مشاركة

0

/5

(

0

)

تزدهر الأسواق المالية من خلال الكفاءة والوضوح والثقة، وهي عوامل حاسمة لنجاح كل متداول. يُحدث نموذج الوساطة بنظام STP (المعالجة المباشرة) ثورة في عالم التداول من خلال الاتصال المباشر مع أبرز مزوّدي السيولة، مثل البنوك والمؤسسات المالية.

على عكس الوسطاء التقليديين الذين يعتمدون على مكاتب التداول، يبسّط وسطاء STP عملية التداول من خلال توفير تنفيذ فوري، وتسعير قائم على السوق، وإطار عمل شفاف يضع مصلحة المتداول في المقام الأول.

ستوضح لك هذه الإرشادات القصيرة نموذج تداول STP في سوق الفوركس، وكيف يعمل، وما تحتاج إلى معرفته لبدء مشروع وساطة بنظام STP.

أهم النقاط

يُنفذ وسطاء STP عمليات التداول بشكل آلي عبر توجيه صفقات العملاء مباشرة إلى مزوّدي السيولة. يقدمون مزيجًا من الفروق السعرية الثابتة والمتغيرة، وعادةً بدون عمولات، ويتجنبون التداول ضد عملائهم.

على عكس صانعي السوق (Market Makers)، يتحمّل وسطاء STP مخاطر أقل لأنهم لا يجنون الأرباح من تذبذبات الأسعار. كما يوفرون تنفيذ أوامر أكثر دقة وأدوات لضمان أفضل الأسعار الممكنة.

يستفيد العملاء من الوصول المباشر للأسواق على مدار الساعة طوال أيام الأسبوع، وزيادة السيولة، وتدفّق الأوامر مباشرة إلى السوق، مما يتيح فرص تداول أوسع وأسعارًا تنافسية.

ما هو وسيط STP؟

وسيط STP هو مؤسسة مالية وسيطة تيسّر التداول عبر توجيه أوامر العملاء مباشرة إلى مزوّدي السيولة، مثل البنوك وصناديق التحوط والمؤسسات المالية.

على عكس الوسطاء التقليديين الذين لديهم مكتب تداول، لا يتدخل وسطاء STP في الصفقات ولا يتخذون مراكز معاكسة لعملائهم. يضمن هذا النموذج التشغيلي تنفيذًا أسرع للصفقات ويزيل تضارب المصالح، مما يُنشئ بيئة تداول أكثر شفافية.

يعد نموذج STP جذابًا بشكل خاص للمتداولين الذين يقدّرون الكفاءة والعدالة. حيث يقدم وسطاء STP أسعارًا فورية بفروق تنافسية عبر الاتصال المباشر بـ مجموعة من مزوّدي السيولة.

ويحقق هؤلاء الوسطاء إيرادات من خلال فروق بسيطة على الأسعار أو عمولات على الصفقات بدلًا من جني الأرباح من خسائر العملاء. تعزز هذه الشفافية الثقة وتبعث بالطمأنينة في نفوس المتداولين.

من أبرز ما يميز شركات STP فروق الأسعار المتغيرة التي تعكس الظروف الفعلية للسوق، وقدرتها على التعامل مع أنواع مختلفة من الأوامر مثل أوامر السوق والحد من الخسارة وإيقاف الخسارة (limit & stop-loss orders). وتعتمد هذه الشركات على أحدث التقنيات لضمان تنفيذ سريع وسلس للصفقات، لتلبّي احتياجات كل من المتداولين الأفراد والمؤسسات.

غالبًا ما يُشاد بوسطاء STP لشفافيتهم وإمكانية وصولهم الواسع. فهم يتيحون للمتداولين وصولًا مباشرًا إلى سيولة السوق ويقدمون أسعارًا عادلة تستند إلى أوضاع السوق الفعلية.

وهذا ما يجعلهم خيارًا مثاليًا للمتداولين الذين يرغبون في تجنّب تضارب المصالح والتأخيرات المحتملة لدى الوسطاء الذين يستخدمون مكاتب التداول.

