Compartir

0

/5

(

0

)

Ingresar a la industria financiera como empresa se ha vuelto cada vez más complicado, ya que la competencia es feroz en la actualidad. Construir una plataforma requiere demasiado tiempo, conocimientos y recursos humanos. Por eso, las soluciones white label se han convertido en opciones populares.

En este artículo, examinamos las 5 principales plataformas de trading white label para 2025. Para ayudar a las empresas a tomar decisiones bien fundamentadas, cada plataforma se evalúa de acuerdo con sus características sobresalientes, tecnología, protocolos de seguridad y tendencias del mercado.

Conclusiones Clave

Las plataformas WL ofrecen soluciones preconstruidas que permiten una entrada más sencilla al mercado para los brokers.

Las empresas pueden adaptar la plataforma a sus necesidades y requisitos con varias opciones personalizables.

Las plataformas WL ofrecen herramientas de trading avanzadas y admiten diversos tipos de activos.

Definición y Panorama General

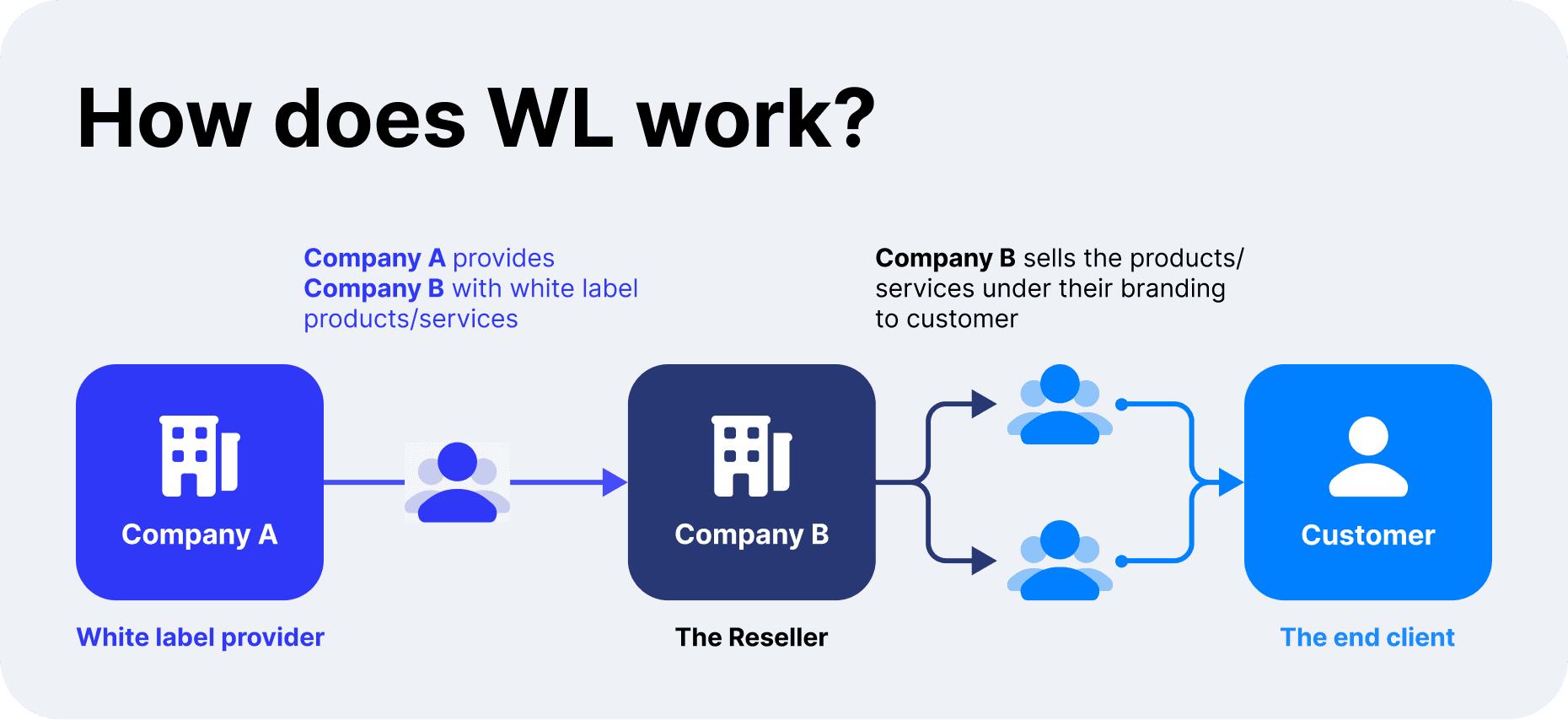

En pocas palabras, las plataformas de trading white label son programas de software predefinidos para empresas financieras y brokers. Permiten a las compañías ofrecer servicios de trading bajo su propio nombre al personalizar las herramientas, características y estilo de la plataforma. Las soluciones white label brindan una estrategia turnkey que reduce la complejidad técnica y permite un lanzamiento rápido al mercado.

Estas plataformas ofrecen una base totalmente funcional, a menudo con herramientas de gestión de riesgos, compatibilidad con múltiples divisas e integración con proveedores de liquidez. Los brokers crean una experiencia de usuario fluida para sus clientes al volver a etiquetar la plataforma con su logotipo, paleta de colores y funciones únicas.

Algunos de los principales beneficios son una entrada más rápida al mercado, menores gastos operativos y un mayor enfoque en la adquisición y retención de clientes. Las soluciones WL brindan eficiencia operativa y escalabilidad al permitir que las empresas eviten los costosos procesos de desarrollo. Las funciones avanzadas, como datos de mercado en tiempo real y herramientas de trading algorítmico, ayudan a los brokers y empresas de inversión a mantenerse competitivos.

Supongamos que desea lanzar un bróker. Su equipo es sólido, su estrategia de negocio es sólida y su idea es fantástica. Sin embargo, carece del tiempo y el dinero necesarios para crear su propia plataforma de trading desde cero.

