Share

0

/5

(

0

)

White label (WL) and grey label (GL) solutions refer to brokers utilising another company's trade platform and rebranding it as their own. This enables them to quickly enter the market without having to develop their own platform. Both options provide a solid opportunity to begin a brokerage business without a significant financial commitment, but they also come with their own set of challenges.

In this article, we will learn the concepts of white-label and gray-label solutions, as well as their benefits and key differences.

Key Takeaways

White Label offers a ready-made broker solution for quick market entry.

Grey Label offers greater governance over client relationships and customisation.

WL and GL share many similarities but also have some core differences.

Understanding White Labeling

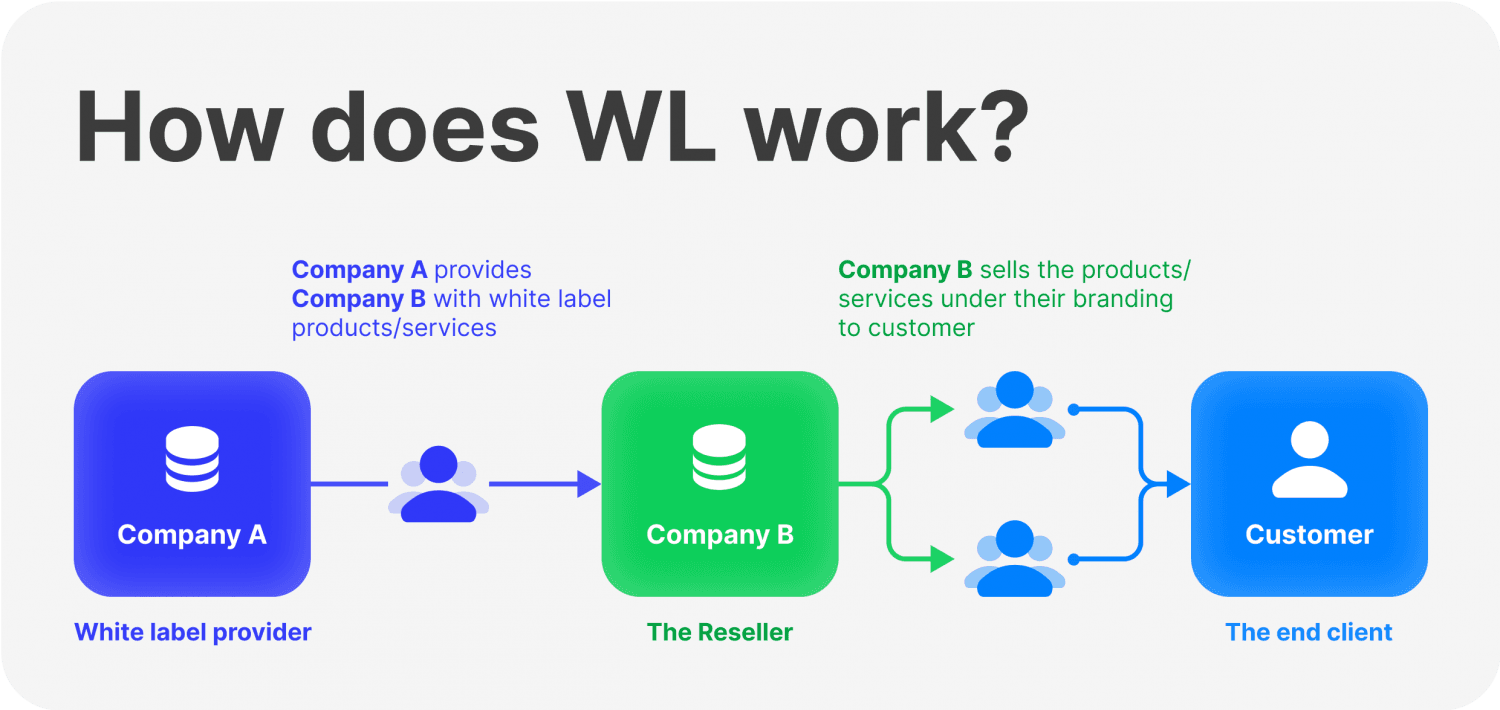

WL FX trading platforms are a cost-effective solution for brokers, offering a branding-ready solution with short-to-market delivery. These solutions are suitable for both individuals and enterprises with experience in currency trading. They allow customisation and rebranding, making it the fastest way to set up and get the business running. New FX brokers typically pay an initial cost and a monthly fee for technical support.

