Share

0

/5

(

0

)

The whole point of trading is to anticipate and act on price movements in a given market. When traders profit from a decline in an asset's price, it is known as shorting. Despite the risks, experienced traders often favour shorting in cryptocurrency markets due to its potential for significant returns.

In this article, we explore the role of margin and futures trading, short-selling tactics, and effective strategies for navigating these opportunities.

Key Takeaways

To profit from price declines, shorting means borrowing and selling crypto assets, then buying them again at lower prices.

Futures contracts, margin trading, direct short selling, and leveraged tokens or inverse ETFs are common shorting strategies.

Setting clear pricing targets, managing risk, and avoiding undue leverage effectively reduce losses.

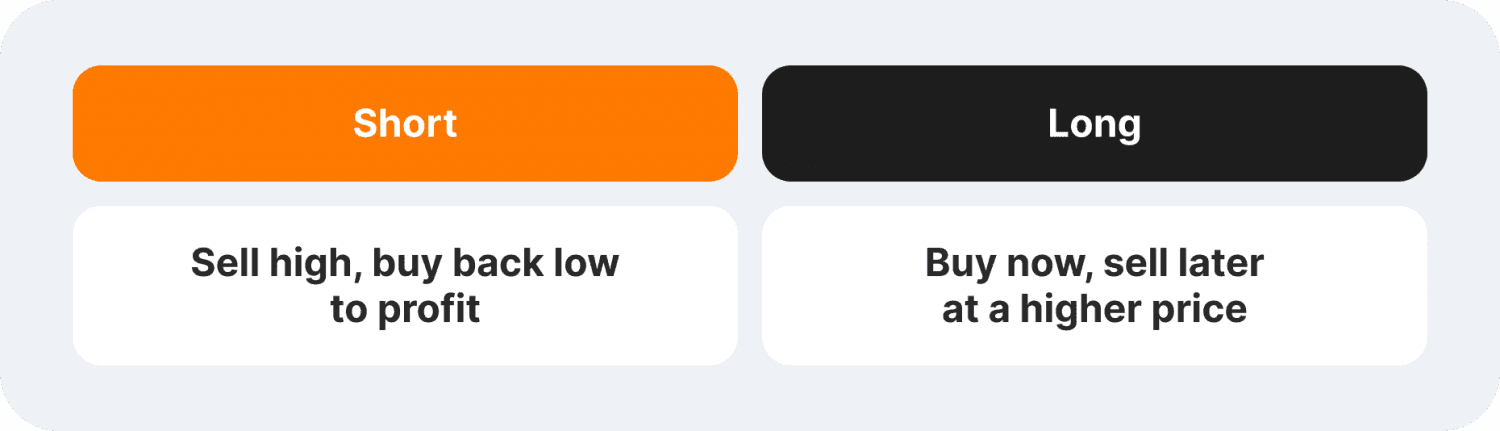

What is Long and Short in Crypto Trading?

In trade, shorting is taking out a loan, selling it at the going rate, and then buying it back at a discount. The trader's profit is the difference between the sale and repurchase prices. This technique is used by traders in crypto shorting for digital assets.

And visce versa, purchasing an asset with the hope that its value will increase and that the trader can sell it later for a profit is known as a long position. Let’s say you think that the price of the coin X will go up in the future. So, you purchase 10 X's at $20 each. You can sell your 10 coins for a $100 profit if the price of X rises to $30 each. This is long in trading.

Because of the volatility and decentralised structure of the crypto market, shorting is different from shorting more conventional assets like equities or FX. The cryptocurrency market is more vulnerable to abrupt price swings and market trends since it lacks the monitoring of a central authority, in contrast to traditional financial markets.

To profit from market price declines or when anticipating a bearish market mood, traders short crypto. Because of their volatility, coins frequently present chances for seasoned traders to execute short positions. Many traders also employ shorting as part of larger trading strategies or as a hedge against losses in their long positions.

How to Short Crypto

The next example is shorting. You think that the price of the coin Y will drop in the future. You borrow 100 Y and then sell them at the current market price of $0.50 each. You can purchase 100 Y at the reduced price to give back to the lender if the coin price drops to $0.40 per Y. In this case, 10 dollars would be your profit.

Crypto exchanges use loan programs that let traders borrow money or assets on certain conditions. And if you are wondering where to short crypto, it is supported by numerous exchange platforms.

