Share

0

/5

(

0

)

Financial markets are rich with opportunities for traders to make money and for brokers to grow wealth. Most of these venues are subject to different factors affecting the price movements and valuation, offering various approaches to balance someone’s portfolio.

As a broker, you need to fulfil your client’s investment needs and attract new customers to grow your multi-asset class trading platform. In this article, we will review the top trading asset classes and highlight the trends and dynamics in each market.

Key Takeaways

Asset classes are financial instruments categorised based on their characteristics and applicable laws.

Multi-asset class trading offers portfolio diversification value, enabling investors to distribute their funds and risks.

Stocks, stock indices, ETFs, NDFs, energy equities, commodities, precious metals and fixed income are the main asset classifications that offer value growth and hedging possibilities.

Understanding Asset Classes in Trading

Asset class refers to categorising financial instruments based on their characteristics and regulations affecting their market performances.

Investors use this classification to distribute their funds and create a balanced portfolio where the risk is scattered across multiple markets, profitability models and regulatory environments.

Classically, stocks, bonds, and cash were the major asset classes. However, more types of alternative asset classes were added, like cryptocurrencies, money market funds and cash equivalents. The development of financial and trading systems led to the expansion of these alternative investments.

Launching a multi-asset brokerage firm allows you to attract experienced traders who want to diversify their investments across multiple markets to minimise exposure risk and capitalise on breakthrough opportunities.

What Are The Most Profitable Asset Classes?