WLs typically supply server segments, software, and a backup system for external market transactions. The Forex White Label supplier handles technical infrastructure, resolves issues, and provides access to the trading platform, customer care, management systems, plugins, and tools for client engagement, risk management, payment integration, and liquidity management.

Benefits and Drawbacks of Working with White Label Services

A White Label trading software for an FX brokerage firm is very popular among beginner and seasoned traders due to its outstanding benefits. Let’s discuss some of them in more detail.

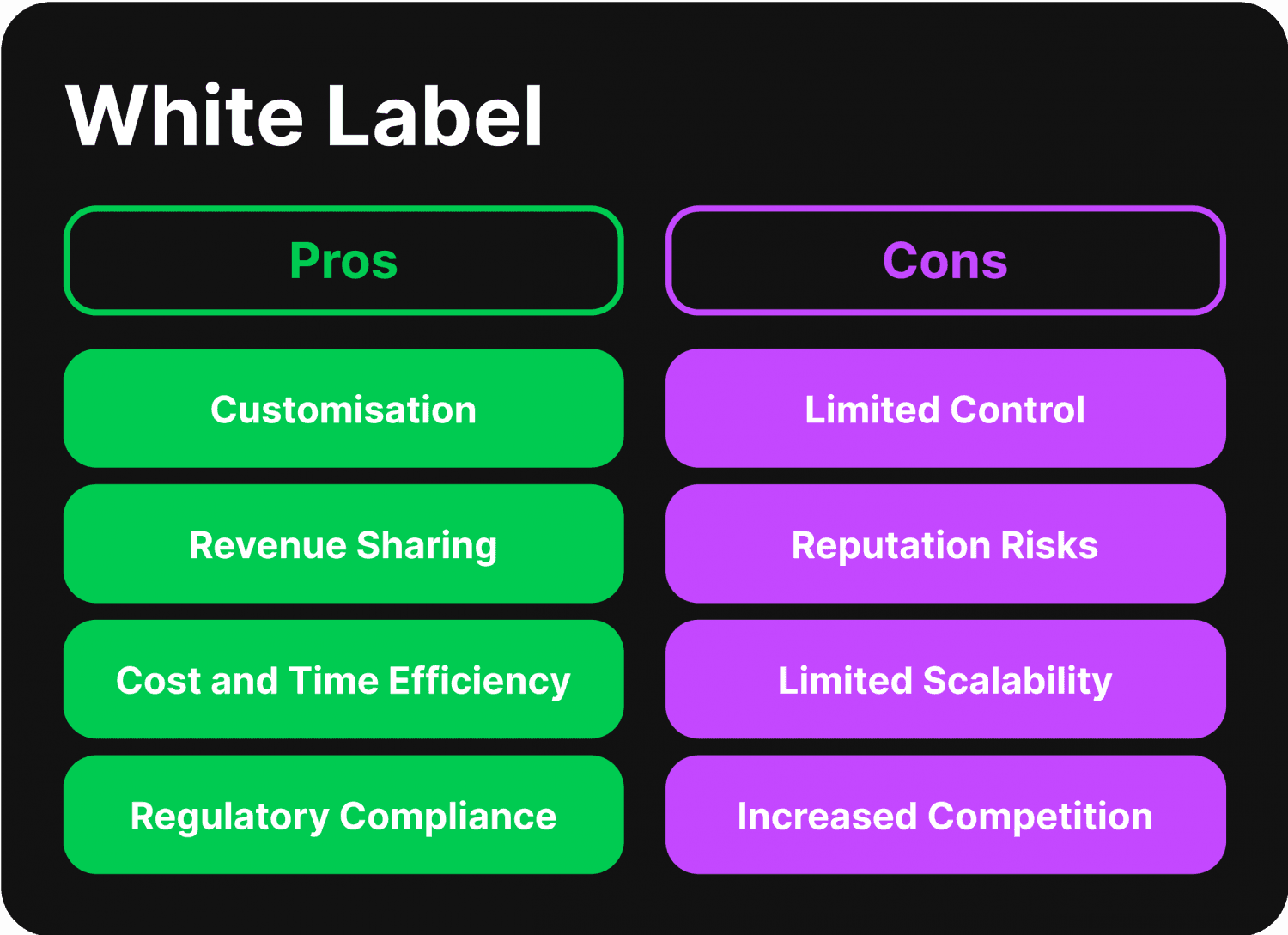

White Label Pros

Customisation - WL solutions offer the advantage of establishing a unique brand in the FX market, hence the appeal. This solution allows for customising trading platforms, websites, and marketing materials to match your brand identity, thereby distinguishing you from competitors.

Revenue Sharing - White-label solutions often offer revenue-sharing models in which partners receive a percentage of client spreads or commissions. This provides a lucrative income source, particularly if they attract a large number of active traders.

Cost and Time Efficiency - Choosing a White Label Forex trading platform can save time and money by leveraging the existing infrastructure and technology of an FX broker, allowing focus on marketing and customer acquisition instead of technical aspects.

Regulatory Compliance - FX brokers offering White Label online trading platform options typically have a strong regulatory framework, allowing white-label partners to benefit from parent broker oversight and compliance, fostering trust and fair trade execution.

White Label Cons

Despite many significant advantages, WL also has some drawbacks that traders and Forex brokers should be aware of when picking a White label solution. Here are these weaknesses.

