Share

0

/5

(

0

)

Ensuring a proper working environment for your clients, where they can deposit, manage their funds, and trade in financial markets, requires robust security protocols. In fact, big-money clients are more likely to invest in your platform if you provide airtight safety for their capital and personal data.

These practices have become increasingly demanded due to the rising cybersecurity threats, breaches, and personal data leaks. A fraud detection system ensures you tackle these risks before they occur and combat hackers before they reach your user base.

Not sure how fraud prevention works and how to find the best software for it? Here’s everything you need to know.

Key Takeaways

Fraud detection involves advanced systems that analyse, detect, and alert for anomalies that can lead to significant cyberattacks.

Integrating scam-detection software safeguards user data and funds at brokerage firms.

The application of artificial intelligence in scam detection improves its accuracy and copes with modern hacking techniques.

Understanding Fraud Detection Software

Let’s start by explaining fraud—a deliberate act of deception to gain an unfair or unlawful advantage, often involving financial theft, misrepresentation, or identity misuse. This matter is critical for brokerage firms because they handle money and personal data.

When traders register on your trading platform, they submit their personal information, save payment data, deposit their funds, and open investment accounts. This is the perfect prey for hackers and scammers.

Financial fraud detection software scans and identifies suspicious activities before happening. The detection occurs after a systematic check with pre-determined parameters, and when a particular account, activity, or input falls outside these limits, the system alerts for anomalies.

The anti-fraud system can either automatically neutralise the threat through a pre-set course of action or leave the decision to admins.

Who Needs Fraud Prevention Software?

Any business or commercial activity needs a powerful scam-prevention system to protect providers and users by detecting, mitigating, and preventing illegal activities, ensuring trust and compliance.

This becomes highly crucial when sensitive information or money is involved, such as the following sectors:

Brokerage Firms: To safeguard client investments and prevent unauthorised trading or transaction redirection.

Banks and Financial Institutions: To monitor transactions and verify identities, preventing involvement in money laundering.

E-commerce Businesses: To detect payment fraud and illegal credit cards and safeguard customer data.

Healthcare Providers: To prevent insurance fraud and data breaches.

Online Gaming Platforms: To help platforms maintain operational integrity and reduce users’ financial losses.

How Does an Anti-Fraud System Work?

