Share

0

/5

(

0

)

Nowadays, multi-asset trading has gained remarkable traction in financial markets. As traders increasingly adopt multi-asset strategies, the demand for user-friendly and successful brokerage businesses is rising. This guide will delve into the essential steps to establishing a successful multi-asset brokerage firm, covering everything from platform implementation to client attraction strategies.

Key Takeaways

Starting a multi-asset brokerage business aligns with modern investors' evolving needs, offering diversification, adaptability to market changes, and synergies among different asset classes.

Crucial steps to start a multi-asset brokerage business include market research, a comprehensive business plan, robust technology infrastructure, risk management and legal compliance.

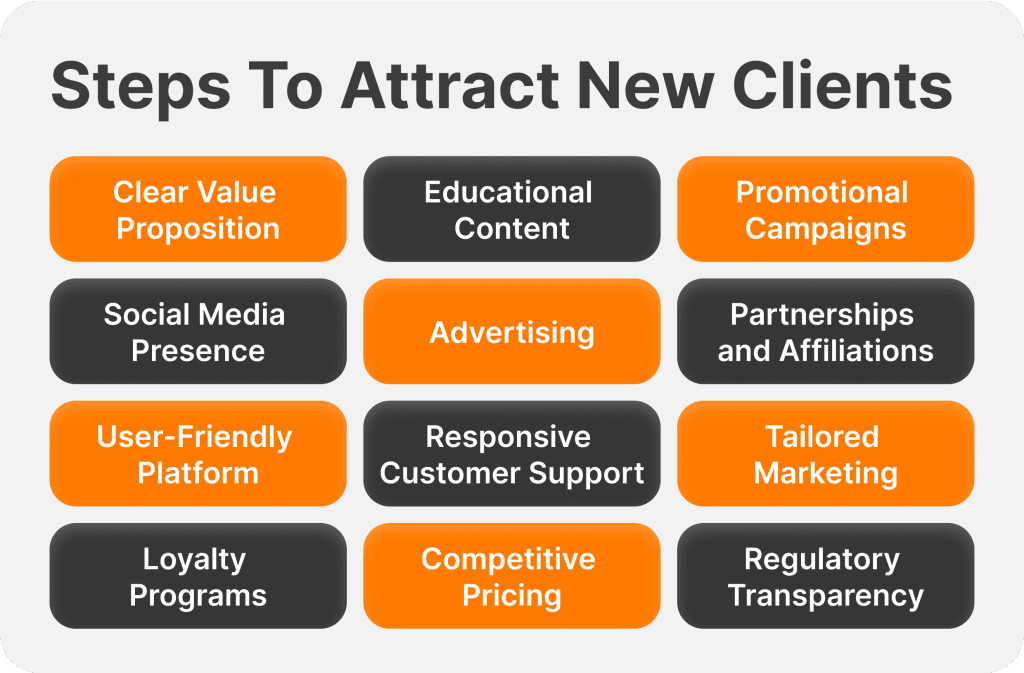

Attracting and retaining clients requires a strategic approach, including a clear value proposition, educational content, promotional campaigns, a solid social media presence, and user-friendly platforms.

Understanding Multi-Asset Brokerage Business

A multi-asset brokerage refers to a financial institution that facilitates trading across various asset classes within a single platform. These classes typically include stocks, bonds, commodities, equities, ETFs, derivatives, and cryptocurrencies.

Investors can diversify their portfolios by accessing various financial instruments through a unified account. This approach allows for greater flexibility and risk management as traders can capitalise on opportunities in different financial markets.

Why Start a Multi-Asset Brokerage Firm?

Starting a multi-asset brokerage offers several advantages in the financial services industry. Firstly, it allows entrepreneurs to tap into a broader market by providing clients access to various asset classes. Diversification becomes a key selling point, attracting investors looking to spread risk across different markets.

Additionally, a multi-asset brokerage enhances client retention and acquisition. Traders appreciate the convenience of managing diverse portfolios from a single platform, saving time and effort. This comprehensive approach also positions the brokerage company as a one-stop shop for financial instruments, fostering customer loyalty.

