Share

0

/5

(

0

)

The financial markets thrive on efficiency, clarity, and trust, which are critical to every trader's success. The STP (Straight Through Processing) brokerage model revolutionises trading by directly connecting to top-tier liquidity providers, such as banks and financial institutions.

Unlike traditional brokers that rely on dealing desks, STP brokers streamline the trading process, delivering real-time execution, market-driven pricing, and a transparent framework that prioritises the trader's best interests.

This short guide will tell you the Forex STP model, how it works, and what you need to know to create your STP brokerage project.

Key Takeaways

STP brokers automate trade execution by routing clients' trades directly to liquidity providers. They offer a mix of variable and fixed spreads, often without commission fees, and avoid trading against customers.

Unlike market makers, STP brokers carry lower risk because they don't profit from price volatility. They also provide more accurate order execution and tools to secure better quotes.

Clients benefit from 24/7 live market access, increased liquidity, and direct exchange order flow, enabling more trading opportunities and competitive pricing.

What is an STP Broker?

An STP broker is a financial intermediary facilitating trading by routing client orders directly to liquidity providers, such as banks, hedge funds, and financial institutions.

Unlike traditional brokers with a dealing desk, STP brokers do not intervene in trades or take positions against their clients. This operational model ensures faster execution of trades and eliminates conflicts of interest, creating a more transparent trading environment.

The STP model is particularly attractive to traders who value efficiency and fairness. STP brokers offer real-time pricing with competitive spreads by directly connecting to a pool of liquidity providers.

These brokers earn revenue through small markups on spreads or commissions on trades rather than profiting from clients' losses. This alignment of interests fosters trust and confidence among traders.

Key features of STP firms include their variable spreads, which reflect real market conditions, and their ability to handle different order types such as market, limit, and stop-loss orders. These brokers rely on advanced technology to ensure seamless and fast trade execution, catering to both retail and institutional traders.

STP brokers are widely recognised for their transparency and accessibility. They provide traders with direct access to market liquidity and offer fair prices based on actual market conditions.

This makes them ideal for traders who want to avoid the potential conflicts of interest and delays associated with brokers who use a dealing desk.

[aa quote-global]

