Share

0

/5

(

0

)

Ever wondered how financial markets actually work? What happens in the back-end of things between your screen and the actual market floor?

For the end-user, it is as simple as clicking a few buttons to place a trading order. However, the process is much more complex than that, and the arrival of technology and digital platforms gave it another dimension.

Let’s look at the trade lifecycle and how your market order goes from being requested to settled.

Key Takeaways

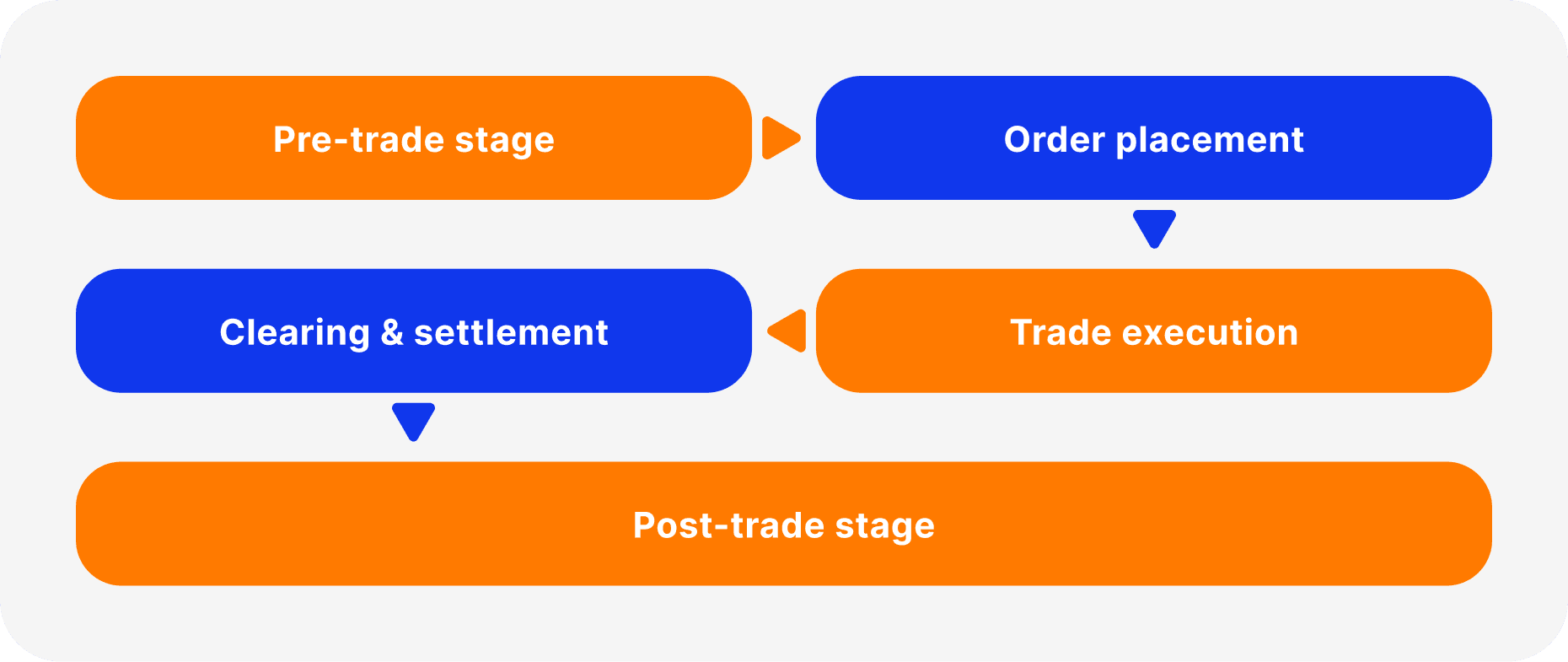

Trade lifecycle refers to the stages each market order goes through, from requesting the position to actually executing it.

Every market order goes from the pre-trade stage to position placement, execution, clearing, settlement, and reporting.

The rise of technology and interrelated business models affect each trade lifecycle event differently.

Understanding a Trade Lifecycle

The trade lifecycle explains the stages that every financial market order goes through until it is settled, and you can view it in your trading room.

This concept combines the trader’s psychological sentiment when reading inputs and making decisions over the right investment assets according to their trading strategies. It also highlights the sophisticated technology that carries each investor’s requests after the trade is made, where transactions are cleared and placed.