En este caso, una plataforma de trading WL puede ayudar, ya que le ofrece una plataforma prediseñada que contiene todas las características necesarias:

Gestión de cuentas: Los clientes pueden crear y acceder a sus cuentas.

Herramientas de trading: Los clientes pueden realizar un seguimiento de sus inversiones, analizar gráficos y ejecutar órdenes.

Procesamiento de pagos: Los usuarios pueden hacer depósitos y retiros.

Servicio al cliente: Los clientes pueden recibir asistencia y orientación.

Después de eso, puede modificar la plataforma para adaptarla a su marca:

Branding: Incluir los colores, tipografías y el logotipo de su empresa.

Características: Agregar o eliminar según las necesidades de su público objetivo.

Integración: Conectar su software contable o CRM con otros sistemas.

Puede iniciar su negocio de corretaje más rápido y por mucho menos dinero si utiliza una WL. No tiene que preocuparse por las dificultades tecnológicas de crear una plataforma desde cero. En su lugar, puede concentrarse en sus fortalezas, que incluyen la captación de clientes y la prestación de un excelente servicio de atención al cliente.

Criterios para Elegir una Plataforma

Antes de profundizar en la lista de las mejores plataformas de trading white label, es fundamental saber qué cualidades y elementos debe buscar.

Tecnología y Fiabilidad

Las plataformas deben contar con estabilidad y un alto tiempo de actividad para manejar eficazmente las condiciones del mercado. La tecnología avanzada garantiza un rendimiento fluido y sólidas medidas de seguridad para salvaguardar los datos y las transacciones.

Opciones de Personalización

Las plataformas que ofrecen soluciones personalizadas y branding permiten a las empresas adaptar sus servicios de trading a sus objetivos. Ejemplos de opciones de personalización incluyen interfaces amigables, herramientas flexibles y conexiones fluidas con servicios externos.

Cumplimiento Normativo

Las soluciones white label deben admitir el cumplimiento normativo en múltiples jurisdicciones. Esto incluye el cumplimiento de las directrices de protección de datos y los requisitos de licencias para empresas de inversión internacionales.

Capacidades de Integración

Las herramientas de análisis, las opciones de pago y la conectividad CRM son fundamentales. Con diversas integraciones, las empresas pueden adaptarse a las condiciones del mercado y mantener la eficiencia operativa.