Limited Control - Such solutions limit control over the trading platform, requiring partners to rely on the parent broker for updates, improvements, and technical support.

Reputation Risks - The reputation of a white-label partner is linked to the parent broker, and unethical practices or regulatory issues can negatively impact your brand image, so it's crucial to choose a trustworthy broker.

Limited Scalability - WL solutions may not offer the same growth potential as establishing an independent brokerage, as white-label partners rely on the parent broker's success.

Increased Competition - The FX market is highly competitive, and offering WL services can make it difficult to attract and retain clients, especially if you cannot differentiate yourself from the competition.

How to Find The Best White Label Provider

To choose the right white-labelled trading platform, consider factors such as the company's size, licensing and regulations, FX industry experience, fees and commissions, reputation, and products and services offered.

A larger company with a long service tenure is more likely to have a successful track record and credence among clients. A compulsory licensing and regulation check is also essential to add credibility to the provider. Estimating hidden fees and charges is crucial for assessing the financial situation. A solid reputation helps eliminate fraud and bias.

Also, research your target audience to choose a platform that caters to the needs of today's traders.

A White Label service provider should offer a spectrum of services with an easy user interface.

It is also important to research the market offer of FX technology partners, including their payment processors, copy/social trading solutions, branding options, ready-made packages, white label broker costs, and 24/7 technical support.

Choose a platform with built-in apps like the Client Office, payment gateway, copy/social trading, and advanced charts. These tools are essential for traders and should be integrated into the platform.

