Share

0

/5

(

0

)

The Forex realm is a dynamic and challenging field that necessitates a multifaceted approach to differentiate itself from competitors.

Technology is revolutionising the way people interact with businesses. Online interactions are becoming increasingly common, replacing face-to-face conversations. Online client interaction has become a more comprehensive experience, extending beyond mere transactions.

This article will explore how customer service teams can use digital customer engagement strategies to improve customer satisfaction.

Key Takeaways

CRM systems are essential for providing a seamless customer experience.

FX businesses can benefit from CRMs to launch targeted marketing campaigns and increase client retention.

Using social media and omnichannel interaction are the strategies to boost client engagement.

What Is Digital Customer Engagement and Engagement Metrics?

Establishing strong, lasting connections with customers is essential for businesses, and proper interaction is key to achieving this. A study conducted by Salesforce revealed that 80% of customers place equal importance on how they are treated by a company and the products they purchase.

Developing genuine connections with clients is essential for fostering enduring relationships and increasing their loyalty to a company. This also helps a company differentiate itself from its rivals.

Digital customer engagement uses digital channels to build relationships, communicate with customers, resolve issues, and use strategies like social media pages, email marketing, company websites, and guest blogging.

Customer engagement metrics are essential for businesses to gauge their success. These include:

Сustomer satisfaction (CSAT): it measures customer satisfaction with a specific interaction, product, or service.

Social media metrics (likes, shares, reach, or engagement rate): this metric measures the activeness of the audience on social media platforms.

Feedback and reviews (even negative feedback): it show the user's thoughts about the brand.

Customer Effort Score (CES): it measures the ease of a user's experience with a specific interaction, product, or service.

Customer loyalty: this index is often associated with higher levels of engagement, as active engagement with a brand leads to emotional connections and loyalty.

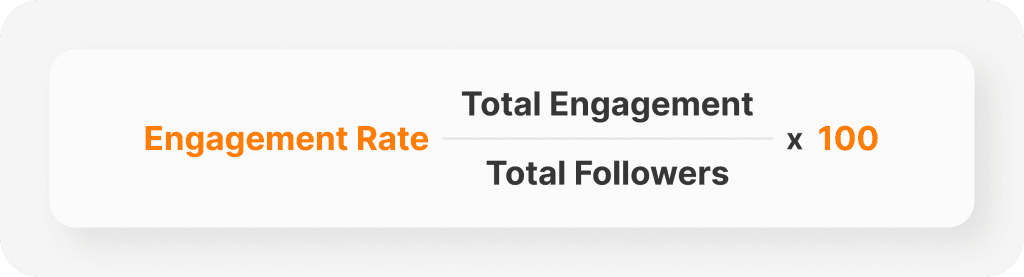

Customer engagement rate is another essential metric for FX broker firms. It measures the level of interaction with followers generated from user-created content or a brand campaign. The customer engagement rate formula looks as follows:

The Role of CRM in Customer Engagement

CRM (Customer Relationship Management) systems are essential tools for FX businesses to improve customer interactions, streamline processes, and maintain customer engagement. Forex brokers can use CRM insights to craft personalised campaigns by analysing customer data, including demographics, past interactions, and client preferences. CRMs help tailor communication and identify traders at risk of loss. CRM systems optimise resource allocation, allowing sales teams to focus on promising opportunities.

CRM software is essential for Forex businesses as it provides real-time visibility of customer histories, enhancing communication and engagement. It allows for efficient management of relationships with existing and potential traders, enhancing productivity. CRMs also help identify and eliminate customer churn issues by analysing customer trends and identifying when they tend to leave. By addressing these issues, businesses can retain more clients and increase revenue.

CRMs can also monitor individual clients, identifying trends in their behaviour and purchases that may indicate potential cancellations. Additionally, FX CRMs track client activity across multiple channels, identifying effective retention strategies and those needing improvement, facilitating smooth transitions between channels and fostering stronger partnerships.