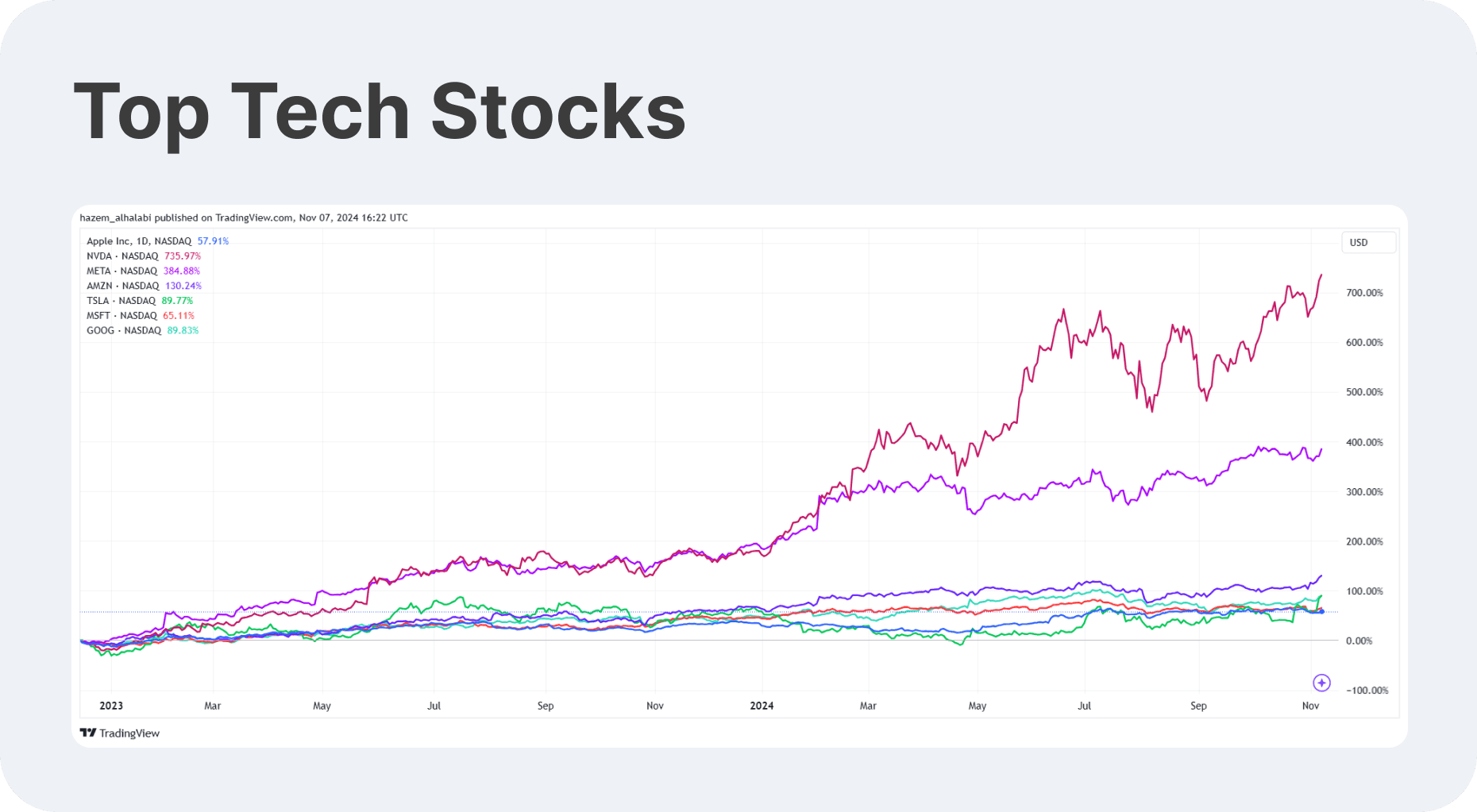

Each market has its own trend. For example, tech stocks, like Nvidia, Meta and AMD, performed massively in 2023, while the crypto market witnessed historical growth in Q1 2024.

However, in today’s day and age and after the recent US elections, the dynamics might change. Stocks and commodities might be the most growing instruments.

The newly elected US president, Donald Trump, promised significant tax cuts and support for energy production to support local industries, which can reflect positively on the power, renewable energy and fossil fuel manufacturing and sales performance.

[aa quote-global]

Fast Fact

On 4 November, Nvidia’s market capitalisation exceeded $3.4 trillion, overtaking Apple as the most valuable company in the world.

[/aa]

Types of Asset Classes

The development of trading markets and technology led to more diversification, offering traders and brokers more opportunities to seek financial well-being.

Equities

Shares are typical trading instruments used to claim ownership of company stock and benefit from market growth and dividends. New and experienced traders invest in stocks, tracking companies’ performances, sales activity and earnings, which are reflected in the trader’s account.

Tech stocks were in the spotlight in 2023-2024, triggered by the massive artificial intelligence developments and cutting-edge technologies that benefit other industries. Meta, Apple and Nvidia were some of the best tech equities, garnering significant returns for shareholders.

Equity investment is straightforward, using a comprehensive understanding of macroeconomics, earning reports and regulatory changes. Moreover, private equity investments offer exclusive profitability that requires advanced intel and market reach.

Equity Indices

A stock index is a benchmark of multiple equities grouped by type or market capitalisation. Indices give a snapshot of categorical market performances, offering traders an in-depth view of the industry’s health.

