Share

0

/5

(

0

)

In a world where payment and trading services are fully automated using online platforms, the matching engine emerges as a critical piece that holds all brokerage and trading software together.

In a nutshell, it replicates the manual order clearing that used to be done on traditional trading floors. The matching engine algorithm saves time and effort and is the main factor behind the massive growth in the online brokerage industry.

Therefore, this technology is vital to your platform if you are launching a brokerage business. Here’s everything you need to know about trading matching engines.

Key Takeaways

The matching engine is an automated system that finds and couples market orders with less human interference.

A trading engine ensures that pending orders have a suitable bid/ask counterpart at the best possible price.

Matching engines execute orders based on entry-time or trading-volume priority to streamline the brokerage performance.

Understanding The Matching Engine

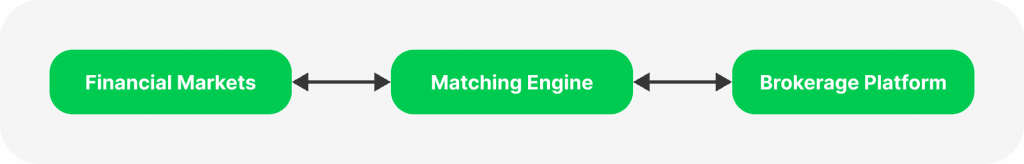

The matching engine is a cutting-edge technology that finds counterparts for buy and sell orders in the trading market. It is like an automatic matchmaker that takes into account the asset price, market volume, and overall liquidity to find the best match.

Brokerage firms integrate the order matching software into their platforms, feeding the supplied assets and instruments into the matching algorithm, which scans the order book and executes trades seamlessly.

This sophisticated system eliminates the need for manual scanning and matching, making this task fully self-managed based on predetermined conditions.

Why is a Matching Engine Important?

Thanks to the matching engine software, order execution has become much faster, leading to an overall boost in online trading services.

If you own a small brokerage house and offer a handful of assets for tens of clients, manually finding matching orders is mostly possible. However, if you serve hundreds or thousands of clients and support various financial markets and asset classes, it is almost impossible to do that with traditional methods.

Matching engines use API messaging protocols to receive inputs, process orders and make trades “happen”.

[aa quote-global]

Fast Fact

The first matching engine was developed in 1982 by the Chicago Stock Exchange, called the MAX system – the first fully automated order execution model.

[/aa]

Matching Engine vs Traditional Matching

In previous times, trading used to happen over the telephone, using paper and pen or simple computer programs to list and find pending orders. This manual process used to take so long and can involve human errors, which, in most cases, is frustrating.

However, the arrival of automated matching engines lowered the margin of error and performed these tasks at a higher throughput and speed.

How Does an Order Matching Engine Work?

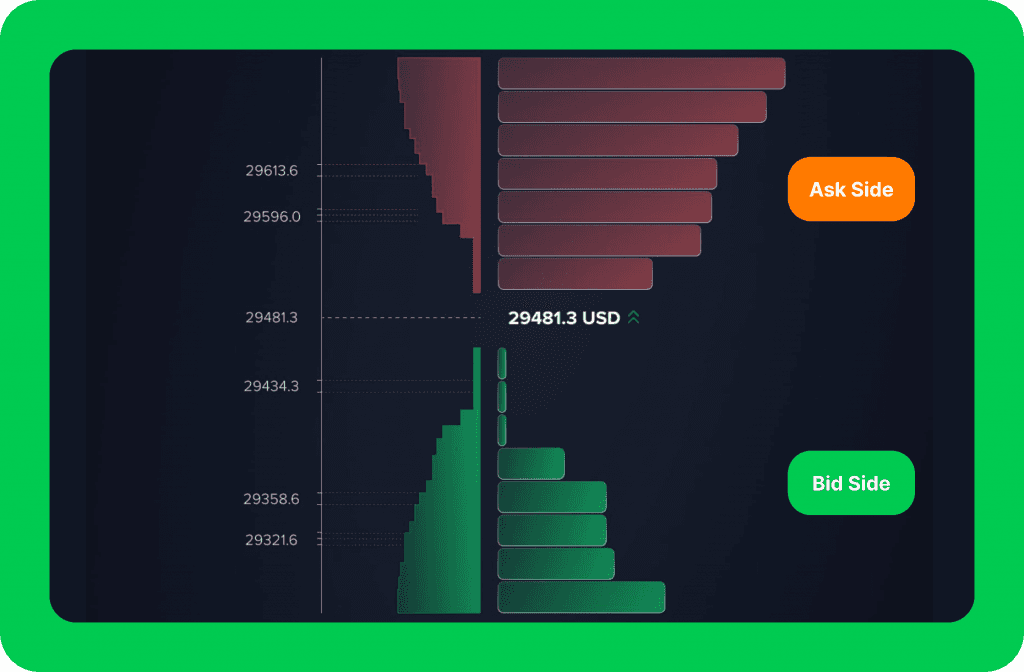

The order book is the backbone of the matching engine, which is used for price discovery through existing requests. When investors place a trading order, whether buying or selling, the request goes to the order book.

