Share

0

/5

(

0

)

Modern electronic trading offers a wealth of market patterns and situations that signal shifts in market sentiment and, consequently, the prevailing trend. In this landscape, diverse trading strategies and styles exist, each with the potential to grow capital and acquire valuable knowledge. One such style involves finding and identifying order blocks — a zone of increased liquidity due to large buying/selling by institutional investors.

This article will help you understand what order block trading is and how it works. You will also learn about the main strategies used in this trading method and their effectiveness.

Key Takeaways

Order blocks signify crucial price points where substantial orders from corporate traders are executed.

Traders can differentiate between legitimate and illegitimate order blocks by analysing certain features, such as take-outs and liquidity sweeps, and identifying inefficiencies, imbalances, and unmitigated conditions.

By accurately recognising and utilising different categories of order blocks — such as bullish, bearish, breaker, rejection, and vacuum — traders can improve their strategies and increase their profit potential.

What is an Order Block in Trading?

An order block in trading refers to a specific zone on a price chart where repudiatory buying or selling activity occurs, typically by large institutional players like banks, hedge funds, or investment firms. These blocks represent a collection of large orders that cannot be filled at once due to the sheer size of the transaction. Instead, these orders are executed in parts, often causing the price to react or reverse at these levels. Traders use order blocks to anticipate future market moves by identifying key interest zones where the price will likely stall or reverse.

Order blocks represent areas of high liquidity, meaning these zones attract significant buy and sell orders, usually from large institutions. Since institutions need liquidity to execute large orders, they frequently place them at levels with enough market interest to absorb. Then, these zones become pivotal areas of support or resistance, where the price either consolidates or reverses depending on whether those orders are being filled or removed. Traders look for these liquidity zones (order blocks) to gauge where the market will likely react, giving them an edge in predicting future price movement.

[aa quote-global]

Fast Fact

Order block trading is a price action strategy centred on clusters of market orders that generate noticeable discrepancies between supply and demand on a chart.

[/aa]

What is Order Block Trading and How Does It Work?

Order block trading is a method traders use to identify specific price levels where massive institutional buy or sell orders are placed. These order blocks represent areas of significant activity in the market, often created by major financial institutions, hedge funds, or other large players. By identifying these blocks, traders can anticipate future price movements, as these zones typically signify a shift in market sentiment due to high-volume trading activity.

Order block trading is particularly valuable for traders in the Forex and cryptocurrency markets due to the high volatility and liquidity. Large institutional orders in these markets can significantly move prices, creating opportunities for retail traders to capitalise on the movements. By understanding and leveraging order blocks, traders can make more deliberate assessments about when to enter or exit trades, helping to increase the probability of success while managing risk.

Types of Order Blocks

In order block trading, there are several types of orders, each of which has its own characteristics and gives an idea of a particular situation that takes place on the market, including such phenomena as a change in trend, consolidation of trading volumes, etc. Below, we will discuss the main types of these orders.