Most of today’s trading activities are conducted over the Internet through brokerage firms and online trading software like MetaTrader and cTrader. Offline trading also exists, but hosting market participants on marketplace floors has decreased significantly.

The Development of Trading Process

Classically, investors, brokers and entrepreneurs used to gather on stock exchange floors. The New York Stock Exchange, NASDAQ, and other venues hosted traders to check market conditions, analyse prices, predict trends and execute orders. Communication used to happen in face-to-face interactions or through the telephone.

However, the advent of online platforms and electronic trading systems transformed the lifecycle of a trade into a computer-based one. Today, almost anyone can create an account and interact with the market either directly or through financial brokers.

This evolution inflated the market with millions of transactions and participants who can connect and execute operations within seconds. Most online brokerage platforms today can manage thousands of buy/sell orders in one second, elevating the overall trading experience.

[aa quote-global]

Fast Fact

Online trading came through in the early 1990s when systems like E*TRADE provided electronic trading technologies. Later, NASDAQ introduced its first online-based platform in 1994, boosting the growth of internet-powered trading capabilities.

[/aa]

The Lifecycle of a Trade

For the average trader, entering the market happens with two clicks. In reality, it is much more complicated because orders must clear some financial, regulatory and technological barriers. Let’s explore them.

Pre-Trade Stage

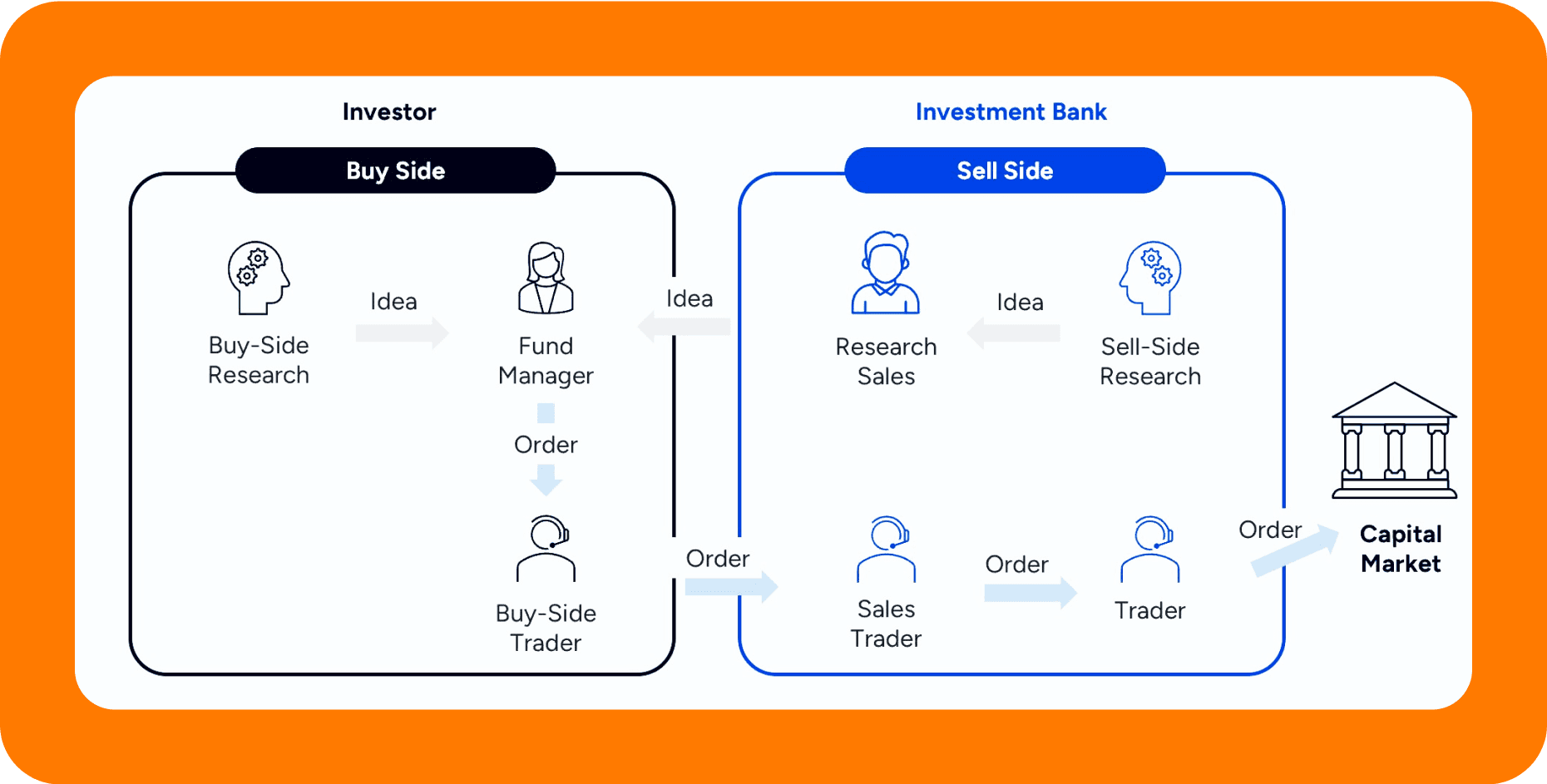

At this stage, the trader reads and analyses market inputs, including price action, economic announcements, expert analysis, and other technical and fundamental information. The investor either chooses assets that align with their trading strategies or picks up on trends and invests in currently on-demand products.

If the trader uses copy or algorithmic capabilities, they add order execution parameters that dictate the market entry/exit conditions to trading bots. Setting these systems includes stop-loss and take-profit levels, as well as the type of investments they wish to engage in.

The trader must also calculate the expected trading costs, including spreads and commissions, to accurately estimate their returns. After factoring in all analytical and preparatory activities, the trader chooses the asset, position type and lot size.

Order Placement

Here, the investor inserts their trading request, including the type (buy or sell), lot size, overall trading value and limits. From here on, the trade lifecycle is managed by complicated procedures.

