Share

0

/5

(

0

)

Today, institutions play a dominant role in the global exchange of assets. For example, in the Forex sector, institutional investors control a staggering 70% of the market, while retail traders make up a mere 5.5%. This huge disparity in market control is a testament to institutional trading firms' immense power and influence.

But what exactly is institutional trading? What companies fall under this category? And how do they affect the global financial system as a whole?

Key Takeaways

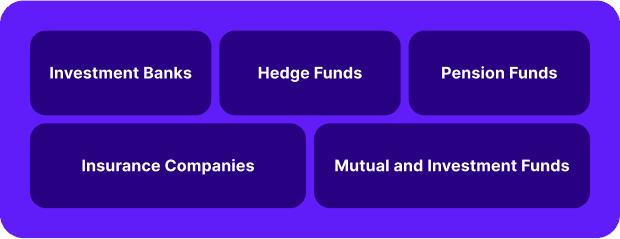

Institutional traders and investors are professional entities that manage a substantial amount of funds.

Among the institutional traders are huge investment firms, pension funds, insurance companies, mutual and investment funds, as well as hedge funds.

Institutional trading differs significantly from retail trading in terms of commissions, trading volumes, regulatory requirements, and market influence.

What is Institutional Trading?

Institutional trading involves buying and selling financial assets on behalf of institutions, such as big funds or investment banks. These large companies have dedicated teams consisting of analysts and traders who work together to make optimal trades.

Due to their large capital, institutions exert a significant influence on the markets. They can diversify their investments and access better prices, giving them an advantage over retail traders. Moreover, their actions can directly influence the price movement of assets.

Traders from the institutional sector use both technical and fundamental analysis tools to buy and sell stocks and other financial assets. The analysts on their team conduct thorough research and provide recommendations based on their research.

These companies usually have access to advanced institutional trading tools and technologies. The use of considerable capital entails a greater risk of loss as well as the possibility of earning a higher return.

Types of Institutional Traders

The market is dominated by different types of institutional traders, each with their own approach. Some of the most common types include:

Hedge Funds

Hedge funds are an alternative investment vehicle typically available only to accredited investors or institutional traders. These entities are known for their aggressive strategies and high-risk, high-reward approach.

One distinguishing characteristic of hedge funds is the level of freedom their managers have in choosing assets to invest in. Hedge fund managers are not restricted by traditional investment guidelines and can deal with a variety of assets, including complex instruments like derivatives.

Hedge funds often employ hedging strategies, which involve taking both long and short positions on correlated assets to minimise risk. Additionally, they may use arbitrage strategies to take advantage of pricing discrepancies across different markets.

Due to their high-risk nature, hedge funds typically require substantial funds to invest. Their clients are typically companies, pension funds, or other institutional investors.

The largest hedge fund firms as of 2023 by AUM* (assets under management) include:

Field Street Capital Management

Citadel Investment Group

Bridgewater Associates

Mariner Investment Group LLC

Millennium Capital Partners

Ares Management

Balyasny Asset Management

All of these funds are US-based firms.

*AUM is the total amount of capital that a fund manages. It shows the size of the fund's operations and its potential impact on the market.

Pension Funds

Pension funds are investment vehicles that manage money from employee contributions to their pension plans. These funds are typically overseen by professional entities that decide where and how to invest the assets.

Pension funds can be seen as a subset of institutional trading, as they also involve managing large sums of money and making strategic investments. The main goal of pension funds is to offer returns for their clients, who are typically employees saving for retirement. These funds may also be used as a source of income for retirees.

The largest public pension funds in the world by AUM in 2024 include:

Social Security Trust Fund Investment (USA)

Government Pension Investment Fund (Japan)

Military Retirement Fund (USA)

Federal Employees Retirement System (USA)

Caisse des Dépôts (France)

National Pension Service of Korea (South Korea)

Federal Retirement Thrift Investment Board (USA)

Central Provident Fund (Singapore)

[aa quote-global]

Fast Fact

The world’s largest 300 pension funds represented 43.0% of the global pension assets in 2023, according to the Thinking Ahead Institute’s annual Global Pension Assets Study.

[/aa]

Investment Banks

Investment banks are financial intermediaries that provide advisory services in market-related transactions. This can include activities such as an Initial Public Offering (IPO), subscriptions, mergers, and reorganisations. Some investment banks also act as brokers for their clients.

Investment banks also offer services such as underwriting, where they purchase shares from an issuer and then resell them to the public. This enables companies to raise capital for new projects or expansions. They may also advise on mergers and acquisitions, helping businesses navigate complex financial transactions.

The largest investment banks are often known as "bulge bracket" firms and include names such as:

JPMorgan Chase (USA)

Goldman Sachs (USA)

BofA Securities (USA)

Morgan Stanley (USA)

Citigroup (USA)

UBS (Switzerland)

Deutsche Bank (Germany)

HSBC (UK)

Insurance Companies

Insurance companies are institutional traders that invest the premiums collected from policyholders in different assets to earn profits and ensure long-term financial stability.

These companies manage large amounts of capital, which are invested in securities, bonds, property, and commodities. The main goal of insurance company investments is to generate consistent returns over time while minimising risk.