The ability to adapt to changing market conditions is another compelling reason. The brokerage can navigate different economic climates with multiple asset classes available, attracting traders seeking opportunities in various markets. This flexibility contributes to long-term sustainability and resilience in market fluctuations.

Furthermore, a multi-asset brokerage can benefit from synergies among different asset classes. Integrated trading platforms and risk management systems streamline operations, reducing costs and improving overall efficiency.

Steps to Launch Your Multi-Asset Brokerage

Launching a multi-asset brokerage involves careful planning and adherence to regulatory requirements. Here are vital steps to consider:

1. Market Research and Business Plan

Conduct thorough market research to identify target demographics, competition, and potential gaps in the market. Understand the regulatory landscape and compliance requirements specific to multi-asset brokerages.

Develop a comprehensive business plan outlining your brokerage's mission, target market, revenue streams, and growth strategies. Include financial projections, risk management, and marketing plans.

2. Technology Infrastructure

The core of any brokerage lies in its electronic, high-quality trading platform. While implementing a platform from scratch may not be financially effective, opting for a white-label solution can save costs and time, providing a platform with your trademark and high-quality built-in software.

In this case, you will find B2Broker's White Label cTrader extremely helpful, a full-featured brokerage infrastructure used by institutional businesses and retail broker-dealers worldwide. White Label cTrader allows you to quickly and easily establish yourself as a forex broker, crypto broker, or multi-asset broker.

You don't have to worry about things like buying a cTrader server licence, setting up a backup system, establishing a global network of access servers, or hiring people to configure and maintain the server structure constantly - White Label cTrader comes with all of these features and more.

cTrader is known to be one of the most advanced trading platforms on the market, featuring modern UI and extended trading flow management solutions.

3. Risk Management System and Security Measures

Implement a robust risk management system to monitor and mitigate risks associated with trading across diverse assets. This system should include measures for liquidity risk, market risk, and operational risk.

Prioritise cybersecurity by implementing robust security measures to protect client data and financial transactions. Employ encryption, secure login processes, and regularly update security protocols to stay ahead of potential threats.

4. Mobile and Web Apps

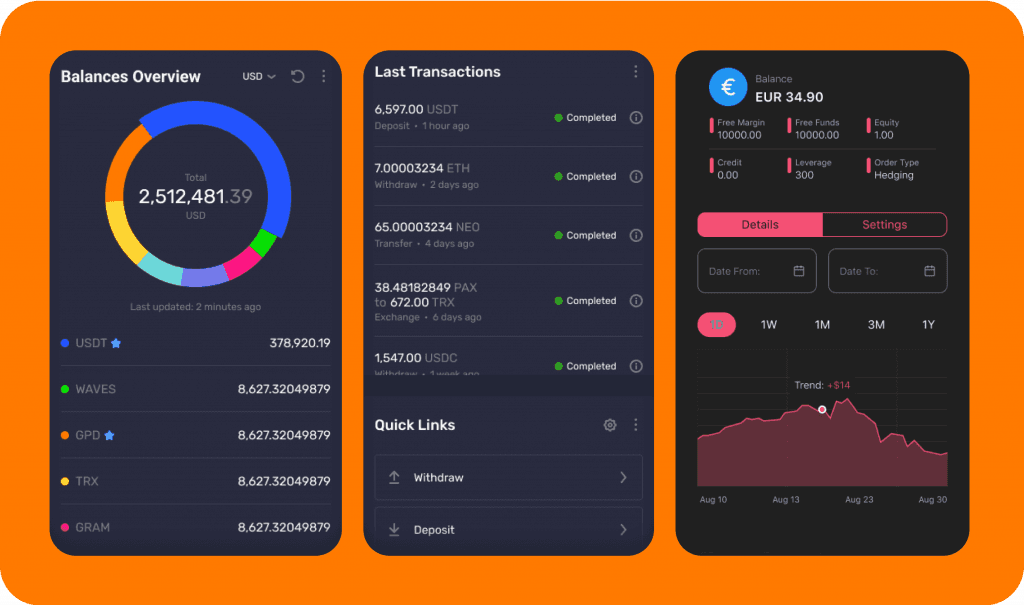

In the age of digital convenience, traders expect accessibility from various platforms. Developing mobile and web applications for Android, iOS, and desktop is crucial for catering to a diverse audience of traders.