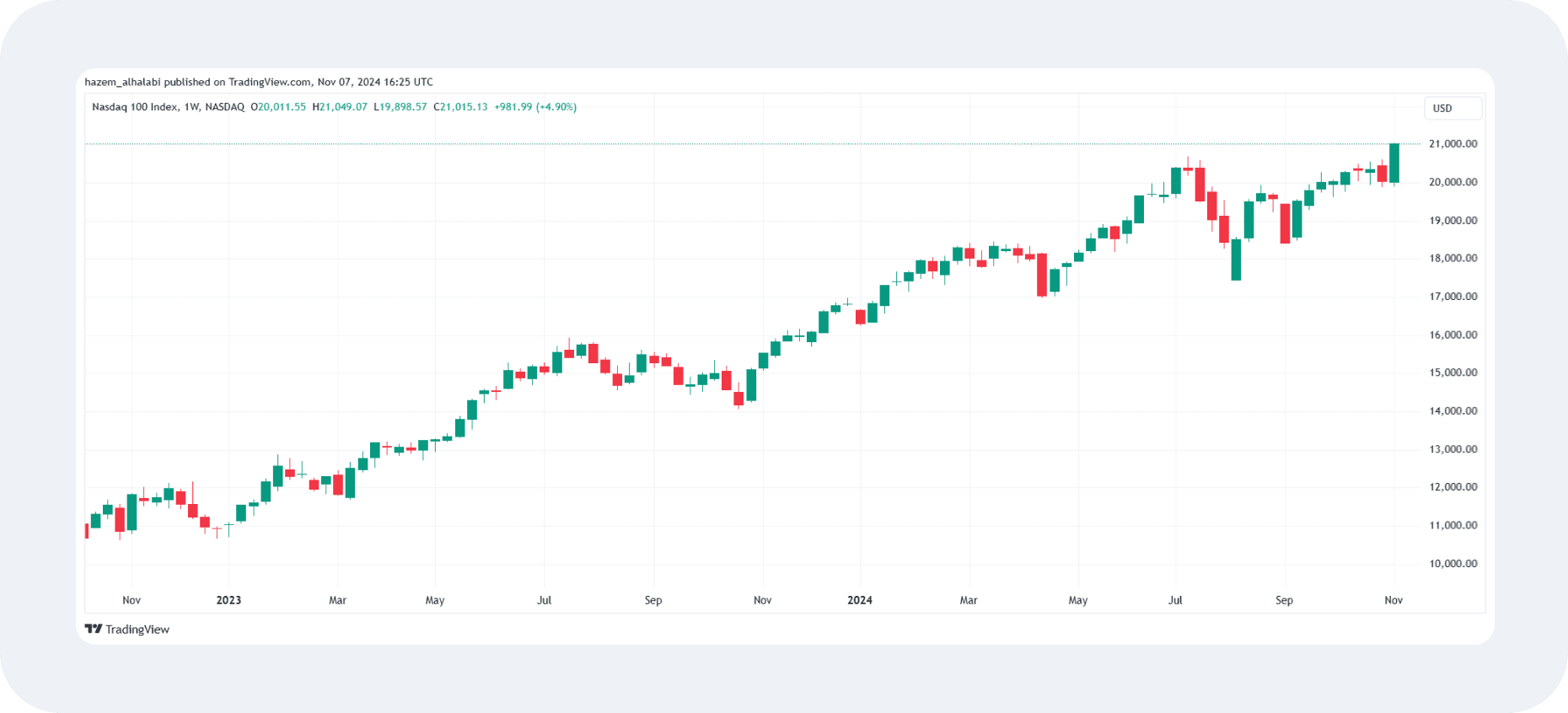

The tremendous performance of AI-based and tech stocks led to significant growth in the NASDAQ 100 and S&P 500 indices, which include some of the largest technology and software developers.

This year, NASDAQ grew by over 35% compared to the previous year, while S&P recorded similar figures (+36%) to 2023.

Indices are great tools for investing in industrial trends, allowing traders to capitalise on overall market movement instead of single-stock performance.

