Share

0

/5

(

0

)

Stepping into the financial markets can feel like navigating a minefield, with studies showing that 70% to 90% of traders lose money. This daunting statistic underscores the critical need for preparation and practice before investing real capital.

Paper trading offers a practical solution. By simulating real trading scenarios without risking actual money, it allows traders to test strategies, develop skills, and gain confidence. Whether you’re new to trading or refining your techniques, paper money allows you to master market dynamics before diving into live trading.

Key Takeaways

Paper trading offers a risk-free way to learn and test strategies, but it lacks the emotional pressure and real-world execution challenges of live trading.

Top platforms like TradingView, thinkorswim, and eToro offer powerful tools and realistic simulations to enhance your trading skills.

Swing trading, options trading, scalping and other strategies can be refined through paper trading to fit your personal trading goals.

A successful transition to live trading requires consistent paper trading success, emotional readiness, and disciplined risk management.

What is Paper Trading?

Paper trading (or demo trading) is the practice of buying and selling financial instruments in a virtual environment without risking real money. This method allows traders to test strategies, understand market dynamics, and gain experience before committing actual capital.

Paper trading bridges the gap between theoretical knowledge and practical application, providing a sandbox for experimentation and learning.

Who Can Benefit from Paper Trading?

Beginners: New traders can familiarise themselves with trading platforms, learn order types, and grasp market mechanics without financial risk.

Experienced Traders: Seasoned traders can test or refine their strategies without impacting their real portfolios.

Investors Exploring New Markets: Those looking to venture into unfamiliar asset classes, such as options, futures, or cryptocurrencies, can use paper trading to understand their unique dynamics.

Paper Trading: Pros and Cons

While paper trading offers significant benefits, it’s essential to recognise its limitations. Let’s explore both sides.

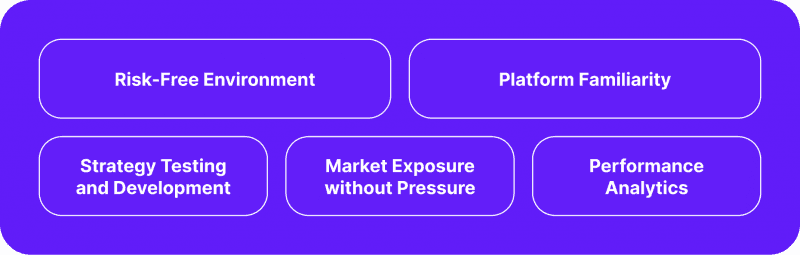

Among the pros of paper trading are:

Zero-Risk Setting: Traders can play around and learn without fearing losing money. This makes simulated trading a perfect option for education and skill development.

Platform Familiarity: Paper trading makes users proficient with trading tools and interfaces. From placing various order types to analysing charts, traders can navigate the brokerage’s features without the pressure of real financial consequences.

Strategy Testing and Development: Whether refining an existing approach or developing a new one, paper trading provides a safe space to test strategies in real-time market conditions. This process helps identify strengths and weaknesses before applying them in live markets.

Market Exposure Without Pressure: Beginners can observe and react to market movements without the emotional weight of actual profits or losses. This exposure aids in understanding market volatility and trends, building confidence over time.

Performance Analytics: Many paper trading platforms offer detailed analytics, enabling traders to track their performance, assess risk-reward ratios, and refine their strategies based on data-driven insights.

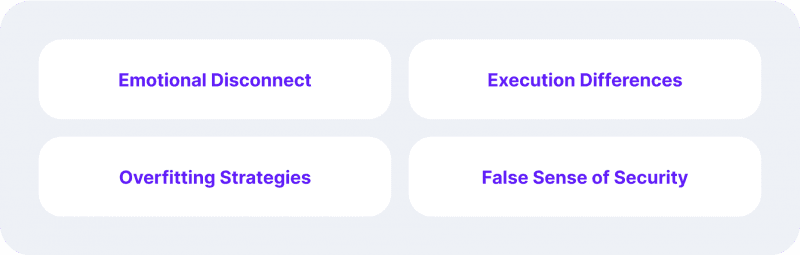

Cons of paper trading include:

Emotional Disconnect: Since no real money is at stake, traders may not experience the fear or greed that often influences decision-making in live trading. This absence can lead to overconfidence and unrealistic expectations.