Check out our mobile app, which combines a range of products, including B2Core, B2Core IB, B2Trader, MetaTrader 4/5, White Label, Copy Trading and B2BinPay. B2Broker enables you to offer your end users the opportunity to use our app, which can then be customised in line with your requirements. We can either hand over the rights to the program or release it under our development.

5. PSP Integrations

As the use of cryptocurrencies continues to rise, integrating crypto payments into your brokerage provides a low-cost, speedy, and efficient fund transfer method. Offering crypto debit/credit cards for fiat transactions adds another layer of flexibility.

Don't delay checking the industry's #1 crypto processing solution, B2BinPay, which enables you to accept, store, receive, send and exchange crypto payments. B2BinPay is designed to fulfil all the crypto processing needs of all types of clients with a range of benefits not available with traditional payment methods, such as low processing fees, real-time balance/transaction history, downloadable reports, secure checkout and much more.

6. Customer Relationship Management (CRM)

CRM software streamlines brokerage activities and strengthens client relationships. CRM can be utilised for lead generation, IB administrations, handling payments, KYC, and other vital procedures, contributing to a smoother brokerage experience.

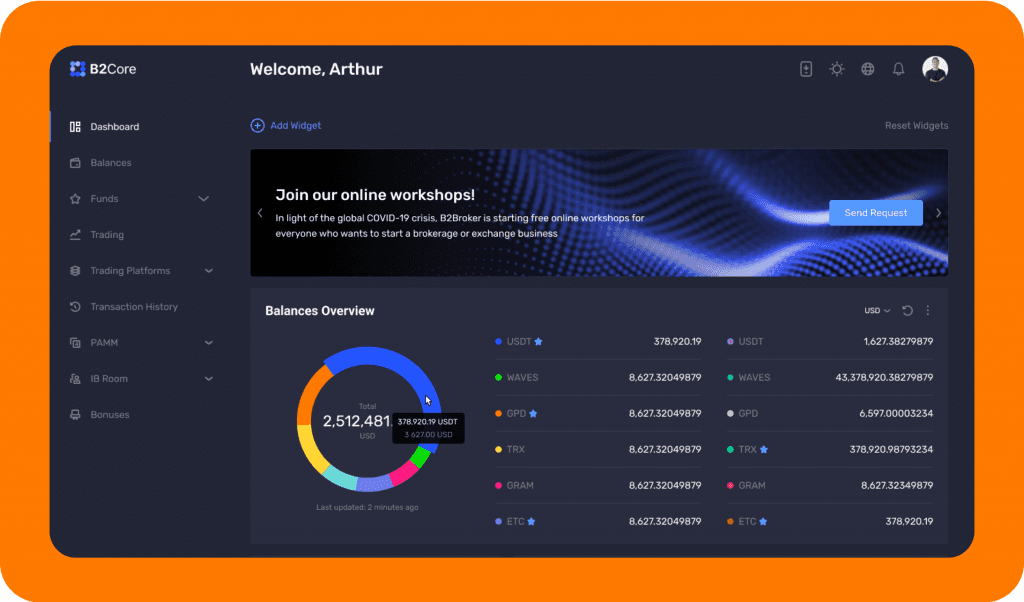

B2Core is a new generation of CRM, client cabinet and back office software - state-of-the-art technology for forex and crypto businesses.

7. Trader's Room

Providing a central hub for trading activities and analysis is essential. The trader's room, designed to give traders ultimate control over their trading activities, enhances the overall trading experience.

To understand this option visually, check B2Core's Trader's Room, a new generation of professional software that helps brokers and exchanges manage their customers, admins and IB partners in one place.