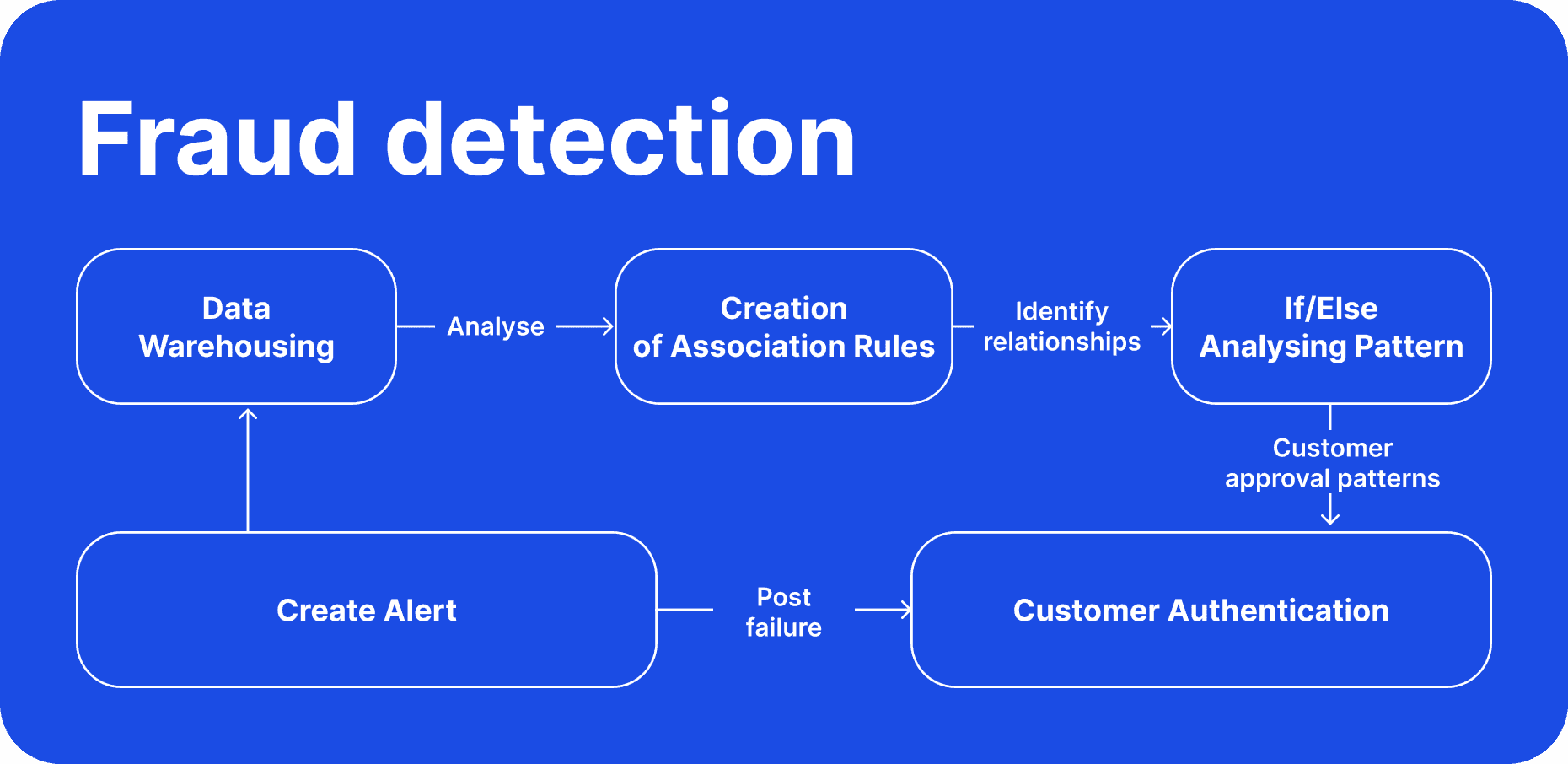

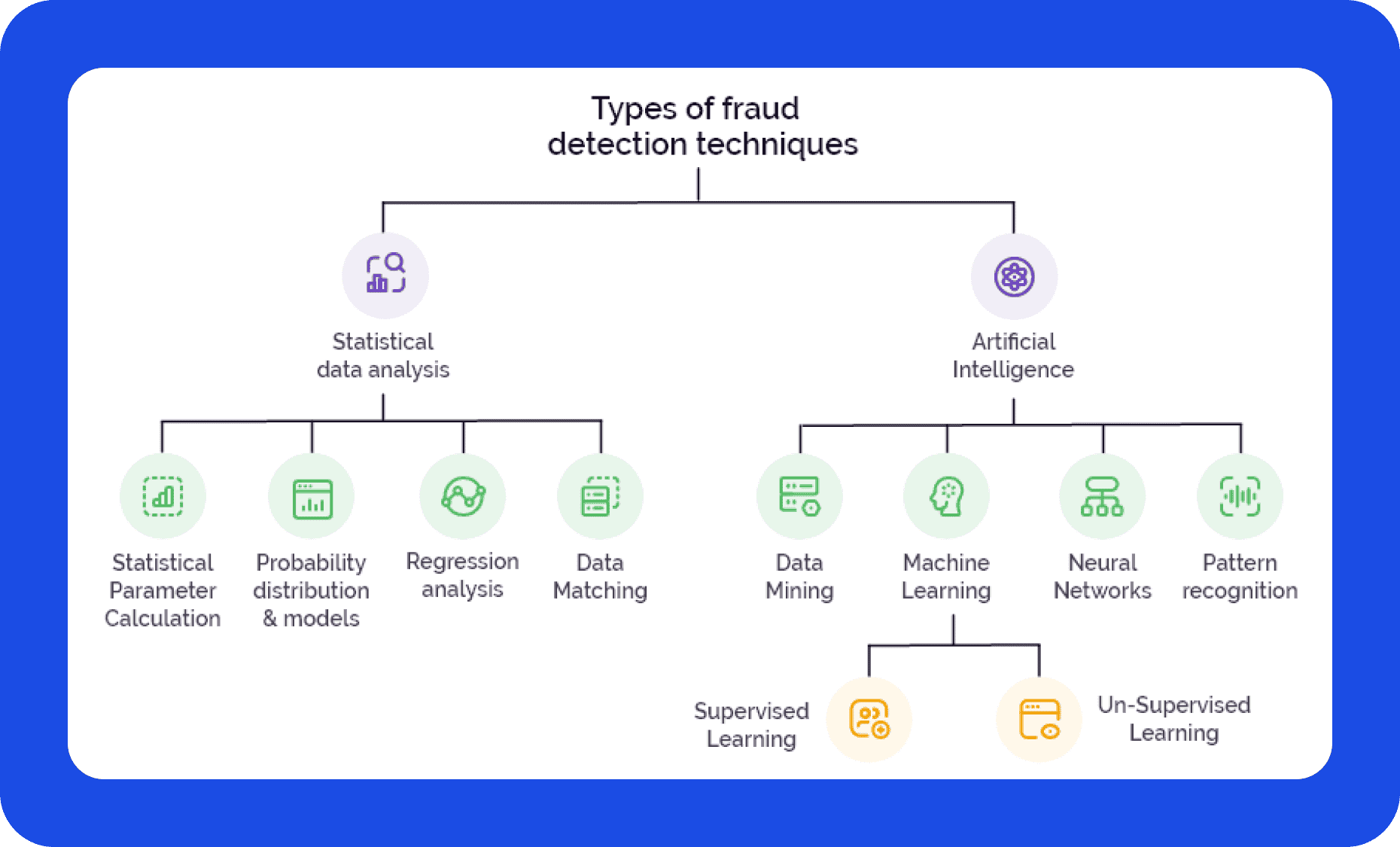

An adequate fraud prevention program uses complex technologies and data analytics to detect, prevent, and respond to abnormal activities in real time.

These systems integrate advanced algorithms, machine learning, and behavioural analysis to monitor transactions, user activities, and patterns that may indicate serious cyberattacks. Typically, the process involves data collection, risk assessment, behavioural pattern identification, and alert generation.

Data Collection

The system gathers information from various sources, such as financial transactions, user profiles, and device information. It analyses this data for patterns and benchmarks, aiding in the discovery of anomalies using predefined rules and machine learning models.

For instance, if a brokerage firm’s client initiates an unusual withdrawal or logs in from an unfamiliar device or location, the system flags it as suspicious.

Risk Assessment

The system assigns a risk score to each activity based on its likelihood of being illicit. High-risk activities trigger alerts for further investigation or immediate action, such as transaction blocking or account freezing, while less risky activities can be classified and saved for reporting and data improvement.

Behavioural Biometrics

The program analyses how users interact with systems, such as typing speed or mouse movement, to identify unauthorised users. AI fraud detection software continuously learns and updates prevention models to adapt to emerging tactics.

Real-time Alerts

The system generates notifications and reports, allowing organisations to act swiftly, minimise losses, and enhance security protocols. Admins may set a preferred course of action for each instance to make the neutralisation process immediate.

