Share

0

/5

(

0

)

As a gateway to the world's financial markets, online trading platforms are an important resource for traders. They provide users with real-time information, analytical tools, and a straightforward interface to help them make profitable trades. These sites serve as a connection between individual traders and the global financial markets. The two most popular trading systems in this space are MetaTrader (MT) and cTrader, both well-liked among current merchants because of their powerful features.

In this article, we will discuss the similarities and discrepancies between the MT and cTrader to make it easier for traders to find the one that meets their trading objectives.

Key Takeaways

cTrader is a multi-asset platform for medium and long-term Forex trading.

The cTrader terminal offers a variety of trading tools to its users.

MetaTrader is a popular multifunctional platform for trading.

Two versions of the MetaTrader platform exist — MT4 and MT5.

MT and cTrader platforms have both similarities and significant differences.

What Is cTrader?

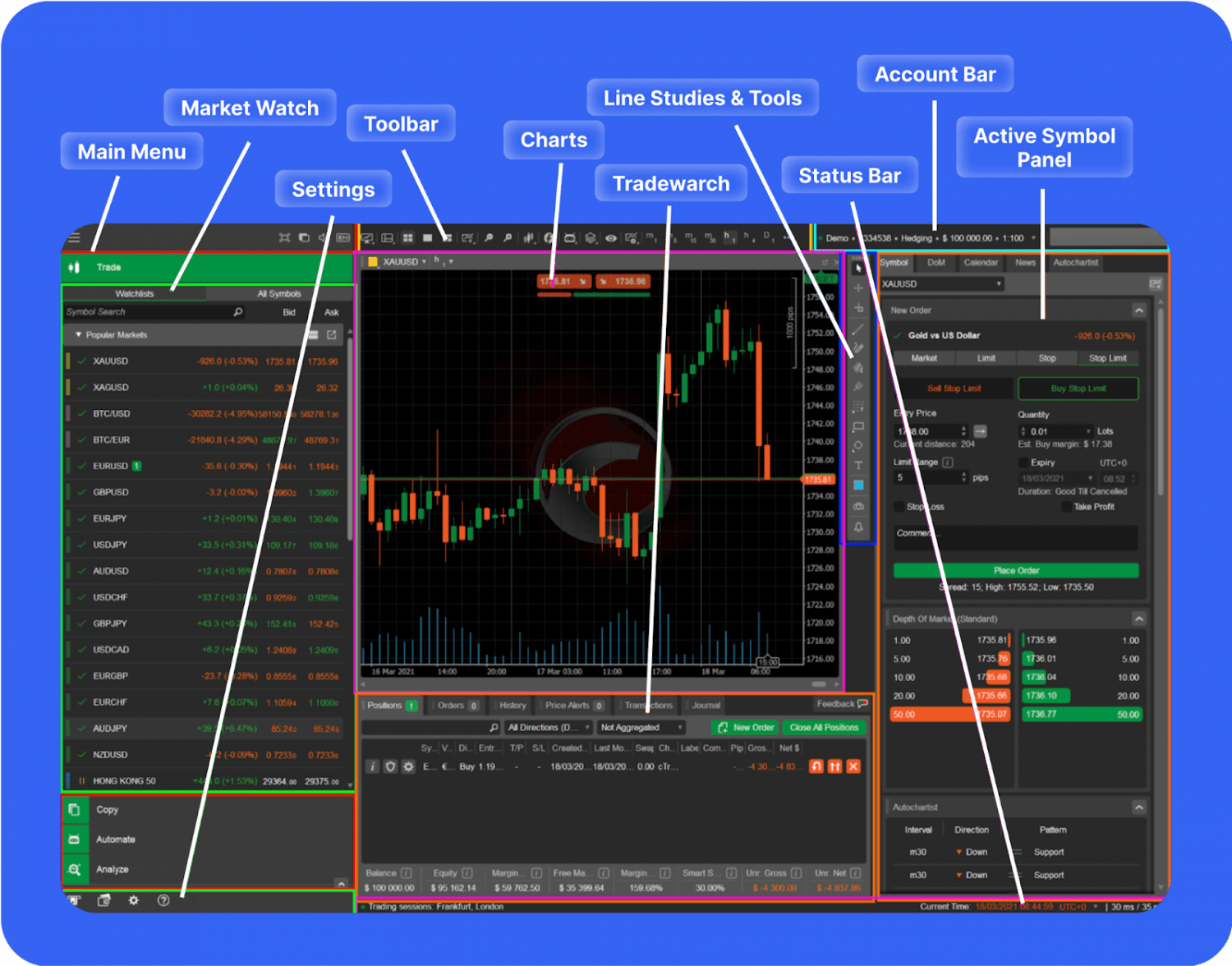

cTrader is one of the best multi-asset CFD and FX platforms for medium to long-term trading. It includes various trading tools and advanced order types, enhanced charting tools, and fast order execution. With the most sophisticated server technology and intuitive user interface, cTrader is available worldwide as desktop software and a mobile app for iOS and Android.

The cTrader terminal is a cutting-edge technology in the field of online trading. It is designed to work with ECN accounts and combines advanced tools and functions that can meet the needs of both beginners and professional FX traders.

The cTrader terminal has a simplified workspace, and you can place orders through the order book or chart. Moreover, the terminal includes advanced features for market depth analysis, automatic identification of technical analysis patterns, volatility calendar and news feed. It also comprises tools for investment portfolio analysis and customisation.

The cTrader architecture is built on the FIX API protocol, which enables the terminal's customisation to meet large companies' needs. Market access is possible via brokers such as FxPro, Fondex, IC Markets, and others.

To trade via cTrader, you must open a trading account with one of the cTrader brokers, who will charge a commission for trade transactions on the platform.

cTrader Features

The cTrader terminal has a variety of tools for trading which can be offered to its users. Among the most noteworthy are the following:

Tools for managing trading orders - The cTrader platform has a standard set of orders: limit, market, stop, stop-limit and stop-loss/take-profit, as well as leverage trading. cTrader has a built-in alert system: you can mark a selected spot on the chart, and the alert will be issued after reaching this spot. The terminal also allows you to work with CFDs when opening an ECN account through a partner broker.

Algorithmic trading tool - The cTrader team developed the cAlgo plugin to create automatic trading bots and technical analysis indicators via the #C coding language. You can open a position from the menu of the selected algorithm. By default, 12 bots and 10 automatic indicators are available in the cTrader interface.

Charts and technical analysis tools - In addition to the standard line chart, cTrader comprises a tick, Renko, and Range chart. Their display can be configured as candlestick charts, bar charts, dots or lines. The charts have eight scaling options and many timeframes, from 10 minutes to 1 month. More than 50 technical indicators are integrated into cTrader for technical analysis. They are divided into 6 categories: trend, oscillators, volatility, volume, others, and custom indicators. In the Trade section, you can view several charts simultaneously. The location and size of the graphs are customisable.

Orders processing - The ECN cTrader platform uses STP technology to process orders, allowing you to trade directly on the FX market with the world's leading banks (Deutsche Bank, Bank of America, Goldman Sachs, etc.) without a broker intermediary. Processing NDD orders guarantees the execution of transactions on the Forex currency market at market prices in one click.

Pros And Cons of cTrader

Among the pros of the cTrader platform are the following:

An extensive list of trading instruments. It includes 83 currency pairs on the FX market and precious metals.

The cTrader terminal is multifunctional, allowing you to create unlimited charts and customise them using various layouts, modes and templates. Also, it is possible to open charts in separate windows without compromising the functionality.

A complete set of tools necessary for conducting thorough technical analysis, including over 50 indicators, with the ability to combine and optimise them and develop your own scripts.

Convenient interface with multiple settings.

The platform has an order book that makes it possible to analyse orders for the purchase and sale of assets in real time.

ChartShots and ChartCasts functions for sharing experiences and ideas with other traders.