[aa quote-global]

معلومة سريعة

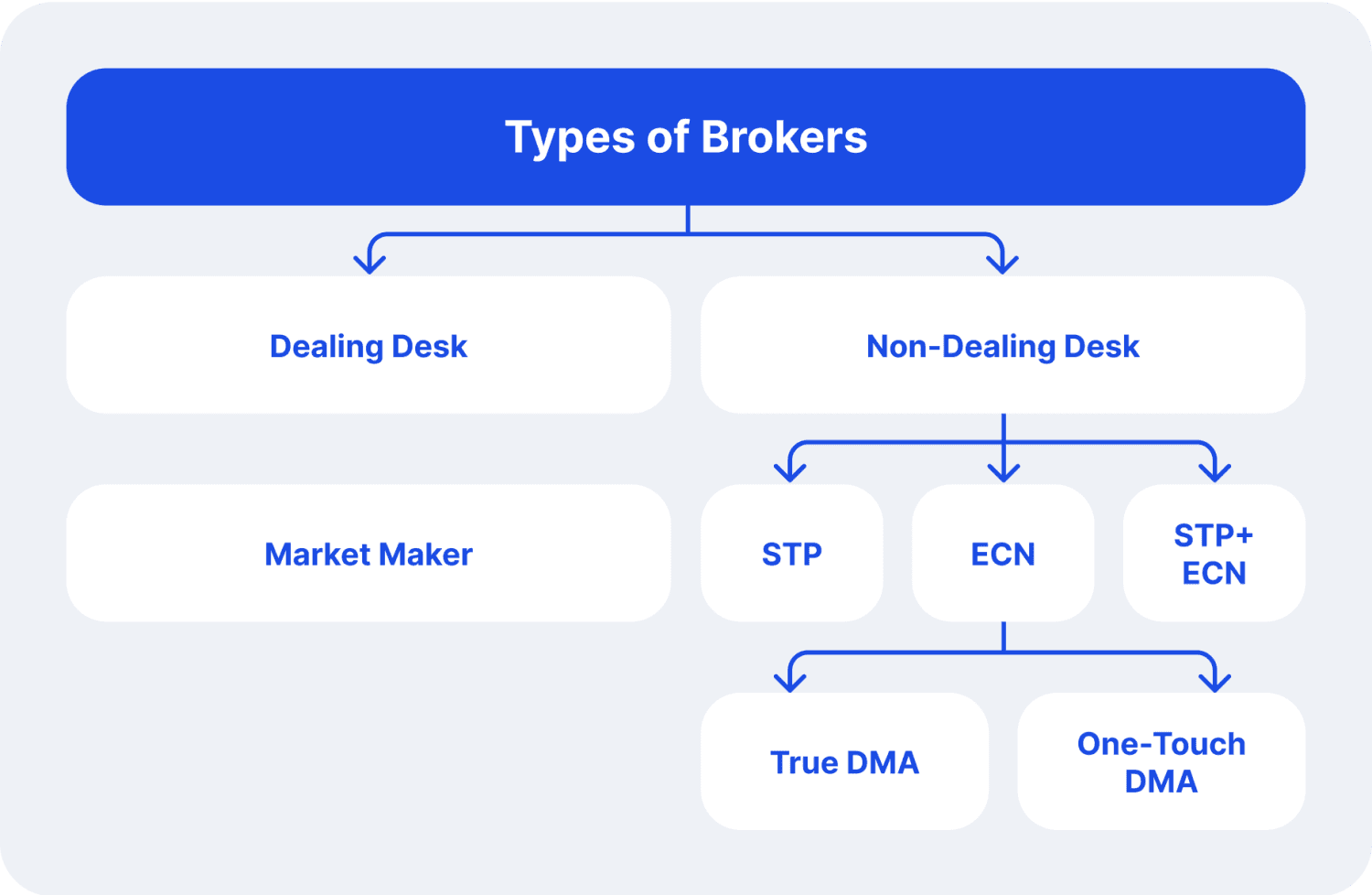

وسطاء STP، وكذلك وسطاء ECN، هم وسطاء بلا مكاتب تداول (No Dealing Desk) يوفّرون للعملاء وصولًا مباشرًا إلى سوق الفوركس.