Execution Differences: Simulated trades may not accurately replicate real-world execution. Factors such as slippage, liquidity issues, and transaction fees are often not accounted for in paper trading, leading to discrepancies between simulated and actual trading outcomes.

Overfitting Strategies: Strategies that perform well in a simulated environment might not translate effectively to real markets due to the absence of real-world challenges, such as market noise and unexpected events.

False Sense of Security: Success in paper trading can sometimes mislead traders into believing they are fully prepared for live markets, resulting in overconfidence and potential financial losses.

How to Start Paper Trading

If you’re ready to explore the world of paper trading, the process is simple and rewarding. Follow these steps to ensure you’re making the most of your simulated trading experience:

Step 1: Choose the Right Paper Trading Simulator

The first step is selecting a platform that suits your needs. Look for these key features:

Real-Time Data: A reliable simulator should provide accurate, up-to-date market data.

User-Friendly Interface: Whether you’re a beginner or an advanced trader, the platform should be intuitive and easy to navigate.

Asset Variety: Ensure the platform supports the assets you want to trade, such as stocks, options, forex, or cryptocurrencies.

Pro Tip: Before diving into trading strategies, spend time understanding market behaviour. Observe how different assets react to news events, analyse their price movements, and study key indicators like moving averages and RSI. This foundational knowledge will give you a deeper understanding of market dynamics and help you make better-informed decisions during your paper trading journey.

Step 2: Open a Paper Trading Account

Most platforms offer free paper trading accounts, making simulated trading accessible to everyone. Setting up an account is typically straightforward:

Sign up for the platform of your choice.

Choose the “paper trading” or “simulation” mode.

You’ll be assigned virtual funds—often between $10,000 and $100,000.

For instance, Interactive Brokers provides a virtual account with $1,000,000 in simulated funds, giving traders ample room to test high-risk strategies.

Step 3: Set Initial Parameters

To simulate real trading conditions, start by:

Setting a Realistic Virtual Balance: Choose an amount close to what you might actually invest in live trading if this is possible. For example, if you plan to trade with $5,000 in the future, set your paper trading account balance to the same amount.

Mimic Realistic Transaction Costs: Platforms like thinkorswim allow you to factor in commissions, slippage, and other fees that impact real-world results.

Step 4: Develop a Trading Plan

A solid trading plan is the backbone of successful trading. Your plan should include:

Trading Goals: Are you practising day trading, swing trading, or long-term investing?

Risk Tolerance: Define the risk you will take per trade (e.g., no more than 2% of your account balance).

Strategies: Choose a strategy to test, such as trend following or mean reversion.

Consider adding indicators like moving averages, RSI, and Bollinger Bands to your simulated trading. For instance, an RSI below 30 suggests oversold conditions, while combining it with prices touching the lower Bollinger Band can signal a buying opportunity—ideal for testing in paper trading.

Pro Tip: Focus on testing one strategy at a time in a paper trading environment. This allows you to evaluate its performance under various market conditions and refine it before applying it in real trading.

Step 5: Start Trading and Monitor Performance

Once your account is set up and your plan is ready, it’s time to execute trades:

Use the same mindset as if you were trading real money. Avoid treating paper trading like a game.

Track every trade in a journal. Record entry and exit points, reasons for the trade, and outcomes.

Regularly review performance metrics such as win/loss ratio, average profit per trade, and maximum drawdown.

