Share

0

/5

(

0

)

In a world where everything is globalised and online, security becomes crucial for all businesses, especially in the financial sector. Companies are becoming more widespread, serving and providing solutions to customers worldwide.

However, with this endeavour comes the legal factor, entailing companies to ensure they do not serve manipulative users or blacklisted clients who have suspicious business records.

Therefore, companies work with KYC service provider companies to carry out regulatory compliance procedures and ensure they serve the right customers, catering to their local rules and regulations. Let’s dive deeper into KYC as a service and how to implement suitable KYC software.

Key Takeaways

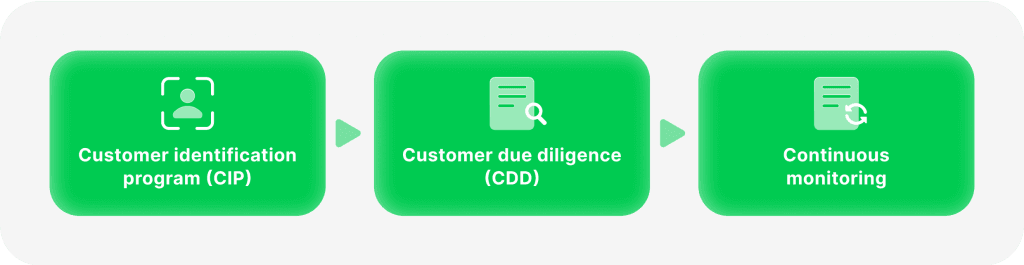

KYC software is the process of customer identity verification that involves collecting, processing and storing user data.

Businesses delegate the identity verification process to a reliable KYC software provider with robust security and verification tools.

Hiring an identity verification provider is critical to prevent illegal activities on your platform, especially when it comes to financial and monetary transactions.

KYC software providers offer various services and tools for compliance requirements, adhering to general data protection regulation (GDPR).

Understanding KYC Compliance

KYC, or Know Your Customer, is the process of customer’s identity verification, ensuring they are genuine and legal entities. KYC procedures are mostly required for products and services that have age restrictions, such as financial markets, gambling, alcohol, etc.

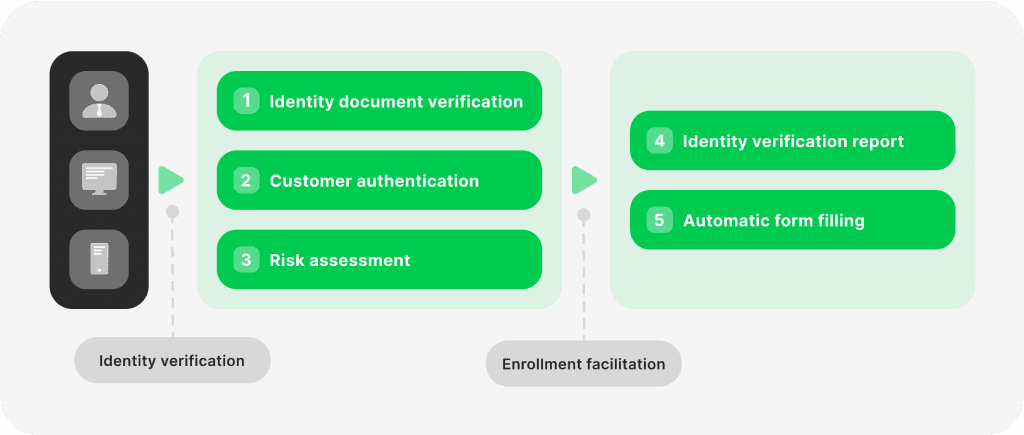

Due to the complexity of these procedures, which involve processing and analysing big data and benchmarks, companies delegate these operations to a KYC solution provider.

Since everything is becoming digitalised, the KYC procedure can be conducted fully online, with more automation being put into the process to make it faster and more reliable.

The KYC verification process is usually deemed time-consuming and hurdle, and many try to avoid it and think twice before submitting their details. Therefore, having a good KYC provider is critical to ensure a smooth user experience.

An experienced KYC provider is powered with tools that streamline this process to make it more appealing to the clients, with the use of automated KYC as a service to speed up the process.

Why Is KYC Important?