Market Insights & Statistics

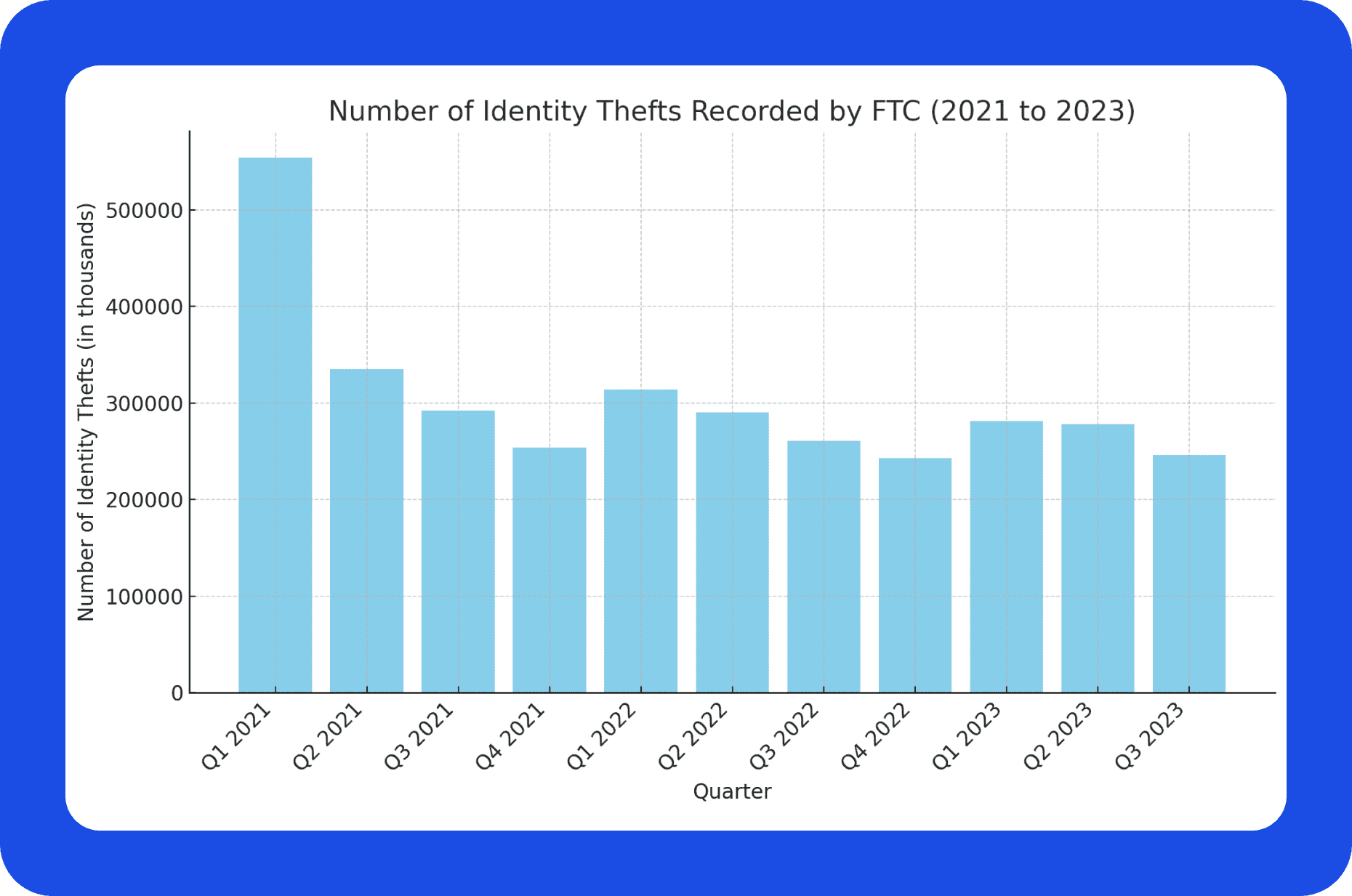

Identity theft and cybersecurity are serious threats to any online platform or digital business. Although artificial intelligence can help strengthen security protocols, hackers can also use it to improve their infiltration capabilities.