Best Paper Trading Platforms

Embarking on your trading journey requires a solid foundation — the right paper trading platform. Several platforms stand out for their features, user experience, and educational resources. Let’s explore some of the top contenders:

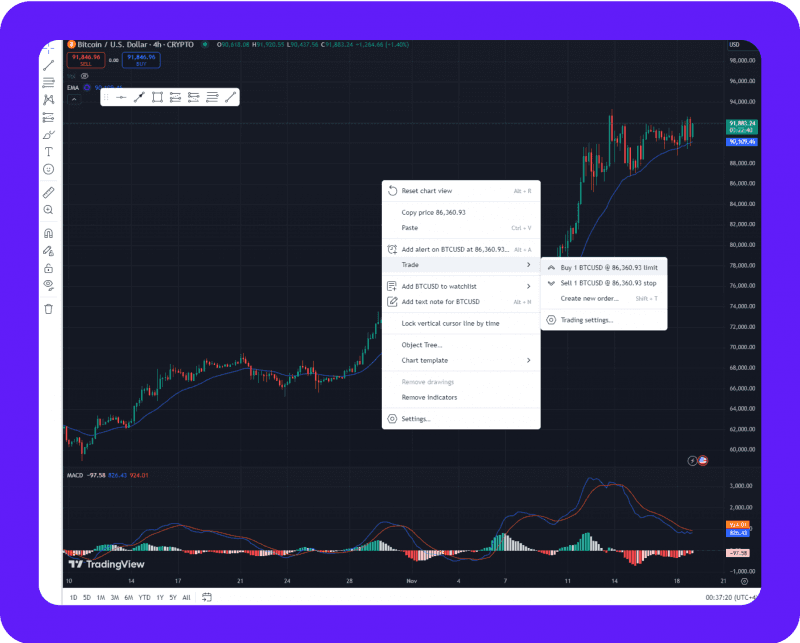

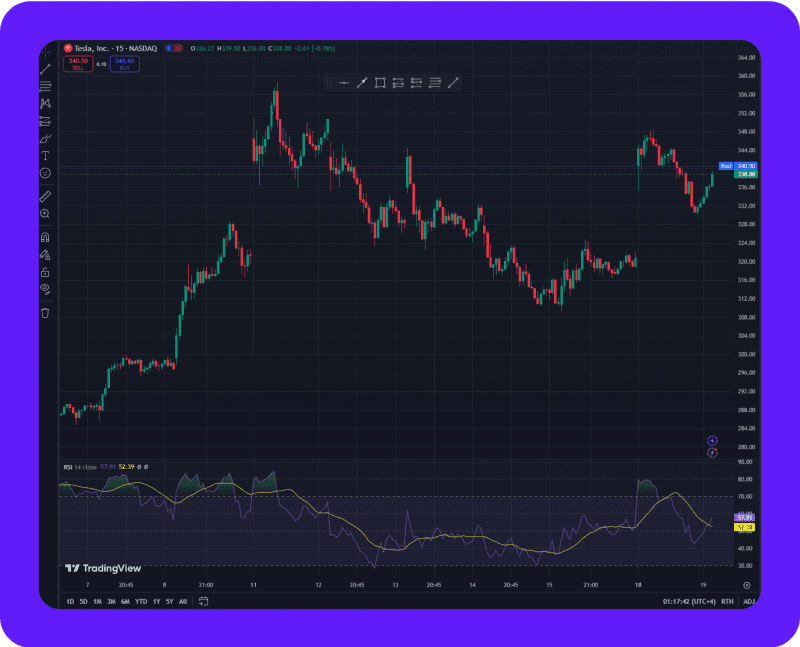

TradingView

TradingView is a global hub for traders and analysts, offering cutting-edge tools for charting and market research. The platform is perfect for technical analysis enthusiasts and traders looking for an interactive, collaborative learning experience.

TradingView’s paper trading simulator gives you access to real-time data and a treasure trove of technical indicators. Whether you’re a beginner learning RSI or pro scripting your indicators with Pine Script, you’ll find everything you need here.

[aa quote-global]

Fast Fact

TradingView is a vibrant community of over 90 million users worldwide, where you can share ideas, learn from others, and fine-tune your strategies.

