Share

0

/5

(

0

)

The fast pace of today's world prompts humans to seek simplified solutions to all processes. Of course, the financial field and trading are no exceptions, where serious efforts are needed to achieve success. To simplify the trading process, several strategies have been developed, among which are copy trading and PAMM accounts. Both offer a way to potentially profit from the financial markets by using the expertise of professional traders for your sake. But what differentiates them, and which is better suited for your investment goals?

In this article, we'll explore the nuances of Copy Trading vs PAMM accounts, their mechanisms, benefits, and potential drawbacks to help you make an informed decision.

Key Takeaways

Copy trading enables you to automatically replicate the trades of a chosen signal provider in your account.

PAMM Accounts involve pooling your funds with other investors under the control of a professional money manager, providing a hands-off, passive investment approach.

Both methods carry inherent risks, so it is crucial to conduct careful research, understand your risk tolerance, and choose reputable brokers.

What is Copy Trading?

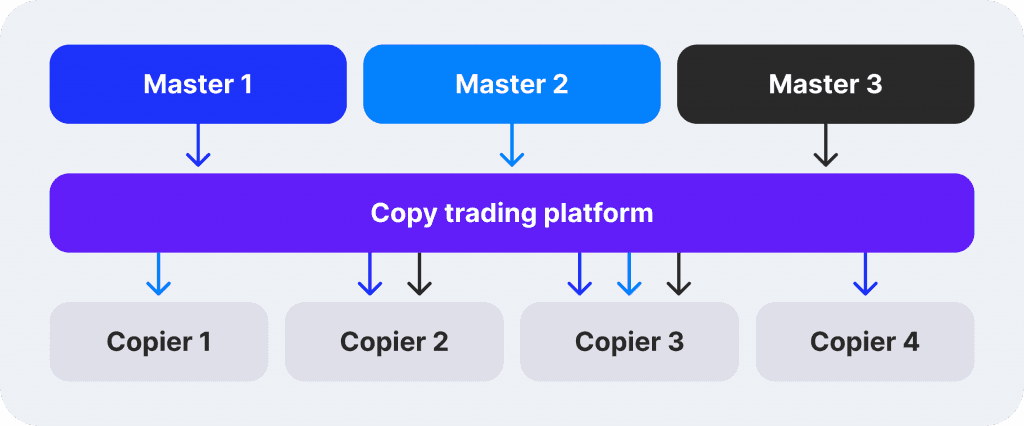

Copy trading is a form of automated trading that allows investors to replicate the trades of experienced traders (signal providers) directly into their trading accounts. By linking their accounts to a copy trading software, investors can automatically mimic the trading actions of chosen signal providers, thereby utilising the expertise of seasoned traders without needing to execute trades themselves.

Pros & Cons

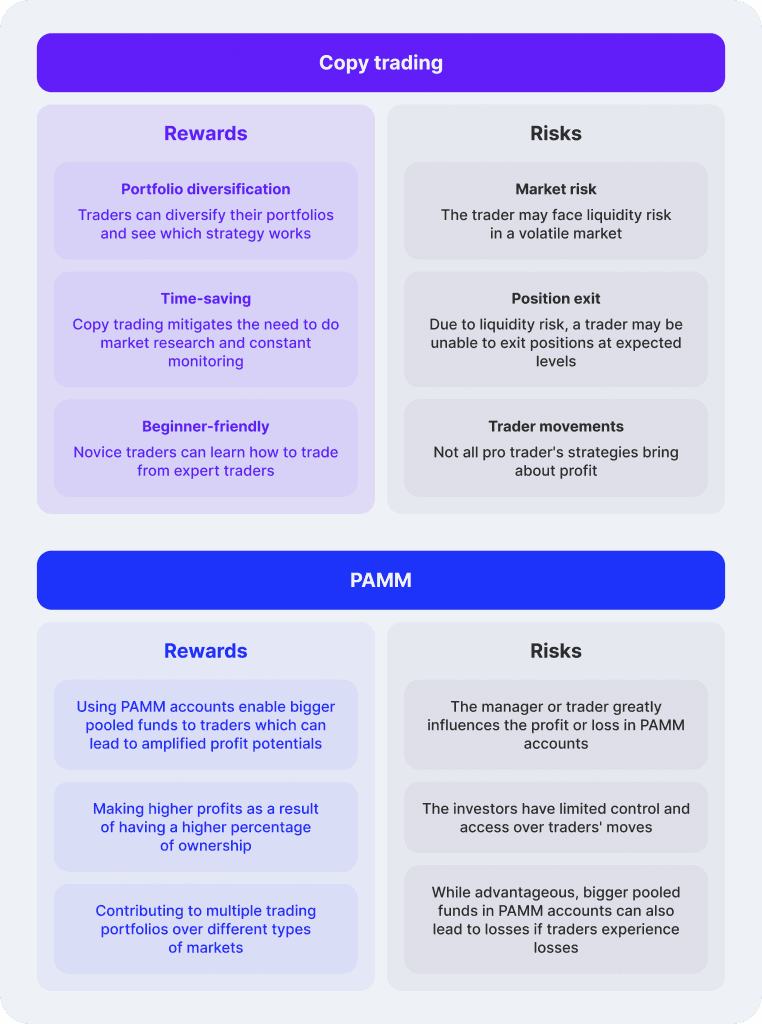

Copy trading offers several advantages:

Accessibility for Beginners: You don't need extensive trading knowledge to participate. Choose a signal provider with a good track record and mirror their trades in your account.