1. Bullish Order Block

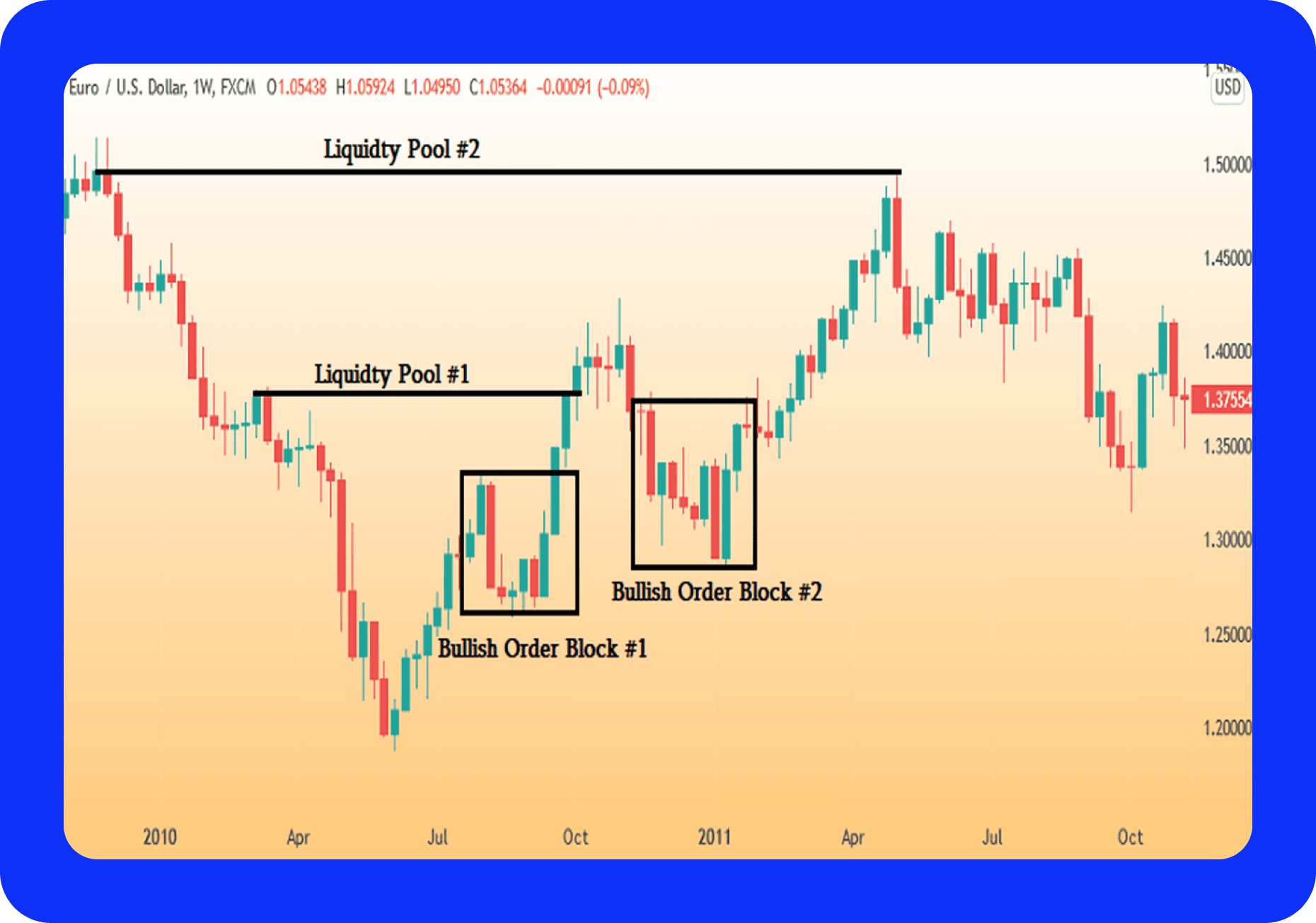

A bullish order block occurs when large institutional buy orders are concentrated within a specific price zone, typically after a downtrend or during a consolidation phase. This type of order block signifies strong buying pressure, often leading to a reversal or a continuation of an uptrend.

It appears in downtrends or at the end of consolidation and indicates a potential price reversal or upward momentum. It also acts as a support zone, where buyers step in aggressively.

Traders look for bullish order blocks as areas to enter long positions, anticipating that the price will rise as the large orders get filled. These blocks often result in a price bounce.

