Share

0

/5

(

0

)

In 2023, daily trading volumes in the global FX market surged past $7.5 trillion, confirming its place among the largest and most competitive financial landscapes. In this high-stakes arena, maintaining strong client relationships isn’t just advantageous—it’s essential.

For brokerages, this scale demands efficient client management, seamless operations, and stringent compliance. Forex-specific CRM software today is indispensable, facilitating everything from account management and onboarding to data security.

With countless Forex CRM solution providers offering features like multi-platform integration, affiliate management, real-time analytics, and automated KYC, choosing the right one can be challenging. This guide highlights the top Forex CRM software for 2024, helping you make the best choice for your brokerage.

Key Takeaways

Forex CRMs assist with efficient client management, compliance, and streamlined operations.

Leading solutions from B2BROKER, Leverate, FXBO, UpTrader, and CloudForex bring game-changing features like multi-platform access and mobile trading.

Look for Forex-tailored tools, easy integrations, and top-notch security.

Top Forex CRM Providers in 2024

Below is an overview of some of the best Forex CRM companies in 2024, each offering distinct features tailored to meet the needs of Forex brokers.

B2BROKER (B2CORE)

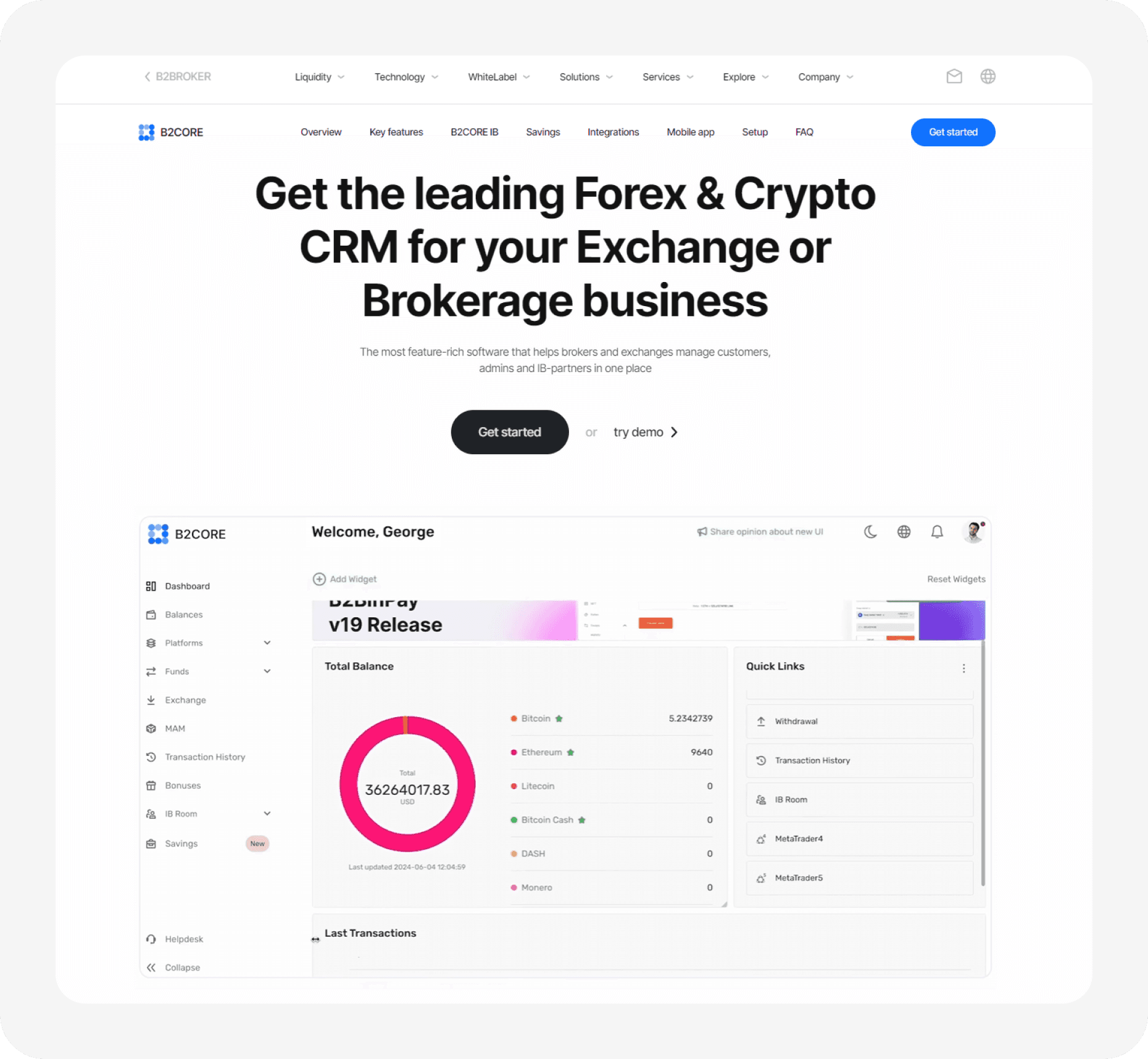

B2BROKER, a liquidity and technology provider for the financial space, offers an all-encompassing CRM solution tailored for multi-asset brokerages: B2CORE. This CRM platform integrates essential tools for client management, back-office operations, and analytics, consolidating these functions into a unified system that simplifies operations and enhances accuracy.

Designed to be highly adaptable, B2CORE integrates with numerous payment providers, including B2BINPAY, and offers compatibility with popular trading platforms like cTrader, MT4 & MT5, and B2BROKER’s proprietary B2TRADER. The platform is mobile-compatible, enabling brokers and clients alike to access trading features from iOS and the recently added Android app. B2CORE also offers extensive customization options and a fully updated user-friendly UI, giving clients maximum convenience when managing IBs, cTrader bonuses, and more.

For security and compliance, B2CORE incorporates robust tools, including KYC tools and an anti-fraud system that safeguards client data and streamlines onboarding. Enhanced with data-driven insights and customizable analytics powered by RudderStack and Amplitude, B2CORE assists brokers in making informed decisions that optimize their operations. Additionally, the CRM supports 24/7 customer service, helping brokerages maintain uninterrupted client support.