These are some essential terms you need to know for short trading crypto:

Leverage: To boost their exposure to a deal, traders utilise borrowed money. Although leverage raises possible gains, it also raises risks.

Margin: The security that the platform requires to guarantee the loaned money. Platform and trade size-specific margin requirements differ.

Liquidation Price: The precise price at which the exchange cancels the position to stop more losses is the liquidation price. This happens when the price of the asset swings against the short position more than the margin can absorb losses.

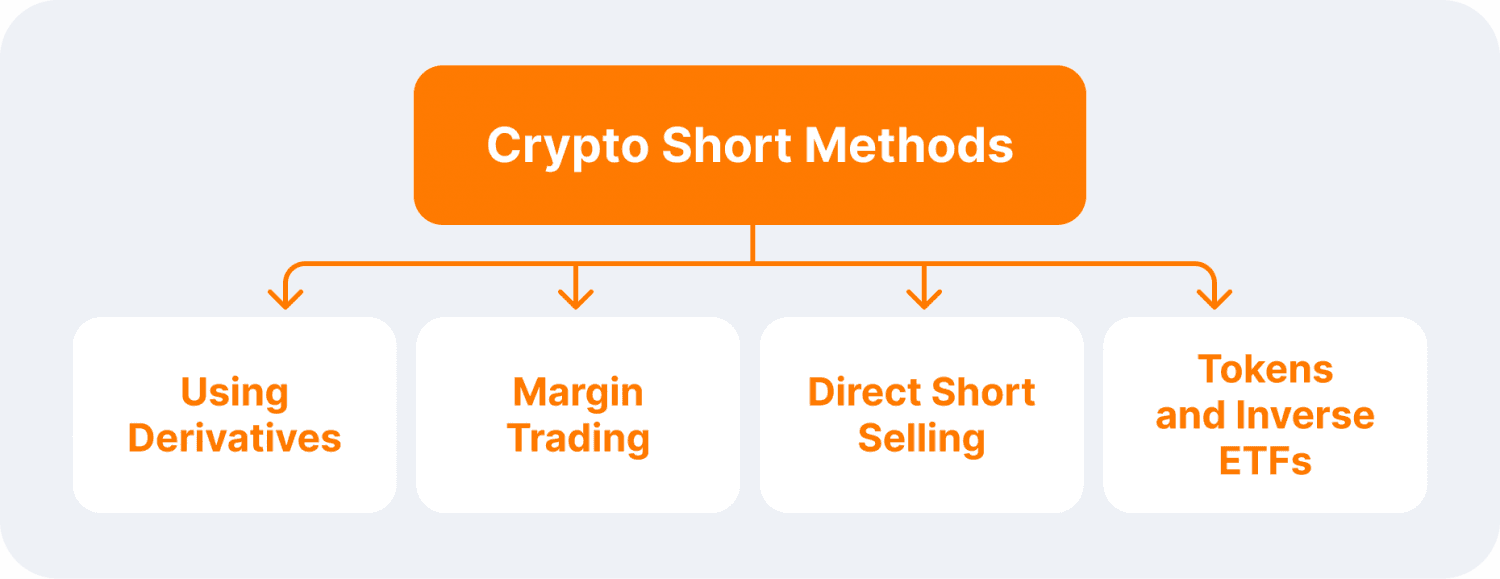

Methods to Short Cryptocurrencies

There are several ways to short crypto, and let's discuss the most prominent ways:

Using Derivatives

A futures contract is a commitment to purchase or sell a certain quantity of cryptocurrencies at a fixed price later. By entering a futures market to sell an underlying asset at a predetermined price, traders can short crypto and benefit if the price drops before the contract expires.

Several well-known exchanges facilitate trading in futures. Through options trading, dealers can have the right—but not the responsibility—to sell cryptocurrency within a given time frame and at a particular price. Because of the dangers involved, advanced traders frequently employ these strategies, which entail trading derivatives.

Margin Trading

Borrowing money to enhance a trade's size is known as margin trading. Traders can initiate a short position by borrowing cash, selling cryptocurrency, and then buying it back at a lower price. The profit is calculated as the difference between the selling and repurchase prices.

Maintaining a margin account, which includes particular margin requirements and interest rates on borrowed funds, is necessary for margin trading. Both possible profits and risks are increased when trading on margin.

Direct Short Selling

On some platforms, traders can directly borrow and sell cryptocurrency assets. Using this strategy, you borrow money or cryptocurrency assets from a lender, sell them, and then buy them back at a discount to repay the loan. A trading platform that facilitates borrowing and short selling is necessary for direct short selling. Although this approach avoids trading in futures, it has additional costs, such as borrowing fees and liquidity issues.