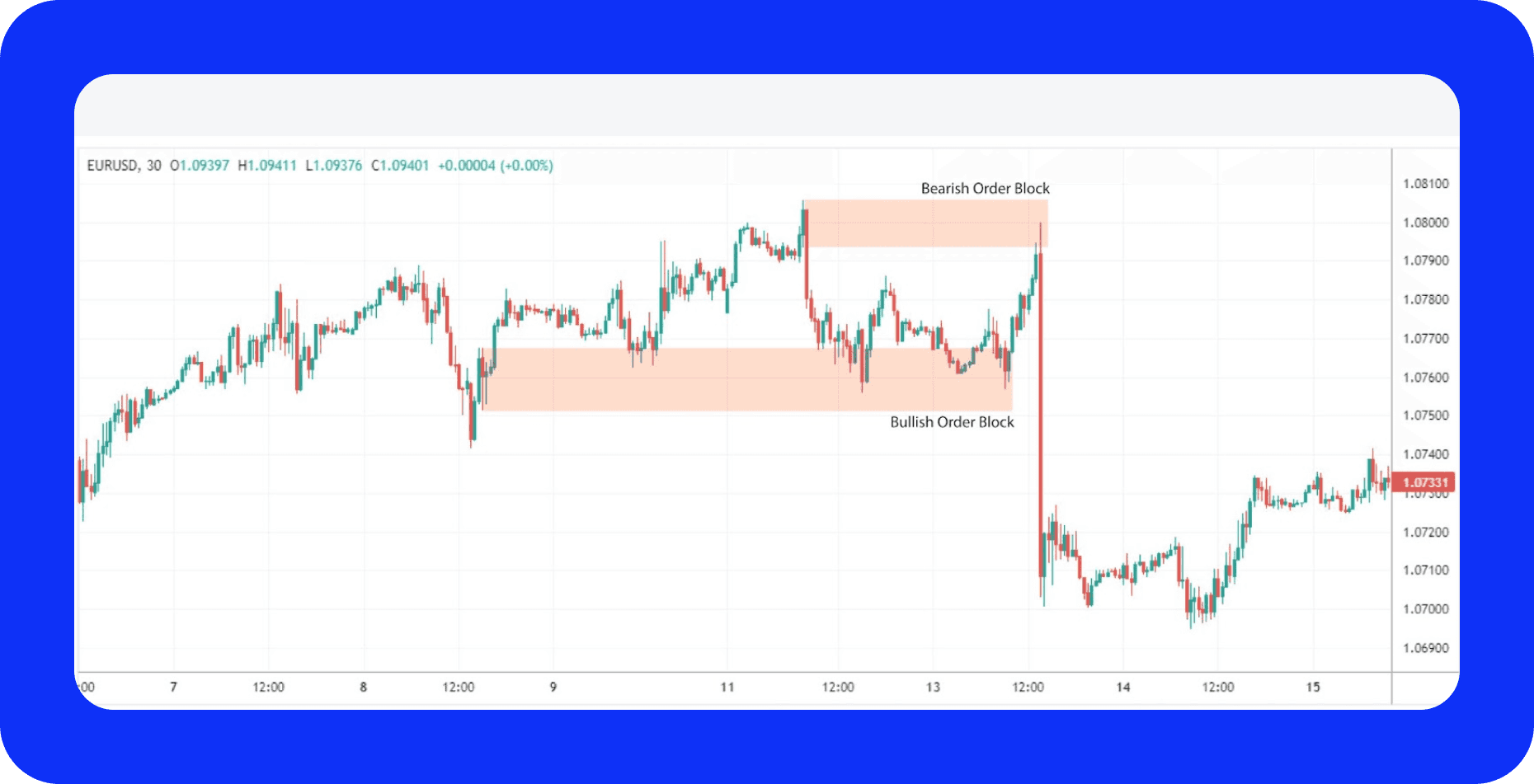

2. Bearish Order Block

A bearish order block is where large institutional sell orders accumulate, usually after an uptrend or at resistance levels. It is indicative of severe selling pressure, signalling a potential price reversal or continuation of a downtrend.

It can be found at the end of an uptrend or within consolidation periods, and it represents a resistance zone, preventing the price from moving higher. Furthermore, it also indicates a likely drop in price once large sell orders are filled.

Traders identify bearish order blocks to enter short positions, expecting the price to fall after hitting the zone of heavy selling.