Atención al Cliente

Los proveedores ayudan a las organizaciones a mantener una experiencia de usuario impecable al ofrecer asistencia 24/7 y multilingüe. Para el éxito a largo plazo, los recursos educativos y el soporte técnico son esenciales.

Estructura de Costos

Las tarifas de instalación, los acuerdos de reparto de ingresos y los gastos continuos deben incluirse en estructuras de precios transparentes. Las soluciones rentables son cruciales para las empresas que buscan una solución escalable a medida que su organización crece.

Medidas de Seguridad

Las funciones avanzadas de seguridad, como la autenticación multifactor y los mecanismos de protección de datos, son fundamentales para operar en el mercado y atraer clientes a la plataforma.

Cobertura de Activos

Las plataformas de cobertura de activos deben admitir operaciones en múltiples clases de activos, como activos digitales, pares de trading y exchanges descentralizados. Tanto los traders con experiencia como las empresas que buscan crecer encuentran atractivas las soluciones integrales.

Crecimiento y Escalabilidad

Las soluciones turnkey con tecnología de vanguardia y funciones de blockchain garantizan la escalabilidad. Las plataformas deben satisfacer las necesidades de empresas que buscan participar en el dinámico sector de las criptomonedas.

Experiencia de Usuario

Una experiencia de usuario fluida y un diseño intuitivo son esenciales para atraer a los usuarios y brindarles información valiosa que les ayude a tomar decisiones acertadas.

Top 5 White Label Trading Platforms en 2025

La elección del principal proveedor de software de trading white label depende de usted y sus necesidades. A continuación, encontrará algunas de las organizaciones más destacadas:

cTrader White Label

cTrader White Label proporciona una solución personalizada para brokers que se centran en varias clases de activos, como Forex y CFDs. La plataforma admite métodos de trading avanzados, niveles de margen escalonados y sistemas de ejecución híbridos. Ofrece capacidades de trading automático y manual, soluciones escalables y una experiencia de usuario fluida.

Con total compatibilidad con API, cTrader permite a los brokers integrar sus marcas, garantizando un entorno de trading estable y eficaz tanto para traders experimentados como para nuevos participantes en el dinámico mercado de criptomonedas.

