Share

0

/5

(

0

)

Launching a FinTech startup is overwhelming; there is a wide range of technologies that you can use and integrate into your business, and you must find and filter a massive number of providers.

The search gets narrowed down based on your industry. For example, a small brokerage firm requires tools different from those of a software development startup. Therefore, finding the right IT solutions for business depends on your objectives.

However, there are common ones that almost all companies in different industries use, which we will discuss in the following.

Key Takeaways

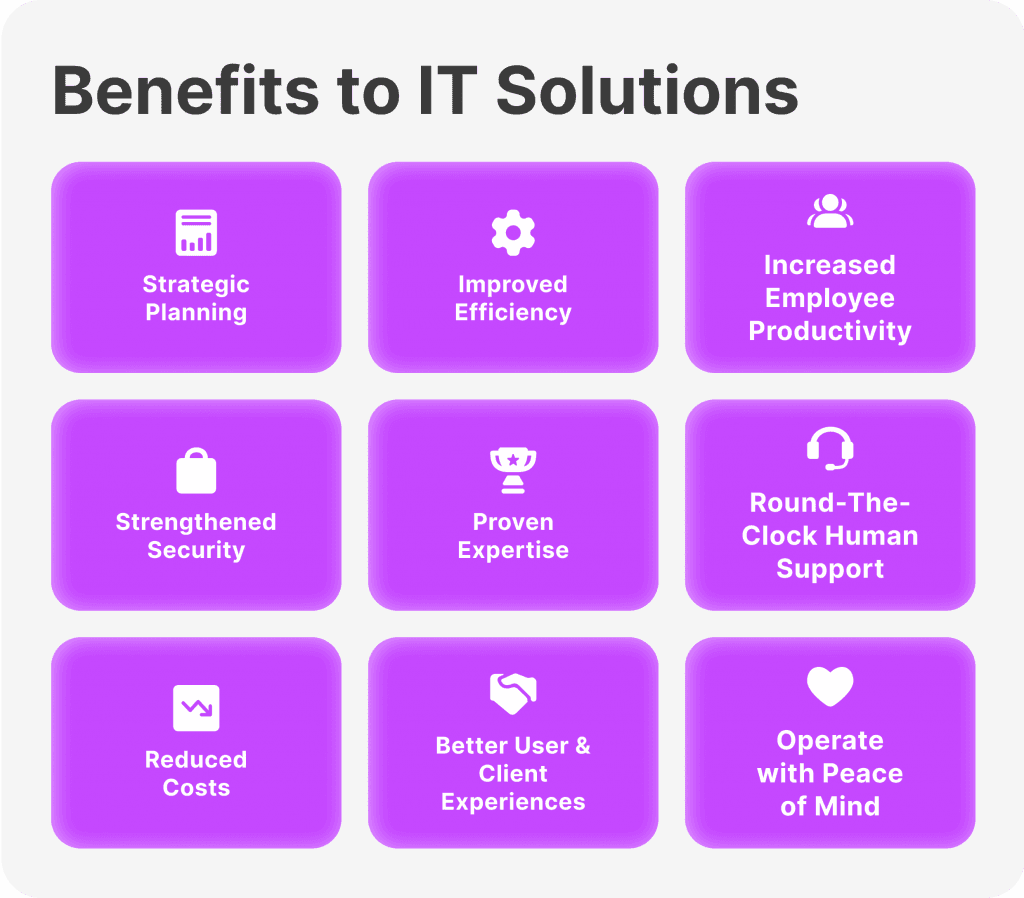

IT solutions for business are technical assisting tools that contribute to delivering your products or services.

Integrating business technology solutions allows you to manage your costs and operations more efficiently.

FinTech startups require different IT solutions for business, but there is a standard range that most companies need.

Understanding FinTech IT Solutions for Business

A FinTech startup is a company that provides technology to financial services, whether developing payment solutions, currency exchange tools, online shopping experiences, e-commerce deals, and more.