Tokens and Inverse ETFs

Leveraged tokens and inverse ETFs are intended to move against the direction of the underlying cryptocurrency asset's price movements. With the help of these products, traders can profit from a decline in cryptocurrency prices without borrowing money or selling assets.

Although leveraged tokens raise risks, they offer greater exposure to market fluctuations. These tools are usually utilised as a component of sophisticated trading methods and are accessible on particular cryptocurrency exchanges.

[aa quote-global]

Fast Fact

Dutch merchant Isaac Le Maire, a Dutch East India Company shareholder, is thought to have created the concept of short selling around 1609. but the name "short" has been around since at least the middle of the 19th century.

[/aa]

Advantages and Risks of Short

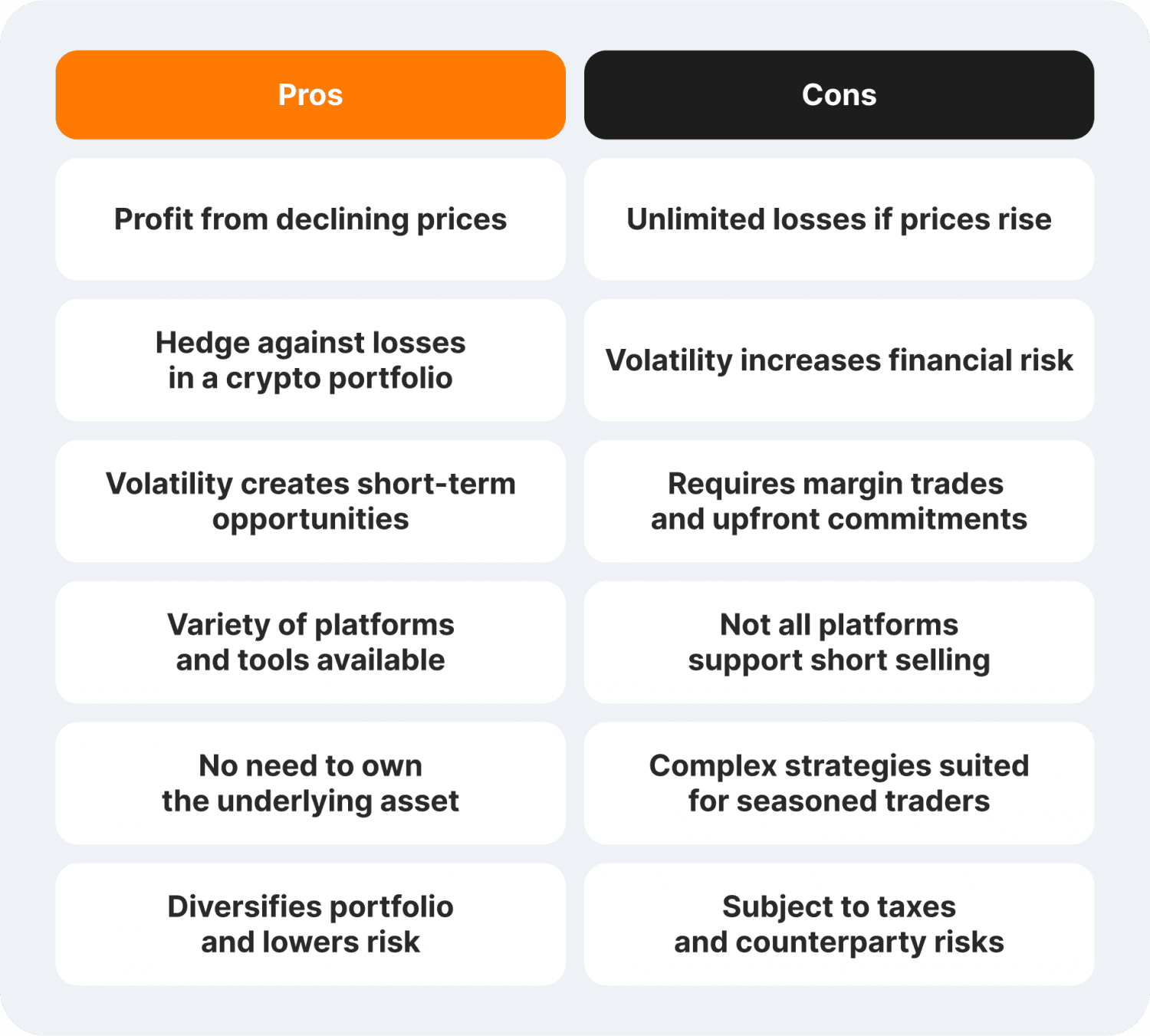

There are various benefits to shorting cryptocurrencies, and let’s point out some of them:

Shorting enables traders to take advantage of poor market situations and profit from declining prices.