B2TRADER

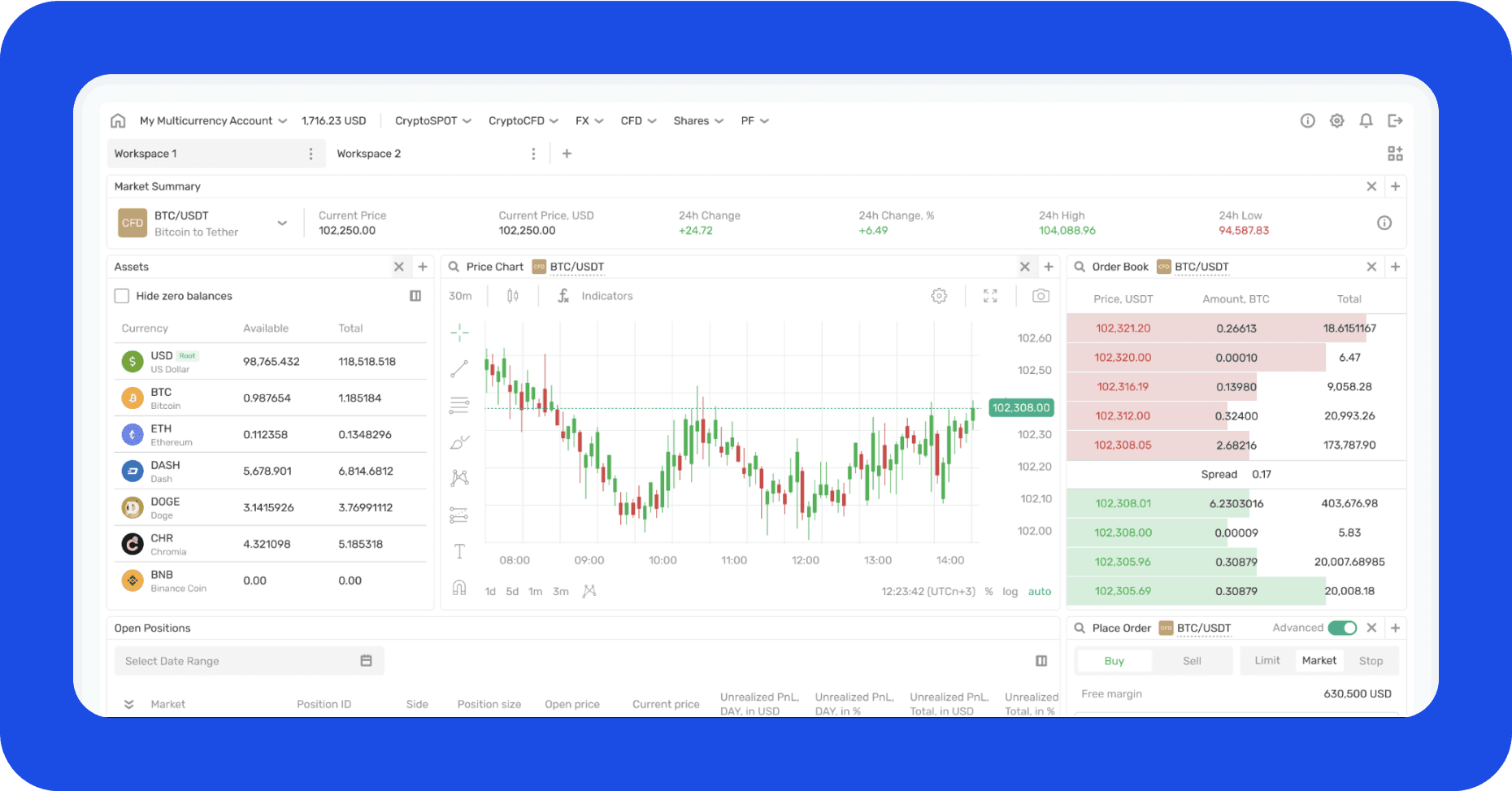

Como parte del grupo B2BROKER, B2TRADER es una plataforma de trading multiactivos diseñada específicamente para criptomonedas, CFDs y brókeres de forex. Con solo una cuenta, los usuarios pueden acceder a una amplia gama de productos tanto del mercado spot como de futuros. Gracias a funciones como la gestión de garantías con margen cruzado, los brokers pueden gestionar el riesgo de manera efectiva y los traders pueden modificar las asignaciones de garantías para mayor flexibilidad.

Un árbol inteligente de tipos cruzados garantiza una fijación de precios óptima y una ejecución rápida, especialmente para pares de divisas exóticos y cruzados. La palanca dinámica ofrece relaciones flexibles para ayudar a controlar la volatilidad del mercado. Desde brókeres de Forex y criptomonedas hasta empresas multiactivos que deseen ampliar su gama de productos, B2TRADER es escalable y se adapta a diversos modelos de negocio.

Las aplicaciones móviles para iOS y Android de la plataforma permiten el trading en tiempo real, la administración de cuentas y conexiones fluidas con proveedores de liquidez. Su tecnología avanzada garantiza un acceso de liquidez confiable para los mercados de derivados y spot.

B2TRADER ofrece herramientas de trading completas que permiten a los brókeres mantenerse competitivos con actualizaciones frecuentes y funciones innovadoras.

Match-Trader

Match-Trader ofrece soluciones completas para brokers del mercado de FX y proveedores de liquidez. Esta plataforma brinda soporte multicurrency para empresas internacionales y facilita las finanzas y exchanges descentralizados. Incluye características clave como la integración con opciones de pago, herramientas de análisis y tecnología blockchain avanzada.

Al ofrecer una experiencia de usuario fluida y un acceso rápido al mercado, Match-Trader permite a las empresas atraer clientes y empodera a los brokers para responder de forma eficaz a las cambiantes condiciones del mercado.