Fast Fact

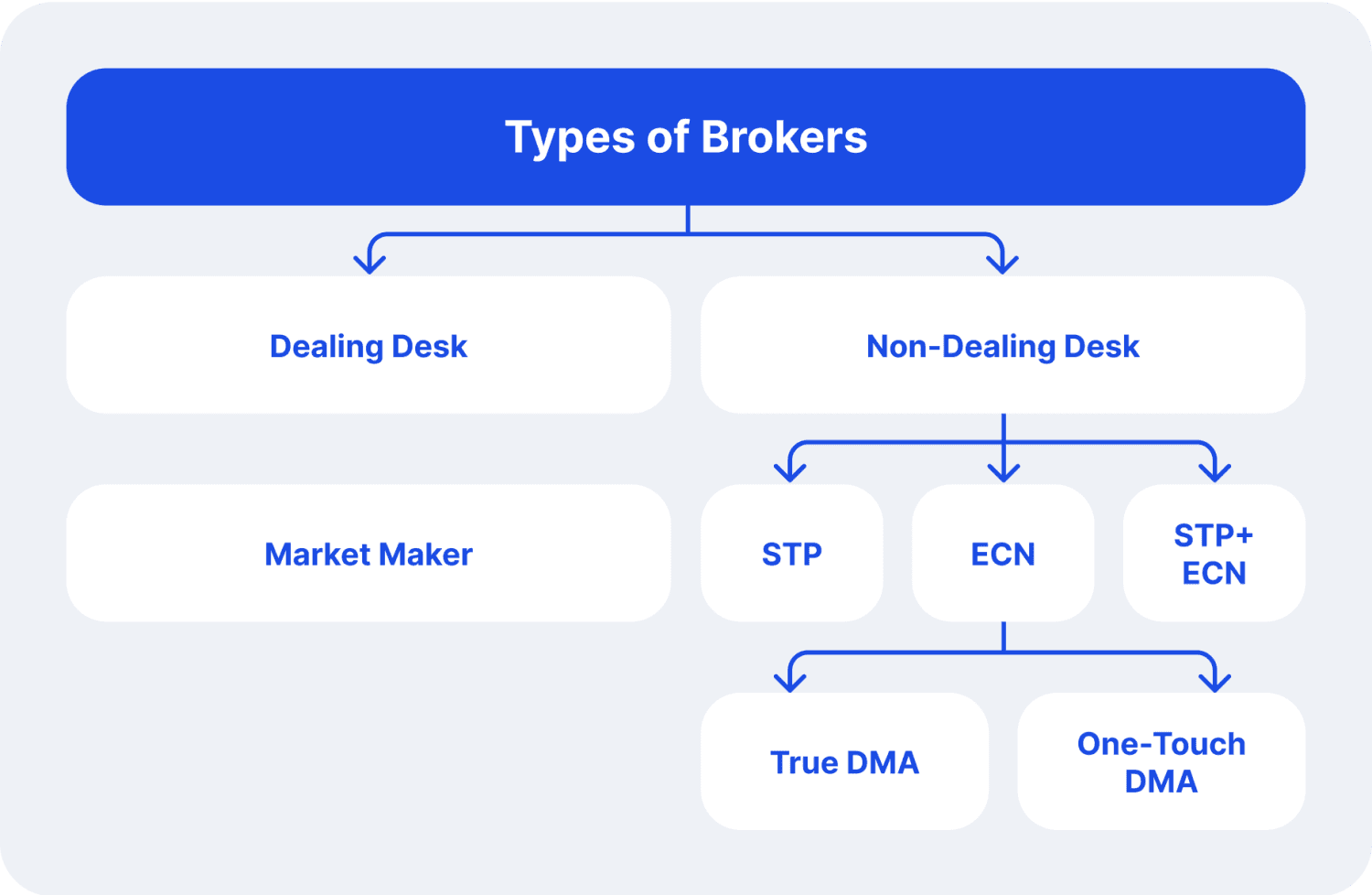

STP brokers, as well as ECN brokers, are no-dealing desk brokers that offer clients direct access to the Forex market.

[/aa]

How Does an STP Broker Work?

