Share

0

/5

(

0

)

Almost 80% of traders fail at the earliest stages of their careers and decide to give up. This number shows us how difficult it is to gain professional trader status. This career requires commitment, analytical thinking, and a systematic approach. It involves more than just buying and selling financial products; it includes learning how to make wise choices during times of uncertainty.

Professional traders rely on an organised learning process to gain the knowledge and expertise to succeed. In this article, we will help you understand how to become a professional trader, what skills you need, and if it is worth the while.

Key Takeaways

One needs discipline, analytical abilities, and dedication to succeed in this field.

Proficiency in data analysis, risk mitigation, and an awareness of many financial markets are crucial.

Long-term trading success depends on both real-world experience and ongoing learning.

Understanding Professional Trading

Someone whose principal source of income is trading financial instruments such as stocks, FX, or commodities is referred to as a professional trader. The responsibilities of amateur or hobbyist traders, who usually trade part-time or as a side business, differ greatly from those of this profession. Such traders typically possess high expertise and adopt a disciplined approach to achieve long-term profitability.

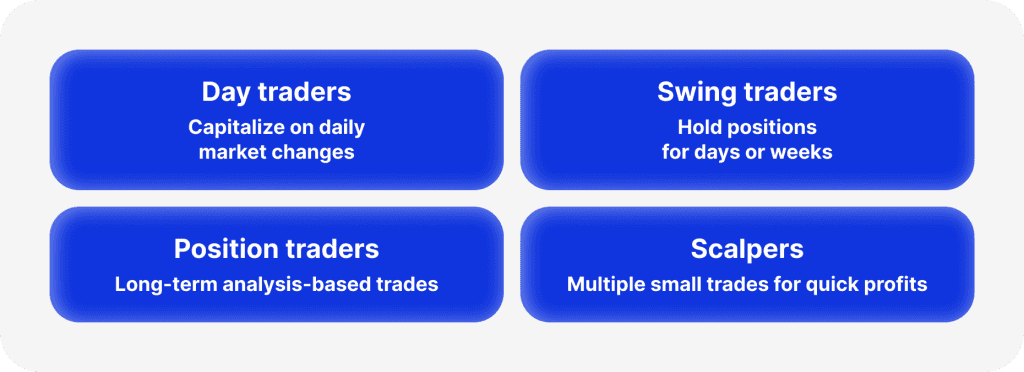

There are several types of professional traders, with each one specialising in a particular trading technique. For example, day traders make several deals in a single day to capitalise on transient changes in the market.

On the other hand, swing traders take advantage of medium-term price patterns by holding positions for a few days or weeks. Position traders have long-term positions based on thorough market analysis, and scalpers, who make multiple minor trades throughout the day to build profits, are two other professional traders.

Necessary Skills and Knowledge

Specific skills and financial expertise are crucial for professional trading. These abilities empower traders to make informed decisions, develop strategies, and navigate the financial markets effectively. Here’s the list of skills one would need to become a professional trader.

Analytical Skills

Traders need to be able to swiftly and precisely analyse vast volumes of data. This ability is necessary for assessing trading opportunities, grasping market trends, and coming to wise conclusions.

Paying Close Attention to Details

Even minor fluctuations in the market can significantly affect trades. Traders may detect trends, recognise opportunities, and avoid costly blunders with the aid of a keen eye for detail.

Risk Management

In trading, risk management is essential. To minimise losses and protect their trading capital, these expert traders must know how to look for advantageous possibilities.

Understanding Financial Markets

It is essential to know about various markets, including stocks, Forex, futures, and options. Traders can select the best financial instruments for their new trading strategies by being aware of the subtle differences in how each market functions.

Learning and Adapting

The financial markets are constantly changing. To keep ahead of developments, successful traders modify their techniques and update their knowledge on a regular basis.

A thorough understanding of financial instruments and their underlying properties is essential for success in professional trading. With this information, traders may evaluate possible risks and benefits, decide wisely, and create effective strategies.

Analysing market data and spotting trading opportunities is a fundamental skill of professional trading. This involves carefully reviewing price charts, economic indicators, news stories, and other relevant information to obtain insights into market trends and possible price changes.

Expert traders use various trading techniques, each customised to their own risk tolerance and particular market conditions. Technical analysis, fundamental analysis, or a mix of the two may be used in these tactics. While fundamental analysis assesses underlying economic fundamentals and corporate values, technical analysis concentrates on price patterns and historical data.