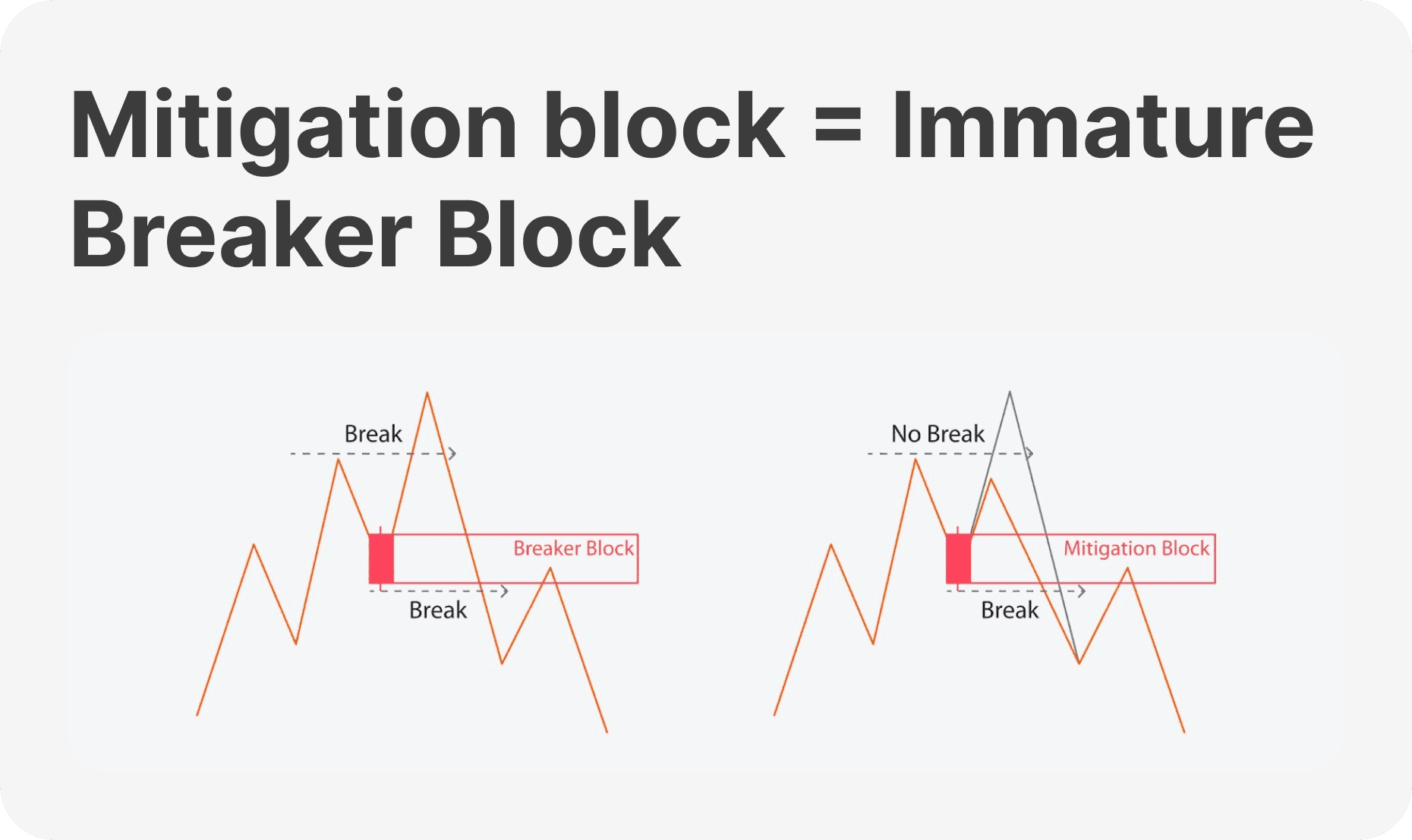

3. Mitigation Order Block

A mitigation order block occurs when the price returns to a previous order block where large orders were left unfilled. This type of order block allows institutions to “mitigate” their losses by completing their orders.

In such a block, the price revisits a previously unfilled order block. Depending on its bullish or bearish nature, it serves as a strong support or resistance level and often leads to a sharp reversal after touching the block.

Traders use mitigation order blocks as confirmation for re-entering positions, expecting the price to resume its previous direction after filling the block.

4. Continuation Order Block

The continuation order block, a crucial concept in trading, is a temporary price consolidation or pullback in a trending market. It's where institutions pause to accumulate or distribute more orders before the trend resumes, presenting potential trading opportunities for astute investors.

Such a block type can be found during trending markets within pullback zones. It indicates the continuation of a current trend after institutional accumulation and appears as a short-term consolidation before the next leg of the trend.

Traders anticipate the trend to continue after a brief pause and look to enter positions when the price breaks out from the continuation order block in the upward direction.

Major Order Block Trading Strategies

Order block trading is a fairly widespread trading style and enjoys great popularity among many traders and investors of distinct types as an alternative method of capital growth within the framework of an individualised trading strategy. Among the strategies used within the order block concept are the following:

Trend Reversal Strategy

Traders use order blocks near support or resistance levels to anticipate market reversals. For example, if a bullish order block forms near a long-term support level, it could signal a downtrend's end and a bullish reversal's start.

Traders often combine order block identification with technical indicators like the Relative Strength Index (RSI) or MACD to confirm overbought or oversold conditions, increasing confidence in a reversal.

Breakout Strategy

Breakout traders monitor the price as it approaches order blocks and wait for a decisive breakout above (bullish) or below (bearish) the block. This indicates a strong move backed by institutional orders.

Higher-than-average trading volume during the breakout can confirm institutional interest, signalling a strong trend continuation.

