Finding the Best Forex CRM Software in 2024

The success of any Forex brokerage hinges on multiple factors, but technology plays a central role. While trading platforms and payment processors are crucial, a powerful Forex CRM (Customer Relationship Management) system can be a true game-changer.

In this comprehensive guide, we’ll delve into the key benefits of Forex CRM software, must-have features, and leading providers in the Forex market. Additionally, we’ll equip you with the knowledge to make an informed decision and select the perfect Forex CRM solution tailored to your brokerage’s specific needs.

Key Takeaways

- Selecting the optimal CRM system is pivotal for brokers to maintain a competitive edge and efficiently manage client relationships.

- Key considerations include customisation options tailored to individual brokerage needs, seamless integration capabilities with trading platforms, and adherence to stringent security measures and regulatory compliance standards.

- CRM system empowers brokers to enhance client management, operational efficiency and sustainable business growth in 2024.

What is Forex CRM Platform, and Why Do You Need It?

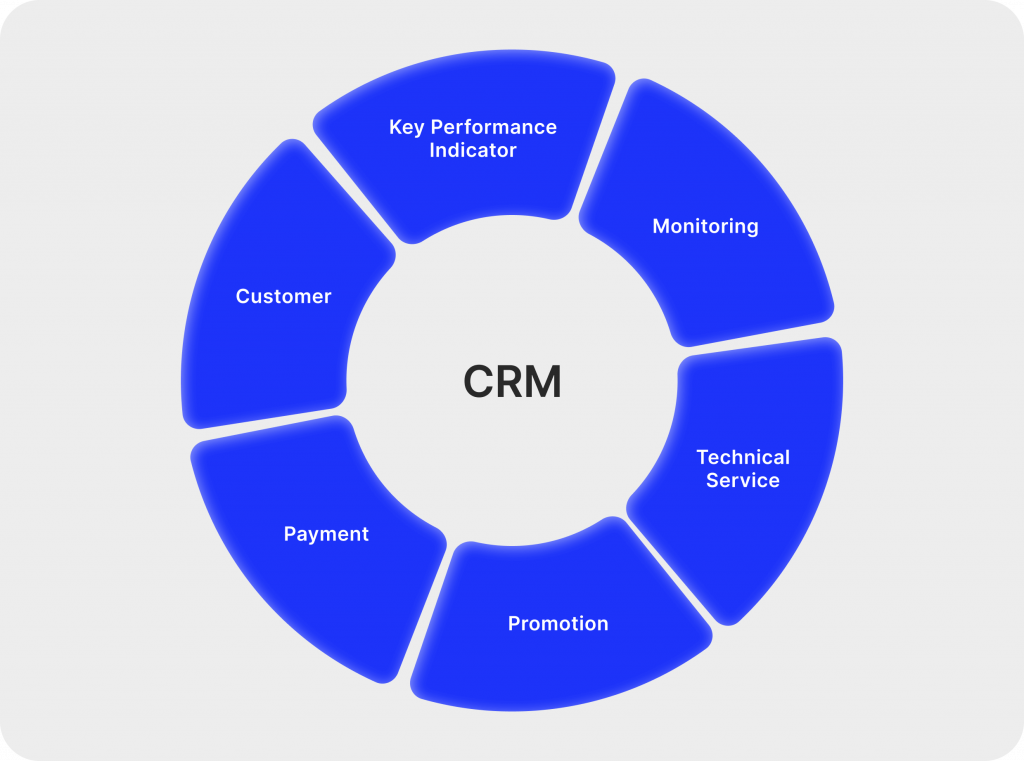

Forex CRM (Customer Relationship Management) software is a specialised platform designed to help Forex brokers manage their interactions with clients, streamline operations, and optimise customer service. Its primary purpose is to enhance client engagement, improve conversion rates, and ultimately increase profitability for Forex brokerage firms.

Forex CRM solution plays a vital role in centralising client management, empowering Forex brokers to efficiently handle customer interactions, monitor trading activity, and elevate the overall customer experience. With the Forex back office software, you will be empowered to:

- Provide a secure online space for clients to access news feeds, economic calendars, and technical analysis tools.

- Automate everyday tasks like account openings and deposits, freeing up your team’s valuable time.

- Generate comprehensive reports on demand or schedule automated deliveries for added convenience.

- Maintain a robust client database with custom fields and import/export capabilities for accurate data organisation.

- Ensure seamless integration with your existing trading platforms and other business tools.

- Manage customer inquiries and requests efficiently through a centralised ticketing system.

- Tailor features to your specific business processes with customisable fields, workflows, and reports.

- Manage your business remotely with mobile access to the Forex CRM system, ensuring you stay connected even when out of the office.