[/aa]

كيف يعمل وسيط STP؟

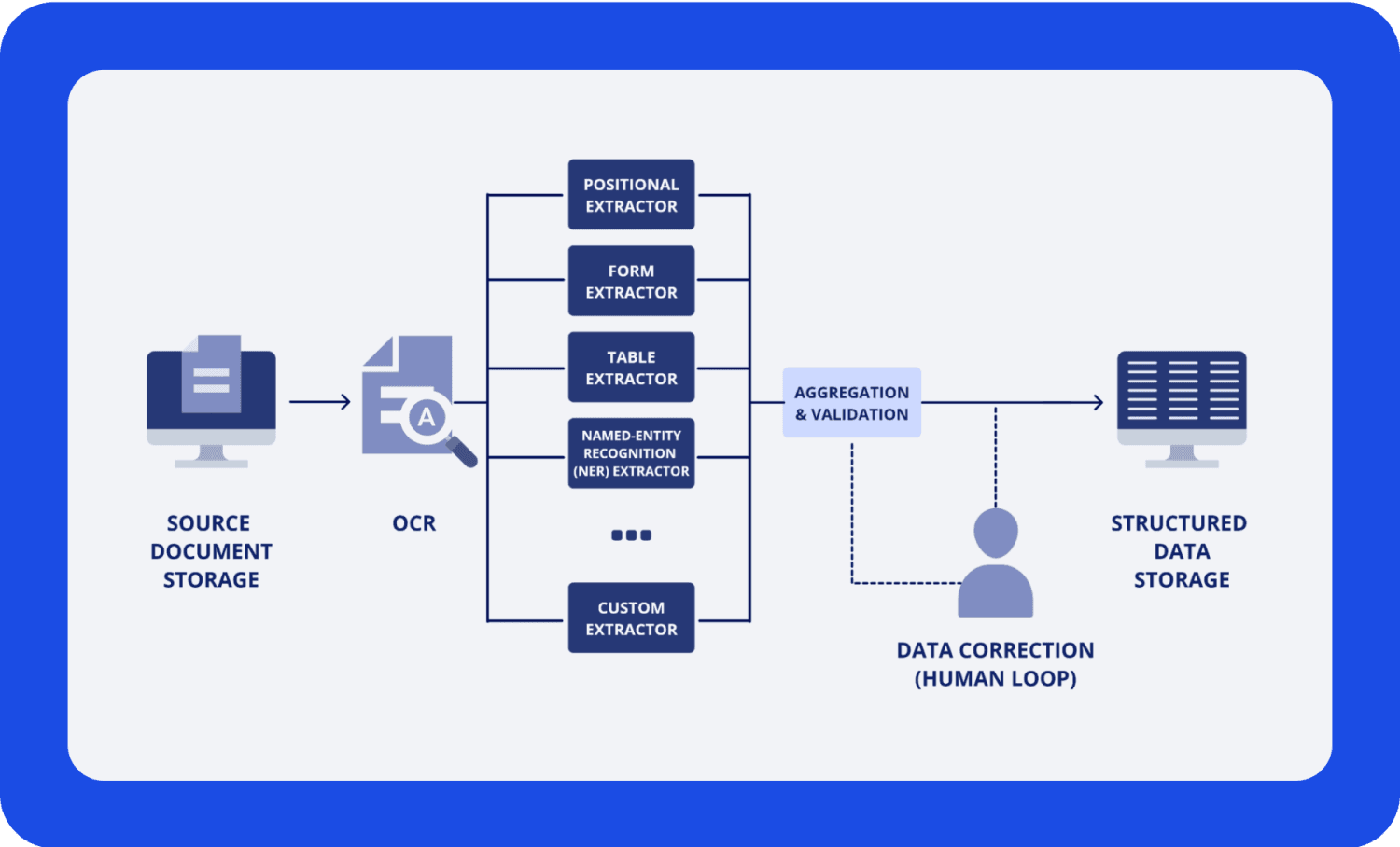

بدون تدخل بشري أو مكتب تداول، يقوم وسيط STP بتوجيه أوامر العملاء مباشرة إلى مزوّدي السيولة مثل البنوك أو صناديق التحوط أو المؤسسات المالية. يتيح هذا الأسلوب تنفيذًا أسرع للصفقات وتقليلًا لتضارب المصالح، وتجربة تداول أكثر شفافية.

