Detailed Guide to The Best Forex CRM Systems in 2024-2025

When you are running any type of business, managing client connections and optimising everyday operations are critical. A CRM system assists Forex brokers in organising client data, streamlining workflows, and ensuring regulatory compliance.

This article digs deep into the role of a Forex CRM system, its usefulness in company processes, and an overview of some of the best Forex CRM systems available today.

Key Takeaways

- Forex CRM solutions centralise client management, enabling brokers to provide more efficient, personalised services.

- Automation in CRM systems improves operations by minimising manual duties and assuring regulatory compliance.

- Forex CRMs use advanced data analysis to give brokers insights about their clients. As a result, decisions are made easily.

What is The Forex CRM System?

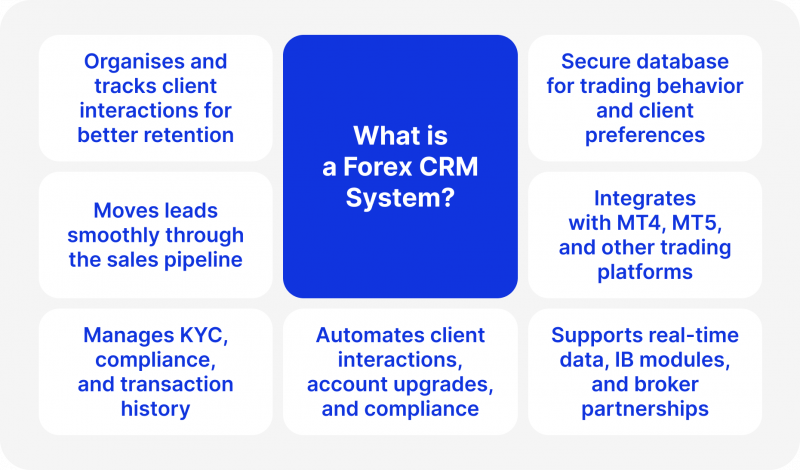

Forex CRM systems are specialised customer relationship management tools designed exclusively for Forex brokers. Unlike ordinary CRM systems, a Forex CRM solution is designed to meet the specific needs of Forex trading, from client management to compliance.

Forex CRMs help brokers manage basic activities efficiently, such as:

- Organising and tracking all client interactions, assuring personalised services, and increasing retention.

- Tracking potential clients, moving leads through the sales pipeline, and speeding conversions.

- Assisting brokers with following financial requirements by maintaining accurate client data, managing KYC protocols, and storing transaction histories.

- Creating a single, secure database for all client data, including trading behaviour and preferences, to enable data-driven business choices.

This system also includes capabilities unique to the trading business, such as interoperability with prominent platforms like MT4 and MT5. Many Forex CRM systems provide real-time trading data and multi-level IB modules that facilitate broker partnerships and affiliate programs, allowing FX brokers to handle business processes and customer interactions more effectively.

In other words, consider a brokerage in which the CRM automatically processes every client interaction. When potential traders view the website, the system sparks their curiosity and walks them through the account setup process.

Once trading begins, the CRM watches their activity and recommends account upgrades when they hit specific trading volumes. The same technology supports compliance by monitoring trading patterns, storing documents, and calculating partner commissions as needed.

Instead of using different tools, everything flows through a single integrated system, from the initial customer interaction to the continuous trading.

Why is a Forex CRM System Necessary for Brokers?

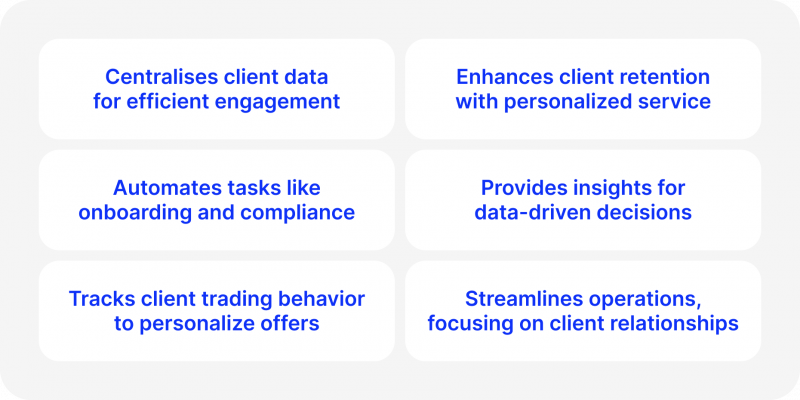

A Forex CRM system improves client engagement by allowing brokers to manage client interactions more efficiently. This system centralises client data, making it simple to view client preferences, trading behaviour, and communication history.

