new trades to exploit emerging trends.

Market Sentiment Shifts: Market sentiment can shift rapidly due to economic news or geopolitical events. Forex market hours dictate when these shifts are most likely to occur, guiding traders on when to be particularly vigilant or when to reduce their exposure to avoid unfavourable market moves.

By understanding how Forex market hours impact trading decisions, traders can optimise their strategies, manage risk more effectively, and make smarter, more informed decisions that align with the most favourable market conditions.

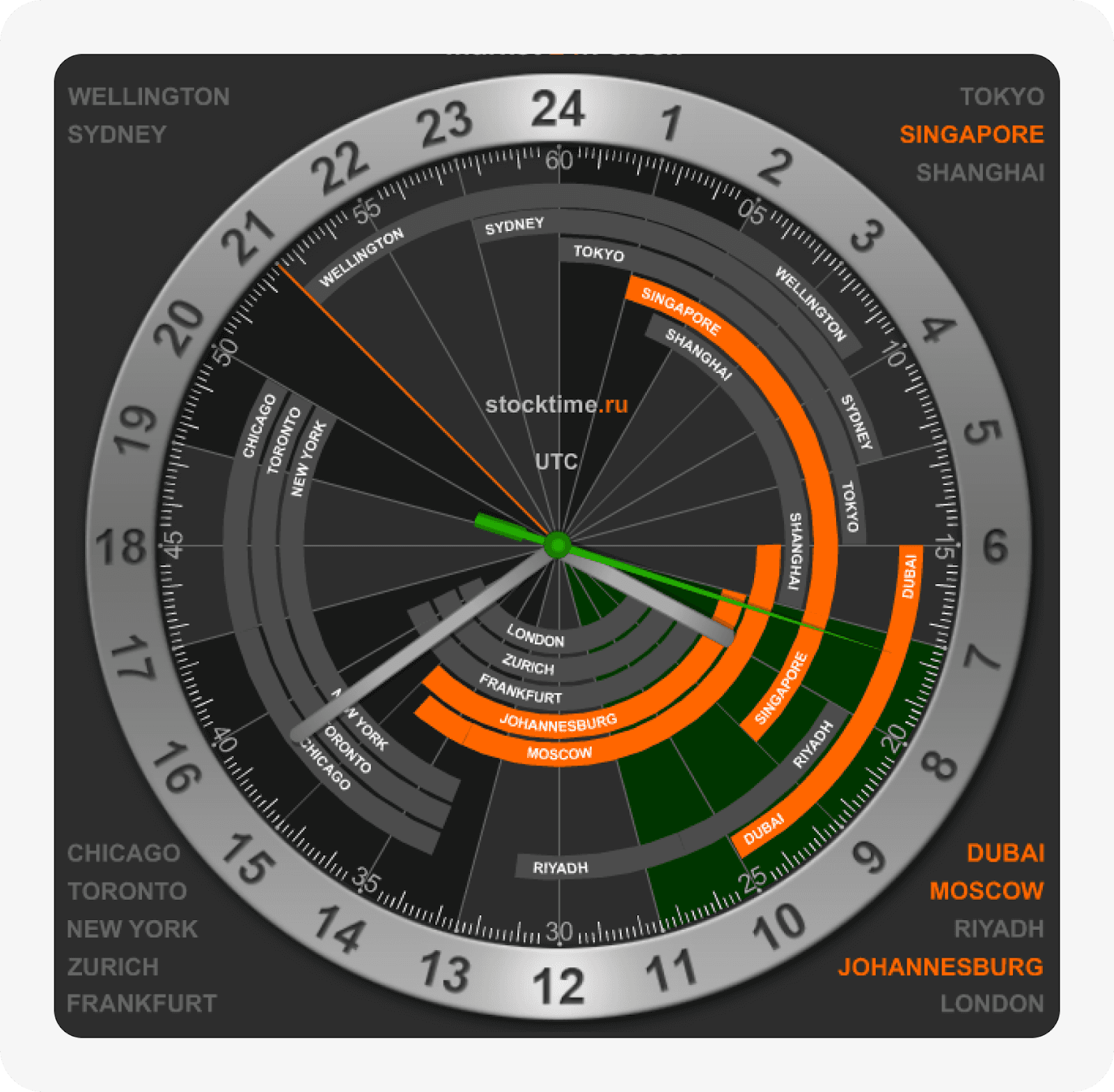

Tools and Resources for Monitoring Forex Market Times

To effectively trade Forex, it's essential to have the right tools and resources for tracking market hours, session overlaps, and key economic events. These tools can help traders stay informed, set alerts, and optimise their trading strategies. Here are the recommended tools and platforms:

Forex Market Hours Monitor

This tool visually represents the Forex trading sessions across different time zones. It helps traders see when sessions open and close, allowing them to plan trades around the most active periods.

TradingView

TradingView offers customisable charts and indicators, including market hours overlays that show session activity directly on price charts. Traders can use this platform to identify session overlaps and monitor real-time market movements.

MetaTrader ⅘

Forex traders widely use MetaTrader platforms for their robust charting tools and built-in indicators. They allow traders to set session-specific alerts and automate trading strategies based on market hours.

Forex Factory Economic Calendar

The Forex Factory economic calendar is an essential tool for news traders. It lists upcoming economic events and their potential impact on the market, helping traders time their trades around major releases.

By leveraging these tools and setting appropriate alerts, traders can ensure they are always in tune with the market, making well-timed decisions that align with their trading strategies and goals.

Final Remarks

Mastering Forex market hours is a cornerstone of successful Forex trading. By understanding the different sessions, their characteristics, and how they interact, you can make informed decisions, optimise your trading strategy, and potentially increase your chances of profitability.

Remember, the world of Forex trading involves risks, and it's crucial to conduct thorough research and consider seeking professional advice before making any investment decisions.

FAQ

What is the best time to start trading?

The US/London markets overlap (8 am to noon EST), have the heaviest volume of trading and are best for trading opportunities.

What are the Forex market opening hours?

The Forex market is available for trading 24 hours a day except on weekends.

Can I trade Forex in 24 hours?

The Forex market is open 24 hours a day during weekdays but closes on weekends. Because this market operates in multiple time zones, it can be accessed anytime except for the weekend break.

What time does London session open?

London session opens at 8:00 am local time, that is, 7:00 am UTC.

Read also