[/aa]

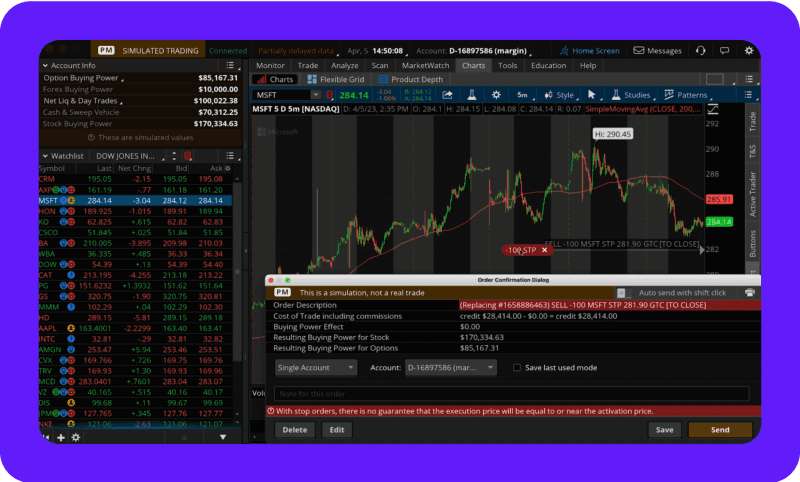

TD Ameritrade’s thinkorswim

Crafted by traders for traders, thinkorswim is the platform where professionals push the boundaries of their strategies. With advanced analytics, customisable charts, and robust options trading features, it remains the best paper trading platform for seasoned traders.

The paperMoney® simulator is equipped with $100,000 in virtual funds and provides access to real-time market data. thinkorswim enables practice trading across stocks, options, futures, and forex using professional-grade tools.

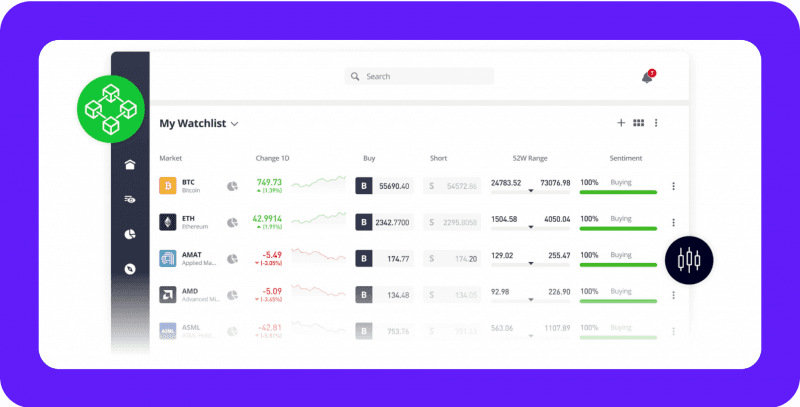

eToro

eToro reinvents trading by transforming it into a social experience. Its CopyTrader™ feature allows users to replicate the trades of successful investors, fostering a community-driven approach to trading.

The platform offers a virtual portfolio with $100,000 in virtual funds, enabling users to practice and refine strategies across stocks, ETFs, and cryptocurrencies.

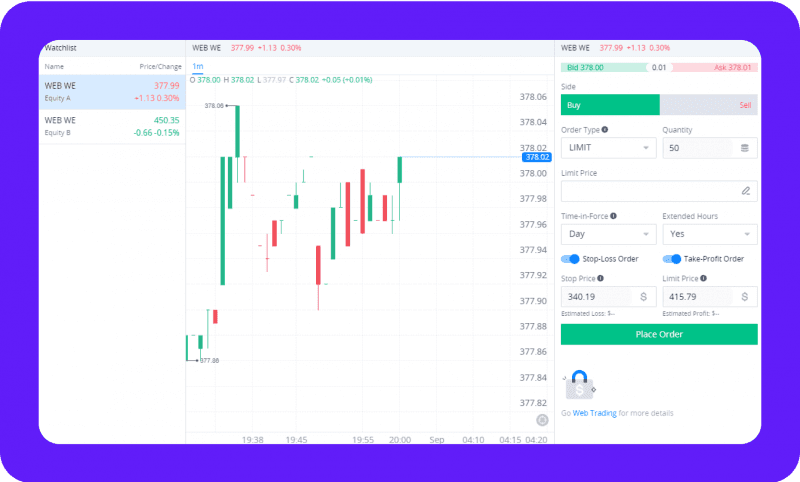

Webull

Webull seamlessly blends user-friendly design with advanced trading tools. The platform features a sleek interface, real-time data, extended trading hours, and a variety of technical indicators. Its paper trading account provides a frictionless environment for practice.