Lastly, a CRM system enables direct engagement with clients. By optimising the email feature of a CRM, companies can update existing clients on new products, services, features, and more. They can also use dashboards, tasks, and calendar integration to engage with customers, such as sending automated, personalised emails or providing product recommendations based on past purchases.

How to Boost Digital Customer Engagement Using CRM

There exist many techniques to enhance digital customer engagement through CRM. Let's focus on some of the most popular customer engagement strategies.

Using Personalised Communication

Personalisation enhances customer satisfaction and helps increase customer retention by tailoring experiences based on personal preferences, past activities, and behaviour. This approach sets a brand apart in a competitive market, promoting recurring business through personalised solutions, greetings, and product suggestions.

Utilise CRM's customer segmentation capabilities to divide your audience into targeted groups based on demographics, behaviour, or preferences. Tailor communication through email campaigns, personalised messages, or targeted offers. CRM tools offer features like email templates, A/B testing, and performance analytics.

Providing Omnichannel Interaction

CRM data can help Forex brokers optimise their marketing channels by identifying the most effective ones for reaching and engaging with specific client groups. By analysing metrics like email open rates, website traffic, and social media engagement, brokers can allocate resources accordingly.

For example, if social media engagement is high, brokers can focus on creating content on that platform. Similarly, if email campaigns generate high conversion rates, they can refresh their strategies. In today's competitive Forex market, effective marketing is crucial for attracting and retaining traders. By leveraging CRM data, brokers can stand out and achieve greater goals in the dynamic Forex trading world.

Using Social Media

To retain traders on a Forex trading platform, you can share information and updates about the latest developments in the market, educate traders on your platform, write blogs to provide in-depth knowledge, connect with people, share promotional materials, ask for feedback and ratings, engage in forums and discussions to build relationships with new and existing traders and launch promotional campaigns to attract new traders. Asking for feedback and ratings on social media can help you understand and resolve the issues traders face faster.

By educating traders on the latest developments in the Forex trading market, you can help them stay on your platform and build a reputation for your platform. Connecting with traders through regular interactions and sharing promotional materials can help you build a more humane personality and leverage word-of-mouth publicity.

Gamification and referral programs

A gamified referral program uses game elements like points, levels, rewards, feedback, and social interaction to make the referral process enjoyable and rewarding. It can offer different reward tiers, provide feedback on referral status, and create a leaderboard or community for competition and collaboration.

Traders become players who trade in virtual currencies. They receive rewards for signing up, making their first trade, and following a specific strategy. They can also follow the advice of other skilled traders to improve their skills. The competition factor is attractive, as traders can climb the leaderboard and compete with others to find the best trading skills.

Gamification encourages customer engagement by adding an element of fun to the trading experience. It has the potential to help individuals generate income and collect crucial data. Additionally, it assists businesses in collecting trading approaches and obtaining crowdsource insights. Businesses implementing gamification techniques have observed a doubling in website traffic and engagement levels.

Gamification can enhance referral programs by leveraging intrinsic and extraneous motivations, fulfilling clients' needs, and building loyalty and trust. This approach can increase referrals, improve customer satisfaction, and foster a sense of belonging.

Social Trading and Money Management Services

Social trading and money management services enable traders to learn from and share their trading strategies with tools for managing and tracking investments. These services, influenced by social media, provide a platform for collaboration and sharing. Brokers benefit from these services, as they open up broader audiences, create a user-centred atmosphere, and boost transparency. They are a valuable tool for brokers, combining key Forex marketing strategy elements into one offering, making them an essential part of their marketing arsenal.

Closing Thoughts

In the current competitive market, CRMs play a vital role for businesses. Their assistance allows companies to gain a deeper understanding of their customers, tailor products and services to their specific needs, anticipate upcoming trends, enhance efficiency, and boost productivity.

Implementing a robust CRM system allows FX brokers to process customer inquiries quicker, improve customer service, and increase digital customer engagement indices. Delivering exceptional client experiences is crucial for enterprises to cultivate loyalty and improve customer relationships.

Read also