ETFs

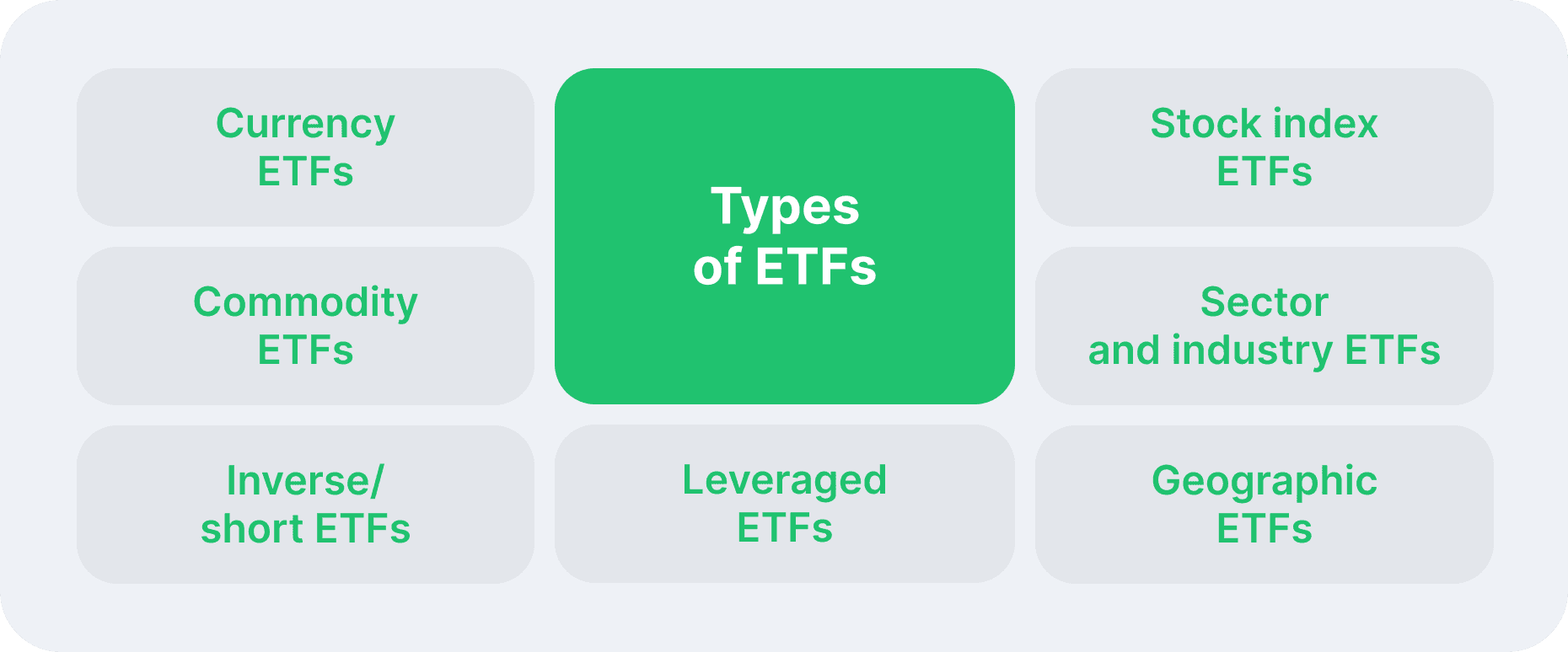

Exchange-traded funds are instruments that span various products in financial bundles. ETFs provide real-time performance tracking of the underlying investment assets, directly reflected in the ETF’s price.

Financial institutions and stock exchanges issue these bundles, allocating stocks, bonds and other asset classes. ETFs may focus on one or more industries and offer a more balanced asset allocation approach.

Invesco QQQ and Vanguard Information Technology ETF have been performing positively in 2023 and into 2024, triggered by the massive developments in technology and AI-based models.

Despite not offering sufficient volatility to secure short-term returns, ETFs are excellent long-term investments for risk management.