لنستعرض العملية خطوة بخطوة:

1. وضع الأمر من قبل المتداول

عندما يضع المتداول أمرًا — سواء أمر سوق أو أمر محدد (Limit) أو إيقاف الخسارة (Stop-Loss) — يتم إرساله على الفور إلى منصة التداول الخاصة بوسيط STP. تم تصميم هذه المنصة للتعامل مع أحجام كبيرة من الصفقات بكفاءة وبأقل تأخير ممكن.

2. توجيه الأمر إلى مزوّدي السيولة

بدلًا من تنفيذ الأمر داخليًا، يقوم وسيط STP بإرساله مباشرة إلى شبكة من مزوّدي السيولة. هؤلاء المزوّدون هم مؤسسات مالية كبرى تقدم السيولة للسوق من خلال عروض الشراء (Bid) والبيع (Ask) للأدوات المتداولة مثل أزواج الفوركس أو السلع أو المؤشرات.

يقوم نظام الوسيط بتجميع الأسعار من عدة مزوّدي سيولة ويعرض أفضل عروض الشراء (أعلى سعر يرغب المشتري في دفعه) وأفضل عروض البيع (أقل سعر يقبل البائع به) للمتداول.

3. تنفيذ الصفقة

بمجرد تأكيد المتداول لأمره، يقوم وسيط STP بمواءمته مع أفضل سعر متاح من مجموعة السيولة. وبفضل عدم وجود أي تدخل يدوي، يتم التنفيذ بشكل شبه فوري. ويتولّى مزوّد السيولة إتمام الصفقة، ما يضمن تنفيذها في الوقت الفعلي.

4. كيفية تحقيق الوسيط للإيرادات

لا يأخذ وسطاء STP مراكز عكسية ضد عملائهم ولا يحققون أرباحًا من خسائرهم. بل يكسبون أموالهم عبر:

فروق الأسعار (Spread Markups): يضيف الوسيط فارقًا بسيطًا إلى فروق الأسعار الأولية المقدمة من مزوّدي السيولة. على سبيل المثال، إذا كان الفرق السعري من مزوّد السيولة 1.2 نقطة (pip)، فقد يقدّمه الوسيط للمتداول عند 1.5 نقطة.

العمولات (Commissions): قد يتقاضى بعض وسطاء STP رسومًا ثابتة على كل صفقة أو لوت، مما يضمن شفافية في نموذج الإيرادات.

ضمان السيولة والتنفيذ السلس

تُعد السيولة أمرًا جوهريًا لعمل وسيط STP بكفاءة. فبالتعاون مع العديد من مزوّدي السيولة، يضمن الوسيط توفر عمق سوق كافٍ لتنفيذ الصفقات، حتى في أوقات التقلبات العالية. ويساهم ذلك في تقليل الانحراف السعري (Slippage)، حيث قد يختلف سعر التنفيذ عن السعر المعروض بسبب التغيرات السريعة في السوق.

التقنيات الرئيسية المُستخدمة

يعتمد وسطاء STP على التكنولوجيا المتطورة للحفاظ على السرعة والموثوقية:

منصات التداول: مثل ميتاتريدر 4/5 أو cTrader التي تتيح وضع وتنفيذ الأوامر.

محركات مطابقة الأوامر: تضمن هذه الأنظمة مواءمة الصفقات بكفاءة مع مزوّدي السيولة.

واجهات برمجة التطبيقات (APIs): تتيح الاندماج السلس بين منصة الوسيط ومزوّدي السيولة لتوفير التسعير المباشر وتوجيه الأوامر بسرعة.

