Share

0

/5

(

0

)

Copy trading platforms have gained momentum in 2024, creating a new movement in the crypto and forex markets. The emergence of digital trading tools and streamlined brokerage services has made it simple for average individuals to enter the trading scene. However, the trading practice hasn’t gotten any easier, leading most newcomer investors to a losing track record in their early investment decisions.

However, social trading practices, like mirror trading and copy trading, have created a way for retail traders to gain experience in the initial stages of their investments without losing money. Copy trading has a much higher chance of success than inexperienced traders' independent decisions.

Key Takeaways

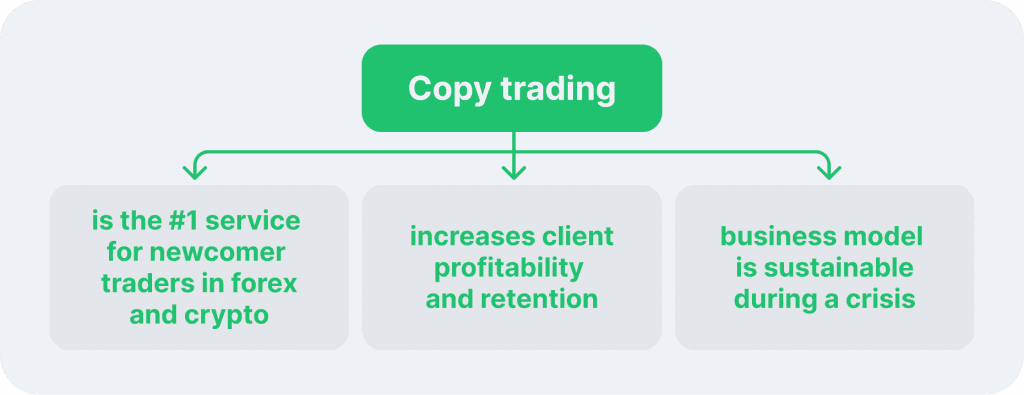

Copy trading has become a go-to brokerage offering in 2024 for newcomer investors in forex and crypto.

Adopting the copy trading service will help your brokerage adopt a new revenue stream and increase client retention.

Copy trading software should be intuitive, easy to use, secure and feature-rich to provide a flexible environment for all parties.

Why You Should Consider Adopting Copy Trading Services

Copy trading has emerged as a go-to strategy for a significant segment of traders - the new market entrants. The market is witnessing an unprecedented number of newcomers using copy trading as a side hustle, part-time income source, or hobby. However, regardless of their entry reasons, most of these newcomers quit within a month, and nearly 90% give up within three months of starting.

The massive drop-off rate is due to the fact that independent trading is hazardous and often unsuccessful. It’s exceedingly hard to generate reliable profits while learning the fundamentals in the initial months. Under these circumstances, rookie mistakes are unavoidable. However, copy trading practice changes the equation completely, offering a secure and reliable trading environment that should reassure and make the audience feel safe.

Increased Popularity of Copy Trading Strategies

As newcomers, copy traders can follow the strategies of more experienced traders, avoiding needless mistakes and harnessing the practical expertise of certified professionals. The copy trading practice is still relatively risky, as even the most decorated and professional traders are susceptible to mistakes and bad luck. However, the average success rate with copy trading brokers is much higher than that of independent investments.

The impressive copy trading performance has led the majority of newcomers to pursue this strategy, increasing the popularity of copy trading software across the entire industry. The question - “Is copy trading profitable?” can now be answered confidently and positively, creating a much higher demand for brokers specialising in this niche.

Long-Term Retention

The second, and arguably an even bigger attraction of copy trades, is the increased retention rate of customers. Investors who become trade copiers have a much higher chance of earning reliable income long-term, allowing brokers to keep them on their platforms for prolonged periods. On average, successful traders will likely stay loyal to their initial platform as they grow accustomed to its unique user experience. However, the key word here is success. If traders fail, they are likely to abandon their trading account within a month.