NDFs

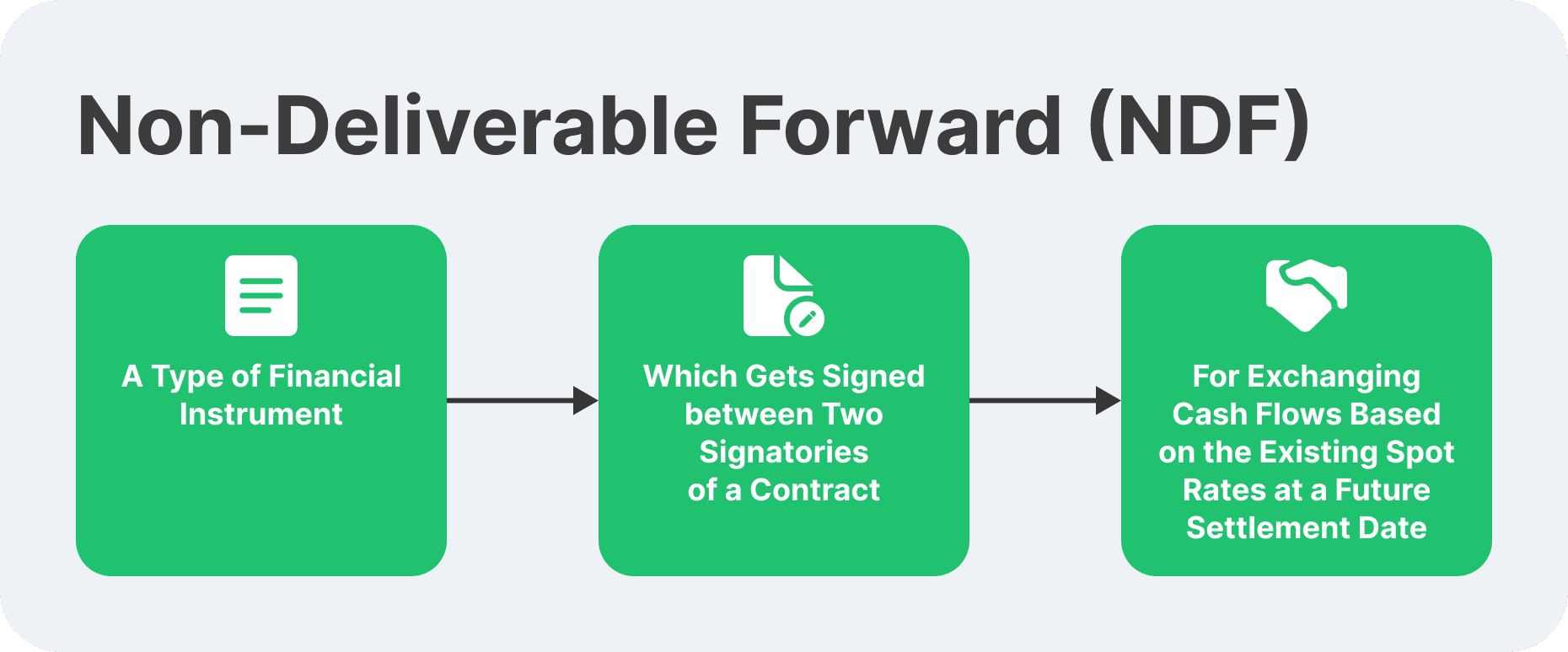

Non-deliverable forwards are financial derivatives used to hedge against risky market positions or unpredictable movements. They were created for trading Forex as an asset class to speculate on currency fluctuations but were later introduced to other types of asset classes.

NDFs might look similar to options and futures contracts. However, they are settled only in cash, while futures require order execution for the underlying security and ownership transfer upon contract expiry.

In 2023, NDFs gained traction in emerging currencies like Indian Rupee, Brazilian Real and Chinese Yuan due to global economic shifts. They offer lucrative opportunities in exotic currency pairs, where risks are usually higher. However, they do not require ownership or exchange using the associated pairs, facilitating accessibility and hedging.

Energy Products

Oil, natural gas, and renewable energy are critical trading asset classes of historical, national and economic importance. Energy products are vital inputs for industrial manufacturing, and their supply, prices and speculations highly affect energy company stocks.