Understanding Grey Label

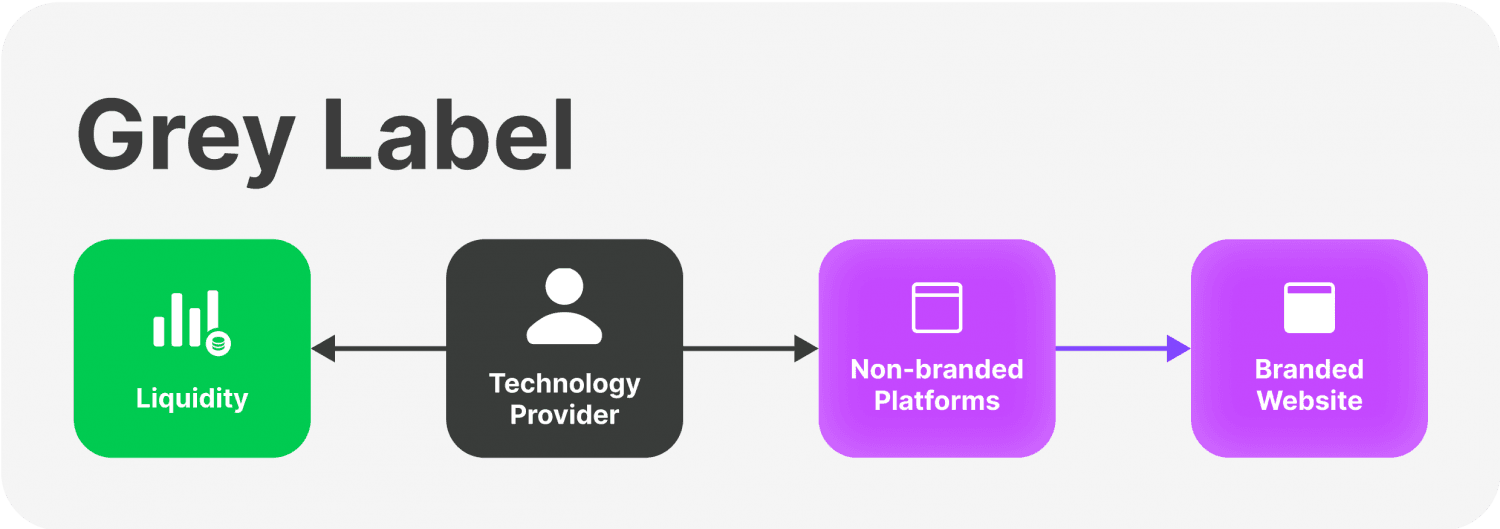

Grey Labels are similar to WLs but differ in approach. They allow businesses to promote their work using the provider's name, offering greater control over client relationships and customisation. GLs also have lower costs compared to WLs, making them a valuable tool for businesses seeking to differentiate themselves in the FX industry.

Grey Label is a cheaper version of White Label, requiring a license from an FX broker but remaining connected to their brand and technology. It's ideal for startups and less experienced individuals but offers less control and is technologically dependent on the broker, affecting their system issues.

An FX grey-label solution allows individuals or businesses to create their own branded FX trading platform without the need for a new platform. This solution allows for the adjusting of current trading infrastructure and technology, offering a seamless trading experience. The provider handles backend operations, allowing a focus on client acquisition and business development.

Benefits and Drawbacks of Utilising Grey Label Services

FX Grey Label is a popular choice for new brokers due to its numerous benefits. Here are only some of the advantages of the Grey Label.