The ability to quickly access the most frequently traded instruments.

There are also some disadvantages to the cTrader platform:

The main disadvantage of the platform is that it can be used specifically for ECN accounts.

High commission rates are another drawback of the platform. cTrader has high fees compared to other trading terminals. This can reduce a trader's profits and motivation to trade on this platform.

Limited language support can be a significant disadvantage for some traders since cTrader only supports a few languages.

What is MetaTrader?

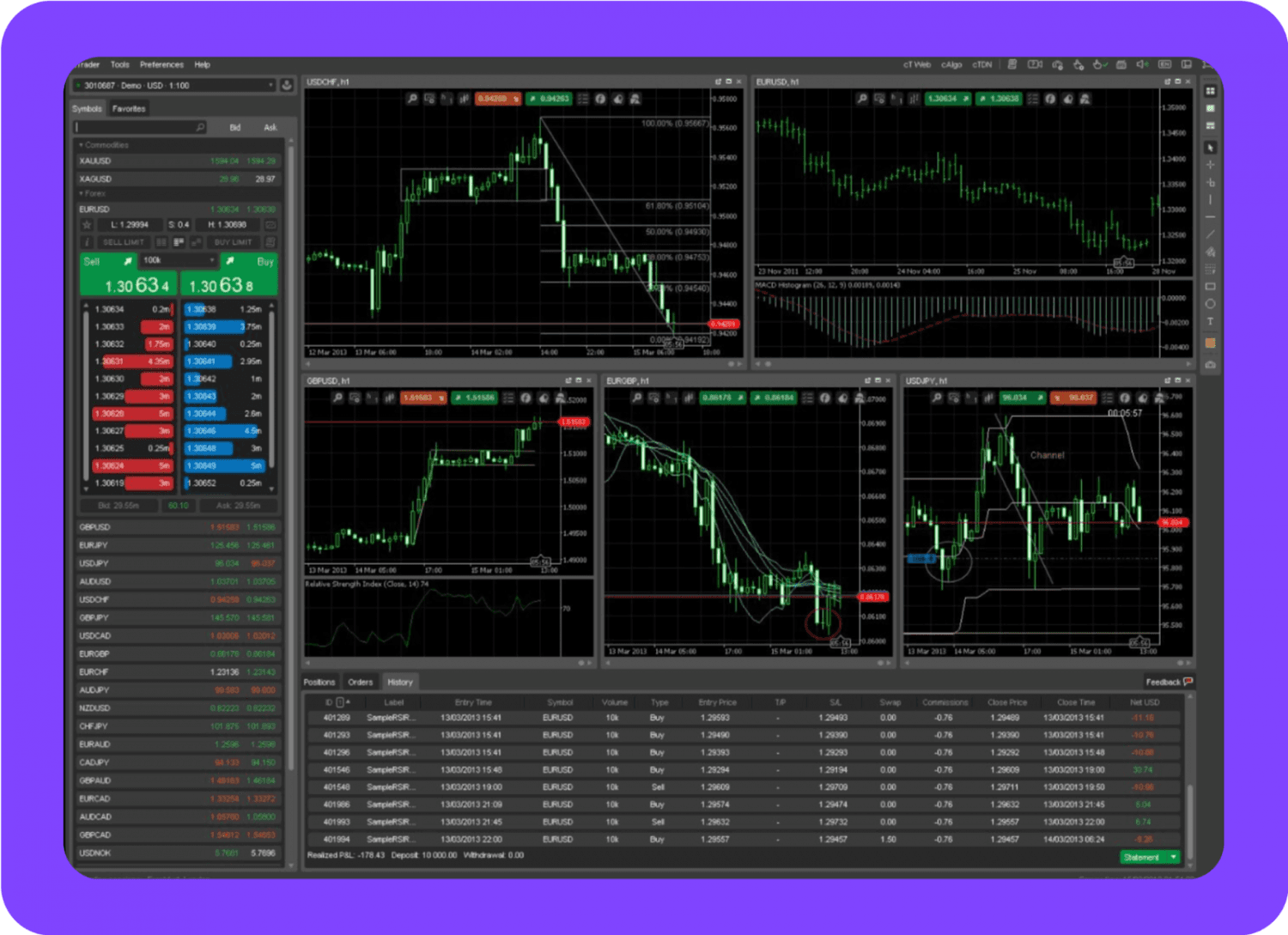

MetaTrader is a multifunctional trading platform used by many traders and brokers.