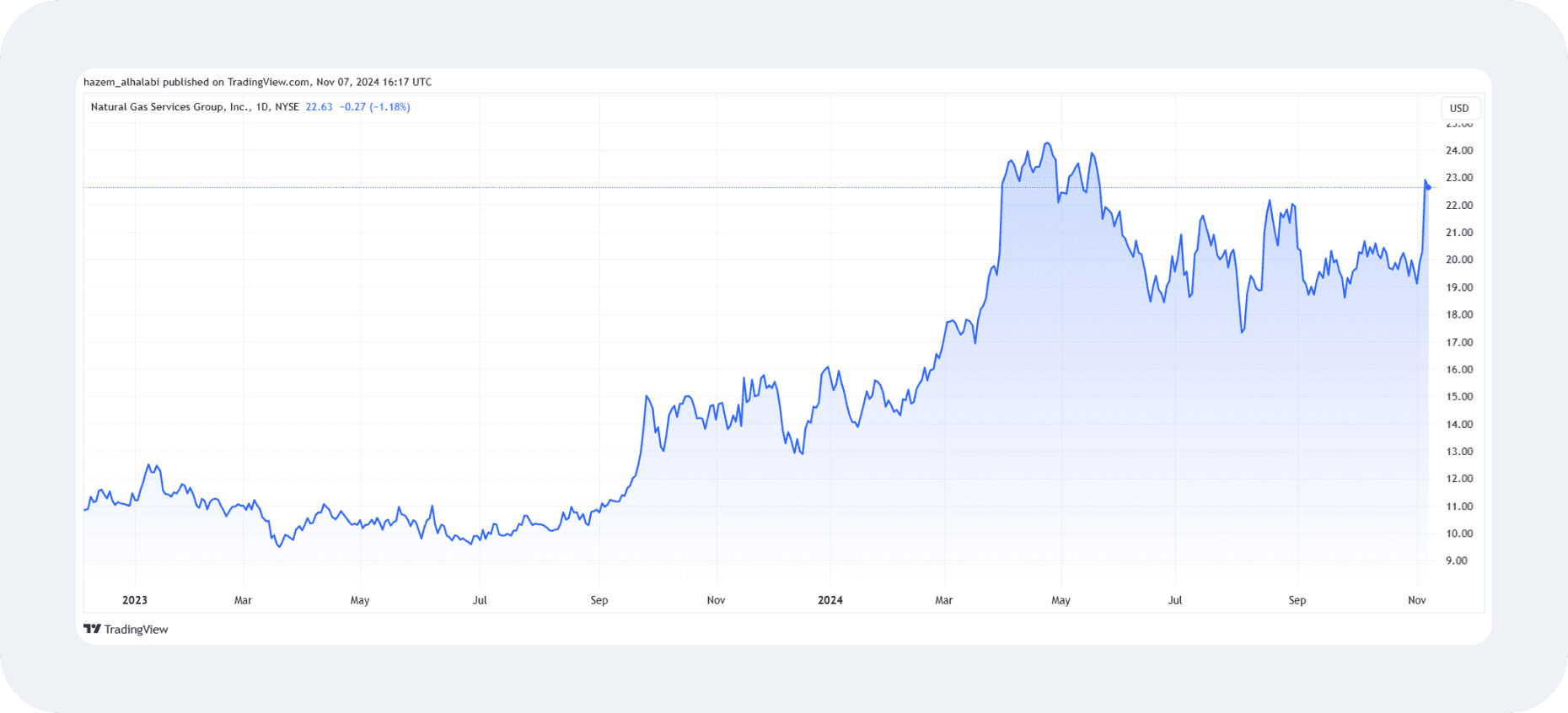

Natural Gas, WTI Crude, and Brent Crude Oil have been highly volatile the last two years due to supply chain disruptions, geopolitical crises, and global economic slowdown, which have highly affected earnings and stock prices.

However, the global shift towards renewable energy sources and the US focus on local energy production can stimulate recovery for leading manufacturers like Chevron and Exxon Mobil. Moreover, they are essential asset classes in trading, offering inflation-resistance value and exposure to overall energy demands.

Precious Metals

Gold holds a historical value and is described as a safe haven during market uncertainty, while silver, platinum and other metals provide various valuation benefits.

This year, silver has grown substantially, offering over 40% price value compared to 2023, while gold reached multiple all-time highs this year, peaking at $2,780 by the end of October.

Much of these valuations were attributed to global market uncertainty, as investors turn to these tangible assets to hedge against currency devaluation and overall economic instability. Nevertheless, they are highly associated with automotive manufacturing and can thrive together.