Pullback Strategy

In a trending market, traders wait for the price to pull back to a previously formed order block before entering a trade. For instance, during an uptrend, a pullback to a bullish order block can offer a low-risk entry point.

This strategy is regularly combined with Fibonacci retracement levels, as corporate traders tend to place orders around key Fib levels, making the pullback to an order block a high-probability setup.

Scalping Strategy

Scalpers focus on identifying smaller, short-term order blocks that form during intraday trading sessions. These order blocks typically represent high liquidity areas, where price bounces back and forth before breaking out.

Scalping order blocks require quick entry and exit, with tight stop losses placed just outside the identified block to manage risk effectively.

Range Trading Strategy

In a ranging market, traders look for order blocks forming near the top or bottom of the range. This strategy involves buying at the lower order block (demand zone) and selling at the upper order block (supply zone) to take advantage of predictable price movements within the range.

Stops are usually placed beyond the identified order blocks to minimise losses if the range breaks.

Supply and Demand Strategy

Traders map out supply (bearish order blocks) and demand (bullish order blocks) zones. When price re-enters these zones, it often signals a point where institutional players are executing buy or sell orders.

Traders enter when the price reaches the order block zone and shows signs of rejection, such as a candlestick pattern like a hammer or shooting star.

News-Based Strategy

Major news events often trigger institutional buying or selling. Traders use these events to watch for the formation of new order blocks as institutions react to the news. For example, a strong economic report might lead to the formation of a bullish order block, signalling large buy trades.

By analysing the order block that forms in reaction to the news, traders can gauge market sentiment and align their trades with institutional flows.

Stop Hunt Strategy

Smart money traders regularly use order blocks to hunt and stop losses retail traders place. These areas represent high liquidity where large institutions can place significant buy or sell orders.

Traders can wait for the market to hit stop-loss zones (just outside the order block), triggering liquidity for large institutions to reverse the price direction. After the stop hunt, traders enter a trade in the opposite direction of the initial move.

Time Frame Confluence Strategy

Traders combine higher and lower time frames to validate order blocks. For example, a trader may spot an order block on a 4-hour chart and then zoom into a 15-minute chart to find a precise entry.

This strategy aims to align trades with the overall trend observed on a higher time frame, using order blocks for more precise entries and exits on lower time frames.

Liquidity Grab Strategy

Some order blocks form near key price levels where liquidity traps retail traders into false breakouts. Traders using this strategy wait for the market to fake a breakout, only to reverse and enter on the retrace to the order block.

After the liquidity grab, traders look for reversal patterns within the order block to time their entry in the opposite direction of the fake breakout.

Conclusion

Order block trading represents a sophisticated strategy that empowers traders to tap into the trading patterns of large financial entities. By cognisant of and discerning order blocks — key areas of high liquidity created by huge buy or sell orders — traders can gain insights into potential market reversals and trend continuations.

As markets evolve, mastering order block trading can provide a competitive edge. However, traders must remain vigilant about the inherent risks, employing sound risk management practices to safeguard their investments. By integrating order block inspection with other technical metrics and market knowledge, traders can develop robust strategies that adapt to dynamic market conditions.

FAQ

What is an order block in trading?

An order block refers to a significant accumulation of buy or sell orders placed by large financial institutions and indicates areas where they have entered the market, leading to high liquidity zones.

How do order blocks influence market behaviour?

When the price reaches an order block, it either reverses or consolidates due to the large volume of orders, creating support or resistance levels.

How can retail traders benefit from order block trading?

Retail traders can use order blocks to identify potential entry and exit points by following institutional activity. Their order blocks create high liquidity areas, making it less difficult for retail traders to enter or exit trades with reduced risk.

What are the risks of order block trading?

While order block trading provides insight into institutional market moves, risks include false breakouts or misidentifying genuine order blocks.

Can order block trading be used in all markets?

Yes, order block trading can be applied across various capital markets, including FX, stocks, commodities, and crypto.

How do large financial institutions create order blocks?

Large institutions often place remarkable buy or sell orders at specific price levels, creating zones of high liquidity. These orders are typically executed in chunks to avoid market disruptions, forming what is known as an order block.

Is Order block trading similar to supply and demand trading?

Yes, order block trading shares similarities with supply and demand trading. Both focus on uncovering areas where great potential for purchase or selling interest exists.

Read also