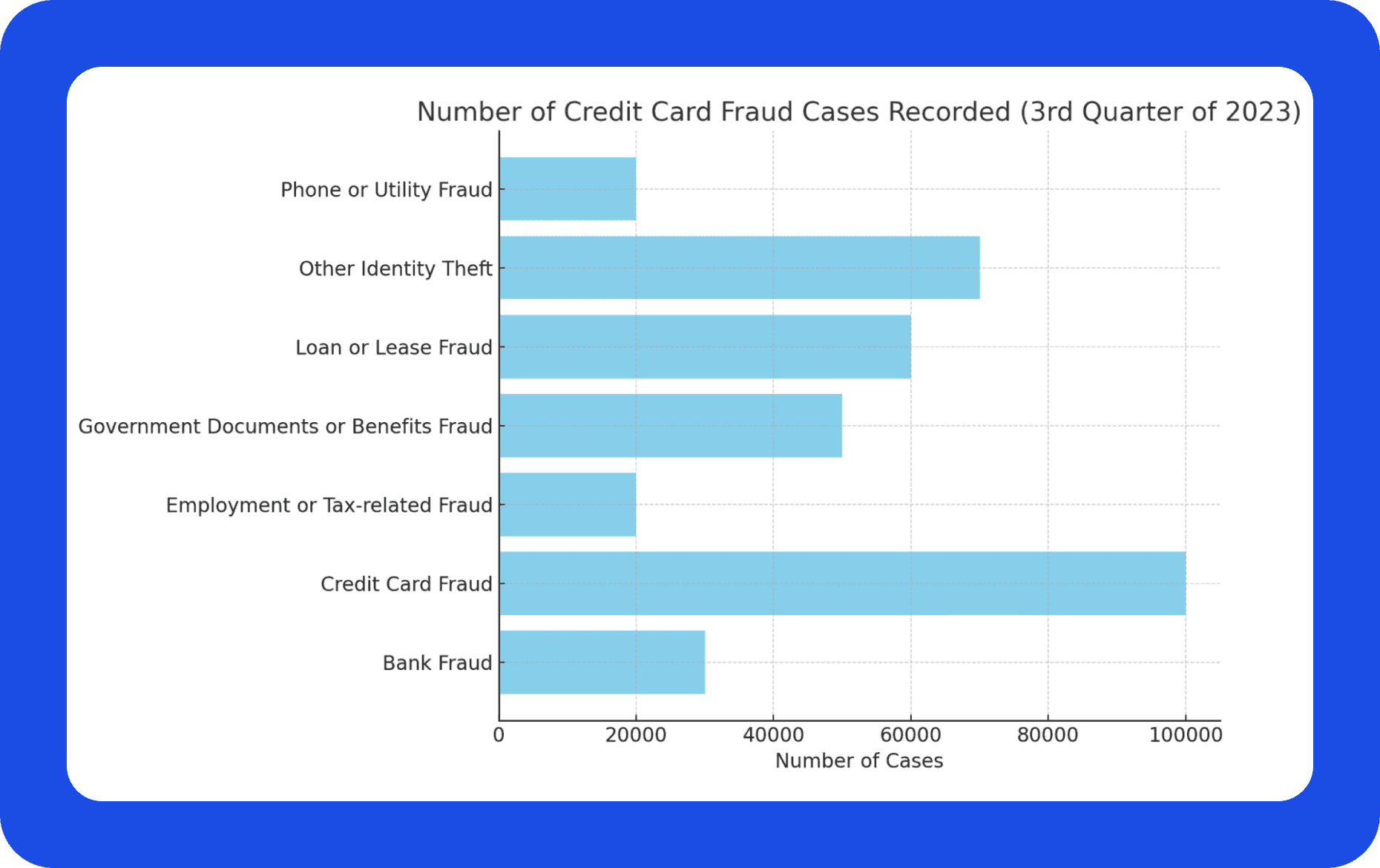

UK consumers are expected to have lost over $700 million from unauthorised and authorised fraud in the first half of 2023, while the US Federal identity theft report suggested that over $10 billion was lost in identity theft in 2023.

