What Makes Up a Perfect Forex Back Office Software?

The world of digital foreign exchange has come a long way since its modest beginnings in the 20th century. Today, the world economy directly depends on the effectiveness and productivity of forex markets. Entire countries and massive markets might suffer colossal losses if the forex landscape is shut down even for a single day.

Thus, the forex industry is vital and in high demand globally. Navigating this complex field as a forex broker can be quite challenging and technically loaded. Adopting cutting-edge forex broker back office software might be a game-changer, providing brokers with all essential tools and advantages to compete on a global stage.

Key Takeaways

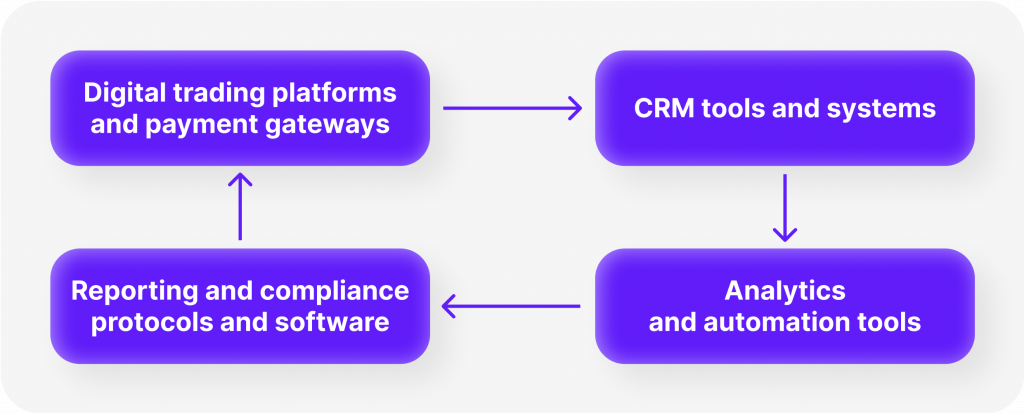

- Forex back office software combines digital tools and systems that allow forex brokers to deliver flawless services.

- Back office software consists of CRM solutions, the digital platform for forex operations, analytics, automation and reporting tools.

- Each subset of the back office software is vital to managing a smooth-running forex brokerage in terms of profitability and technical efficiency.

Understanding The Forex Back Office Software

But what is the Forex back office software, exactly? It represents a collection of tools, infrastructures and systems that allow forex brokers to deliver flawless foreign exchange services. Every back office component is carefully selected to fulfil a specific core functionality and assist the productivity of the overall forex machine.

From the forex platform software, CRM and analytics tools to reporting and compliance protocols, proper back office software handles every possible need for digital forex brokers.

While it is possible to acquire the entire system through white-label providers, building an optimised back office system takes time, determination and a lot of industry experience.

Each component stated below must be excellent: executing its own purpose flawlessly and working optimally with other complementary systems. It is important to remember that even the most advanced tools and methods will not get the job done unless they create a synergy between different solutions.

Thus, to construct or acquire effective Forex back office software, you must carefully consider the following components.

Digital Trading Platforms and Gateways

The digital platforms are at the heart of online forex dealings. Today, even private forex brokers must acquire digital platform capabilities to serve their clients smoothly. Forex digital platforms allow customers to manage their foreign exchange transactions seamlessly and avoid extensive communications for trivial tasks.

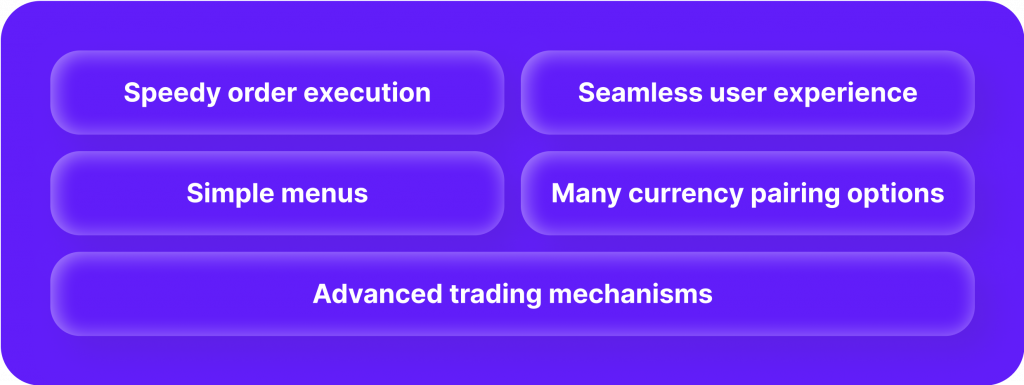

The main factors to consider with digital platforms are their speed, efficiency and the quality of user experience. Since the forex field is quite competitive and relatively saturated, potential customers want a smooth experience and quality-of-life benefits.

First and foremost, the platform should be easy to navigate and interact with. Menus and dashboards should not present intricate layouts or confusing structures. Instead, customers should only get what they need and nothing more.

Naturally, the quality of services themselves is vital as well. Forex platforms should have near-instant execution times that prevent slippage or price discrepancies. Additionally, the best forex platforms have advanced trading tools built into them, allowing traders to remain in the same digital space when conducting complex forex operations.