Therefore, your FinTech business requires various technologies to support and streamline your operations. Adopting these managed IT services is not only a modern way to do business but also an excellent way to keep up with rapid market growth and ensure business continuity.

Should You Get Free or Paid IT Solutions for Business?

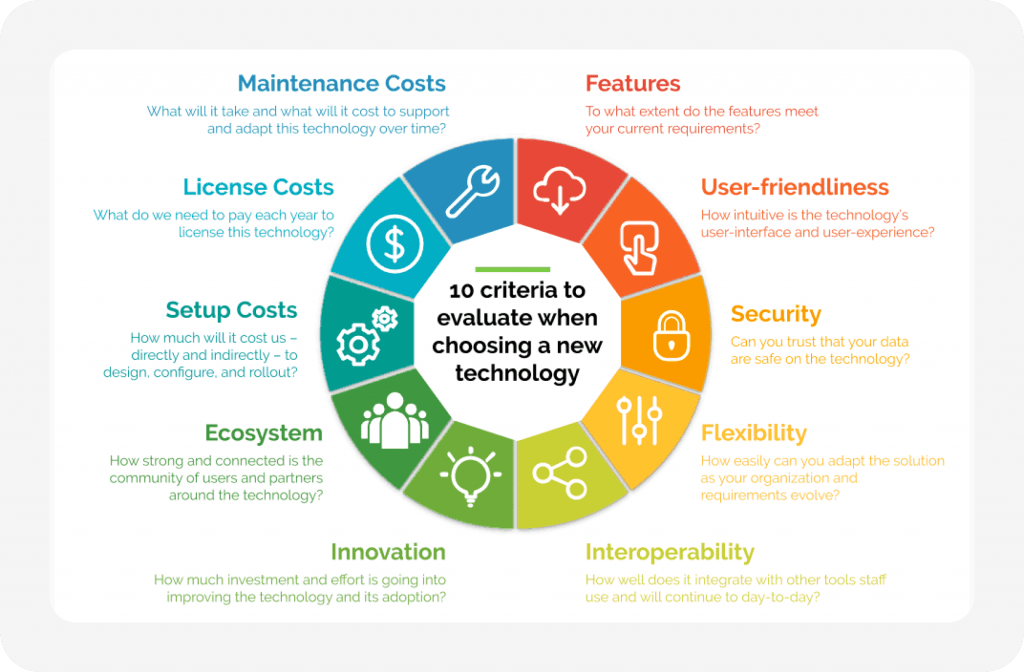

A simple Google search for IT software solutions for business will generate hundreds of outcomes, and you must dig deeper to find the ones that match your purpose, target, and expenses.

Your budget is the most vital factor in this regard because it is easy to dash money on cutting-edge tools, but if you are not profitable enough, you will run out of funds very soon.

Free IT solutions for business are rare and, in most cases, are unreliable. Therefore, you must weigh out the pros and cons of the FinTech IT solutions, including your budget and required features.

Top 10 IT Solutions for Business: The Best 10 Tools

FinTech startup ideas have different IT solution requirements. However, they generally need robust technology software and fixtures to support the development and implementation of their services.

Here are 10 IT solutions for business that you will find useful for your startup.

24/7 Technical Support Services

Offering a tech support desk around the clock works in two ways: for end-users and in-house employees.

When offering online services, you can expect users to interact with your tools and use your solutions any time of the day (or night). When they have questions or face issues about using your services, you must resolve them as soon as possible through 24/7 live chat or email service.

Moreover, you need to integrate an IT support desk to provide technical assistance to your employees. When technical glitches occur or software bugs hinder your service performance, this IT solution ensures you resolve these issues in a timely manner.