To give brokers a firsthand experience of the platform, B2BROKER offers a demo of B2CORE. In the Forex CRM software demo version, users can explore key features such as:

Dashboard: Access an overview of client and account activity.

Wallets: Manage multi-currency wallets (fiat and crypto).

MT5 Support: Experience trading functions specific to MT5.

Transactions: Seamlessly handle deposits, withdrawals, and transfers.

History: Review detailed records of trades and transactions.

Profile and KYC: Test profile management and KYC processes.

Converter Widget: Use in-platform currency conversion.

PAMM Login: Experience seamless access to PAMM accounts.

Bonus & IB Room: Manage bonuses and IB relationships.

Security: Whitelist addresses for added security.

Helpdesk: Utilize the support system for client inquiries.

Why Choose B2BROKER? B2BROKER’s B2CORE is an excellent choice for all types of brokerages looking for a versatile CRM that combines advanced analytics, mobile accessibility, and a comprehensive compliance framework within a unified ecosystem.

Leverate (LXCRM)

Leverate’s LXCRM stands out as a sophisticated CRM solution designed specifically for Forex brokers. Leverate has over two decades of experience in FinTech, with a deep understanding of the challenges brokers face. LXCRM is optimized to streamline operations and maximize productivity, offering tools to manage clients, monitor team performance, and ensure efficient segmentation.

LXCRM integrates seamlessly with multiple trading platforms, including MT4 and Leverate’s proprietary trading software, SIRIX. LXCRM also simplifies the client segmentation process, helping brokers deliver more targeted offerings based on specific client profiles. For brokers seeking operational transparency, LXCRM provides tools for tracking team performance and assigning permissions, allowing for secure access control.

Leverate’s product range goes beyond CRM with complementary solutions like LXRisk, which helps brokers manage exposure in real-time, and LXFeed for market data streaming. With a focus on automation and client retention, Leverate offers a complete package for brokers looking to optimize their CRM operations.

Why Choose Leverate? With its powerful CRM capabilities, extensive experience, and wide range of additional tools, Leverate is well-suited for established brokers looking for a feature-rich solution to support complex operations.