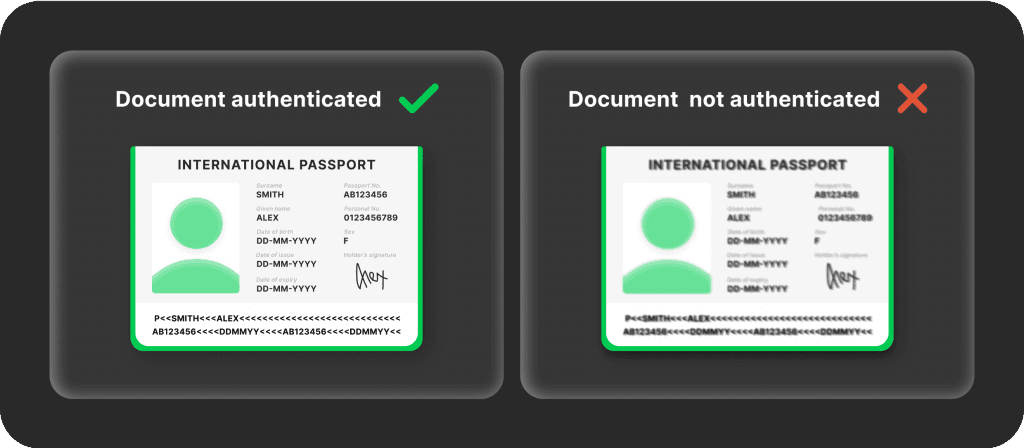

KYC processes are required by the law and are legally binding for companies to collect certain information about their user base. The procedures includes submitting identity information, like name, email address, telephone number, legal address and city of residence.

Usually, submitting these details requires documentation to prove the users are who they claim to be.

Other information required by KYC include the source of income, annual turnover, expected trading volume per annum and other wealth-related details. Users are allowed to use the offered services only after successfully passing the KYC process.

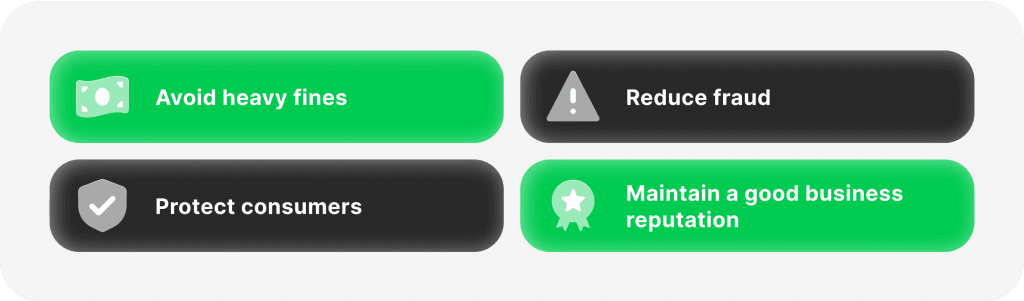

Besides the regulatory requirements of KYC, this verification method promotes healthier ecosystems, mitigating the risk of illicit activities, especially in financial services where illegal transactions can take place.

Hiring a top-rated KYC provider helps businesses track activities on their platforms and identify any anomalies. With KYC software, companies can flag creating multiple accounts under fake names or conducting massive repetitive transactions, which may indicate money laundering.

Where Are KYC Practices Used?

KYC and AML procedures are often mentioned in the financial context as the most impactful sector. However, businesses of different types hire a third-party KYC provider to verify customers’ identities in the following services.

Brokerage & Trading

Trading brokerage companies are required to verify the identity of their clients to ensure the legality of users and their eligibility to carry out financial transactions. Online money transfers and trades are common tools for fraudsters to engage in money laundering and illegal businesses.

Therefore, trading companies are required to conduct KYC procedures carefully, mitigating the chance of serving illegal or banned personnel.

Also, KYC verification helps companies customise their services according to the client’s location. For example, the allowed leverage ratio, tradable instruments, trading cryptocurrencies and other trade-related restrictions.

Cryptocurrencies

Regulations are still inconsistent about trading cryptocurrencies. Some countries fully legalise holding, buying and selling virtual currencies, while other countries impose complete or partial bans on using them.

Crypto exchange platforms implement KYC procedures to authenticate their clients’ identities and locations, allowing exchanges to offer suitable and legal crypto services.

Crypto brokerage companies may disable trading and using cryptocurrencies if a client is registered from a country that bans dealing with crypto coins and tokens.

Moreover, countries that allow cryptocurrency have special requirements for trading them with margin accounts and custodial wallets, and companies can identify these types of accounts using KYC.

Banking

“Know Your Customer” is a common practice for banks and financial institutions before opening accounts or issuing loans. Banks use KYC procedures to verify their customers’ information, such as identity, source of funds, credit score and other information.

Physical banks can carry out these procedures in a face-to-face set-up that includes filling out some forms and providing identity proof.