Potential for Profit: By copying successful traders, you can benefit from their expertise and strategies.

Diversification: You can copy trades from multiple providers, spreading your risk across different trading styles and instruments.

Control and Flexibility: You maintain control over funds and can adjust copy settings or stop copying at any time.

Time-Saving: It saves time as traders do not need to monitor the markets and make decisions constantly. The trades are executed automatically based on the copied trader's actions.

Learning Opportunity: Novice traders can learn about trading strategies and market behaviour by observing the actions of professional traders live.

Transparency: Many copy trading platforms provide detailed statistics on traders' performance, including their track record, risk levels, and trading style, allowing copiers to make informed decisions.

Reduced Emotional Impact: Automated trading minimises the impact of emotional decision-making, which can often lead to poor trading decisions.

However, there are also some drawbacks to consider:

No Guaranteed Success: Your success hinges on the chosen signal provider's performance. Careful research and due diligence are crucial. There's always a risk that the copied trader's strategies may not be profitable.

Platform Fees: Some copy trading platforms charge fees for accessing signal providers or executing copied trades, increasing the cost of trading. These fees can also include subscription costs or a share of the profits.

Limited Control: The success of a copy trading strategy heavily relies on the chosen signal providers' performance. You lose some control over your trading decisions as you're replicating someone else's strategy.

Over-Reliance on Others: Traders may become too dependent on others and not develop their trading skills and knowledge.

Platform Risk: The reliability and security of the copy trading platform are crucial. Technical issues or platform failures can result in losses or missed trading opportunities.

Potential for Overtrading: Some traders being copied might engage in high-frequency trading or excessive trading, leading to higher transaction costs and potentially reducing overall profitability.

In summary, while copy trading offers several advantages, especially for beginners, it also comes with significant risks. To mitigate potential downsides, individuals must conduct thorough research and choose platforms and traders wisely.

What is a PAMM Account?

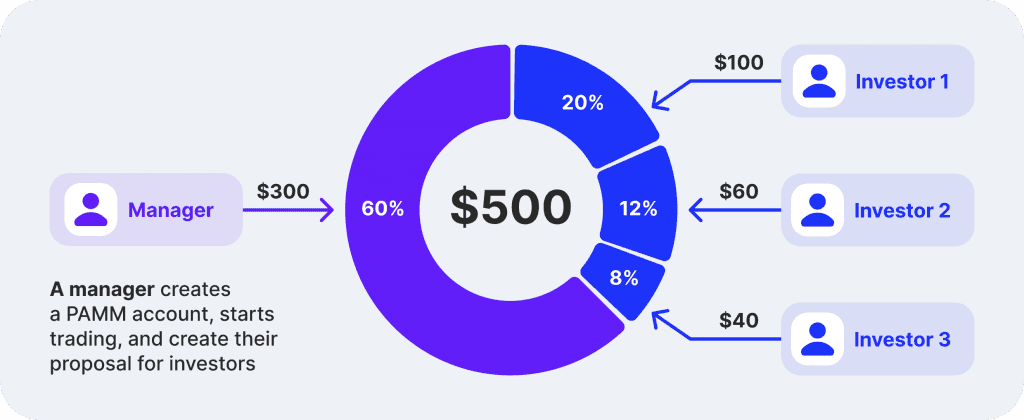

PAMM (Percent Allocation Management Module, also known as Percentage Allocation Money Management) accounts offer a different approach. Here, you invest your capital into a pool managed by a professional money manager. The money manager trades these combined funds to generate profits for all participants. Each investor's gains or losses are proportionally distributed based on their share of the total pool.

Essentially, it's a form of managed account where multiple investors' funds are combined and traded as a single account, with profits and losses distributed according to each investor's share in the fund.

Pros & Cons

PAMM accounts offer some distinct advantages:

Passive Investment: This method generates genuinely passive income, as the manager handles all trading decisions.

Time-Saving: Investors do not need to spend time monitoring the markets and making trading decisions, as the professional manager handles this.

Access to Expertise: You gain exposure to the strategies of experienced forex traders who may not be readily available through copy trading platforms.

Potentially Higher Returns: Skilled money managers might achieve better returns than you could independently. Managers often earn a performance fee based on the profits they generate, aligning their interests with those of the investors.