Professional traders must handle risk with discipline if they are to succeed. This involves putting in place stop-loss orders to restrict possible losses, setting reasonable profit goals, and keeping sufficient capital reserves.

[aa quote-global]

Fast Fact

Famous American trader Jesse Livermore gained a $100 million fortune by shorting the 1929 market collapse. But he had serious financial problems; by 1934, he had filed for bankruptcy several times and had lost his whole fortune.

[/aa]

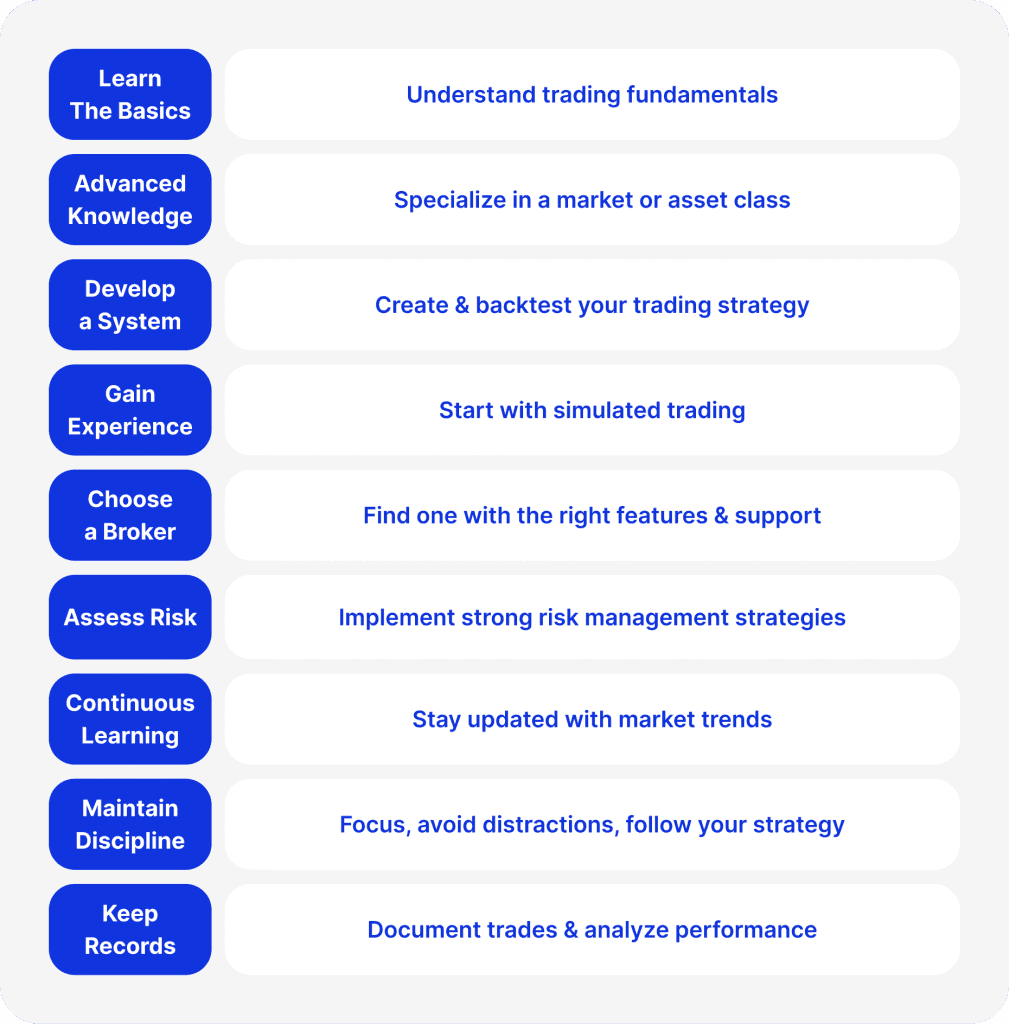

Steps to Become a Professional Trader

After understanding what is needed to become a certified professional trader, let’s take a closer look at how to become one.

1. Learning the Basics

Learn the fundamentals of trading first. Find out more about trading hours, market selection, and capital requirements. Learn about essential ideas such as asking and bidding prices, different sorts of orders, and risk management techniques. Use books, reliable trading websites, and educational materials from stock exchanges to create a strong basis.