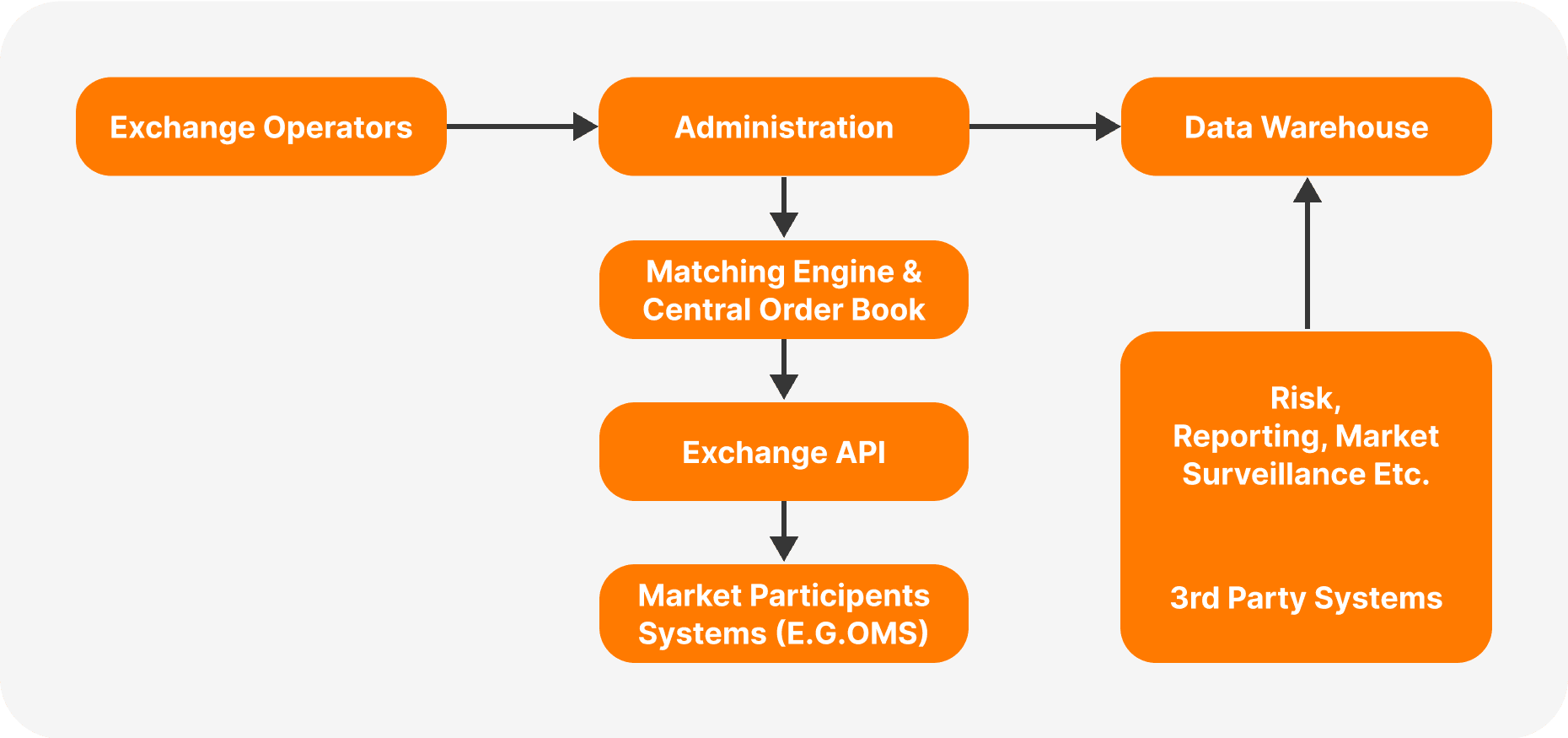

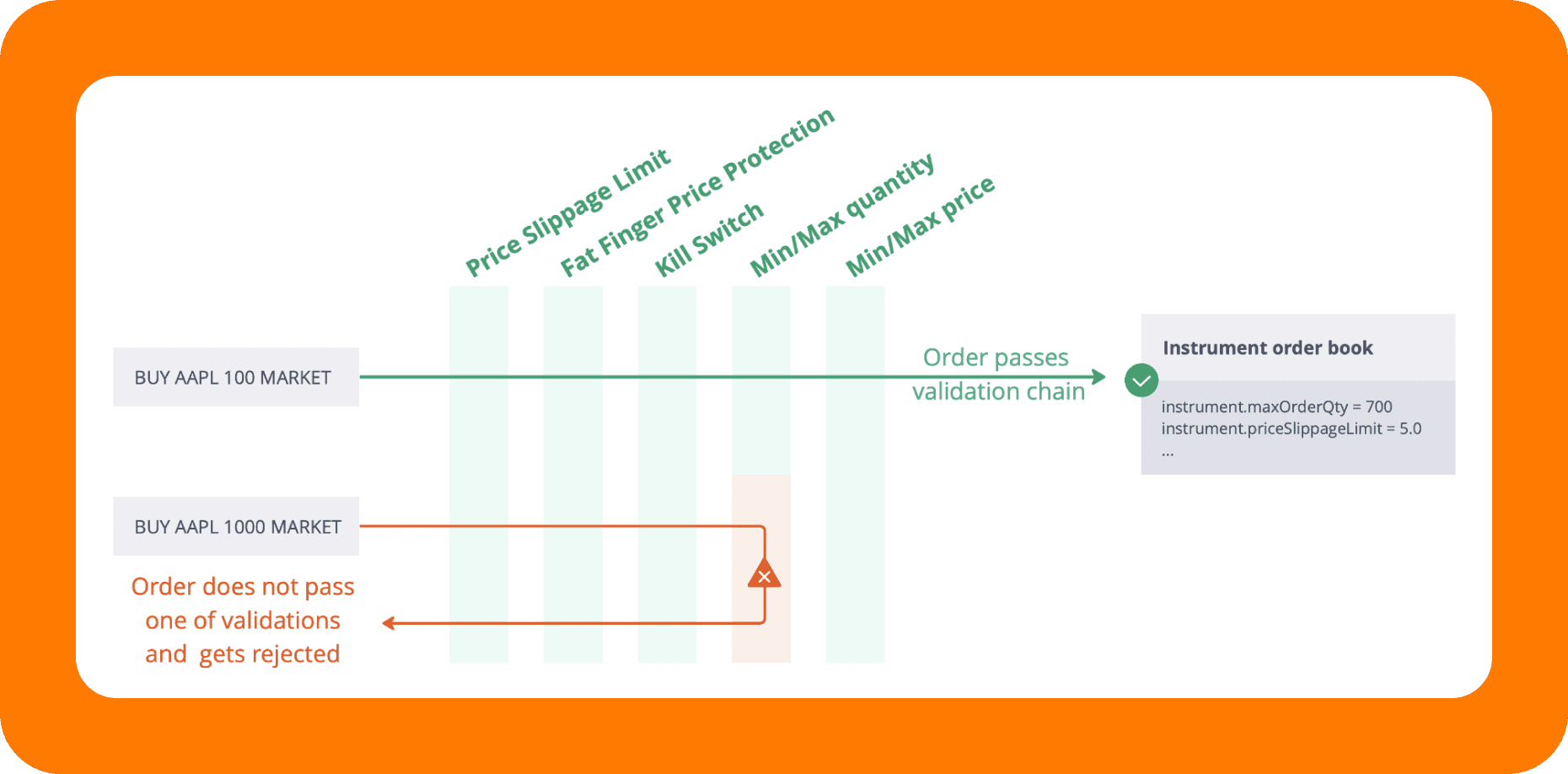

A crucial part of this phase is the order book, which records all pending trade requests placed by all traders. The matching engine may skim through a broad range of order books and pending pools, known as the liquidity sweep.

The order goes into the broker’s trading engine to find a matching order. The process utilises advanced algorithms to scan order books, considering liquidity, size, rates and speed. The system may use distributed ledger technologies, straight-through processing modules (STP), electronic communication networks (ECNs) or high-frequency trading capabilities (HFT).

These order rerouting strategies are dictated by the broker, determining the asset classes, types, and lot size. For example, large positions can be broken down into smaller orders, each processed using one or more matching algorithms.

Trade Execution

The position is executed when the engine finds a matching order. In other words, when the system finds a buyer for a “sell” order or a seller for a “buy” position.

This stage is affected by the trading software, whether through a broker or direct market access, considering the order fulfilment speed, liquidity flow and market depth.

According to the trader’s request, the order may be sent to settlement immediately if a matching order is found. In contrast, limit orders remain on the pending pool until a suitable position meets the criteria.

At the same, different types of executions are considered, such as immediate-or-cancel and fill-or-kill. These models dictate if an order needs immediate confirmation despite slight price discrepancies or waiting until the specified rate is entirely found and executed.

Clearing and Settlement

Once the order is confirmed, it goes through a complex trade lifecycle process, factoring in regulatory requirements and financial verifications.

Clearing houses are risk management agents that make trades “happen” and ensure the safety of the transaction. They receive confirmed orders from brokerage firms and verify them against applicable laws. Once the order is cleared, it will appear in the trading software, and the position will be officially live.

The Depository Trust & Clearing Corporation and CME Clearing are popular clearing agencies in the US. DTCC clears US shares and capital markets, while CME handles futures and options in commodities and Forex.

Other intermediaries include London Clearing House, Eurex Clearing in Germany and Japan Securities Clearing Corporation.