This is a professional Forex trading software developed by MetaQuotes Software Corp for online trading of currencies, CFDs, stocks, futures and options. MT features price charts with built-in indicators, the ability to manage multiple accounts, and access to all types of market orders except OCO. In addition, the platform has its programming language MQL4/MQL5, similar to C, with which you can create your indicators, scripts and robo-advisers. The MetaTrader program is also entirely free for traders.

Trading on MT is easy. The platform consists of several areas and toolbars:

Chart window that displays charts and indicators used to analyse rates of currency pairs.

Market overview with a list of assets available for trading and their bid and ask rates.

Navigator for manoeuvring between accounts, custom indicators, scripts and advisors.

Terminal with open trades, account history, broker alerts, news and calendar.

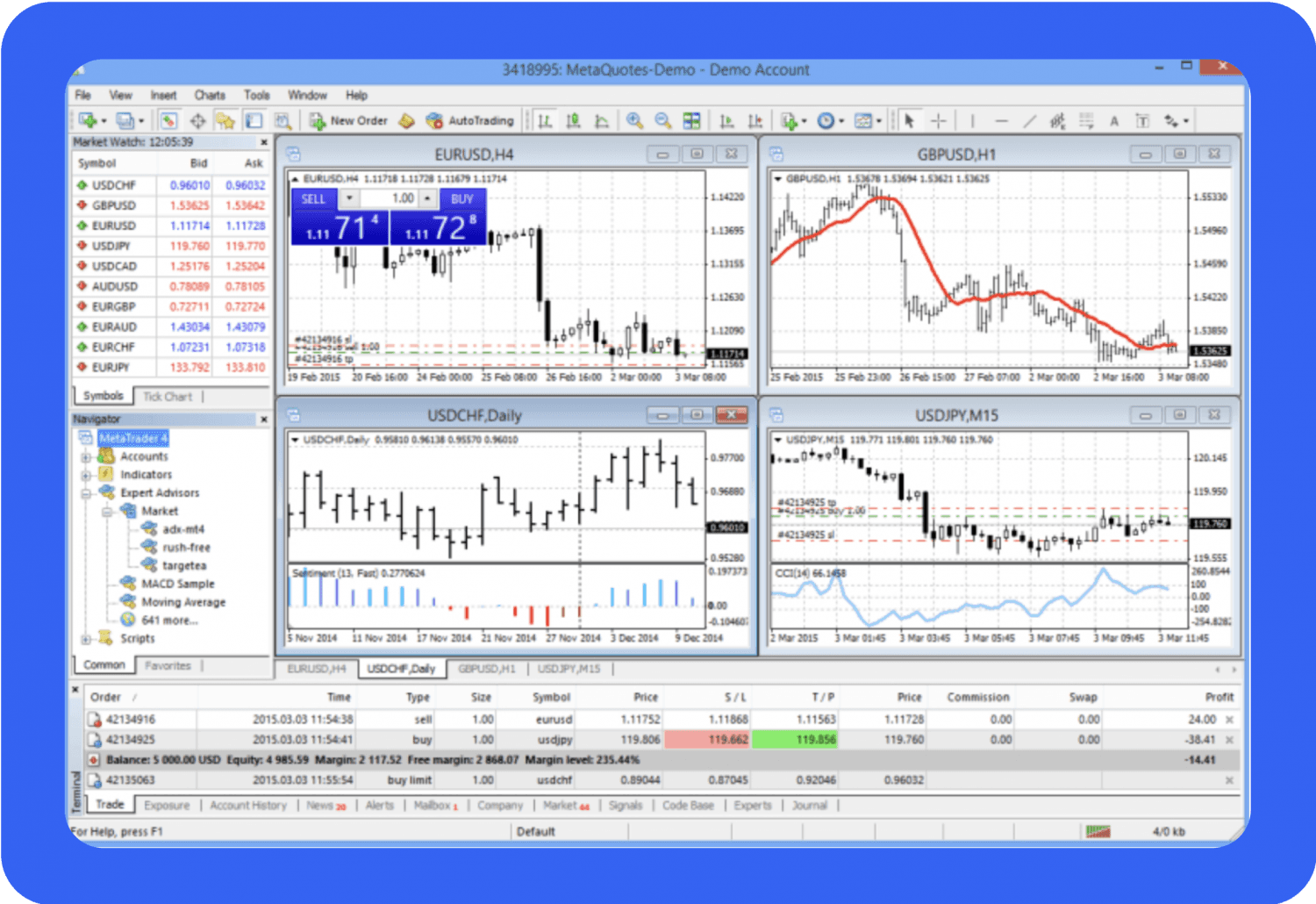

MetaTrader 4 vs 5

MetaTrader 4 was launched in 2005 and became extremely popular, setting the industry standard for platforms for FX and CFD trading.

MetaTrader 5 was launched 5 years later, in 2010.

Today, there are two versions of the platform — MT4 and MT5, differing in functions and capabilities.

Initially, there were two significant differences between the two versions:

In MT4, the programming language MQL4 was more similar to C, while in MT5 (MQL5), it was more like C++.

In MT5, a trader could only hold one trade at a time, so hedging was unavailable. This restriction was set following the American FIFO standard to reduce the swap's impact on traders' balances.

Both these differences are no longer relevant: MQL4 and MQL5 are now compatible, and it is now possible to open more than one trade simultaneously in MT5.

[aa quote-global]

Fast Fact

MT5 wasn't just an improved version of MT4; it was designed to trade markets beyond foreign exchange through centralised exchanges, such as commodities, stocks, futures, and options.

[/aa]

Metatrader 5 was created to follow the USA's rule that bans hedging. This rule means that clients must close their first trade before closing their second.

Metatrader 5 has two significant benefits over Metatrader 4: backtesting and simultaneous multi-currency pair backtesting. This can make the testing process faster.

