Share

0

/5

(

0

)

The foundation of any business is how it retains and fosters its customers. Sometimes, the will to find new clients overshadows the importance of existing ones. According to a study, companies have a 60%–70% chance of negotiating a deal with existing clients, compared to a 5%–20% chance with a new one. The brokerage business is no exception. One of the most essential things in the brokerage business is maintaining clients.

Brokers prioritise keeping their current clientele because it is frequently more economical than finding new ones. The emergence of social trading platforms has completely changed the trading environment.

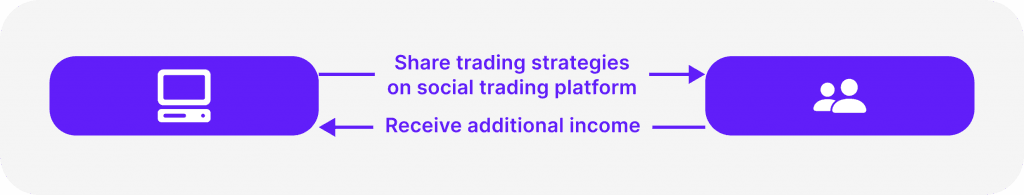

Through a mechanism called "social trading," investors can watch and emulate the trading techniques of experienced traders and establish a cooperative and instructive trading environment that keeps them engaged longer.

Integrating social trading software in the broker CRM makes the navigation and processes more streamlined, naturally increasing client retention, satisfaction, and sales.

Key Takeaways

People can copy the tactics of seasoned traders through social trading.

User satisfaction and engagement increase when social trading tools and CRM are integrated.

Prominent platforms offer a range of options that make social trading more convenient.

Social trading systems improve user experience by offering performance data and educational material that helps retain clients.

What is Social Trading?

Social trading was born with the growth of online trading platforms in the early 2000s. Following the pandemic, which caused some severe changes in our lifestyles, it became increasingly popular as more people sought alternate means of money and started trading. Trading platforms and social trading networks have made social trading more accessible.

Social trading is a contemporary strategy which allows traders to communicate and exchange trading ideas and methods. By imitating the transactions of their successful colleagues, traders might enhance their performance through this method.

Social trading uses a community's collective knowledge, unlike traditional trading techniques that primarily rely on individual study and decision-making. The social trading platform gives traders the means to communicate, follow and emulate the trading decisions of more seasoned traders.

Types of Social Trading

To fully understand the concept, let’s break down the types of social trading. The most common types include:

Copy trading allows another trader to replicate someone else automatically. This is especially helpful for novice traders who wish to imitate the tactics of seasoned traders. Using a user-friendly interface, copy trading software allows users to select traders to follow according to their performance and risk management.

Mirror trading is similar to copy trading because it allows the copying specific trades. However, it frequently offers a wider selection of automated trading tactics, which makes it appropriate for people who would instead take a hands-off approach.

Social following is keeping track of others' activity and insights without necessarily making duplicate trades. It is an educational experience, enabling traders to gain knowledge and make wise choices by drawing from the collective wisdom within the social trading network.

Crowd trading spots trends and makes group trading decisions. This method combines the decisions of a sizable number of traders and seeks to take advantage of the trading community's collective intelligence.

The Role of Social Trading in Client Retention

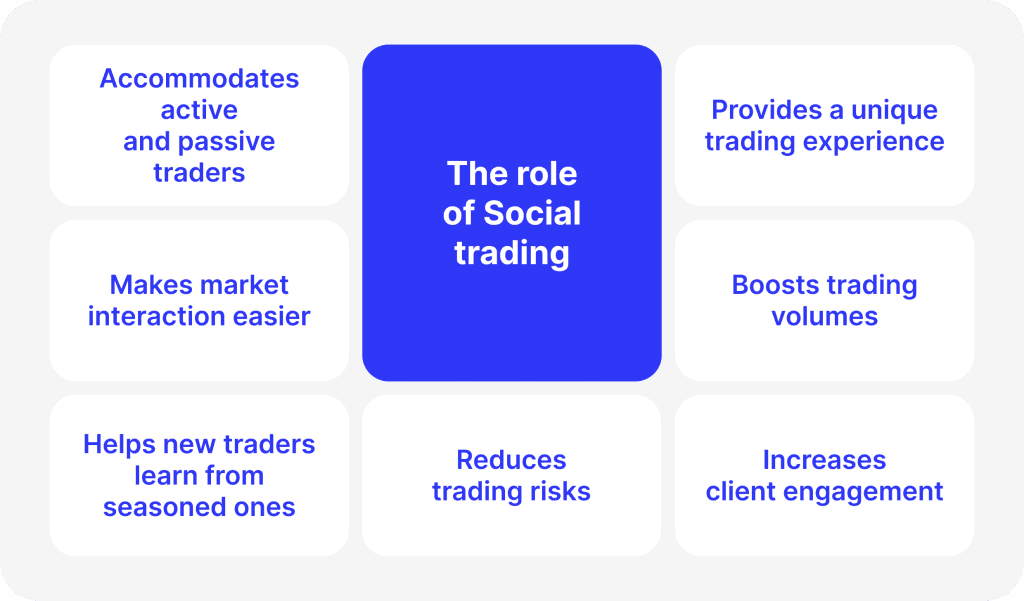

Due to its ability to accommodate a variety of lifestyles, social trading is attractive to active and passive traders. A less time-consuming and unpleasant approach to interacting with the market is through social trading, especially for individuals who know very little or nothing about trading. With the help of this method, new traders can learn from and gain confidence from seasoned traders without having to climb a high learning curve.