By organising client information, brokers may respond swiftly to inquiries, provide personalised services, and increase client retention. The customer management capabilities of a Forex CRM solution mean that brokers can respond to client requests quickly, resulting in stronger client relationships and engagement.

Assume you’re a Forex broker with hundreds of clients. Without this system, you’d have to manually track each client’s information, including preferences, previous trades, and any messages they’ve sent. This would be time-consuming and error-prone.

A Forex CRM system maintains all this information in one location. Suppose a client contacts us with a question concerning their account balance. The broker may instantly access the client’s CRM profile, obtain the necessary information, and respond swiftly. This efficiency saves time and exhibits a high level of service, leaving the client feeling valued.

CRM can also analyse clients’ trading habits. For example, if a client routinely trades a specific currency pair, the broker can provide them with relevant market analysis or personalised offers. This individualised approach develops a better bond with the client, increasing engagement and loyalty.

Streamlined Operations

This system improves daily operations by automating time-consuming chores. Automation tools help with onboarding, document verification, and compliance tracking, reducing the strain on the broker’s back-office workers.

Brokers can reduce the manual operations required to open accounts and meet regulatory standards. This operational efficiency enables brokers to focus on customer relationships and trading activity rather than monotonous activities, allowing them to manage operations more precisely.

Data-Driven Decision Making

This software enables brokers to make informed business decisions. CRMs capture trading activity, account performance, and client behaviour data, offering useful insights into client demands and trends.

Because of this, brokers can modify their services based on real-time information, allowing them to provide clients with a more tailored and relevant experience. Forex brokers can get important insights by analysing client data, which informs strategic decisions and improves business performance.

Consider a Forex broker who wants to know why their client base is declining. Analysing the data obtained by their CRM system reveals that a substantial proportion of clients are leaving owing to a lack of instructional resources.

Armed with this knowledge, the broker can take fast action. They can devote additional resources to developing educational content like webinars and tutorials. Depending on their trading history and preferences, they can also personalise their approach by delivering tailored instructional materials to clients.

Scalability and Growth

A Forex CRM system enables scalability, which is critical for developing brokerages. CRMs allow brokers to access a larger client base by enabling multi-level Introducing Broker structures, affiliate relationships, and seamless connectivity with trading platforms.

A scalable solution like this allows brokers to manage growing networks of IBs and affiliates, broadening their market coverage. With these characteristics, Forex CRMs enable brokers to accelerate business growth and strengthen their presence in the Forex market.

Fast Fact

The term “Customer Relationship Management” first appeared in 1995 and gained popularity from 1997 to 2000, led by companies like Siebel, Gartner, and IBM.

Top Forex CRM Systems

FX CRM systems include a variety of capabilities that enable brokers to manage operations, maintain compliance, and increase client interaction. Each system listed below is designed specifically for Forex trading, providing brokers with some of the best CRM tools for managing customer relationships and streamlining procedures. Any Forex CRM provider should have most of the features listed below.

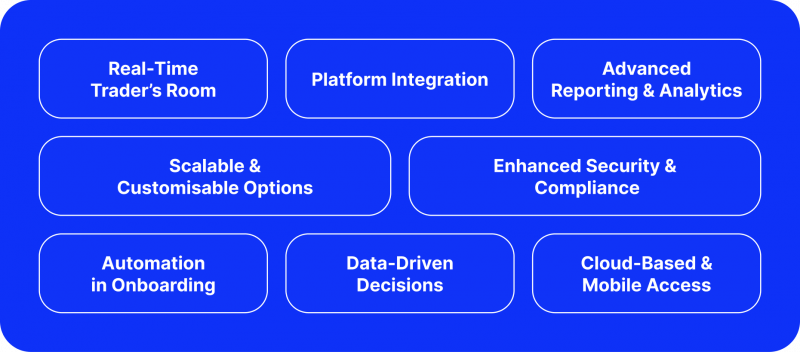

Back-Office Management Tools

Forex CRMs contain extensive back-office administration modules that handle key operations. These tools combine account administration, compliance tracking, reporting, and client data security in a single system. Brokers may easily track deposits, withdrawals, balances, and trade history while maintaining data security through controlled access and encryption.