There are also some minor differences. For example, the MT5 platform comprises more technical indicators, graphical objects and pending order types than the MT4 platform. The later version of the terminal also allows exchange trading and partial fill of orders.

Pros And Cons of MetaTrader

A lot of advantages explain the popularity of the MetaTrader platform:

Free access. You don't have to pay for trading on MT; you need to download the program through any broker's website or directly from the MetaQuotes website. Moreover, using the platform, you can trade even with a broker that does not support this platform.

Simplicity and customisability. Trading through MT does not require special knowledge; the trader can customise charts and other windows and panels.

Tailored indicators and advisors. With MT, a trader can develop trading tools that are entirely tailored to your individual trader's style.

High popularity and vast community. Thousands of free indicators created by other users can be found in the MT community.

History and reports. Using detailed reports, you can carefully study your trading statistics.

However, there are also some disadvantages.

The need to install the program. The MetaTrader platform has a browser version, but it is very limited, and in order to use all the available functionality, you have to download and install the program.

Lack of support for user-created tools. Third-party indicators and advisors may not work as expected, but no support team will address such issues.

The absence of one-cancels-the-other (OCO) order type. You cannot place two orders and have only one executed automatically. However, you can write a special script for this, but there is no standard option.

MetaTrader vs cTrader: Similarities And Differences

Though the cTrader and MT platforms might look alike, you should consider some significant differences when choosing a trading terminal.

User Interface

The MetaTrader and cTrader platforms have distinct user interfaces. MT4 has a traditional, recognisable interface with separate windows for market watch, charts, and trade execution. In contrast, cTrader offers an up-to-date, streamlined interface with a single-screen layout, focusing on simplicity and ease of use.