New Trading Experience

Social trading provides a unique experience that might maintain customers' interest and lessen the possibility that they will move to competitors. By revolutionising the trading industry, this new technology offers current and potential clients a fresh approach to participating in the financial markets.

By studying the tactics of more seasoned traders, this strategy allows customers to make well-informed judgements, improving their trading experience and encouraging platform loyalty.

Increased Trading Volumes

Social trading can benefit brokers and traders alike by increasing trading volumes and encouraging increased client engagement. Thanks to social trading platforms' accessibility and convenience, more customers participate in trading activities. Brokers benefit from these bigger volumes and more trades from this enhanced engagement. New clients may become more confident in engaging in the market by witnessing profitable trades. In addition to reducing risk, this approach allows traders to control their financial future by utilising tried-and-true trading techniques.

Social trading also draws in new customers by giving users a competitive advantage in the trading market. For people who want to get better at trading, having access to and using the tactics of successful traders is a significant advantage.

Furthermore, by enabling users to communicate and share knowledge, these systems' social component raises trader engagement and stimulate more trading activity. Because of this dynamic platform's supportive and community-building atmosphere, users are more willing to stick around and carry on with their trading.

It’s evident that a social trading strategy can benefit customers and brokers simultaneously. For brokers, it means improved customer satisfaction and brand recognition, which logically translates into more revenue. For clients, this is a democratised platform for education, with fewer risks and additional revenue streams.

[aa quote-global]

Fast Fact

The social trading market in 2021 was worth $2,229.56 and is expected to grow to $3,774.17 million by 2028. An estimated CAGR rise of 7.8%

[/aa]

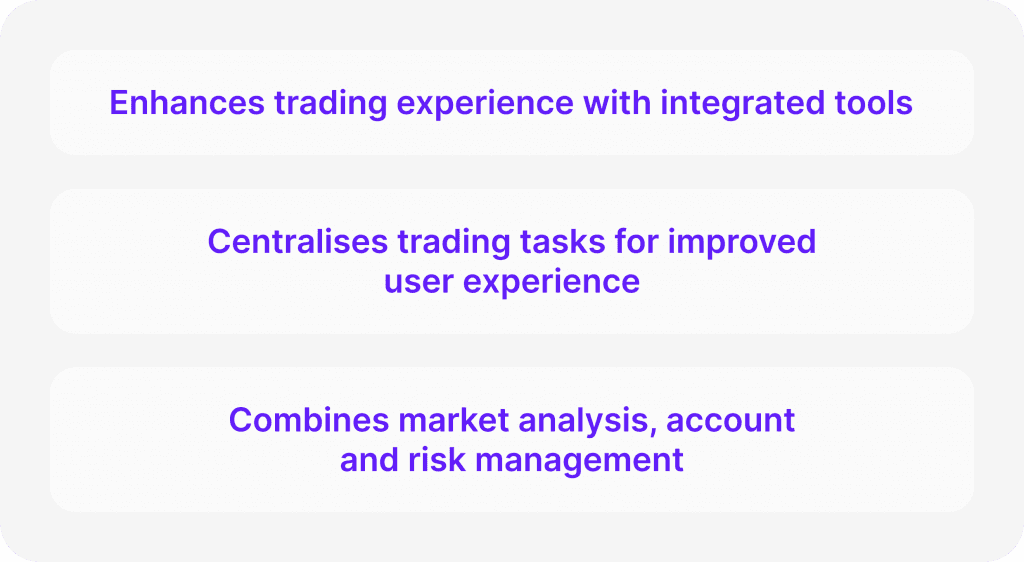

The Importance of Integration of Social Trading with CRM Systems

A broker's CRM system can be enhanced with social trading capabilities to provide a more efficient and simplified trading experience. Brokers can improve the trading experience for users by combining functions like market analysis, account management, and risk management tools into a single platform. This approach allows clients to monitor their trading history, communicate with other traders, and access educational materials without switching between different platforms.

Let’s take B2Core and B2Copy as examples, which offer a seamless trading environment. B2Copy is a potent copy trade tool that easily interacts with B2Core, a complete CRM solution. Through this interface, brokers can provide a platform where copy trading features, account management tools, and support services are readily accessible to current and potential clients. Brokers can enable clients to follow the profitable trades of experienced traders while giving novice traders the tools to make educated selections by utilising B2Core's capabilities.

Enhanced User Experience

CRM integration centralises all trading-related tasks, significantly improving the overall user experience. Users appreciate the convenience of having account management, social trading tools, and support all in one place. This integration allows clients to conduct trades effectively, monitor financial data, and follow market fluctuations. By providing a comprehensive platform, brokers may increase clientele, boost conversion rates, and provide a competitive edge in the Forex industry.