Software Development

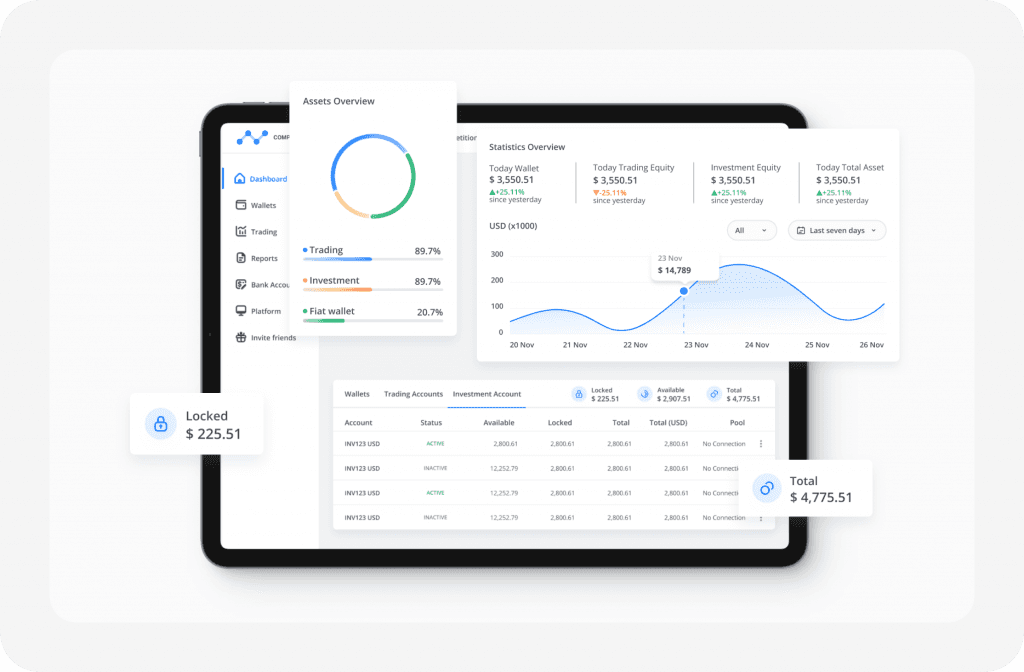

As a financial technology company, you will require various supportive IT systems and software, which you can either create by yourself using in-house developers or use pre-built platforms and configure them to your business objectives.

For example, if you are launching an online brokerage, you will need to integrate scalable solutions and customise your brokerage platform.

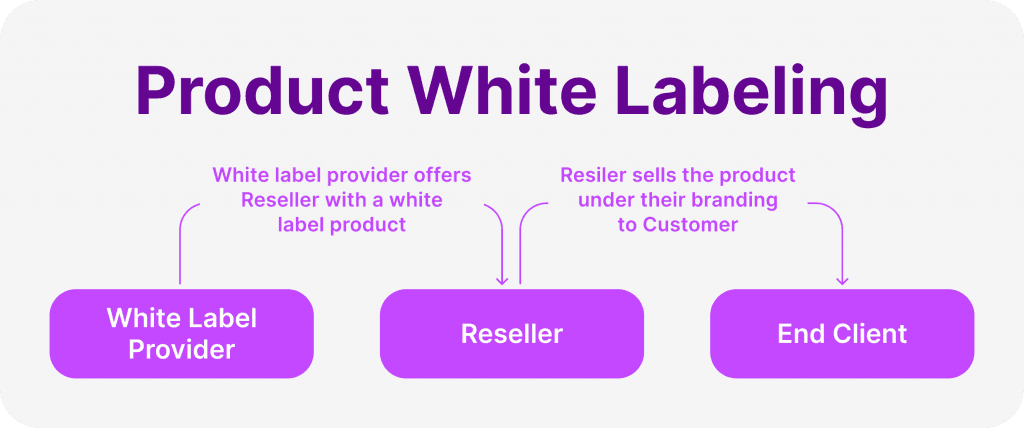

White label is a great example, offering ready-to-use software with core functions that you can adjust according to your preferences. Tailored IT solutions can be altered based on your business type, whether a currency exchange tool, online wallet or payment gateway.