With the risk management tools, disciplined trading strategies, and simplicity of copy trading, investors are far more likely to stay and keep pursuing the strategies of experienced traders. As a result, brokers can avoid high churn rates and maximise their customer lifetime value.

[aa quote-global]

Fast Fact

While copying the decisions of other traders was frowned upon in the previous decades, the industry sentiment has shifted dramatically in the 2020s. Today, copy trading has evolved into a dominant strategy for beginners.

[/aa]

Features to Consider when Choosing a Copy Trading Provider

As analysed, adopting a copy trading practice can be a highly lucrative investment in crypto and forex trading landscapes. A successful copy trading integration can give your brokerage or exchange a critical boost in sales and market reach, dramatically expanding your potential target audience. But what features should you consider when choosing the best copy trading platform? Let’s explore.

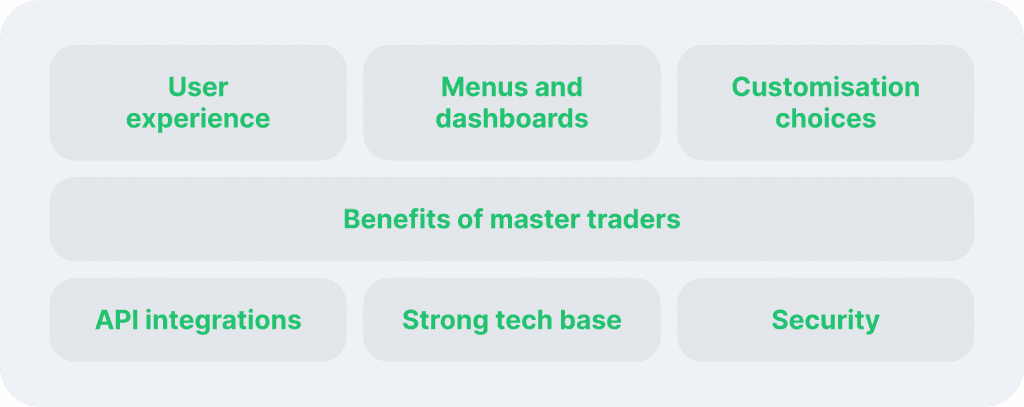

User Interface and Menus

Digital solutions have become more flexible, intuitive and convenient than ever before. A clunky UX and UI is no longer acceptable, as users will simply switch to a more optimised brokerage platform. Today, the financial market is dominated by easy-to-use and well-optimised platforms accessible to newcomers.

So, when choosing crypto or forex copy trading software, you must analyse the user interface and overall presentation, both visually and functionally. The copy-trading platform you adopt should be easy to navigate and highly intuitive, even for inexperienced investors. UI should be designed and then modified according to the best modern practices.

The same applies to UX, which creates a logical flow of menus, dashboards, and complementary tools like trend indicators. Dashboard flexibility is critical to building a successful copy-trading platform. Traders must have the most streamlined and accessible dashboards filled with valuable widgets and complementary tools to maximise their satisfaction with the user experience.