How to Build Trust Through Social Trading

One of the main aspects of retaining your clients is building trust between you and them. The dependability of signal providers is crucial in social trading. Extensive screening guarantees their legitimacy and ability to execute profitable deals. Usually, a thorough examination of their trading history, performance information, and general approach is part of this screening procedure.

Platforms should impose strict requirements on signal providers, emphasising their qualifications and performance history in the currency market. This methodical strategy fosters trust among copy traders, especially novice traders with little or no knowledge of these complexities.

Transparency and Performance Data

Transparency is essential to building confidence in social trading platforms. Giving clients access to comprehensive performance data enables them to make wise choices. This includes metrics such as previous performance, risk tolerance, and the quantity of performed successful trades.

Risk management resources must also be made accessible, enabling customers to lessen possible losses. The platform's integrity and dependability are guaranteed to be trustworthy to both new and current users through the availability of performance statistics and transparency in reporting.

Educational Resources

Educating clients is also essential to gaining trust. Educational materials ought to include a range of topics, including signal provider simulation and comprehension of the trading process. These tools can include webinars, seminars, and articles that break down the nuances of expert traders' methods and copy trading software. By offering these resources, platforms draw in more users and assist them in making wise selections, which eventually results in a more profitable trading experience.

Educational tools can benefit beginner traders the most because they may need more information to understand market movements and make effective judgements. Platforms that provide comprehensive data and valuable insights can enable existing customers to take charge of their financial future. Because they feel more assured and supported in their trading endeavours, clients are more likely to feel loyal and trusting of this strategy.

Top 5 Social Trading Software Solutions

As we've already discussed, client retention is critical because platform success is determined by user engagement and satisfaction. Below, we will examine some of the best social trading software, each with unique features and capabilities designed to satisfy the needs of different traders.

1. B2Copy

With its complete 3-in-1 solution that combines PAMM, MAM, and Copy Trading functions, B2Copy stands out. With the ability to handle more than 1,500 trades per second and offer broad connectivity across many trading platforms such as MT4, MT5, cTrader, and B2Core, it claims extremely quick execution capabilities. Numerous customisation options, including fee structures, minimum deposit requirements, and personalised profiles, accommodate varying trading tastes.

Promo and subscription codes, in addition to leaderboard and statistic widgets, improve user interest and involvement. According to performance measures, B2Copy served a large user base consisting of approximately 65 active brokers, 16,000 master accounts, and 40,000 investment accounts, with a massive turnover of $615.6 billion between May 2023 and April 2024.

2. eToro

eToro is well known for its large trading community and easy-to-use design. The platform has a lively community forum that encourages user participation and improves the trading experience. With no trading commissions, eToro has attracted a large user base of almost 30 million traders worldwide. Its copy-trading function makes advanced trading tactics accessible to even inexperienced traders by enabling users to mimic the transactions of profitable investors.

3. ZuluTrade

ZuluTrade has a vast network of signal providers and has made a name for itself in the social trading sector. Users can use the platform's powerful features for signal provider performance monitoring and analysis to make well-informed decisions based on past performance data. ZuluTrade supports automated trading techniques, giving traders who want to automate their investment portfolios flexibility and convenience. With operations in more than 192 nations, ZuluTrade serves many foreign users.

4. NAGA

NAGA provides a comprehensive social trading platform that emphasises community involvement and education. Its easy-to-use design integrates social networking so that users may share trading methods and insights. With NAGA's copy trading feature, users can mimic the moves made by top investors, increasing their chances of success in the financial markets. Additionally, the platform offers a wealth of instructional materials, such as webinars and tutorials, to equip traders with the information they need to make wise trading decisions.

5. Ayondo

With its social trading platform, Ayondo prioritises security and transparency by giving customers comprehensive performance information for each signal source. Through customisable risk management measures, users can track and replicate successful traders' deals using the platform's copy trading feature, which helps to mitigate risks. Ayondo, popular in Europe and Asia, draws consumers looking for a safe and open trading environment backed by a vital infrastructure and extensive customer service.

It’s hard to say which is the best copy trading solution because, in the end, it is a subjective matter and depends on your needs. Still, each platform has unique features and advantages that add to its appeal and success.

Final Thoughts

Social trading has a bright future ahead of it. Ongoing developments are anticipated to improve client retention tactics within the brokerage sector. Platforms will probably provide even more advanced capabilities, strengthening social trading's position in the financial industry.

Maintaining a devoted clientele through social trading requires creativity and a client-focused mindset. Brokerage businesses can create enduring connections by concentrating on their customers' needs and constantly improving their products.

FAQ

How Does The Social Trading Work?

People can study and repeat the trading methods of professional traders. This strategy allows users to mimic other people's investment strategies.

Differentiating Between Copy and Social Trading

Copy trading replicates profitable deals automatically without social contact or human decision-making, whereas social trading emphasises communication, education, and personal decision-making among traders.

When Did Social Trading Start?

In the early 2000s, social trading first gained popularity as a way to mimic profitable Forex trading techniques. Thanks to its expansion over time to cover a wide range of asset classes, retail traders with no prior trading expertise can now access it.

Read also