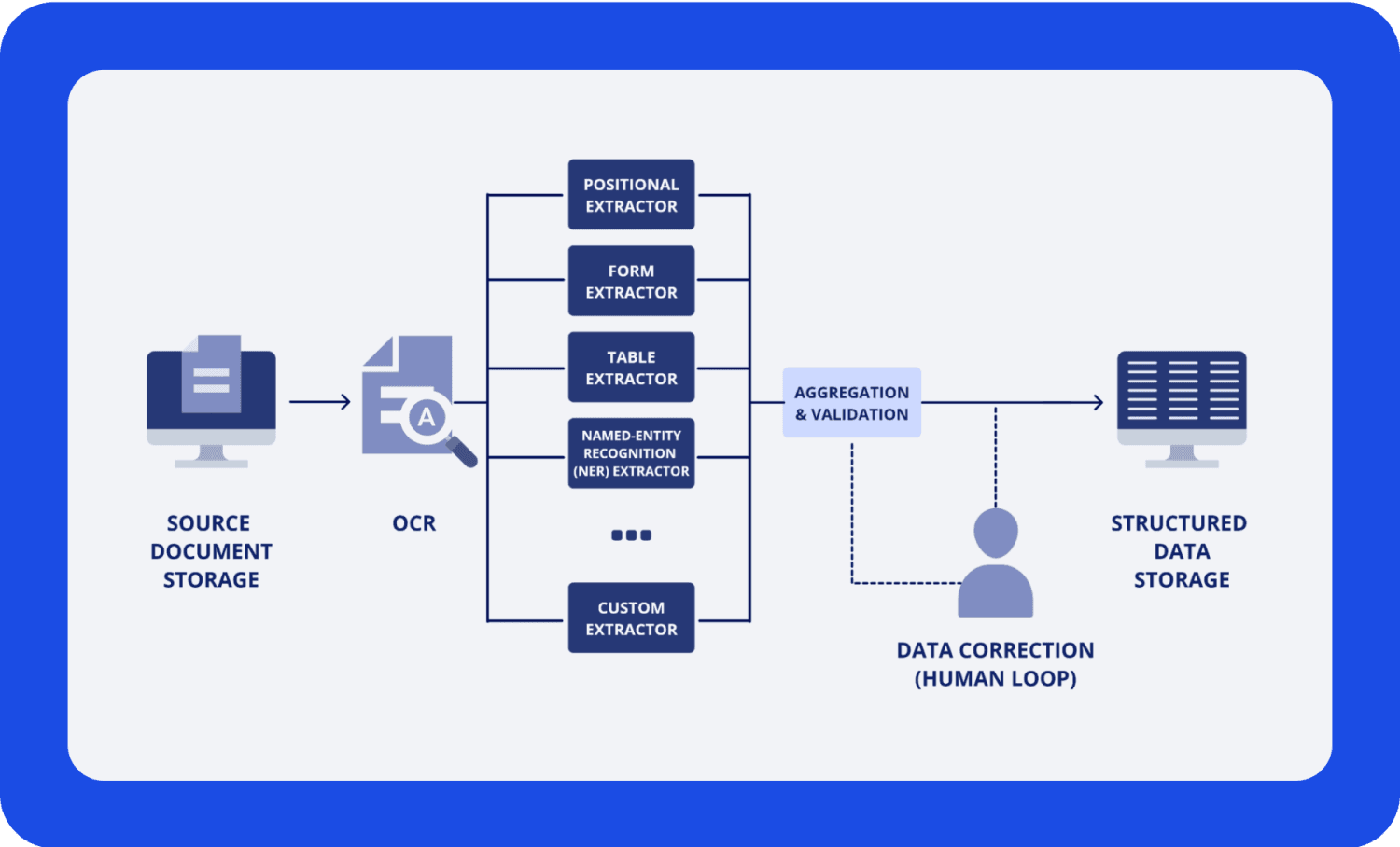

Without manual intervention or a dealing desk, an STP firm seamlessly routes client orders directly to liquidity providers, such as banks, hedge funds, or financial institutions. This streamlined approach allows for faster trade execution, reduced conflicts of interest, and a more transparent trading experience.

Let’s break down the process step-by-step:

Order Placement by the Trader

When a trader places an order — a market, limit, or stop-loss order — it is immediately transmitted to the STP broker’s trading platform. This platform is designed to handle high volumes of trades efficiently and with minimal latency.

Routing to Liquidity Providers

Instead of processing the order internally, the STP broker forwards it directly to its network of liquidity providers. These providers are large financial institutions that supply liquidity to the market by offering bid and ask prices for the traded instruments, such as forex pairs, commodities, or indices.

The broker’s system aggregates quotes from multiple liquidity providers and presents the best bid (highest price a buyer is willing to pay) and best ask (lowest price a seller is willing to accept) prices to the trader.

Trade Execution

Once the trader confirms their order, the STP broker matches it with the best available price from the liquidity pool. Thanks to the absence of manual processing or intervention, execution is nearly instantaneous. The liquidity provider fulfils the order, ensuring the trade is executed in real-time.

Revenue Generation for the Broker

STP brokers do not take positions against their clients or profit from their losses. Instead, they earn revenue through:

Spread Markups: The broker adds a small margin to the raw spreads provided by the liquidity providers. For example, if the liquidity provider’s spread is 1.2 pips, the broker might offer it to the trader at 1.5 pips.

Commissions: Some STP Forex brokers charge a fixed fee per trade or lot, ensuring transparency in their revenue model.

Ensuring Liquidity and Smooth Execution

Liquidity is crucial for an STP broker to operate efficiently. By partnering with multiple liquidity providers, the broker ensures there is always enough market depth to execute trades, even during high volatility. This minimises slippage, where the executed price differs from the quoted price due to rapid market fluctuations.

Key Technology Involved

STP brokers rely on advanced technology to maintain speed and reliability:

Trading Platforms: Platforms like MetaTrader 4/5 or cTrader facilitate order placement and execution.

Order Matching Engines: These systems ensure trades are matched efficiently with liquidity providers.

APIs: Allow seamless integration between the broker’s platform and liquidity providers for real-time pricing and order routing.

How to Start Your Own STP Brokerage?

STP Forex brokerage can be a highly rewarding business venture. However, it requires meticulous planning, technological know-how, and a firm grasp of regulatory frameworks. Below is a step-by-step guide to establishing a successful STP brokerage.