In a more extensive crypto portfolio, short positions can cover possible losses.

There are a lot of opportunities for short-term trading methods due to the cryptocurrency market's volatility.

Traders can employ a variety of shorting tactics thanks to a range of platforms and tools.

Without holding the underlying asset, traders can predict price changes.

Shorting can lower overall portfolio risk and diversify investing techniques.

However, short trading has as many drawbacks as advantages. If the price of crypto increases, short sellers could lose their money indefinitely. Because abrupt price jumps can cause considerable financial setbacks, the cryptocurrency market's volatility further raises dangers. These losses can be increased using leveraged trading, as even slight price changes can significantly affect a trader's margin account.

Borrowing money or assets is frequently required while short selling, which results in extra expenses like lending fees. Additionally, many exchanges charge competitive fees, which raises trading costs even more. Also, shorting cryptocurrency usually requires margin trades, which require an upfront commitment. Traders unable to fulfil margin calls run the danger of liquidating their holdings.

Not all platforms support short selling; therefore, traders must locate an exchange with sophisticated trading technique alternatives. Profits from short sales are liable to capital gains tax, which lowers net earnings even in cases where they are successful.

Shorting crypto using derivatives trading, such as futures contracts and options trading, is a complicated process that calls for in-depth study and technical analysis. Generally speaking, this strategy works well for seasoned traders. Because there is a chance that a platform or broker won't deliver the borrowed money or assets, there are additional counterparty risks.

The Tips for Crypto Shorting

Before short-selling Bitcoin or other cryptocurrencies, careful research is essential. Examining price charts and indicators to spot trends and possible price moves is known as technical analysis. Market demand, trading volume, and macroeconomic trends are some variables examined by fundamental analysis. Reviewing past performance is equally important, even though it does not ensure future outcomes.

Set a Specific Price Goal

Effective shorting requires establishing a clear price goal. To control the risks involved, traders must establish entry and exit points depending on anticipated price movement. By doing this, traders may act methodically and avoid rash decisions. A transaction will be carried out under the intended investment strategy if a precise stop-loss level and take-profit threshold are established.

Put Risk Management Strategies to Use

When shorting, putting risk management techniques into practice guards against suffering significant losses. Take-profit orders protect profits when prices reach a predetermined level, while stop-loss orders automatically halt trades if the price swings against the trader's position.

Increase the Variety of Instruments

Diversifying your instruments helps spread the risk. With futures contracts, traders can agree on a future price. Exposure to short positions is possible with leveraged tokens without the need for direct margin trades. By enabling traders to wager on particular price moves without actually possessing the underlying cryptocurrency asset, options trading provides flexibility.

Keep a Careful Eye on the Market

Finding possibilities requires keeping an eye on market movements and the price of the coin. By combining the views of other market participants, prediction markets can offer insights into possible price movement. Tracking price changes in real-time enables traders to spot trends, reversals, and patterns.

Recognise Margin Trades

Shorting often requires margin trading. To execute larger stakes, traders borrow money, but dangers are involved. Maintaining adequate capital in the margin account is necessary to satisfy regulations and prevent forced liquidation.

Don't Over-Leverage

The dangers of shorting are increased by excessive leverage. Adverse market movement is especially risky when using high leverage because it magnifies gains and losses. Leverage should be used carefully, and traders should only expose themselves to as much as they want to lose.

Account for Tax Liabilities

Crypto short sales profits are taxable as capital gains. While preparing an investment strategy, traders must account for any tax implications. Jurisdiction-specific tax rates can result in unforeseen liabilities that lower total profits if they are not considered.

Final Thoughts

An advanced trading strategy that brings profit from price drops is shorting. It is essential for diversifying methods. This method involves many risks, and reducing losses requires understanding them and applying appropriate risk management techniques.

Have a well-defined investment plan and conduct extensive research before shorting. Keep yourself updated, evaluate the state of the market, and create a trading strategy that manages risk.

Read also