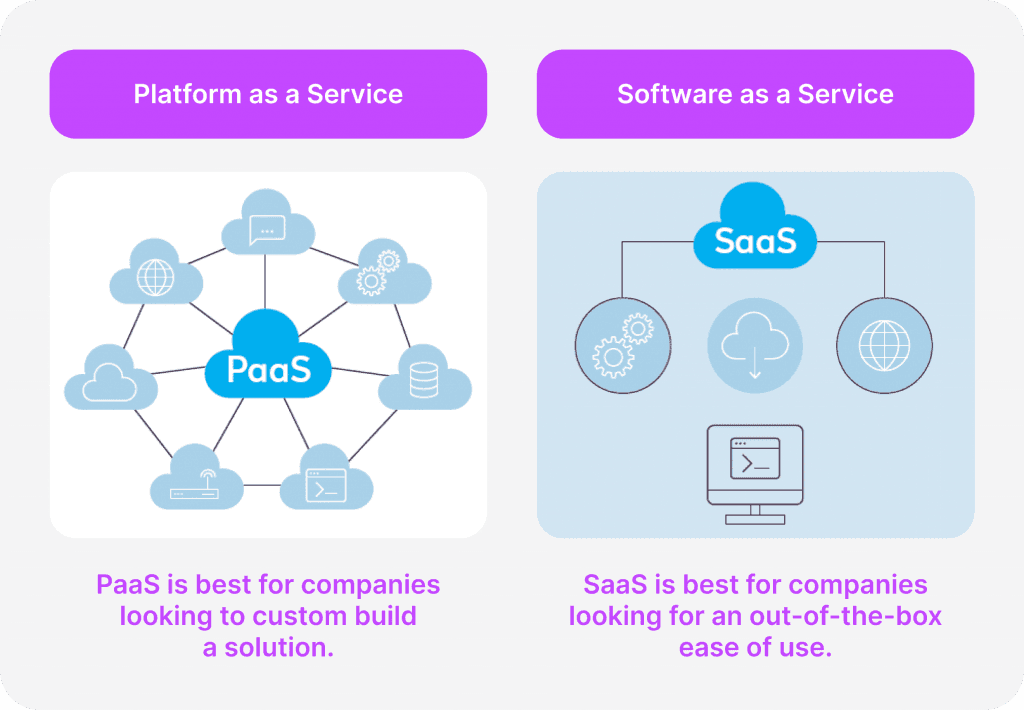

Software as a Service

SaaS - software as a service is a program solution you can use with a subscription model. Thus, you pay to access certain online utilities, such as cloud storage, video conferencing, back-office management or any other online service that does not require installation on your local PC.

The SaaS IT solutions for small businesses depend on what you require and the functionality your team needs to develop and provide the promised product or service.

This can be a corporate messaging application like Slack, a video call facility like Zoom or a cloud-based trading platform like TradingView.

Cloud Services

Cloud storage and processing are cost-effective solutions to streamline your operations and focus on productivity. Cloud service providers, such as Amazon Web Services and Microsoft Azure, allow developers to build, deploy, and manage websites and applications.

Access to cloud storage can be shared among employees, giving permission only to authorised users, such as software developers and digital technology creators, to store, pull data and contribute to the workload.

You can also integrate cloud computing services like Github, which offers an online software development and deployment facility, allowing collaborative work with all necessary tools for tech developers.

[aa quote-global]

Fast Fact

Many consider AWS the first cloud service provider, which provided The Elastic Compute Cloud for the first time in 2006.

[/aa]

CRM System

Customer relationship management software is a crucial IT solution for most FinTech business models, allowing you to streamline and organise your enterprise resource planning.

You can store user data in your CRM, including contact details, customer behaviour patterns, and preferences, to create personalised services that convert more sales to your business.