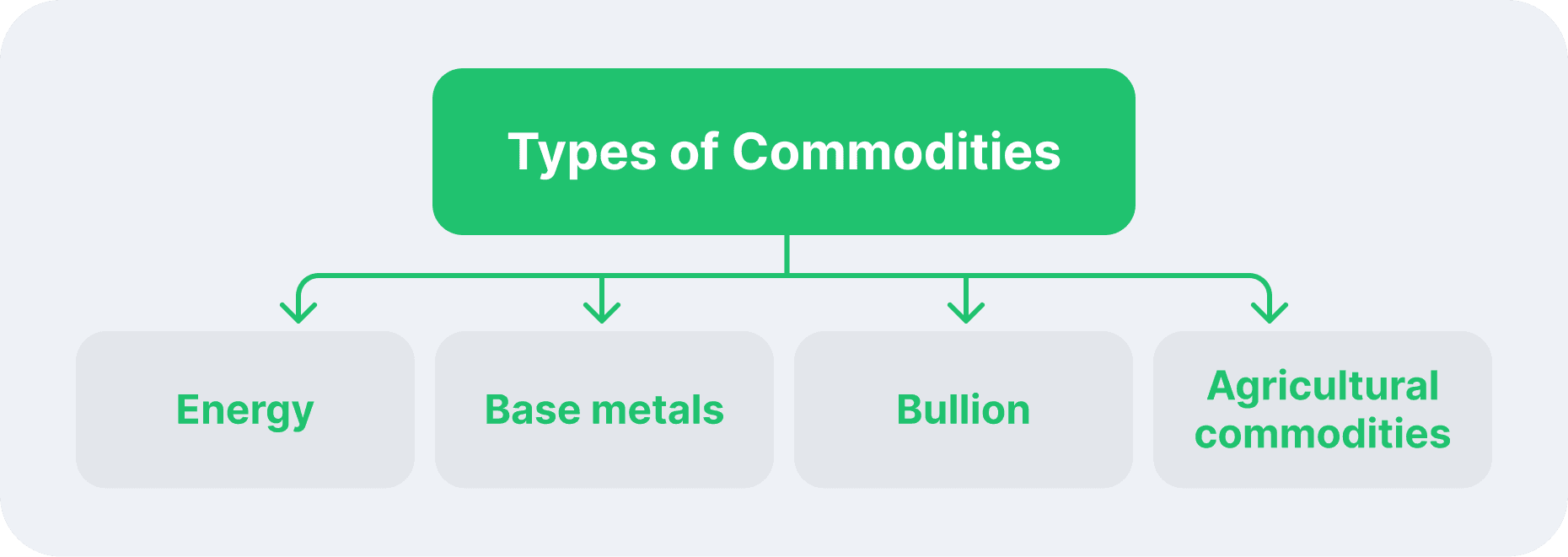

Commodities

Commodities are natural and agricultural products that are important economically and in production, such as wheat, corn, cotton, and iron ores. These products serve as a hedge against inflation, and their prices are affected massively by weather and supply and demand dynamics.

Most agricultural products experienced price declines in 2023 compared to 2022 due to improved global supply and reduced demand pressures.

Traders speculate on commodity prices to create demand pressures and benefit from short-term market volatility, besides creating a balanced investment portfolio.