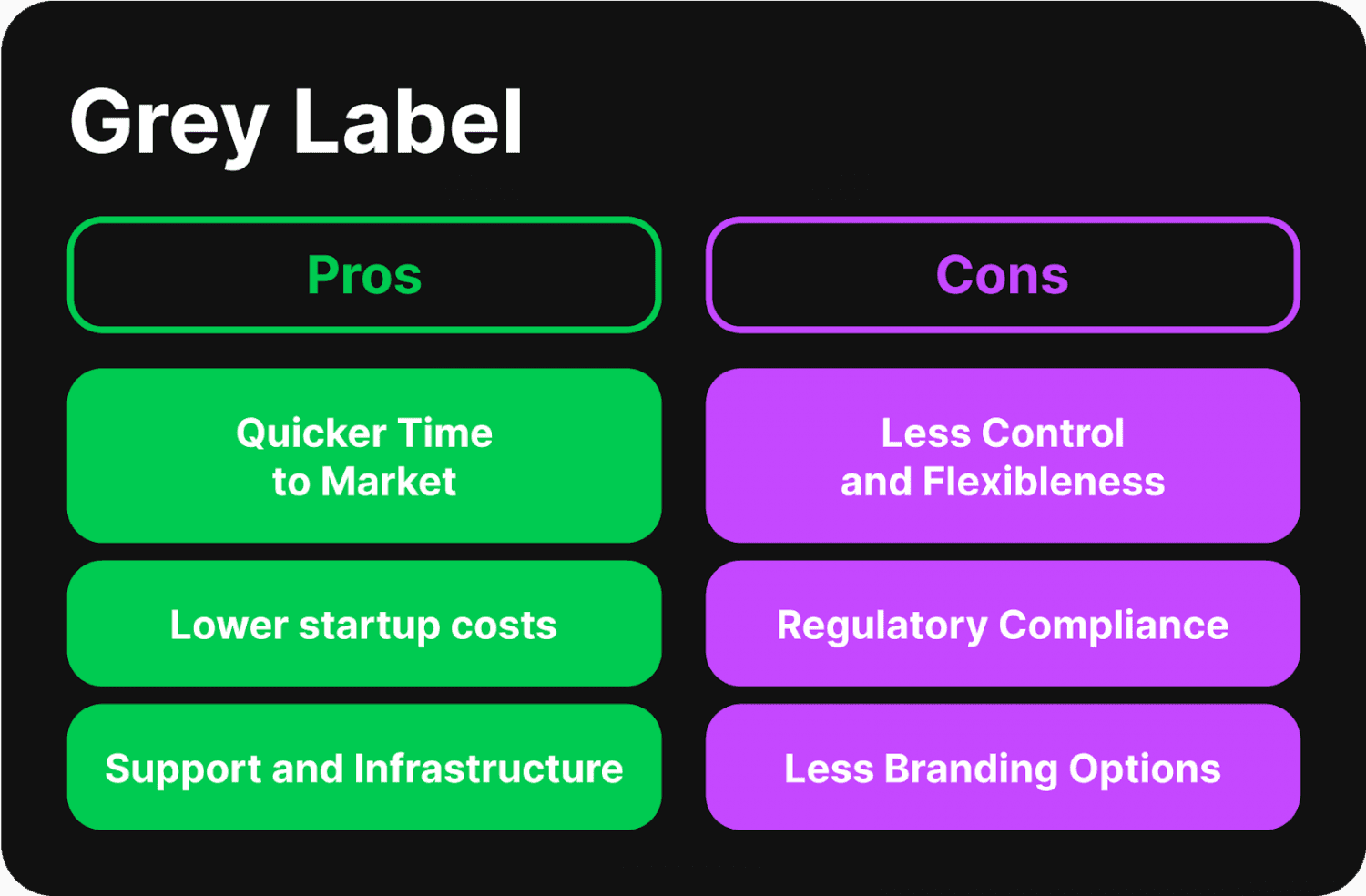

Grey Label Pros

Grey label software has many advantages that can simplify a brokerage setup, minimise startup costs, and enhance the underlying infrastructure of your business.

Quicker Time To Market - Forex Grey Label brokers can be established quickly, compared to WL ones, which can take months or years to develop. By leveraging the provider's existing technology and infrastructure, GL solutions allow for faster market entry, allowing focus on client acquisition and brand building.

Lower startup costs - FX GL brokers offer cost-effective options that eliminate initial capital expenditures associated with building an FX brokerage, reducing the need for extensive trading technology development.

Support And Infrastructure - Liquidity and operational support are compulsory for a reliable trading experience, freeing up time for client services and reducing technical and operational complexities.

Grey Label Cons - Despite their unique benefits, grey-label solutions have their fair share of shortcomings that need to be carefully considered before making the final choice.

Less Control and Flexibleness - The broker has restrained control over the third-party company's trading platform and infrastructure, restricting its versatility and adding potential limitations in offering services to clients.

Regulatory Compliance - When picking a GL option, brokers must ensure the providers are regulated by reputable authorities to foster transparency and trust in their services.

Less Branding Options - The broker may face limited control over its services' branding, making it challenging to distinguish itself from its competitors.

How to Find The Best Forex Grey Label Provider

FX Grey label providers offer a tailored product that combines brand expertise. They handle back-end operations like technology, liquidity, and risk addressing, allowing businesses to focus on client relationship management.

To enter a GL partnership, contemplate factors such as reputation, regulatory compliance, technology and trade venue quality, customisation options, and support and training resources. Choose a supplier with a good history of quality services, the latest technology and infrastructure, and excellent customer support to expand your finance services portfolio and meet client necessities.

Ensure the provider is regulated by a reputable authority to promote transparency and trust. Assess the level of customisation you can implement to brand the venue, website, and other client-facing aspects.

Collaborating with a reputable supplier with fair revenue-sharing models, transparency, and necessary tools can contribute to success in the dynamic FX trading world.