كيف تبدأ وسيط STP خاص بك؟

يُعتبر تأسيس وسيط STP للفوركس مشروعًا مجزيًا للغاية، ولكنه يتطلب تخطيطًا دقيقًا ومعرفة تقنية قوية وفهمًا واضحًا للوائح التنظيمية. فيما يلي دليل خطوة بخطوة لإنشاء وسيط STP ناجح.

1. فهم نموذج وسيط STP

الخطوة الأولى هي فهم كيفية عمل نموذج STP في سوق الفوركس. حيث تُوجَّه أوامر العملاء مباشرة إلى مزوّدي السيولة، مثل البنوك أو المؤسسات المالية أو صناديق التحوط، دون وجود مكتب تداول. وهذا يُزيل تضارب المصالح لأن الوسيط لا يتداول ضد العملاء. تُجنى الأرباح من خلال إضافة فروق أسعار أو عمولات على الصفقات، مع توفير بيئة عادلة وشفافة للتداول.

2. إجراء أبحاث السوق ووضع خطة

يجب إجراء بحث شامل ووضع خطة عمل مفصلة. حدد جمهورك المستهدف، سواء كانوا متداولين أفرادًا أو عملاء مؤسسيين أو كليهما، واستكشف احتياجاتهم. اختر الأدوات المالية التي ستقدمها — أزواج الفوركس أو السلع أو المؤشرات أو العملات المشفرة — بناءً على الطلب في السوق. حلل المنافسين لتحديد الفجوات والفرص للتميز. وضع أهداف واضحة لاكتساب العملاء وتحقيق الإيرادات.

3. ضمان الامتثال التنظيمي

يُعد الالتزام بالقوانين أساس أي شركة وساطة ذات مصداقية. اختر السلطة القضائية المناسبة للتسجيل، مثل قبرص أو سيشيل أو المملكة المتحدة أو أستراليا، المعروفة بأطرها التنظيمية القوية. احصل على التراخيص اللازمة عبر استيفاء متطلبات المنطقة. طبّق أنظمة معرف العميل (KYC) ومكافحة غسل الأموال (AML) للتحقق من هوية العملاء ومنع الاحتيال.

4. الشراكة مع مزوّدي السيولة

يُعد مزوّدو السيولة عنصرًا أساسيًا في نجاح عمليات الوساطة. تعاون مع مزوّدين موثوقين يقدمون تسعيرًا تنافسيًا وزمن وصول منخفض وخدمة موثوقة. تفاوض معهم للحصول على أفضل عروض البيع والشراء، مع ضمان وجود بدائل عدة تحسّبًا للطوارئ. استخدم واجهات برمجة التطبيقات (APIs) للدمج السريع وتوفير تسعير لحظي وتنفيذ فعّال للأوامر.

5. الاستثمار في التكنولوجيا والبنية التحتية

يُعد الإعداد التكنولوجي القوي أمرًا حاسمًا. اختر منصة تداول مثل ميتاتريدر 4 أو ميتاتريدر 5 أو cTrader لتوفير واجهات سهلة الاستخدام وأدوات متقدمة للمتداولين. قم بتنفيذ أنظمة خلفية مثل أنظمة إدارة علاقات العملاء (CRM) لإدارة الحسابات والتقارير وبيانات العملاء. اعتمد إجراءات أمان مثل التشفير والمصادقة الثنائية (2FA) وحماية DDoS للحفاظ على أمان المنصة وبيانات العملاء.

6. إنشاء واجهة سهلة الاستخدام

يُعد توفر بوابة عملاء آمنة وسهلة الاستخدام أمرًا حيويًا لإدارة عمليات الإيداع والسحب والأنشطة الحسابية. زوّد لوحة التداول بأدوات متقدمة وتحليلات لحظية وتصاميم قابلة للتخصيص لتلبية احتياجات المتداولين المبتدئين والمحترفين. تأكد من توافق المنصة مع الهواتف الذكية لتلبية احتياجات المتداولين الذين يفضلون التداول عبر الأجهزة المحمولة.