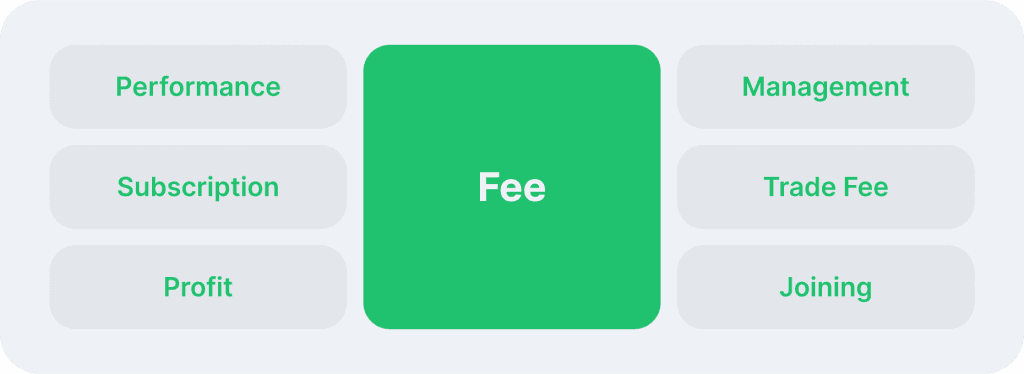

Customisation Options for Fees and Strategies

A great crypto or forex copy trading software should provide your brokerage with numerous customisation options for fees and master trader functionality. You should be able to set up a comprehensive system that employs the fee types you prefer. There are six popular fee types on the market: performance fee, subscription fee, profit fee, management fee, trade fee, and joining fee.

Moreover, you should be able to set restrictions and capabilities for master traders, controlling their activities and giving them enough freedom to succeed. Functionalities should include providing brief information about the strategy, showcasing the master trader’s record and details about their activities.

An Optimised Environment for Master Traders

The best copy trading app should accommodate master traders thoroughly and consider their needs carefully. After all, the success of master traders will determine your long-term viability as a copy trading signal provider. Popular practices in this field include setting subscription and promo code functionalities for master traders to promote their services, set discounts for users, and enhancing their privacy.

Additionally, master traders should be able to set minimum deposits for their audience to increase their profit margins and allow their strategies to flourish. Personalisation of accounts should also be a big focus, letting your master traders distinguish themselves from their competitors and allowing your trade copiers to make a more detailed choice. Master traders can also provide guides on how to start copy trading, enhancing user engagement on your platform.

Integrations and Tech Stack

Technological prowess is dearly valued in the current trading landscape. To provide the best copy trading signals, your chosen platform should accommodate numerous API integrations and present a state-of-the-art technological infrastructure. Both forex and crypto trading fields are fast-moving and hectic, requiring swift decision-making that should be supported by the best tools available on the market.

A solid technological base will allow your brokerage to implement a robust copy trading service that supports live data feeds, analytics, fast execution, and extra security layers that might not be present in subpar tech stacks. Additionally, integrating various APIs is vital for diversifying your platform and enriching your services with additional benefits.

Extra features will help your brokerage stand out amongst average copy trading providers. Finally, a robust IT infrastructure will help you integrate copy trading and CRM modules effortlessly, allowing you to have greater control over your audience and more efficient communication channels with customers.