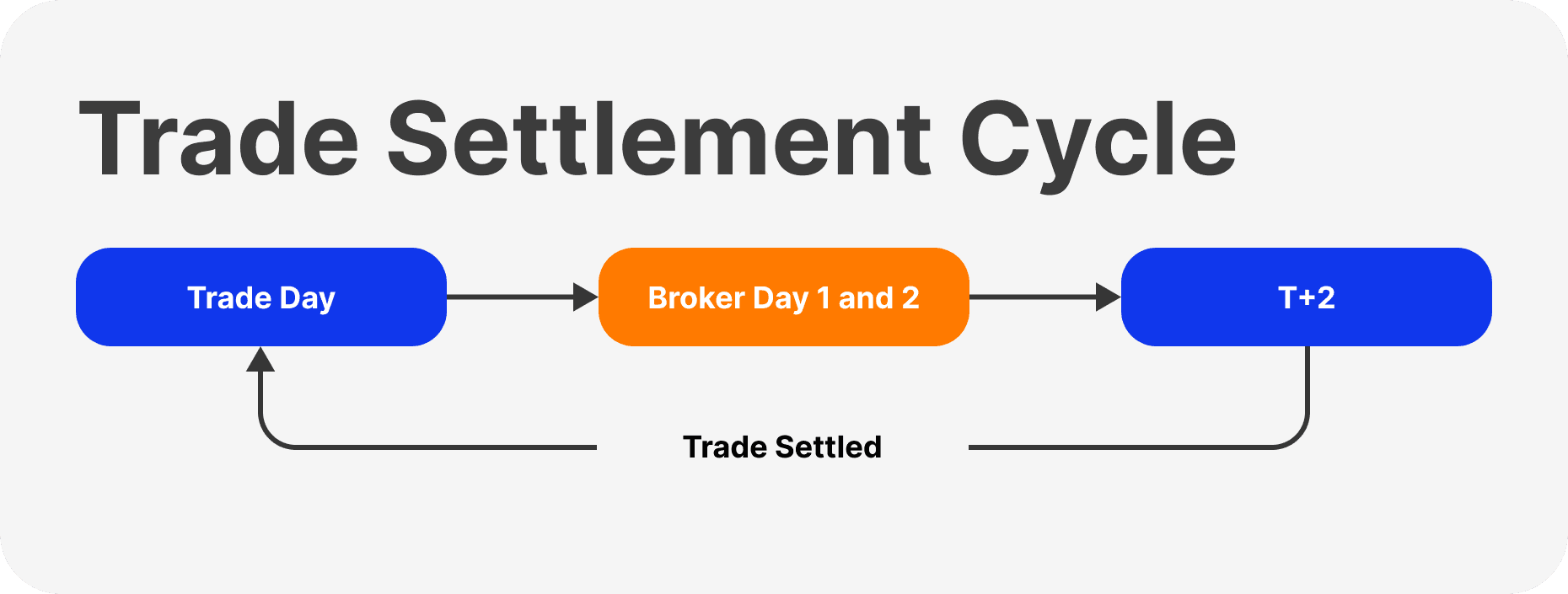

Afterwards, the order goes to settlement, where underlying securities and funds are exchanged. Typically, trades follow a T+2 settlement date cycle. For example, if you buy X shares on Monday, your position appears almost immediately, but the official ownership transfer happens on Wednesday.

It is worth noting that derivatives trading is not subject to the standard settlement cycle because CFDs do not entail asset ownership transfer.

Post-Trade Processing

Once the order is legally cleared and settled, it must be approved across the board, ensuring all trade lifecycle events align. Trading software, brokerage platforms, and order books must be updated accordingly.

This stage involves automatically reporting the position’s value, timestamps, and trade date to authorities for auditing and tax purposes. Additionally, any associated broker’s commissions, brokerage charges and intermediary fees are calculated here.

Brokerage firms and financial institutions processing this order use this phase to archive the transaction for tracking and auditing purposes.

In other words, post-trading processing is all about trade lifecycle management and reporting trade details to all parties involved.

Factors Affecting The Trade Lifecycle Process

Today, with new technologies and business processes in the financial services industry, this life cycle branches into more intermediary stages. White labels, affiliates, introducing brokers, prime-of-prime brokers, prime brokers and direct-market access affect the process.

Let’s review these actors and their role in the market order cycle:

White Labels: WL providers offer pre-built trading software, increasing the inflow of brokers and enriching order books for faster order execution.

Affiliates: Affiliate brokers are marketing agents that convert leads to brokerage firms. They affect pre-trading by providing advice and financial knowledge, making this stage faster and more efficient.

Introducing Brokers: IBs introduce new investors to brokers and offer financial advice. They also affect the pre-trade and order placement stages and make them much faster.

Prime-of-prime Brokers: PoPs are intermediaries connecting small brokers to large financial institutions. They affect the trade execution process by offering more efficient liquidity solutions.

Prime Brokers: PBs offer consultancy, analysis and liquidity solutions to large brokerage companies, affecting multiple trade cycle events and making them faster and more streamlined.

DMA Software: Direct-market access is a trading system that allows traders to interact directly with financial markets without brokers. Therefore, they speed up order placement and execution.

Conclusion

The trade lifecycle is more complicated than you might think. What appears to be a two-click process is, in fact, a highly advanced system of algorithmic connections and an automatic verification process.

This system starts with pre-trade and continues with position placement, execution, clearing & settlement, and post-trade reporting. Technology is vital in this process, making it safer, faster and more streamlined, while intersecting business models affect each stage of this cycle differently.

Read also