Most of these instances relate to monetary transactions and identity theft, especially credit card fraud, where over 100,000 users were damaged in Q3-2023, according to the Federal Trade Commission.

[aa quote-global]

Fast Fact

In December 2024, the Securities and Exchange Commission ordered Morgan Stanley to pay $15 million in settlements related to fraud-prevention failure allegations.

[/aa]

Anti-Fraud Detection Features

Fraud prevention software provides advanced tools to identify and prevent illegal activities across industries. You can integrate these technologies to boost confidence in your platform, protect data, and safeguard user capital.

By automating fraud prevention, organisations can safeguard assets, enhance compliance, and maintain customer trust. Key features include:

Real-Time Monitoring: Continuously analyses transactions and activities to instantly identify and flag suspicious patterns, enabling swift action to prevent financial loss.

Machine Learning Algorithms: Uses predictive models and AI to adapt to emerging scam tactics, improving detection accuracy and minimising false positives over time.

Behavioural Analysis: Monitors user interactions, such as typing speed and log-in habits, to identify deviations that could signal unauthorised access.

Fraud Scoring: Assigns risk scores to transactions or activities based on their likelihood of being fraudulent, allowing prioritisation of investigations.

Integration Capability: Seamlessly integrates with CRM or payment platforms and scales according to business requirements, ensuring compatibility and enhancing data security.

How to Find The Best Fraud Detection Software?

Locating and integrating the right fraud-prevention model requires careful research. You must look for systems that integrate seamlessly with your platform, offer scalability, and focus on your unique needs.

For brokerages, prioritise tools that protect client accounts, detect unauthorised trades, and comply with regulations. You can also check user reviews and case studies from trusted companies to identify proven solutions. Here are the 5 best fraud detection software providers.

1. SEON

SEON is famous for its powerful machine-learning technology and real-time fraud detection tools. It excels in identifying fraudulent activities through device fingerprinting, email verification, and IP analysis.

Brokerages benefit from its scalability and seamless integration into existing systems. SEON’s affordability and pay-as-you-go pricing make it a top choice for startups and established firms. Companies like Patreon and AirFrance use SEON to combat fraud risks more effectively.

2. Signifyd

Signifyd specialises in fraud protection for e-commerce and financial services. Its AI fraud detection prevents chargebacks and fraudulent transactions, making it ideal for brokerages handling high volumes.

Known for its decision automation and global coverage, the software is trusted by brands like Samsung and eBay. It also stands out for its exceptional risk assessment features and financial protection.

3. DataDome

DataDome is a leader in bot detection and scam prevention, offering solutions tailored to financial institutions and online services. It is trusted by global brands like Foot Locker and Axel Springer.

Its real-time bot combat helps brokerages prevent credential stuffing and account takeovers—popular cyberattacks that target usernames and passwords.

4. Fraud.net

Fraud.net provides end-to-end scam detection for enterprises, including brokerage firms. It offers advanced features like predictive analytics, case management tools, and fraud scoring that can be integrated with CRM and Enterprise resource planning.

Fraud.net leverages shared data to enhance detection accuracy, suitable for companies in high-risk industries like PayPal.

5. Sift

Sift is a trusted scam detection software that offers tools such as behavioural analysis, risk scoring, and machine learning. It is tailored for industries like finance and e-commerce, making it a strong fit for brokerages that need account security and fraud detection cost management.

Companies like DoorDash and PayMongo use Sift for its accuracy and scalability. Its global intelligence network sets it apart, offering unmatched threat detection capabilities.

Conclusion

Fraud prevention systems are vital to safeguarding data and funds on your platform, especially if you operate a brokerage firm. Scam detection software helps track and determine abnormal behaviours that can be associated with financial crimes, such as identity and credit theft.

This happens after a complex pattern creation and observation process. The system determines the standards, and anything deviating can be flagged for further analysis, mitigation, or neutralisation.

Read also