2. Advanced Knowledge Acquisition

To gain more insight, focus on a particular market or asset class. Examine advanced trading methods and tactics tailored to specific markets. You can improve your trading career and make well-informed selections using this knowledge.

3. Developing a Trading System

Make a customised trading strategy based on your trading objectives and thoroughly examine the market. To see how your methods work in various market scenarios, backtest them. To increase consistency and profitability, refine your processes.

4. Acquiring Practical Experience

Before moving on to live trading, the transition from theory to practice by participating in simulated or paper trading. Use this expertise to gain insight from actual trading results and modify your tactics accordingly.

5. Choosing the Right Brokerage

Examine brokerage possibilities according to their costs, features, and level of market expertise. Choosing a trustworthy broker is essential to successful professional trading. Ensure the broker provides the resources and assistance you require for successful trading.

6. Risk Assessment

Put strong risk management strategies into practice to protect your investment. Decide how much you are ready to risk on each trade to reduce possible losses and place stop-loss orders. Long-term success requires an understanding of risk and effective risk management.

7. Continuous Learning

Keep informed of the most recent advancements in the market and trading plan. Read books, participate in online courses, and keep up with financial news. By committing to lifelong learning, you may enhance your trading abilities and adjust to shifting market conditions.

8. Concentration and Discipline

Retain discipline and attention during trading. Establish a specific area for trading, cut down on outside distractions, and follow your trading strategy. Two essential characteristics of good traders are discipline and constant focus.

9. Maintaining Records

Maintain complete documentation of every trade you make. Record the time, date, setup, state of the market, and results of every trade. Examine your trading journal regularly to spot trends, advantages, and development opportunities. You'll make better decisions overall and perform better in trading if you practise this.

For example, these steps will help you become a professional Forex trader if you want to trade Forex. Focus on continuous learning, effective risk management, and meticulous record-keeping to achieve long-term success in the financial sector.

How Much Does a Professional Trader Make?

In the US, the average yearly salary for a professional trader as of August 2024 is roughly $96,774. About $46.53 an hour, $1,861 a week, or $8,064 a month would be the equivalent of this. Pay varies considerably; the highest-paid individuals may make up to $185,000. These numbers are influenced by years of experience, location, and skill level.

Are There Perspectives in a Trading Career?

The Bureau of Labour Statistics projects a 4% growth rate for professional traders over the next ten years, which indicates a stable job outlook. This rate is comparable to the industry average for other financial professions.

Many career paths, each with its particular chances and challenges, are available in professional trading. Below are a few of the most popular paths:

Traders can work from home. This adaptable choice allows them to plan their schedules to accommodate other obligations. However, to be considered a pattern day trader, you must have a minimum equity of $25,000.

Proprietary trading firm provides the opportunity to trade using business funds. Traders are independent contractors who take a cut of the profits rather than receiving a set wage. The advantages are reduced expenses, access to advanced trading tools, and training programs.

Currency and CFD Markets markets offer prospects with less cash needed. Accounts that allow high leverage and round-the-clock trading on international markets can be opened with as little as $100.

Independent traders trade financial instruments with their funds while working for themselves. Although it gives freedom and autonomy, it also requires high self-control and risk management abilities.

To produce profits, hedge funds employ various strategies as investment pools. Expert traders frequently manage asset portfolios and carry out intricate trading techniques for hedge funds.

Investment firms, banks, and other financial institutions employ many professional traders. Managing trading desks, carrying out trades, and creating trading strategies are typical responsibilities of these positions.

Government organisations, including central banks and regulatory councils, employ professional traders. These positions usually entail economic analysis, policy execution, and market surveillance.

Conclusion

Success as a trader requires commitment, education, and regular practice. Learn the fundamentals of trading and finance before you ever start trading. Getting involved with a respectable trading company might offer the necessary tools and assistance. Gaining proficiency in technical analysis, risk management, and trading psychology is necessary for success in the trading journey.

Remember that learning new things is essential. Keep aware of emerging technologies, trading rules, and industry trends. Committing to your trading career will guarantee that you stay flexible and competitive.

Significant benefits, such as monetary profits and personal development, come with a career in professional trading. But it also comes with difficulties, like volatile markets and psychological strain. Developing the necessary perseverance and determination to become a profitable trader may be a very rewarding path.

Read also