Transparency: Investors can review the performance track records of money managers before allocating funds. PAMM accounts typically provide detailed performance reports and metrics, allowing investors to track the performance of their investments.

Diversification: Investors can diversify their portfolios by allocating funds to multiple PAMM accounts managed by different traders with varied strategies.

However, PAMM accounts also come with limitations:

Limited Control: You have minimal control over the manager's strategy and risk management. Once funds are allocated, investors have no control over trading decisions.

Performance Dependence: There's always the potential for loss, and investors must rely on the manager's expertise. Choosing a skilled manager is critical, as your returns are directly tied to the manager's performance.

Fees and Commissions: PAMM accounts typically involve performance fees and management fees, which can reduce overall returns.

Liquidity Constraints: Some PAMM accounts may restrict when investors can withdraw their funds, potentially leading to liquidity issues.

Platform Risk: The reliability and reputation of the platform hosting the PAMM accounts are crucial. Platform issues can affect access to funds and the execution of trades.

In summary, PAMM accounts offer the advantage of professional management and the potential for higher returns, but they also come with risks, including the possibility of significant losses and a lack of control over trading decisions. Investors should carefully consider these factors and conduct thorough due diligence before investing in a PAMM account.

[aa quote-global]

Fast Fact

PAMM accounts are legal in most countries; however, their safety can vary depending on several factors.

[/aa]

Key Differences Between Copy Trading and PAMM Accounts

Now, let's outline the main aspects differentiating these two methods.

Fund Management and Control

Copy Trading: Investors have full control over their accounts and can choose which trades to copy and when to withdraw funds.

PAMM Accounts: Investors' funds are managed directly by the trader, with no active involvement from the investor once the funds are allocated.

Cost Structure

Copy Trading: Typically involves a spread fee plus a commission charged by the copy trading platform.

PAMM Accounts: Usually only involve a spread fee, with management fees varying by the fund manager.

Flexibility

Copy Trading: Offers flexibility in choosing multiple signal providers and adjusting investment amounts.

PAMM Accounts: Provide a more hands-off approach, with investors entrusting all decisions to the manager.

Which is Better for You?

The best option for you depends on your individual circumstances and risk tolerance. Here's a breakdown to help you decide:

Choose Copy Trading if:

You're a beginner with limited trading experience.

You value control over your investments and risk management.

You prefer to diversify your portfolio by copying multiple traders.

Choose PAMM Accounts if:

You prefer a completely hands-off, passive investment approach.

You're confident in the expertise of a chosen money manager.

You're seeking potentially higher returns through a professional's strategy.

Copy trading might be more appealing to beginners due to its flexibility and control over individual investments. It also serves as a learning platform where novice traders can understand forex market dynamics by observing professional traders' strategies.

Experienced investors or those with more considerable capital might prefer PAMM accounts. These accounts use the expertise of seasoned traders without requiring continuous oversight, allowing investors to benefit from potentially higher returns managed by professionals.

Your choice between these methods should also consider your risk tolerance. Copy trading provides more control, allowing you to mitigate losses by stopping the copying process at any time. In contrast, PAMM accounts require higher trust in the money manager, as investors cannot intervene once funds are allocated.

Regardless of your choice, remember these necessary considerations for both methods:

Do Your Research: Thoroughly research potential signal providers or money managers before investing. Analyse their track record, trading style, and fees.

Start Small: Begin with a smaller investment amount to test and gain experience before committing more significant sums.

Understand the Risks: Both copy trading and PAMM accounts involve inherent risks. Never invest more than you can afford to lose.

Use Reputable Brokers: Choose reputable and regulated brokers with transparent terms and fees.

By carefully considering your needs and conducting proper due diligence, you can use copy trading or PAMM accounts as valuable tools to potentially achieve your financial goals.

Conclusion

Copy Trading and PAMM accounts offer unique advantages for passive income generation in forex trading. Copy trading provides flexibility, control, and learning opportunities for novice traders. At the same time, PAMM accounts offer professional management and potentially higher returns for those willing to entrust their funds to experienced managers. Ultimately, your choice should align with your investment goals, risk tolerance, and desired degree of participation in the process.

FAQ

Can copy trading make you rich?

If the trader has a proven track record of making profitable trades consistently, then copy trading could be profitable for them.

Are PAMM accounts legal?

Yes, PAMM accounts are legal in most countries; however, their safety can vary depending on several factors. To ensure a secure investment experience, selecting a reputable and regulated forex broker that offers PAMM services is crucial.

Is copy trading profitable?

Yes. If a trader can identify a successful trader and mimic their deals, copy trading may be profitable. Yet, there is always a danger because even seasoned traders can make errors and lose money.

How does a PAMM account work?

The workings of a PAMM account are straightforward. The PAMM manager opens an account and allocates a certain amount of their own capital—known as the "Manager's Capital." The manager shares profits with investors based on the respective amount they deposit when profitable trades are made.

Read also