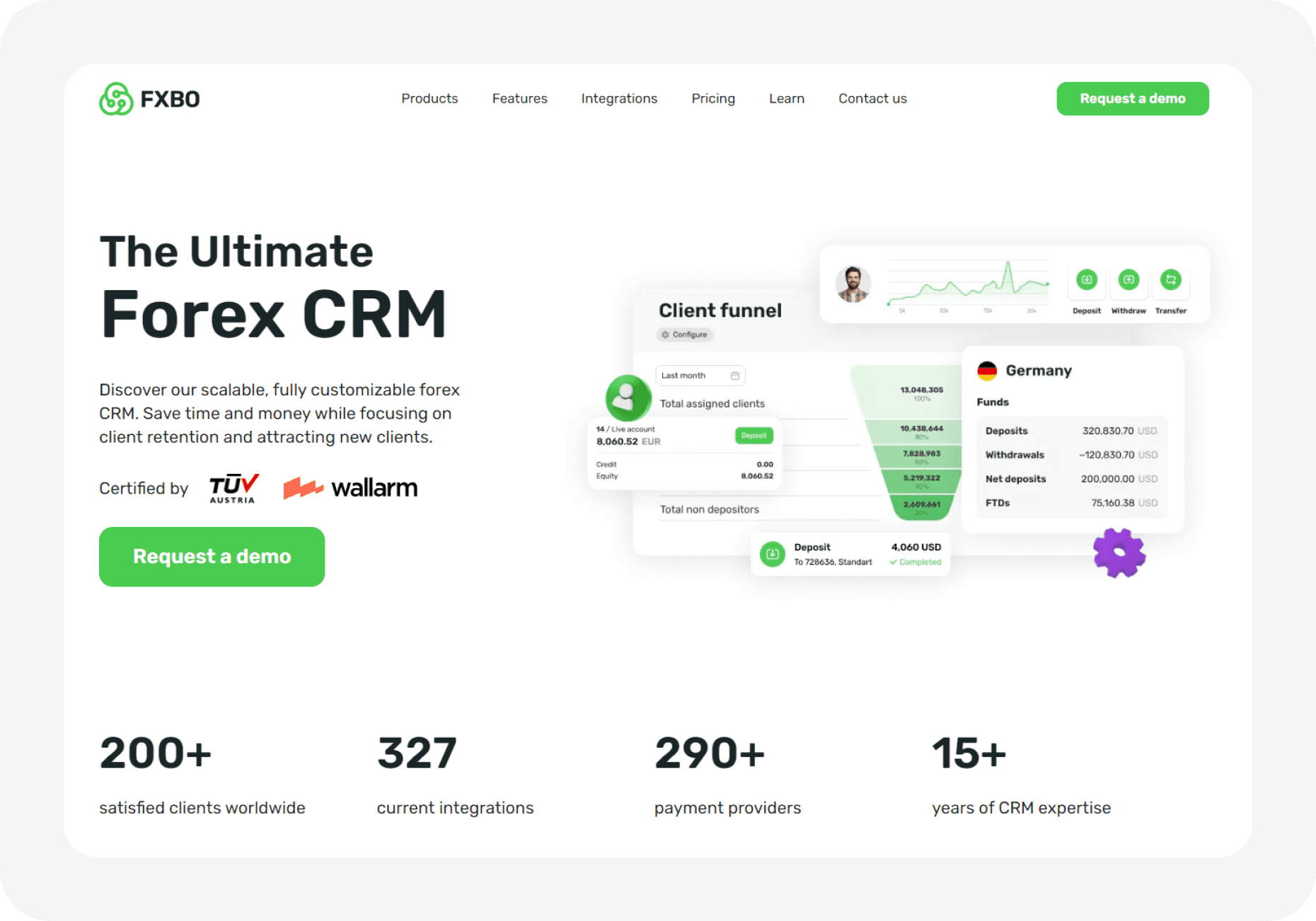

FXBO

FX Back Office (FXBO) is a leader in CRM systems, offering feature-rich Forex back office software tailored to enhance operational efficiency for brokerages. Since its founding in 2007, FXBO has evolved to support over 320 integrations, providing flexibility for brokers who want to customize their CRM with various payment processors, trading platforms, and compliance tools.

FXBO’s back office solution simplifies client data management, allowing brokers to organize customer information, track documentation for KYC compliance, and automate tasks. The client area is a vital feature that provides insights into client interactions, enabling brokers to tailor their offerings based on customer behavior. Additionally, FXBO offers a dedicated mobile application for both Android and iOS, allowing brokers to extend their services to clients across devices.