DXtrade White Label

Los brokers que se especializan en FX, CFDs y trading de criptomonedas en el mercado spot pueden beneficiarse de las soluciones personalizadas de DXtrade White Label. Esta plataforma ofrece una infraestructura de back-office personalizable, autenticación multifactor y herramientas de finanzas descentralizadas.

DXtrade garantiza el cumplimiento normativo al tiempo que admite pares de trading y provisión de liquidez. Gracias a su tecnología de vanguardia y capacidades de desarrollo de blockchain, las empresas pueden atraer usuarios y adentrarse en el mercado DeFi a la vez que ofrecen una experiencia de trading fluida.

Leverate LXSuite

Leverate LXSuite es una plataforma completa para brokers que se inician en el mercado de las criptomonedas y para empresas consolidadas. Ofrece un sistema integral con énfasis en la funcionalidad de trading, herramientas de gestión de riesgos y CRM.

LXSuite ayuda a los brokers a alinearse con sus objetivos comerciales al brindar recursos educativos y soporte multicurrency. Esta plataforma es popular entre las empresas que buscan una forma rentable de gestionar sus operaciones y ofrecer a sus clientes acceso a recursos útiles.

Ventajas y Desventajas de Usar una Solución WL

Con una amplia gama de funciones, las plataformas de trading WL ofrecen a las empresas una oportunidad atractiva para ingresar al mercado. Sin necesidad de un gran conocimiento técnico, estos sistemas proporcionan a los brokers las herramientas necesarias para entrar rápidamente a los mercados.

Las plataformas white label resultan atractivas para las empresas que desean lanzarse al mercado, ya que los proveedores ofrecen características esenciales, incluidas opciones de pago, soluciones personalizables y soporte continuo.

Las plataformas WL de criptomonedas brindan a las empresas una opción personalizada para lograr sus objetivos particulares. Dado que ofrecen posibilidades de personalización, las empresas pueden adaptar la plataforma a sus requisitos de marca y estrategias de trading. Este planteamiento puede resultar beneficioso para las empresas que buscan atraer a usuarios del sector de las criptomonedas y el DeFi.

Las plataformas white label son socios confiables de crecimiento para empresas tanto nuevas como establecidas. Estos sistemas proporcionan una experiencia de usuario fluida y acceso a las últimas tecnologías, y están diseñados para expandirse al ritmo de la compañía.

Las soluciones que ofrecen los proveedores permiten a las empresas ofrecer a sus clientes un alto enfoque en el rendimiento, la eficiencia y la satisfacción del usuario, todos elementos esenciales para la viabilidad a largo plazo en el competitivo mercado de criptomonedas.

Las soluciones WL son una excelente herramienta para las empresas que desean atraer a traders experimentados y, al mismo tiempo, permitir que los clientes novatos tomen decisiones informadas. Debido a su capacidad de adaptarse rápidamente a los cambios del mercado, los brokers y las empresas que navegan por las complejidades de los exchanges descentralizados y el sector cripto más amplio eligen estas plataformas.

Aunque las plataformas white label brindan una forma rápida y sencilla de entrar en el mercado, entre los factores a largo plazo se incluye la evaluación de la dependencia de proveedores externos y la necesidad de un mayor control sobre la infraestructura clave a medida que la empresa crece. Las empresas que esperan cumplir sus objetivos estratégicos en el ámbito cripto y DeFi deben equilibrar estos elementos cruciales.

Cómo Elegir la Mejor Plataforma para su Negocio

Preste atención a algunos aspectos importantes al elegir la plataforma adecuada para su empresa. Ya sean clientes institucionales o minoristas, comience por definir su público objetivo y sus necesidades específicas. Considere las plataformas que ofrezcan una solución personalizada con un conjunto de características amplias que se ajusten a los objetivos de su negocio.

Para asegurarse de que la plataforma cumpla sus metas financieras, evalúe su presupuesto y el retorno de inversión esperado. Las empresas que buscan sostenibilidad a largo plazo prefieren plataformas que permitan a los brokers ingresar al mercado rápidamente, a la vez que ofrecen escalabilidad y opciones de personalización.