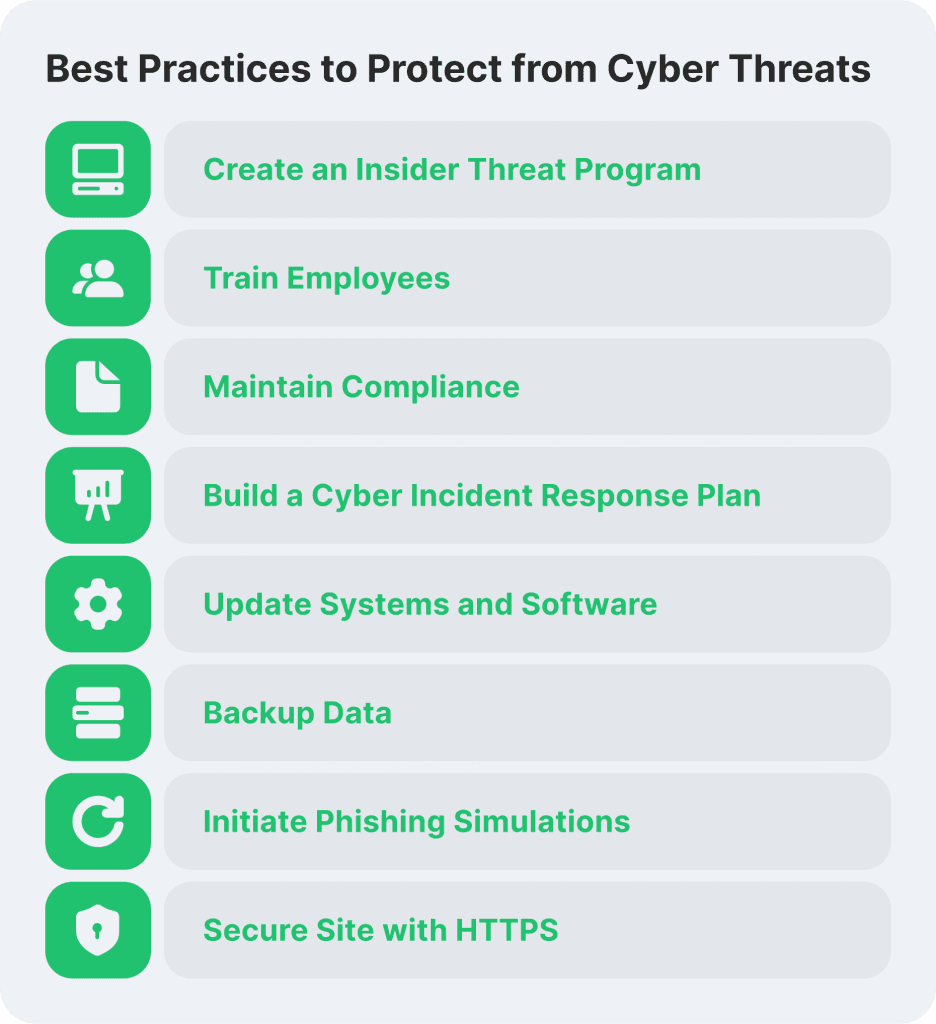

Security and Reliability

Security is highly valued in financial markets across the globe, as many brokerages have become a target for cyber attackers, employee fraud and other malicious activities over recent years. After all, both master traders and trade copiers entrust copy trading platforms with their hard-earned funds that have often disappeared in the crypto scene. So, obtaining a secure solution that guarantees fund security might be the biggest competitive advantage for your brokerage.

So, it is crucial to check whether your copy trading software of choice is equipped with leading protection tools and methodologies like anti-money laundering and know-your-customer protocols. It is also imperative to have a dynamic security system that updates routinely, incorporating new safeguards against emerging threats. Protection against phishing attacks is also important, giving your employees an extra layer of protection against human error and social hacking.

B2Copy - the Next Big Thing in Digital Copy Trading

B2Copy has emerged as a clear-cut winner in the copy trading niche, providing all of the abovementioned benefits and services in this landscape. B2Copy ensures that both master traders and trade copiers have flexible options for carrying out their operations thoroughly, securely and profitably. Master traders can set their preferred terms, adjust minimum deposits and choose their desired audience through promo codes and subscription codes.

On the other hand, master traders are verified and vetted, and their personal records are displayed on the platform for all trade copiers to analyse. As a result, B2Copy creates a transparent environment for all parties involved, allowing traders to select the best possible master traders for their purposes. Additionally, B2Copy presents numerous customisation options for brokerages, with over 200 adjustments that include price settings, privacy settings, layout changes and many other details.

As a result, brokerages can modify the platform to their exact preferences and create their unique spin on the copy trading formula. B2Copy’s tech stack comprises leading software and hardware solutions, ensuring fast execution, security and diversity for customers.

Finally, B2Copy’s user experience is unrivalled on the market, creating by far the most accessible, simple and intuitive platform in the copy trading niche. Unlike other platforms, the setup and navigation process on B2Copy is seamless and swift, with no confusing menus or needless information cluttering the interface. With such a mix of functionality and simplicity, B2Copy has cemented itself as a leading copy trading provider in the current software market.

Final Thoughts

Acquiring proper copy trading software can help your brokerage enter the big leagues of the forex or crypto trading landscape. The recent popularisation of copy trading has elevated its demand across the globe, creating a massive profit window for brokerages that are able to acquire this service in a short time span. So, doing your research thoroughly and making the right choice can help your brokerage acquire a sustainable and large revenue stream that has exponential growth potential in the coming years.

Read also