Webull offers commission-free trading, even when transitioning to live markets, which is a significant advantage for cost-conscious traders. It’s suitable for new traders eager to start without feeling overwhelmed, yet powerful enough for veterans to fine-tune their strategies.

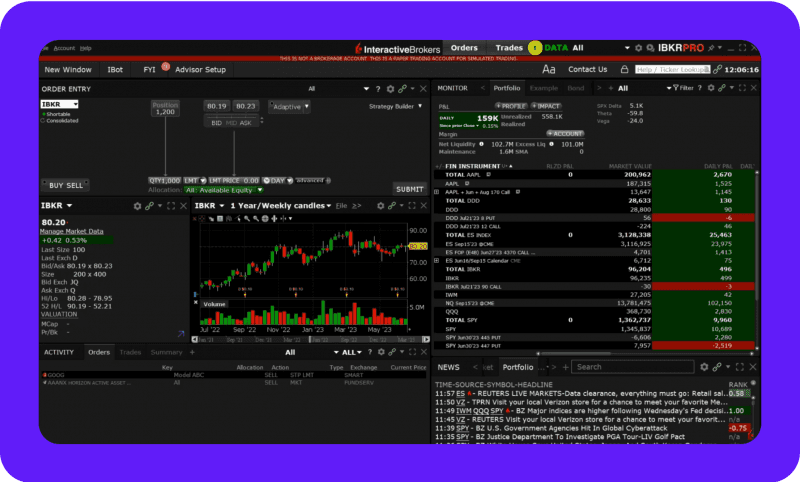

Interactive Brokers (IBKR)

Interactive Brokers is an established brokerage offering a gateway to worldwide markets. Its offers the best brokerage account for paper trading, which mirrors the real-world trading environment, offering access to thousands of instruments, including stocks, ETFs, currencies, and commodities.

Advanced analytics, real-time monitoring, and comprehensive reports make this broker a favourite for serious traders and investors.

[aa quote-global]

Fast Fact

Founded in 1978, Interactive Brokers has grown into one of the world’s largest and most trusted trading platforms.

[/aa]

Paper Trading Strategies

Paper trading is your risk-free sandbox to test and refine strategies. By experimenting with different approaches, you’ll uncover what works best and gain confidence for live markets.

Day Trading

Day trading focuses on short-term price movements, with trades opened and closed within the same day. It thrives on market volatility and liquidity, making it ideal for assets like stocks, forex, and cryptocurrencies.

In paper trading, you can practice identifying intraday trends using indicators like moving averages, setting stop-loss orders to protect against losses, and analysing volume to time your trades effectively. The goal is to develop quick decision-making skills and a disciplined approach to handling rapid market movements.

Start with a single market or asset class to understand its behaviour before diversifying into others.

Swing Trading

Swing trading focuses on holding positions for several days to weeks, aiming to profit from price swings. It’s a slower-paced strategy compared to day trading but requires a solid grasp of technical analysis and market trends.

Use indicators like the RSI to identify overbought or oversold conditions and Fibonacci retracements to pinpoint entry and exit levels. Pay attention to chart patterns like flags and head-and-shoulders formations, which signal potential price movements. Swing trading also benefits from monitoring news events or earnings reports, as they can significantly influence prices.

Set realistic targets and adjust your stop-loss levels as trades progress to lock in profits or minimize losses.

Options Trading

Options trading involves buying or selling contracts that give you the right, but not the obligation, to buy or sell an asset at a predetermined price. This strategy allows you to leverage small amounts of capital for potentially larger returns.

In paper trading, focus on understanding basic options concepts like strike prices, premiums, and expiration dates. Start with simple strategies like covered calls or protective puts before experimenting with advanced techniques like iron condors or straddles. Analysing the impact of implied volatility on option pricing is also critical to mastering this approach.