Transportation

Ride-sharing and transport companies are other users of KYC service providers to validate the identity of drivers, passengers and assets. This process might be simpler than registering at a trading platform. Nevertheless, it is critical to avoid human trafficking and hijacks.

FinTech

Financial technology companies usually provide monetary services to other businesses, such as digital wallets, payment gateways, custodial services and account management.

Therefore, it is crucial to ensure the integrity of these ecosystems by following robust KYC regulations that avoid serving illegal clients or getting involved in illicit transactions.

[aa quote-global]

Fast Fact

The “Know Your Customer” program originated in the US as the Bank Secrecy Act in the 1970s to prevent money laundering after a series of unchecked financial crimes.

[/aa]

How to Find the Best KYC Service Provider

Selecting the right KYC service provider is critical to ensure full legal compliance and ease the identity verification process, which can have a high impact on customer satisfaction. Here’s what you need to consider when searching for a KYC provider.

1- Determine Your Business Needs

There is no one-size-fits-all in KYC solutions because each company has its own unique requirements and capabilities. Identify your needs from the KYC provider in terms of the verification speed, risk level and how critical you want the authentication process to be.

Businesses pay different attention to user experience, customer onboarding process, data collection, and more. Therefore, you can search for alternatives once you determine your volume, risk assessment, and business needs.

2- Search for Reliable KYC Service Providers

When it comes to legal compliance, there is no compromise for price or quality. Therefore, search for a certified and approved KYC provider and check out their license details, such as ISO 27001, pertaining to information security management.

Reliable KYC solution providers have experience and knowledge of best practices when it comes to collecting and processing customer data, especially with the rising concerns about privacy and personal data collection.

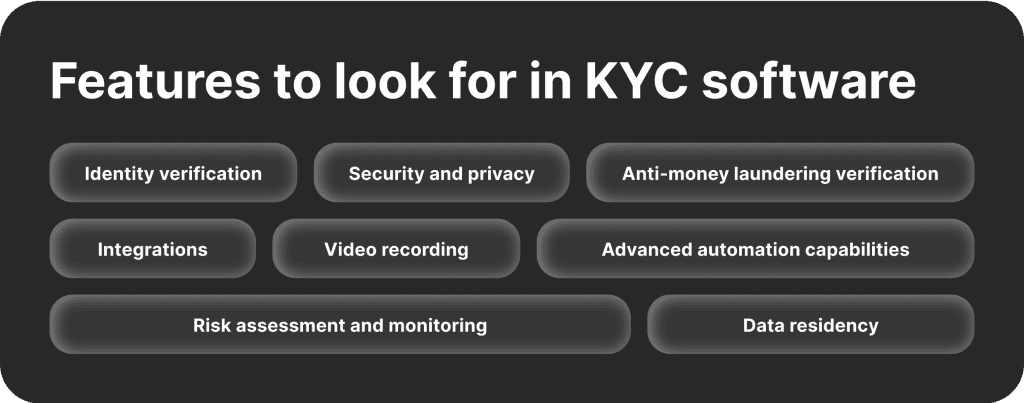

3- Select the Needed Functionalities

KYC companies offer a wide range of services and functions that you can pick and choose from. However, these services must be compatible with your platform and facilitate a simplified user experience.

Select the risk level associated with your business and industry. For example, the financial services industry has a higher degree of risk than shareriding and transportation companies.

Moreover, check out the customer identification program and integration capabilities if you want to automate and improve the synergy between various services, KYC providers and your website.

4- Assess the Security Features

KYC companies analyse and process data using a set of procedures, including identity, biometric, face and document verification. These elements highly impact the user experience while submitting personal information and the robustness of your data security structure.

Moreover, check out the data residency, referring to the location where data is stored. For example, KYC providers may process and store data in-house, which is safer than storing them on third-party cloud storage.

5- Check Out the Pricing Policy

KYC providers imply various fees for their services based on the industry and the complexity of the verification process. You can also look for a KYC provider that incorporates a flexible pricing policy that suits your budget. Settling for the cheapest KYC provider is not necessarily a good idea, especially if they provide sub-par KYC services.

Check out the identity verification services enlisted with each pricing plan and select only the ones required for your business.

Conclusion

KYC is the methodology of verifying customer identities and ensuring the legality of their activities on your platform. This process involves identity verification using robust data-collecting and processing tools to prevent fraud and maintain regulatory compliance.

The customer verification process is part of the customer onboarding and screening, requiring the user to submit personal data and documentation proving they are genuine and legal.

Businesses from different industries implement KYC compliance software to simplify customer onboarding using various KYC tools, such as ID, face and biometric authentication, promoting safer ecosystems and platforms.

Read also