At the same time, you overview your operations, track your business performance, manage teams and delegate responsibilities using a centralised management system. You can use cloud-based or on-premise CRM to manage your business, gain actionable insights and generate custom reports to make fact-based decisions.

Security Protocols

Cyber security services are crucial to safeguard your business from unwanted access and leaking information outside your organisation. Security IT services ensure only authorised users can access particular data, track interaction points, and detect possible threats.

This includes fully managed solutions that offer antivirus software, firewalls and VPN networks to conduct several security audits.

Backup Solutions

Backup services minimise the damage caused by any service outage or crash by keeping copies of your data in external storage, whether in physical hardware or cloud space. The stored data can be restored whenever you want if your original data is compromised or hacked.

Compliance Tools

Regulatory compliance is a crucial part of working as a FinTech startup. There are different laws in financial transactions in different parts of the world that you must follow to become a legitimate business.

Compliance integrations are managed services that check your programming code, practices and internal documentation to ensure adherence to the standards.

On the one hand, it ensures that your website is bug-free and does not store sensitive user information. On the other hand, it ensures that your AML and KYC procedures are on point and that you factor in the right protocols according to applicable laws.

Payment Integrations

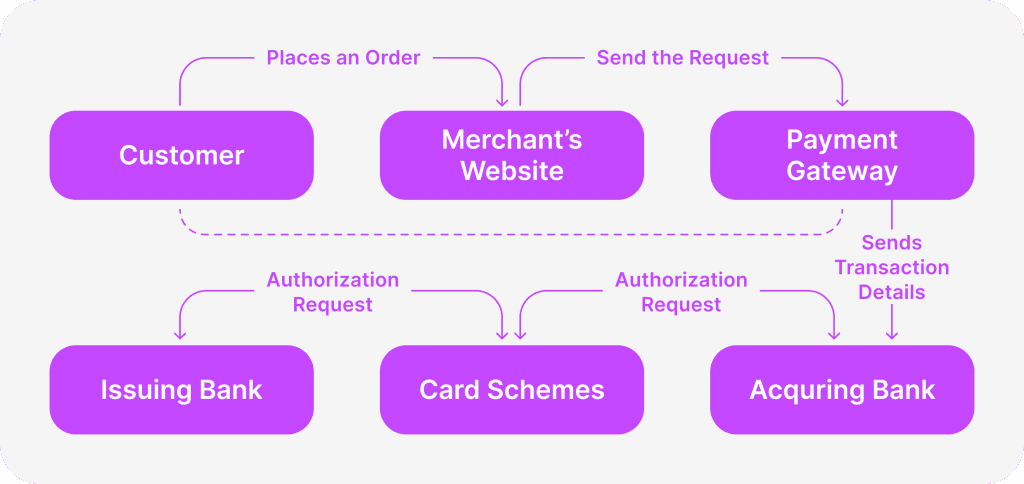

As a FinTech company, you must have a payment mechanism, whether for selling products or services or transacting with your suppliers. Online payment gateways are Internet technologies that facilitate payments between two parties, sending money from buyers to sellers after verifying payment details with the issuing bank.

Integrating a crypto payment solution is crucial to attracting more users, especially with the rising interest in Bitcoin and other cryptocurrencies and the low fees associated with them.

Alternatively, you can find a fiat/crypto-compatible payment solution provider to equip your business with a mechanism that accepts traditional and blockchain currencies.

Email Services

Emailing services are almost an integral part of any business. It facilitates receiving emails from customers, sending announcements, communicating vital news and more.

It is a crucial IT solution to elevate your customer service and communication. When adding one, ensure it does not have a monthly cap, which can affect your business because it can block new communication from customers until you pay additional fees for more storage space.

Conclusion

Operating a FinTech company requires integrating advanced technical integrations to help develop your products or provide the promised services. You can find various IT solutions for business that resonate with your business type and help you launch your startup effectively and serve your customers efficiently.

Read also