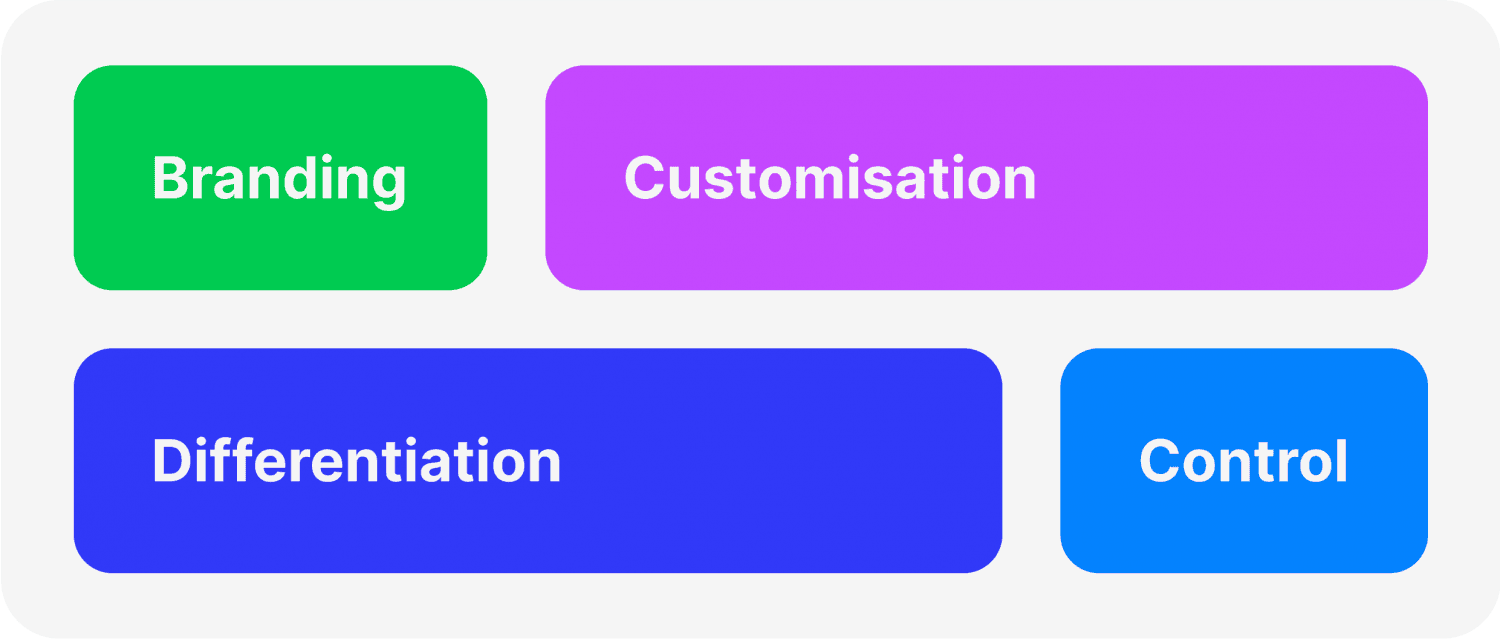

White Label vs Grey Label: Key Differences

WL and FX Grey Label solutions mainly differ in their level of control and customisation. WLs offer predefined branding and operations, while GLs provide more flexibility and customisation options. The key discrepancies between WL and GL are as follows:

Branding

WL alternatives display the supplier's brand prominently, while the manufacturer's identity is usually hidden. GL solutions display both the manufacturer's and supplier's labelling side by side or co-branded.

Customisation

WL suppliers have some control over product/service customisation, like packaging and features, but not the core product/service itself. GL suppliers can tailor aspects but not completely rebrand the product/service.

Differentiation

WL products can lack market distinctness due to multiple companies reselling them, while GL allows resellers to differentiate themselves.

Control

WL resellers rely on manufacturers for quality and support, while GL resellers have more control over product/service aspects but still rely on manufacturers for core functionality and support.

Bottom Line

Initiating a brokerage firm requires picking between WL and GL variants. The choice of the best provider is crucial, requiring thorough evaluation based on factors like regulatory compliance, reputation, customisation options, technology, and pricing structure. This will help you select a supplier that meets your distinguishing needs and start your Forex broker.

Read also