FXBO’s Partner Area helps brokers manage relationships with affiliates and IBs, automating referral bonuses and tracking commissions. The service desk module also enhances customer support by allowing users to create and track support tickets, making issue resolution more efficient.

Why Choose FX Back Office? With its extensive integrations, mobile accessibility, and dedicated tools for managing affiliates, FXBO is a powerful solution for brokerages seeking a highly customizable and scalable CRM for Forex.

UpTrader

UpTrader offers a versatile CRM platform that supports brokers with a range of trading and back-office management tools. Known for its adaptability, UpTrader offers white-label solutions that can be customized according to the specific needs of each brokerage.

UpTrader’s CRM includes essential tools like the Trader’s Room, where clients can onboard, verify their documents, and manage their accounts. The back-office dashboard provides a comprehensive view of the brokerage’s operations, allowing managers to track financials, oversee team performance, and control integrations. The sales module in UpTrader’s CRM supports performance tracking for sales teams, adding transparency for commission-based models.

For brokerages interested in social trading, UpTrader’s white-label social trading solution includes support for managed accounts like PAMM, MAM, and copy trading. This flexibility is attractive to companies looking to offer more trading options to clients. UpTrader also offers affiliate management tools, enabling brokers to grow their IB network and introduce bonus systems to attract and retain clients.

Why Choose UpTrader? With its wide range of features, white-label options, and social trading support, UpTrader is a top choice for brokers looking for a flexible and scalable solution that can support rapid growth.

CloudForex

Based in Singapore, CloudForex brings a streamlined and user-friendly CRM experience to Forex brokers. This CRM prioritizes efficiency and data security, supporting brokerage operations with tools that simplify client onboarding, account management, and automated marketing.

CloudForex’s CRM offers a suite of tools for marketing automation, including automated email campaigns and personalized offers that brokers can leverage to engage their client base more effectively. For client management, CloudForex provides a centralized interface to track account activity, monitor account balances, and support withdrawals and deposits live.

For brokerages that work with IBs, CloudForex includes an IB management module, which helps track commissions and encourages activity through reward programs. CloudForex also emphasizes security, with features like data encryption, access controls, and regular audits that keep sensitive information protected.

Why Choose CloudForex? Ideal for brokers focused on client engagement and security, CloudForex’s emphasis on marketing automation, user-friendly interfaces, and IB management tools make it a great choice for brokerages wanting the best in the Forex CRM industry.

How to Choose Forex CRM Software

A high-performing Forex brokerage is built on a CRM that meets its industry-specific needs. Here are the key factors every brokerage should consider:

Traading-Specific Functionalities

Unlike generic CRM solutions, a Forex CRM is designed to handle the complexities of financial trading. The best solution is to support client onboarding, account management, compliance with KYC/AML requirements, and analytics tools to track client activity and performance.

Integration with Essential Platforms

Today’s Forex brokerages operate across multiple systems and platforms. A strong CRM needs to connect seamlessly with trading platforms like MT4, MT5, and cTrader, as well as integrate with various payment processors and affiliate networks.

Additionally, with over 80% of traders accessing their accounts on mobile devices, a CRM that works across desktops and smartphones is no longer optional. Mobile-compatible CRMs allow brokers and clients to access the system anytime, anywhere, without interruption.

Security and Compliance

Data security and compliance are everything in the highly regulated Forex world. The right CRM will have robust security measures to meet strict regulatory standards and protect sensitive client information. Essential security features include:

KYC/AML Compliance: Automated tools for KYC/AML compliance help brokers adhere to regulations while enhancing the user experience. Built-in KYC tools can cut onboarding times in half, allowing clients to start trading faster.

Fraud Detection and Data Encryption: With the rise of online trading fraud, CRMs need anti-fraud systems and data encryption to keep transactions secure and ensure brokers maintain regulatory compliance.

Affiliate Management and Reporting

Many brokerages rely on introducing brokers and affiliates to expand their client base. CRMs that incorporate affiliate and partner management tools can greatly increase lead acquisition. Tools to manage IB relationships, track referral bonuses, and automate commission payouts simplify the affiliate process, helping brokerages build and maintain a strong partner network.

Conclusion

Investing in a reliable Forex CRM system is more than just a technological upgrade—it’s a strategic move that can strengthen client relationships, ensure compliance, and drive long-term success.

Read also