Understand the STP Brokerage Model

The first step is understanding how the STP Forex model works. Client orders are routed directly to liquidity providers, such as banks, financial institutions, or hedge funds, without a dealing desk. This eliminates conflicts of interest as the broker does not trade against clients. Revenue is earned through spread markups or commissions on trades, ensuring transparency and a fair trading environment.

Conduct Market Research and Planning

Thorough research and a detailed business plan are essential. Define your target audience, whether retail traders, institutional clients, or both, and determine their needs. Select the financial instruments you will offer — Forex pairs, commodities, indices, or cryptocurrencies — based on market demand. Analyse competitors to identify gaps and opportunities for differentiation. Set clear goals for client acquisition and revenue generation.

Ensure Regulatory Compliance

Compliance is the backbone of a legitimate brokerage. Choose a jurisdiction for registration, such as Cyprus, Seychelles, the UK, or Australia, known for their robust regulatory frameworks. Secure the necessary licenses by meeting the region's requirements. Implement systems for Know Your Customer (KYC) and Anti-Money Laundering (AML) to verify client identities and prevent fraud.

Partner with Liquidity Providers

Liquidity providers are critical for smooth operations. Partner with reputable providers offering competitive pricing, low latency, and reliable service. Negotiate terms to access the best bid and ask prices while ensuring redundancy with multiple providers. Use APIs for seamless integration, enabling real-time pricing and efficient order execution.

Invest in Technology and Infrastructure

A robust technological setup is vital. Choose a trading platform like MetaTrader 4, MetaTrader 5, or cTrader to provide traders with user-friendly interfaces and advanced tools. Implement back-end systems like a CRM to manage accounts, reporting, and customer data. Employ security measures such as encryption, two-factor authentication, and DDoS protection to safeguard the platform and client information.

Create a User-Friendly Interface

A secure, intuitive client portal is essential for managing deposits, withdrawals, and account activities. Equip your trading dashboard with advanced tools, real-time analytics, and customisable layouts for both novice and experienced traders. Ensure mobile compatibility to cater to clients who prefer trading on the go.

Develop Marketing and Client Acquisition Strategies

A strong marketing approach attracts clients to your platform. Build a professional website that outlines your offerings and brand. Use digital marketing strategies like search engine optimisation (SEO), pay-per-click advertising, and social media to reach your audience. Offer incentives like welcome bonuses, referral programs, and competitive spreads to onboard clients. Collaborate with Introducing Brokers (IBs) and affiliates to expand your reach.

Provide Excellent Customer Support

Quality support is key to client retention. To that end, offer multilingual support 24/7 through live chat, email, and phone. Provide educational resources like tutorials, webinars, and eBooks to help traders improve their skills. Assign dedicated account managers to high-value clients for personalised support.

Focus on Maintenance and Scalability

Continuous updates and scalability are essential for growth. Regularly update your trading platform with new features and security enhancements. Expand your offerings by introducing new trading instruments or account types to meet market demand. Scale your infrastructure to handle increased traffic and trading volumes as your client base grows.

Monitor Financials and Manage Risks

Effective financial management ensures sustainability. Budget for startup costs, including licensing, technology, and marketing, as well as ongoing expenses like maintenance and support. Monitor revenue streams from spread markups and commissions. Use risk management tools to oversee liquidity and ensure regulatory compliance, safeguarding the business from unforeseen challenges.

Conclusion

Starting an STP brokerage isn't just about entering the world of finance — it's about creating a transparent, efficient, and trader-focused environment that thrives on fairness and technology. By embracing the STP model, you align your business with the modern trader's speed, reliability, and integrity needs.

An STP brokerage isn't just a business — it's a gateway to empowering traders with real market opportunities. With the right approach, your brokerage can become a trusted partner for traders worldwide, a transparent pioneer, and a model for fair trading practices.

FAQ

How do STP brokers handle liquidity?

STP brokers partner with multiple liquidity providers to ensure adequate market depth and smooth trade execution.

Can an STP broker handle high trade volumes?

Yes, STP Forex brokers are designed to handle high trade volumes efficiently. Their reliance on advanced trading platforms and order-matching systems ensures seamless execution, even during periods of market volatility.

How do STP brokers ensure client security?

STP brokers use robust security measures to safeguard client data and transactions, including encryption, two-factor authentication, DDoS protection, and compliance with regulatory standards.

Read also