Order Types and Execution

Both platforms operate with different types of orders, such as market orders, stop orders, limit orders, etc. cTrader is known for fast order execution and suggests advanced ways to place orders, like setting time limits and using multiple triggers to stop orders. It also allows users to trade directly in the market without the third party getting involved. On the other hand, MT uses an Electronic Communication Network (ECN) where orders go through the broker's network.

Charting and Technical Analysis

Both platforms, MetaTrader and cTrader, have strong charting capabilities, but they differ in their features. MT has a variety of tools to help with trading, like technical indicators and other customisable options. cTrader is a helpful tool for analysing charts closely, exploring market depth, and getting detailed information on pricing for Level 2. cTrader also offers various tools for studying market data, but it might have fewer choices compared to MT.

Algorithmic Trading

Both platforms, MT and cTrader, have the option of algorithmic trading. MetaTrader uses MQL4 or MQL5 languages for this, while cTrader uses the C# language and an API to create your own trading bots and indicators.

Community and Ecosystem

The platform MetaTrader has a larger user community and a vast marketplace of third-party indicators, EAs, and scripts that traders can use or purchase. This ecosystem offers a wide range of ready-to-use tools, as well as social trading and copy-trading advantages. cTrader also has a growing user community and a marketplace for customised indicators and robots, although it may not be as extensive as MT’s ecosystem.

Access to The Market

The MetaTrader platform helps traders connect to a network that includes brokers and providers of market liquidity. At the same time, cTrader allows traders to access the global FX market directly, giving them access to liquidity from different places.

Platform Availability

MT is a well-known trading terminal that many brokers use. There are two versions of MetaTrader, MT4 and MT5. Despite being well-liked, cTrader might be provided by fewer brokers.

Which Platform to Choose?

The choices of trading platforms typically depend on various factors, such as the FX broker you choose, your trading strategies and objectives, and even market trends.

The MT4 terminal is very straightforward and highly efficient, which makes it an excellent choice for forex traders. It offers a wide range of indicators, backtesting features and customisation options. MT4 provides the best solution for automated trading operations.

The MT5 terminal suits those who trade various assets and need more advanced features.

cTrader offers a broad spectrum of trading tools, an easy-to-use interface, customisable settings, and detachable charts. This platform is an excellent option for expert traders. cTrader has a nice and simple user interface and tools for scalp traders and day traders.

It is also crucial to mention that cTrader and MetaTrader have white-label options. So, if you plan to start your brokerage, consider these two platforms as a white-label forex trading platform solution.

Although both platforms, MetaTrader and cTrader, have strengths and weaknesses, each offers unique features, and the ultimate choice of the trading terminal depends on your preferences and trading strategies.

Final Remarks

MT and cTrader are computer programs traders use to participate in the FX market. Yet, MT has been around for longer and offers greater flexibility in terms of tailoring the trading experience and incorporating automation. However, cTrader has gained popularity because of its user-friendliness, sophisticated charting features, and Level 2 pricing.

Your preferences, trading style, and goals should all inform your decision about the trading platform you use. Look at all the features and choices each platform has to offer before making a final decision and think about the advantages and disadvantages of each.

FAQ

Which is better: MT or cTrader?

MT has a traditional interface with a top menu bar, multiple charts and trading panels, and a tab-based layout. At the same time, cTrader offers a modern, intuitive design with a single-window layout.

What is the difference between MT4 and MT5?

The main difference is that using the MT4 terminal, you can only trade on the FX market, whereas with the MT5 platform, you can trade on both the foreign exchange and stock markets.

What is the minimum deposit for cTrader?

You can start with a cTrader account by depositing as little as $100 and benefit from competitive spreads across over 70 Forex pairs, indices, metals, and energy commodities.

Can I trade Crypto on cTrader?

While cTrader Web comes with BTC/USD and BTC/EUR pairs as standard, individual brokers may offer different trading instruments. It's advisable to reach out to your specific broker to confirm if they facilitate cryptocurrency trades.

Read also