Begin with straightforward, single-leg options strategies to build confidence before moving to complex multi-leg setups.

Scalping

Scalping is a high-frequency trading strategy to profit from small, rapid price changes. Traders typically hold positions for just seconds or minutes, making multiple trades throughout the day. This approach is best suited for highly liquid assets like major forex pairs or large-cap stocks, where tight spreads and quick execution are crucial.

In paper trading, practice executing trades efficiently using hotkeys or automated tools while analysing bid-ask spreads to find the optimal timing for entry and exit. Managing transaction costs is also critical, as frequent trades can erode profits in live markets.

Scalping demands intense focus and precision, so start with one or two assets to master the rhythm of the market before expanding your portfolio.

Key Metrics to Monitor

To evaluate the effectiveness of your strategies, track the following metrics during your paper trading sessions:

Win/Loss Ratio: This measures how often your trades are successful compared to unsuccessful. A higher ratio indicates better consistency.

Average Profit/Loss Per Trade: Understand how much you typically earn or lose, which helps determine if your risk/reward ratio is favourable.

Maximum Drawdown: Monitor the largest decline in your account balance to assess your risk tolerance and adjust your approach as needed.

Transitioning from Paper Trading to Live Trading

Shifting from paper to live trading is an exciting but challenging milestone. While paper trading allows you to practice strategies without financial risk, live trading introduces real money—and with it, the emotions and pressures that come with actual gains and losses.

Before you move to live trading, assess your readiness on these key fronts:

Consistent Success: If you’ve been consistently profitable in your paper trading over several weeks or months, your strategies are working well. Success in simulation doesn’t guarantee the same in live markets, but it’s a positive sign.

Platform Proficiency: Ensure you’re fully comfortable with your trading platform. You should know how to execute different order types, set stop-losses, analyse charts, and navigate features seamlessly.

Emotional Preparedness: Live trading introduces psychological challenges, such as the fear of losing money or the greed of chasing gains. Reflect on whether you’re ready to face these emotions without deviating from your plan.

How to Transition?

Don’t rush into large trades. Begin with a modest amount of money that you can afford to lose. Use small trade sizes to limit your exposure while getting used to the realities of live trading.

Stick to the plan. Carry forward the strategies and risk management techniques you developed in paper trading. Don’t be tempted to chase quick wins or abandon your plan during periods of volatility. Stay disciplined, especially when emotions try to influence your decisions.

Maintain a trading journal to document every trade. Record your reasons for entering and exiting, and reflect on what went well or poorly. The live market environment is dynamic. Use your trading journal insights to tweak strategies over time.

Psychological Considerations

The emotional aspect of live trading is one of the biggest hurdles for new traders. Paper trading eliminates the fear of loss, but in live trading, the stakes feel real. Here’s how to manage this transition effectively:

Control Risk: Set strict stop-loss levels for every trade. Risk no more than 1-2% of your account balance on a single trade.

Build Emotional Resilience: Practice mindfulness or meditation to stay calm during volatile periods. Focus on the process, not the outcome. A good trade is one that follows your plan, regardless of the result.

Avoid Overtrading: Excitement or frustration can lead to impulsive decisions. Take breaks after significant wins or losses to regain composure.

Conclusion

Paper trading is a valuable resource for traders at any stage of their growth. It offers a safe, no-risk space to understand trading platforms, fine-tune strategies, and gain the confidence needed to succeed in live markets.

The transition to live trading requires preparation and emotional resilience, but the skills honed through paper trading serve as a solid foundation.

FAQ

Can you make money from paper trading?

No, paper trading is done with virtual funds, so you don’t earn real money. However, it’s an invaluable tool for building skills, testing strategies, and preparing for live trading where you can earn real profits.

How realistic is paper trading?

Paper trading closely mimics live market conditions, including price movements and trading tools. However, it often lacks factors like emotional pressure, slippage, and liquidity challenges, which are common in real trading.

How long should you paper trade?

The time required for paper trading varies based on your level of experience and confidence. For beginners, it may take at least four to six months to build foundational skills, while seasoned traders can use it occasionally to experiment with new strategies or improve existing ones.

Read also