7. وضع خطط للتسويق واكتساب العملاء

يجب اتباع نهج تسويقي قوي لجذب العملاء. أنشئ موقعًا احترافيًا يبرز عروضك وهويتك التجارية. استخدم أساليب التسويق الرقمي مثل تحسين محركات البحث (SEO) والإعلانات المدفوعة بالنقرة (PPC) ووسائل التواصل الاجتماعي للوصول إلى جمهورك. قدّم حوافز مثل مكافآت الترحيب وبرامج الإحالة والفروق التنافسية لجذب العملاء. تعاون مع الوسطاء المعرّفين (IBs) والشركاء التابعين لتوسيع نطاق الوصول.

8. تقديم دعم عملاء متميز

يُعد الدعم الجيد عنصرًا أساسيًا في الحفاظ على العملاء. لذلك، قدّم دعمًا متعدد اللغات على مدار الساعة عبر الدردشة المباشرة والبريد الإلكتروني والهاتف. وفّر مواد تعليمية مثل الشروحات والندوات الإلكترونية والكتب الإلكترونية لمساعدة المتداولين على تطوير مهاراتهم. عيّن مديري حسابات متخصصين للعملاء ذوي القيمة العالية لضمان تجربة مخصصة.

9. التركيز على الصيانة وقابلية التوسع

تُعد عمليات التحديث والتوسع المستمر أساسية لاستمرار النمو. حدّث منصة التداول بانتظام بميزات جديدة وتعزيزات أمنية. وسّع نطاق العروض عبر إضافة أدوات تداول جديدة أو أنواع حسابات مختلفة لتلبية الطلب في السوق. حسّن البنية التحتية لاستيعاب الزيادة في حركة المرور وأحجام التداول مع نمو قاعدة عملائك.

10. مراقبة الأمور المالية وإدارة المخاطر

يضمن التخطيط المالي الفعال استدامة المشروع. ضع ميزانية للتكاليف المبدئية مثل التراخيص والتقنيات والتسويق، بالإضافة إلى المصاريف المستمرة للصيانة والدعم. راقب مصادر الإيرادات من فروق الأسعار والعمولات. استخدم أدوات إدارة المخاطر لمتابعة السيولة وضمان الامتثال للقواعد التنظيمية، لحماية الشركة من التحديات غير المتوقعة.

الخلاصة

إن بدء وسيط STP لا يقتصر فقط على دخول عالم المال، بل يتعلق بإنشاء بيئة شفافة وفعالة تُركّز على المتداول، وتقوم على قيم العدل والتكنولوجيا. عبر تبنّي نموذج STP، فإنك تصوغ نموذجًا تجاريًا يلبّي حاجة المتداول الحديث للسرعة والموثوقية والنزاهة.

إن وسيط STP ليس مجرد عمل تجاري، بل هو بوابة تمكين المتداولين للوصول إلى الفرص الحقيقية في الأسواق. ومع النهج الصحيح، يمكن لشركة الوساطة الخاصة بك أن تصبح شريكًا موثوقًا به للمتداولين حول العالم، ورائدًا في الشفافية، ونموذجًا يُحتذى به في ممارسات التداول العادلة.

الأسئلة الشائعة (FAQ)

كيف يتعامل وسطاء STP مع السيولة؟

يتعاون وسطاء STP مع العديد من مزوّدي السيولة لضمان وجود عمق سوق كافٍ وتنفيذ سلس للصفقات.

هل يمكن لوسيط STP التعامل مع أحجام تداول كبيرة؟

نعم، فوسطاء STP في سوق الفوركس مصممون للتعامل مع أحجام تداول كبيرة بكفاءة. حيث تعتمد على منصات تداول متقدمة وأنظمة مطابقة أوامر تضمن تنفيذًا سلسًا، حتى في فترات تقلبات السوق.

كيف يضمن وسطاء STP أمان العملاء؟

يعتمد وسطاء STP على تدابير أمان قوية لحماية بيانات العملاء وعملياتهم، بما في ذلك التشفير والمصادقة الثنائية (2FA) وحماية DDoS والالتزام بالمعايير التنظيمية.

اقرأ أيضًا