The largest insurance companies in 2023, according to Forbes, were:

UnitedHealth Group (USA)

Ping An Insurance (China)

Allianz (Germany)

AXA (France)

Life Insurance Co. (China)

Mutual and Investment Funds

Mutual funds and investment funds are a type of collective investment scheme where investors pool their capital together to form an investment portfolio. These funds may be managed by companies or professional fund managers, but unlike hedge funds, they are subject to strict investment guidelines.

The main advantage of mutual and investment funds is that they allow for diversification across multiple asset classes, which can help mitigate risk. These funds also tend to be more accessible to retail traders, as they usually require lower capital investments.

Mutual and investment fund managers are important players in institutional trading, allowing individuals to access a wider range of assets under more advantageous conditions.

Institutional vs Retail Traders: How Do They Differ?

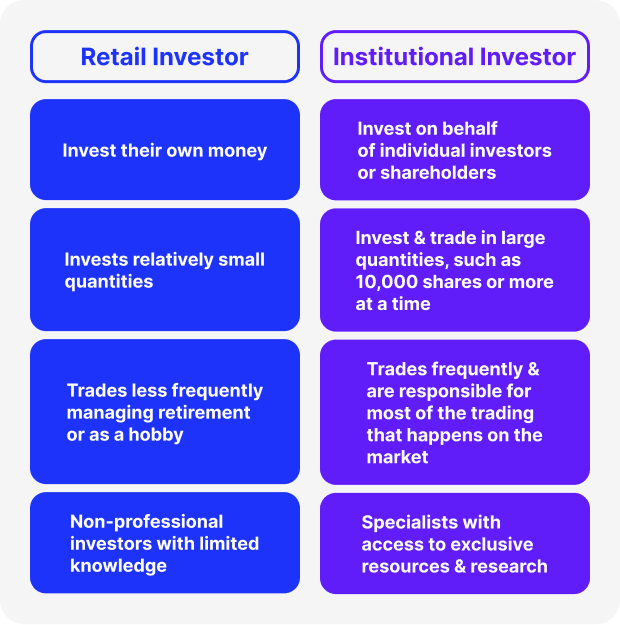

There are significant differences between institutional and retail traders. Here are some key points to keep in mind:

Trading Accounts: Retail trading involves buying and selling assets through a personal or individual account, while institutional trading does so for company accounts. It influences the type of assets available for trading, capital requirements, and access to information.

Regulation Differences: Institutions are subject to different regulations. They often face stricter compliance requirements, which can affect firms' institutional trading strategies and add additional costs for maintaining regulatory compliance.

Commissions: Institutions usually deal with larger amounts of capital. As a result, they can negotiate better commissions and prices when making trades.

Trading Volumes: The institutional market deals with significantly larger volumes than retail trader markets. These companies and funds can have a greater impact on stock prices and market trends than individual traders whose trade sizes are relatively smaller.

Market Impact: The huge volumes of trades made by institutions indicate that these entities can move markets, a phenomenon rarely caused by retail traders. When institutions buy or sell large volumes of assets, it can create volatility and cause prices to fluctuate.

Institutional Trading on Practise

Institutional trading activities manifest in various forms, impacting different aspects of the financial markets. These examples illustrate the scale and scope of institutional trading operations and how they can influence market trends, asset prices, and overall market liquidity:

Forex Operations: With their substantial financial resources, banks and financial firms are big players in Forex operations. Their large currency trades can impact exchange rates, affecting the global economy.

Fixed-Income Investments: Large institutional investors often invest in government and corporate bonds, essential in interest rate setting and credit market health. Their investments can affect borrowing costs for governments and companies, ultimately influencing economic growth.

Block Trading: Large institutional traders often engage in block trading, which involves buying or selling many securities simultaneously. This strategy significantly influences a stock's price and overall market sentiment.

Hedge Strategies: The most common strategy used by hedge funds is to use derivatives and other complex financial instruments to mitigate risk. These strategies can have a ripple effect on market stability, especially during times of volatility.

High-Frequency Trading: The rise of high-frequency trading (HFT) has also been primarily driven by large institutions. Using their advanced technology and algorithmic models, some companies can execute trades at lightning-fast speeds, contributing to market volatility and liquidity.

Final Remarks

Institutional trading is a large segment of the financial sector that often goes unnoticed by small traders. The world’s biggest institutions hold immense power and influence, and they can use advanced resources and strategies to move markets in their favour.

FAQ

How do you detect institutional trading?

Observing trading volume is a perfect indicator for determining this type of trading. Look for a successive increase in volume, which indicates true buying demand from institutions.

What does it take to be an institutional trader?

One must hold a bachelor's degree and have several years of experience trading index and/or equity derivatives at a bank or trading company. Additionally, expertise in trading and position management around market flows is essential.

What is an example of an institutional trading platform?

A good example of such a platform is the Bloomberg Terminal. This widely used platform offers real-time data, news, analytics, and execution tools for a wide range of investment products, catering specifically to the needs and requirements of investment professionals.

Other popular platforms used by institutions include Fidessa, Advent, FlexTrade Systems, Eikon, and Interactive Brokers' Trader Workstation.

Read also