Para valorar la reputación de un proveedor, analice los comentarios de clientes y evalúe su rendimiento en el siempre cambiante mercado de las criptomonedas. Además de ofrecer herramientas que atraigan a los usuarios y satisfagan las necesidades de los traders experimentados, los principales proveedores suelen proporcionar información valiosa y una experiencia de usuario impecable.

Elija plataformas que den prioridad al crecimiento, permitiendo a las empresas expandirse de acuerdo con las demandas cambiantes del mercado. Aquellas que ofrecen acceso a exchanges descentralizados y al espacio DeFi, compatibilidad con múltiples activos y soluciones de cripto white label pueden adaptarse a las variaciones del mercado cripto.

Busque plataformas con características fundamentales como herramientas de trading avanzadas, gestión dinámica de garantías y opciones de pago. Estas características son necesarias para brindar a los usuarios el mejor entorno de trading posible y garantizar un éxito continuo en el mercado.

¿Cuánto Cuesta una Plataforma de Trading WL?

El proveedor, las funciones y el nivel de personalización requerido influyen en el costo de las soluciones WL. Por lo general, la configuración inicial oscila entre $5,000 y $30,000. Esta tarifa cubre la infraestructura necesaria; pueden generarse costos adicionales para integraciones o modificaciones más complejas.

Top 5 White Label Trading Platforms en 2025

Mejores White Label Trading Platforms en 2025

Descubra las 5 principales plataformas de trading white label de 2025. Conozca cómo estas soluciones personalizables ofrecen una entrada rápida al mercado, herramientas avanzadas y escalabilidad.

Los costos de uso de la plataforma y el soporte técnico suelen variar entre $1,000 y $10,000 mensuales, dependiendo de los servicios ofrecidos. El costo mensual de los paquetes de servicio completo con beneficios adicionales, como asesoría regulatoria, puede oscilar entre $15,000 y $25,000.

Las soluciones WL son más rentables que desarrollar una plataforma propia. El desarrollo de una plataforma interna puede ser mucho más costoso, a menudo superando los $100,000, y lanzarse a lo largo de varios meses. En cambio, los brokers white label pueden comenzar a operar en unas pocas semanas.

La personalización y las licencias también influyen en el costo total. Aunque se suelen incluir ajustes menores, las modificaciones significativas de marca o funcionalidad pueden aumentar el precio. El costo de la licencia varía según el área de negocio; las regulaciones más estrictas implican tarifas más altas.

Las soluciones WL brindan una opción más asequible que crear una plataforma completamente única para las empresas que desean lanzarse de forma fluida y rápida. Gracias al mantenimiento y soporte continuo del proveedor, los brokers pueden concentrarse en ampliar su base de clientes, lo que simplifica aún más las operaciones.

Conclusiones Finales

Las plataformas de trading WL brindan a las empresas una opción económica y eficaz para ingresar al mercado. Reducen la complejidad y el costo de desarrollo a la vez que ofrecen la infraestructura y las herramientas necesarias para crear una experiencia de trading impecable.

Las empresas pueden mantenerse competitivas eligiendo una plataforma que respalde sus objetivos, dé prioridad a la escalabilidad y ofrezca opciones de personalización. Los principales proveedores permiten a las organizaciones adaptarse a las tendencias del sector cripto y DeFi al admitir aspectos esenciales como la cobertura de activos, los protocolos de seguridad y las capacidades de integración.

Un análisis detallado de las capacidades de la plataforma promueve la sostenibilidad y el éxito a largo plazo en el sector de las criptomonedas.

FAQ

¿Qué es una plataforma de trading WL?

Las empresas pueden añadir su logotipo y diseño a una plataforma WL, proporcionando funcionalidades básicas sin marca.

¿Cuál es el Precio de un WL FX Broker?

Los brokers de FX comienzan a operar en aproximadamente dos semanas y oscilan entre $20,000 y $50,000. Construir un bróker personalizado desde cero puede llevar hasta seis meses y costar alrededor de $150,000.

¿En Qué Consiste el Proceso de White Labelling?

El white labelling permite a las empresas volver a etiquetar los bienes o servicios de otra compañía como propios sin requerir una amplia investigación o fabricación.

Lee también