The order book compiles all pending orders by price level and asset type, which gets updated in real time as more orders are processed.

Pending requests are split between the bid side (where buy orders reside) and the ask side (where sell orders reside). The order-matching engine seamlessly compares both sides, finds a suitable “bid” for each “ask”, and settles the transaction.

Trade Matching Engine Mechanisms

In essence, the matching engine technology strives to find the best market price for each side of the trade. As such, it tries to find the highest prices for sellers and the lowest prices for buyers, finding a middle-ground between them.

However, different matching algorithms dictate how the order processing works. Whether based on priority, pending time or trade volume.

First in, First out

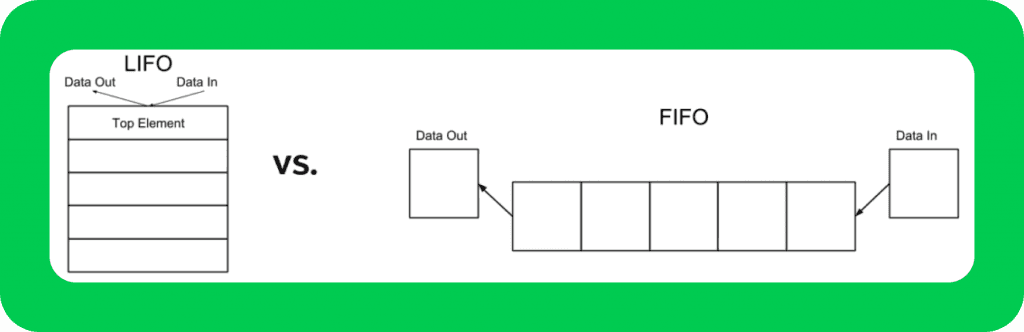

As the name suggests, the “First-in, First-out” (FIFO) method is a popular approach that prioritises the first in the queue. Also known as first-come, first-serve ensures execution fairness when multiple orders have the same price.

Last in, First out

In contrast to FIFO, the LIFO approach serves the last arrival in the queue. This method ensures rapid execution in quickly changing markets or sentiments. Serving the last arrival ensures settling orders with the most recent price and liquidity update.

Pro Rata

Pro-rata processing prioritises requests that have larger trading volumes. As such, when multiple pending orders have the same price and entry time, the larger order gets executed first.

Some brokers use this method to boost their returns from commission per unit or spread gains. However, it creates a sense of unfairness since significant orders can affect the market liquidity and price for the remaining pending orders.

Time-Weighted Average Price

The TWAP approach adds a twist to matching by calculating the average price of multiple orders within a selected timeframe. Orders are piled together and executed in batches to attain the average value and reduce the effect of massive orders on the overall market.

How Do You Find The Right Matching Engine Technology?

Finding a trade matching engine for your brokerage firm depends on factors like execution speed, security and capacity. Moreover, you need to find software that uses your preferred processing methods and ideally allows you to switch between them according to market conditions.

Execution Speed

A good exchange matching engine is a fast engine that minimises the pending time and ensures trades are executed quickly. Finding a reliable engine is crucial for highly volatile markets, such as cryptocurrencies, or when liquidity is prone to fluctuations.

Adopting a FIFO-based matching engine minimises the wait time for orders and ensures orders are settled effectively. In contrast, a time-weighted average price method leads to more hang time, which can cause delays. Thus, choosing the right speed and engine software depends on your objectives.

It is worth noting that the matching engine speed relies on liquidity. If your platform connects deep liquidity sources, orders are more likely to be matched and settled instantly.

Security

Securing your order book ensures smooth processing and minimises cyber threats. Pending orders are more prone to attacks as hackers try to manipulate order books and execute sandwich attacks or rug-pulls to sway the market.

Moreover, protocol breaches can lead to messaging diversion, where hackers redirect the order-matching process to their favour.

Capacity

The matching engine’s capacity is a crucial thing to consider when launching a new brokerage company. When you own a small platform, your throughput might be insignificant.

However, as you start serving more investors and accept more orders, your output will increase. Accordingly, you need scalable multi-asset matching engines that accommodate your changing needs.

Conclusion

Integrating a matching engine into your brokerage platform is crucial for the proper functioning of your business. This technological piece executes orders placed by other market participants after scanning order books and finding suitable counterparts for each market position.

A matching engine can process orders on first-in, first-out, volume or time-weighted priority. Therefore, it is crucial to consider your objectives when finding a trading engine that suits your platform’s size and budget.

Read also