The back office module automates repetitive tasks such as account creation and verification, relieving brokers of manual processes and eliminating errors. Compliance technologies also enable automatic KYC/AML checks and keep a secure, auditable record of all customer transactions to meet regulatory requirements.

Traders’ Room Module

This is vital in Forex CRM solutions since it provides clients with a real-time gateway for monitoring market data, executing trades, and viewing account status. Brokers benefit from the module’s interface with the MT4/MT5 platforms, allowing real-time trading operations synchronisation and seamless data transfer between the CRM and trading accounts.

The trader’s room also offers risk management features, such as stop-loss and margin notifications, to assist clients in adequately managing their trades. It promotes client involvement by allowing direct communication between traders and the support team, swiftly addressing queries, and strengthening client relationships.

Integration of Leading Trading Platforms

Forex CRM companies integrate seamlessly with MT4, MT5, and other popular trading platforms. This connectivity allows automated data sharing between the trading platform and CRM, easing procedures such as account changes, balance tracking, and trade history management. Such connectivity enables brokers to manage trading activities and client data from a single system, eliminating the need for different tools and increasing productivity.

Advanced Reporting Capabilities

Reporting skills are critical for making educated decisions. Forex CRMs collect and analyse information about clients’ trading behaviour, preferences, and participation.

These reports provide brokers with vital insights that help them measure performance indicators, monitor trading patterns, and discover trends. This data-driven strategy helps brokers make decisions, tailoring services to client demands and driving business growth.

CRM Software with Comprehensive Analytics

These solutions incorporate strong analytics that provide insight into customer conduct and trading patterns. This information helps brokers understand what motivates customer involvement, allowing them to design focused marketing efforts, find upsell opportunities, and increase retention rates.

By analysing this behaviour, brokers can provide personalised services, increasing client loyalty and boosting long-term success in the competitive Forex market.

Scalability and Customisation Options

Forex CRMs are designed to assist broking expansion with scalable and customisable features. Brokers can add new modules, instruments, or client management features as their firm grows.

These interfaces and workflows also enable brokers to modify the CRM to their own operational requirements, resulting in a tailored experience that suits their business model.

Enhanced Security and Compliance

Security and compliance are extremely important in the financial services industry. Forex CRM services protect client data with encryption, two-factor authentication, and tight access limits. Compliance management features in the CRM enable adherence to regulatory obligations, such as KYC and AML standards.

These characteristics are critical for brokerages functioning in regulated markets since they provide a safe platform for managing sensitive information and regulatory requirements.

Automation for Client Onboarding and Account Management

Automated onboarding and account management simplify creating new accounts, verifying documents, and conducting compliance checks.

Brokers may handle new clients more efficiently by decreasing manual workload and guaranteeing compliance and transparency throughout onboarding. This automation reduces errors while allowing brokers to focus on customer service and business growth.

Data-Driven Business Decisions

Forex CRM software captures and retains large volumes of client data, providing brokers with meaningful insights into trading behaviour, account performance, and client relationships.

This information enables brokers to make strategic decisions, improve service quality, and personalise services to client preferences. By studying trends and client needs, brokers may improve decision-making and remain competitive in an ever-changing Forex market.

Multilevel IB and Affiliate Management

Forex CRMs contain multi-level IB and affiliate modules, which help brokerages manage partnerships, track referrals, and precisely compute compensation. This feature allows brokers to broaden their reach through structured partnerships, an excellent approach to growing a customer base and boosting corporate awareness.

The module provides scalability, allowing brokers to manage several IBs and affiliates effectively.

Cloud-Based Access and Mobile Compatibility

Many Forex CRMs are cloud-based, allowing brokers to access data from anywhere and scale as needed. Cloud storage protects data and facilitates global operations, allowing brokers to run their business from anywhere.

Mobile-compatible CRMs also enable brokers and clients to access critical functions while on the road, guaranteeing smooth management and client engagement outside the office.

Conclusion

Choosing a specialised Forex CRM solution is critical for brokers looking to meet the unique needs of trading. Each CRM service has unique capabilities, so choosing one that corresponds with your business goals—scalability, affiliate marketing, or client engagement—is critical.

When investing in a CRM system, brokers should consider present needs and future development to ensure long-term success in the FX market.