Providing a generous selection of currency pairings is vital to give clients enough choices on the global market. After all, even the most streamlined and optimised platforms will be for nothing if traders don’t have enough currency pairing options.

CRM Capabilities

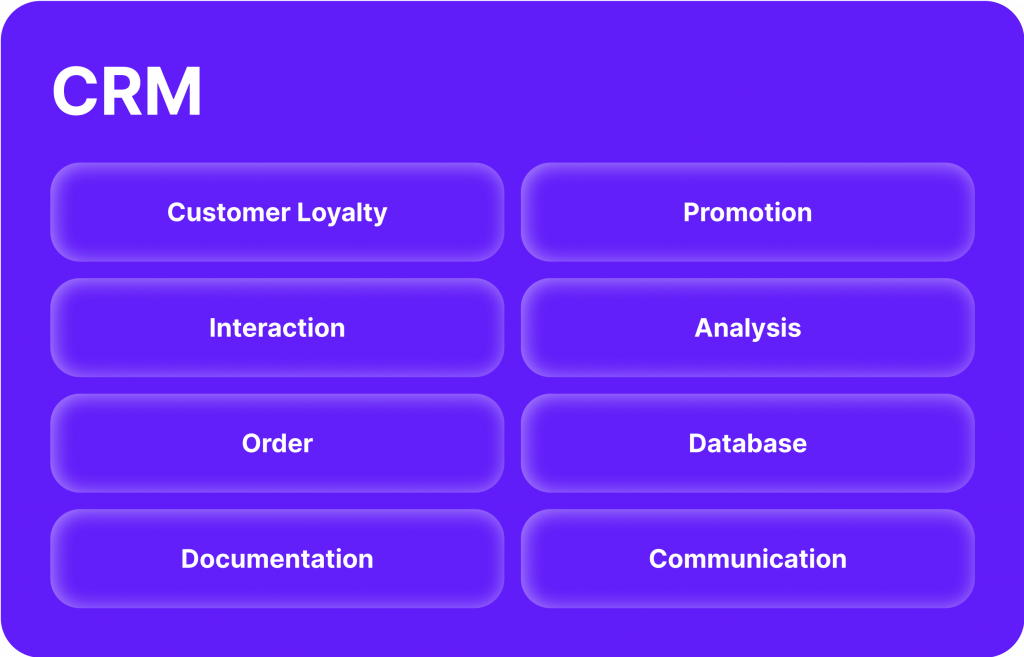

Customer relationship management capabilities are vital for any digital service, especially within the financial sector. Top broker CRM systems encapsulate every customer interaction point, from the initial marketing and nurturing to customer retention and problem resolution.

Without a robust CRM infrastructure, most forex brokerages would have major problems dealing with their extensive customer base. After all, managing a platform with thousands of daily users creates inevitable chaos and forex companies need a tool to streamline this messy process.

Practical marketing tools and metrics provided by CRM will allow forex brokers to expand effortlessly and swiftly identify any growth blockers along the way. Additionally, back-office CRM software offers comprehensive customer support capabilities, enabling forex brokers to provide a near-flawless user experience.

There are numerous Forex CRM providers on the market, and choosing the one that delivers on most of the above-outlined features and capabilities is essential.

Analytics and Automation Tools

In 2023, data has become the most valuable asset in building successful online platforms. Properly analysed business intelligence can provide insights into your forex brokerage operations. From customer engagement and operational efficiency to profitability and technical reports, data analytics will allow you to stay firmly in control.

Big data analysis can solve seemingly impossible problems, allowing forex companies to understand their target audience and operating environment. Today, running a forex brokerage without employing big data analytics is a swift way to give your edge over the competition.

Additionally, automation tools in the back office can equip forex brokers with unique opportunities to streamline their operations and minimise the manual interactions due to maintenance. Automation bots and tools can be applied in numerous ways, including customer chatbots, automatic system reports, etc.

Reporting And Compliance Systems

Finally, it is crucial to incorporate state-of-the-art reporting and compliance protocols to ensure that the forex business is running without any financial or legal troubles. Regulations related to the forex brokerages are strict and thorough, making it all the more important to employ leading reporting and compliance tools.

Aside from adhering to local and international regulations, reporting tools are excellent for optimising your financial side of the business. Optimised P&Ls, balance reports, cash flow statements and monthly reports will help your forex brokerage identify potential revenue streams or cost sinks to fill up.

Advantages of an Optimised Forex Back Office Software

As discussed above, proper forex back office software can take care of every digital need of the forex company. This system will ensure that your forex brokerage runs on all cylinders if constructed diligently. The combination of cutting-edge forex platforms and CRM back office solutions will provide a flawless user experience from start to finish.

Additionally, state-of-the-art analytics, automation and reporting tools will round out the back office capabilities of the business, allowing the workforce to manage the entire digital infrastructure seamlessly.

While adopting back-office forex software is no easy task, it pays massive dividends down the road, enabling forex brokerages to simplify their operations, increase user satisfaction and generally achieve more with less.

Final Thoughts

Back office software for forex brokers is an invaluable asset that ensures long-term success and operational efficiency. From strong digital platform foundations and FX CRM tools to flawless compliance and in-depth analytics, back office tools can arm your forex agency with every essential tool needed to grow.

However, selecting the right components is often complex and requires a deft professional touch. So, before committing to forex back office software, conduct in-depth research and determine how everything fits into your unique business circumstances.