8. Legal Compliance

Legal compliance is paramount to building trust and transparency. Consultation with legal experts, accountants, and other professionals is necessary to ensure adherence to regulatory frameworks. Implement ongoing compliance monitoring processes. Stay informed about changes in financial regulations and adjust your operations accordingly.

9. Launch and Monitor

Launch your multi-asset brokerage and closely monitor its performance. Continuously evaluate customer feedback, market trends, and regulatory updates to adapt and enhance your services over time.

How to Attract Clients to Your Multi-Asset Brokerage Business

Attracting new clients to your multi-asset brokerage requires a strategic approach emphasising value, trust, and differentiation. Here are effective strategies to attract and retain clients:

Clear Value Proposition

Clearly communicate the unique value your brokerage offers. Highlight benefits such as diverse asset classes, advanced trading tools, low fees, and superior customer service. A compelling value proposition sets you apart from competitors.

Educational Content

Provide educational resources to help potential clients understand the benefits of multi-asset trading. Create blog posts, webinars, tutorials, and market analyses that demonstrate your expertise and assist traders in making informed decisions. Content serves as a powerful tool to raise brand recognition and engage with the target market. Regularly posting informative articles on trading strategies, market developments, and other relevant topics, optimised for SEO, enhances online visibility.

Promotional Campaigns

Run targeted promotional campaigns to generate interest and attract new clients. Consider limited-time offers, referral programs, or fee discounts to incentivise sign-ups and initial trading activity.

Social Media Presence

Use social media platforms such as Meta (Facebook), LinkedIn, Twitter, Instagram, and YouTube to increase visibility and engage with your target audience. Share market insights, trading tips, and updates about your brokerage. Actively respond to comments and inquiries to build a community around your brand.

Invest in Advertising

While Google Ads can be effective, exploring cost-effective advertising methods is essential. Allocating a portion of the budget to increase brand visibility is crucial for reaching a wider audience.

Partnerships and Affiliations

Form partnerships with other financial service providers, influencers, or industry-related organisations. Collaborative efforts can expand your reach and credibility within the financial community. Third-party suggestions are often highly trusted in the digital space.

User-Friendly Platform

Ensure your trading platform is intuitive and user-friendly. A seamless and efficient user experience encourages client retention and attracts new users. Regularly update and improve the platform based on user feedback.

Responsive Customer Support

Provide excellent customer support to build trust and satisfaction. Ensure timely responses to inquiries and offer support through various channels, including live chat, email, and phone. A positive customer experience can lead to word-of-mouth referrals.

Tailored Marketing

Segment your target audience and tailor marketing messages to specific demographics. Understand the unique needs of different client segments and customise your marketing approach accordingly.

Loyalty Programs

Implement loyalty programs that reward frequent traders or long-term clients. Offering perks such as reduced fees, exclusive access to research, or priority customer support can encourage client retention and attract new ones.

Competitive Pricing

Offer competitive and transparent pricing structures. Traders are sensitive to transaction costs, so providing cost-effective solutions can strongly incentivise them to choose your brokerage.

Regulatory Transparency

Clearly communicate your commitment to regulatory compliance and security. Prospective clients want to know their funds are safe and that the brokerage operates within legal frameworks. Transparent communication about compliance measures builds trust.

Continuously analyse the effectiveness of your strategies, adapting and refining them based on client feedback and market trends. Building a solid reputation and fostering positive client experiences are crucial to attracting and retaining clients in the competitive multi-asset brokerage industry.

Conclusion

Establishing a multi-asset brokerage is a strategic move in response to the growing trend of traders adopting diversified investment strategies. The demand for user-friendly platforms that facilitate trading across various asset classes is on the rise.

By understanding the benefits of multi-asset trading and carefully following the steps outlined in this guide, entrepreneurs can position themselves competitively in the financial services industry.

The ability to offer diversified portfolios, adapt to changing market conditions, and leverage synergies among different asset classes provides a distinct advantage for long-term sustainability.

Read also