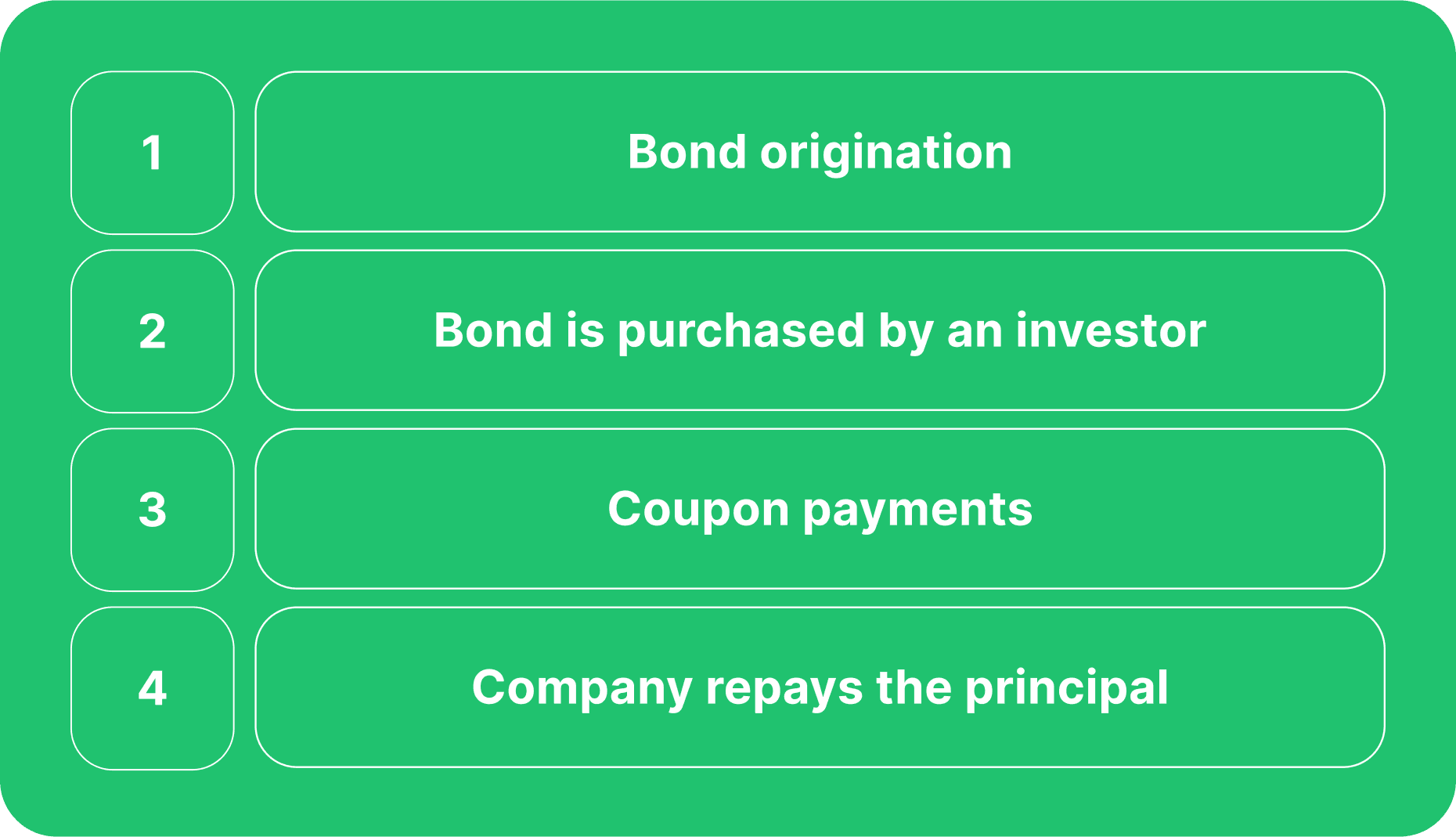

Fixed Income

Fixed incomes are trading asset classes that provide regular payments through interests and other passive income-generation models. These instruments offer less volatility and have limited growth potential. However, they underline stability and long-term profitability.

Bonds, money market instruments, savings accounts, and other financial derivatives entail principal and yield. Governments, hedge funds or companies issue these debts to traders who pay the principal to own the security and receive monthly, quarterly or yearly coupon returns.

US Treasuries, Municipal bonds and corporate bonds are popular fixed-income investments with enhanced interest rates and yields. Some debt notes offer tax benefits and limited exposure risk, which provides protection during a market recession.

Conclusion

For investors who want to create a balanced investment portfolio, trading different asset classes enables them to distribute their capital and risk across various markets, locations and macroeconomic factors.

Therefore, offering a wide range of trading asset classes allows you to attract wealthy individual and institutional investors who want to explore hedging strategies and protect their positions from market uncertainties.

Read also