- Effectively manage partner commissions and maintain secure contact information with encryption settings.

Must-Have Features for the Best Forex CRM Systems

When choosing the right Forex CRM provider, several factors should be taken into consideration to ensure you select the right solution for your business. Key features to look for in the best Forex CRM companies are:

User Interface and Ease of Use

Assess the intuitiveness of the CRM interface and the overall user experience. Look for features such as customisable dashboards, easy navigation, and clear labelling to enhance user productivity. Consider conducting user testing or requesting a Forex CRM software demo to evaluate the software’s ease of use from the perspective of your team members.

Comprehensive Client Management Features

Measure the ability of the solution to capture, organise, and manage client information, including contact details, Forex trading history, preferences, and communication logs.

Marketing Automation and Analytical Tools

Check the variety of tools for automated marketing campaigns, email/SMS notifications, lead generation, and client segmentation based on trading behaviour and preferences.

Examine features for tracking leads, monitoring sales pipelines, setting up sales targets, and generating performance reports.

Check the strength and level of reporting tools for analysing client behaviour, tracking marketing campaign effectiveness, and monitoring sales performance.

Integration with Trading Platforms

Seamless integration between your Forex CRM and trading platforms allows real-time data synchronisation, enabling effective management and monitoring of client trades, positions, and account information. Check if the CRM system integrates seamlessly with popular trading platforms used in the Forex industry.

Consider the ability to integrate with other essential tools such as email marketing platforms, payment gateways, analytics tools, and third-party APIs. Ensure the integration process is straightforward and does not require extensive technical expertise.

Customer Support and Training Options

Evaluate the level of customer support provided by the CRM vendor, including availability, responsiveness, and expertise. Inquire about training options such as online tutorials, documentation, webinars, or personalised onboarding sessions to ensure your team can effectively utilise the software. Consider feedback from existing customers regarding their experiences with the vendor’s support services and training resources.

Check the Capability to create, assign, and track support tickets, along with integrated communication channels for client inquiries and issue resolution.

Compliance Management and Security

Data security and compliance are paramount in the brokerage business. Select a provider that adheres to industry regulations, offers secure data handling practices, and prioritises client privacy. Prioritise CRM solutions that adhere to industry-standard security protocols and encryption methods to safeguard sensitive client data.

Verify compliance with regulatory requirements such as KYC, AML, GDPR, and other data protection laws relevant to your jurisdiction. Assess the vendor’s track record in maintaining security standards and their approach to data privacy and compliance.

Customisation and Scalability

Choose a flexible and scalable CRM to meet your business needs as it grows. Look for CRM solutions that offer a high degree of customisation to tailor the software to your specific business needs. Assess the flexibility to customise fields, workflows, reports, and other features to align with your brokerage’s processes and requirements.

Evaluate whether the CRM allows branding customisation to maintain consistency with your company’s identity. Ensure the CRM platform can handle increased data volume and transactional load without sacrificing performance.

Pricing

And lastly, compare pricing models offered by different Forex CRM software providers to find one that aligns with your budget.

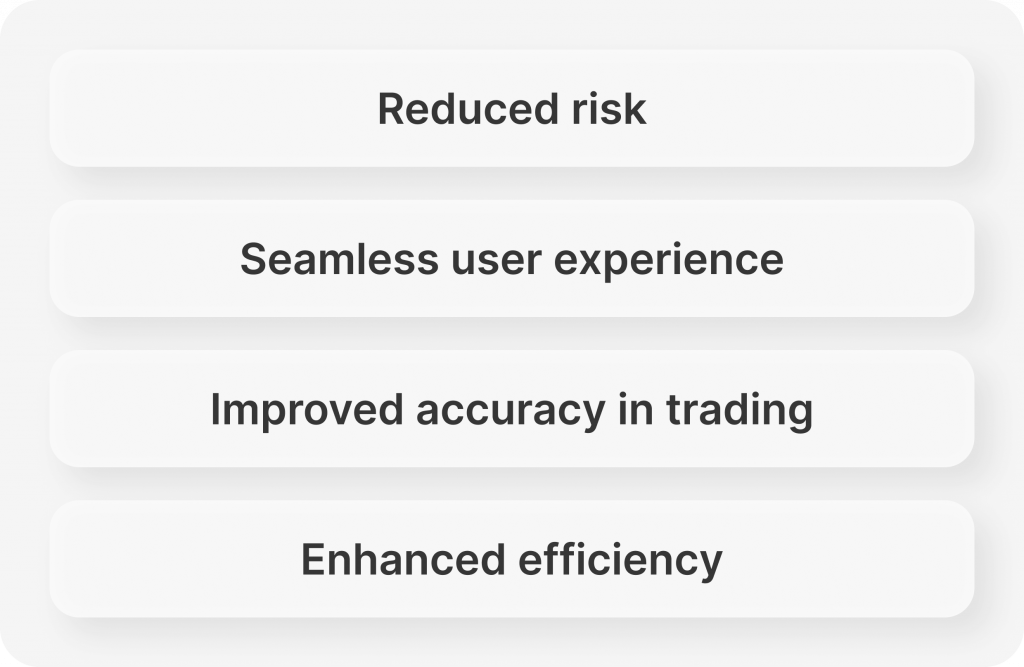

Benefits of Using Forex CRM System

Implementing a Forex CRM offers a range of benefits. Here are the most outstanding ones:

Enhanced User Management – Manage clients, admins, and IB partners effortlessly. Set up emails, payments, editing rights, and generating reports – all from a single platform.

Fast and Cost-Effective Setup – Improve your brokerage’s cost-effectiveness with a ready-to-go solution. Avoid the time and expense of developing a custom platform.

Wide Range of Integrations – Forex CRM platforms integrate seamlessly with various tools, including KYC and PSPs, ensuring your clients’ secure and efficient trading experience.

Data-Driven Decision Making – Gain valuable insights to optimise customer service operations and maximise ROI.

Fast Fact

The average CRM return on investment is $8.71 for every dollar spent.

Top Forex CRM Provider in 2024

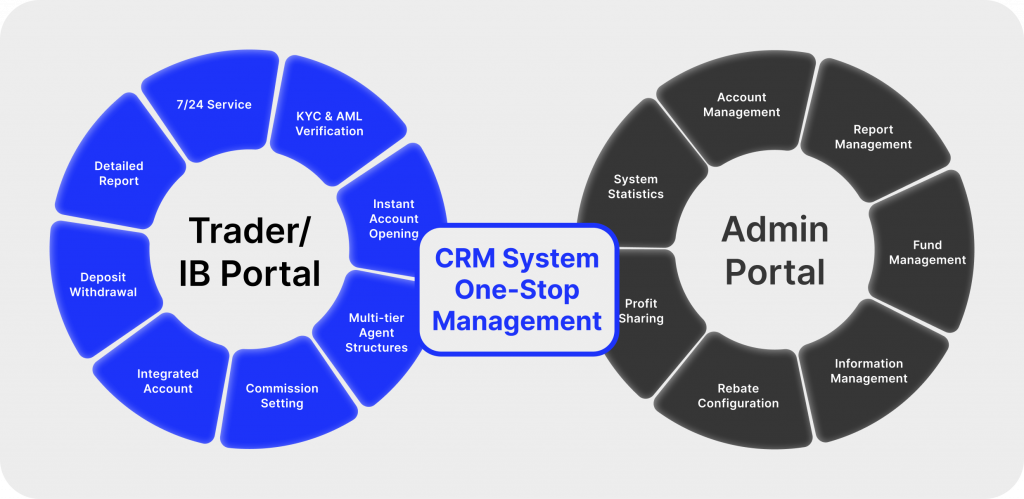

The market offers a plethora of top Forex CRM providers, making the selection process challenging. Let’s explore B2Core, an outstanding example of FX CRM software that is totally all-inclusive and meets modern standards and expectations.

B2Core is a new generation of Forex CRM, client cabinet and Forex back office solution. It positions itself as an all-in-one system that is visibly useful for brokerages.

B2Core offers functionalities such as supporting digital trading platforms, managing users and incorporating security features. Furthermore, it boasts customisability in catering to the specific requirements of various brokerage houses. By implementing a robust back-office system like B2Core, brokerages can streamline administrative tasks, potentially reducing operational costs and improving overall efficiency in areas like risk management and client service.

Conclusion: The Future of Forex CRM Solutions

In 2024, expect to see CRMs leverage AI for tasks like lead management and personalised client communication. Furthermore, Mobile CRM applications will become even more prevalent, empowering brokers with on-the-go client management capabilities.

By implementing the right Forex CRM system, your brokerage can streamline operations, enhance client relationships, and achieve long-term success. Carefully consider your needs and conduct thorough research before selecting a provider.

FAQ

What is the largest FX trading platform?

According to data compiled by Finance Magnates, IC Markets is the largest forex broker by trading volume, with over $774 billion in forex trading volume in the third quarter of 2021 alone.

What is CRM in forex trading?

For Forex brokers, a customer relationship management system is the fundamental operating system that enables the smooth running of your business on a daily basis.

Is there an AI for forex trading?

The vast majority of successful forex traders already depend on AI to reduce the risk factor in their trades. They use bots and different kinds of AI forex trading programs to automate many complex processes that take valuable time to perform.