Share

0

/5

(

0

)

Managing a Forex brokerage can be overwhelming. You need to know and consider lots of things, and many decisions can affect your business.

Forex brokerages utilise sophisticated systems and software that simplify their job, like CRMs, payment gateway, and integrations that streamline the work procedures.

Choosing the right payment gateway is critical as it enables your clients to fund their accounts, conduct transactions, and allows you to receive your revenues. Therefore, it’s important to understand the payment gateway architecture you want and start integrating it.

Key Takeaways

A Forex payment gateway facilitates the process through which brokers receive funds from their clients, enabling traders to deposit and engage in trading.

A white label payment gateway provides ready-to-use platforms for business owners, allowing them to choose the necessary features and brand them according to their business needs.

A few qualities help determine the best payment gateway provider, including quick transaction processing, reasonable exchange rates, and a robust security system.

Understanding Payment Gateways

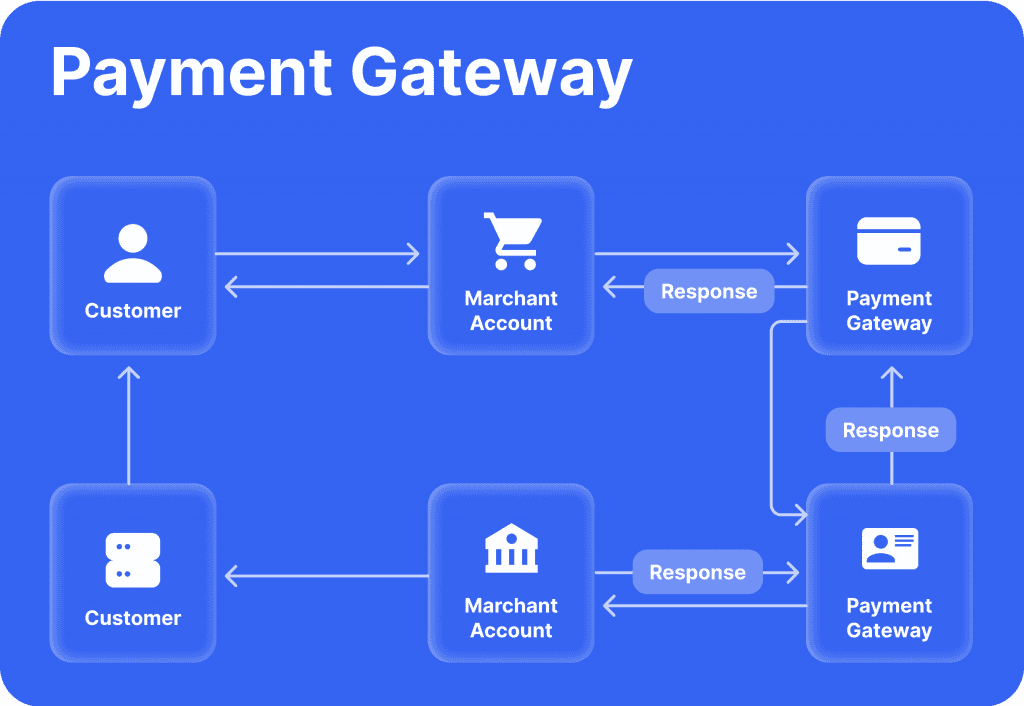

A payment gateway is how merchants receive money from buyers using credit and debit cards or different payment methods. Payment gateway technology supports the payment terminals in traditional brick-and-mortar stores and the online checkout stage on e-commerce websites and online shops.

Therefore, this technology is important for any business offering products and services.

Forex payment gateway is explained similarly: How traders pay for trading services and access the platform. Brokerage companies integrate a payment gateway API to their platforms, where the users deposit before they can start trading.

Once the user deposits, the funds will go to the broker’s account and receive their revenues. Payment gateways charge transaction fees in exchange for their service, which is usually deducted from the broker side.

Instant settlement payment gateways allow brokers to withdraw funds quickly, issue invoices, and create financial reports.

However, not all payment gateways work similarly. The international payment gateway market is massive, with many worldwide gateways, processors, and providers competing intensively.

The payment gateways market size in the United States is over $38 billion, bigger than any other country worldwide, followed by Germany with a $10 billion market cap.

[aa quote-global]

Fast Fact

The first payment gateway was introduced in 2006 by a group of entrepreneurs in the Netherlands who called the system Adyen.

[/aa]

White Label Payment Gateway

White label platforms are custom-made systems coded, designed, and programmed to service the client’s needs with the client’s chosen preferences and features.

Clients prefer white label payment gateways because they can enjoy ultimate freedom of choice and customise their gateway process.

Brokers can adjust their white label payment gateway by choosing the payment methods they want and adding specific features like a scannable QR code, supported languages, invoicing options, and more.

These customised gateways are usually easier to use and faster to get started with. All the client needs to do is brand it, choose the features or integrations they want, and let it go live.

Qualities To Look For In Your Payment Gateway

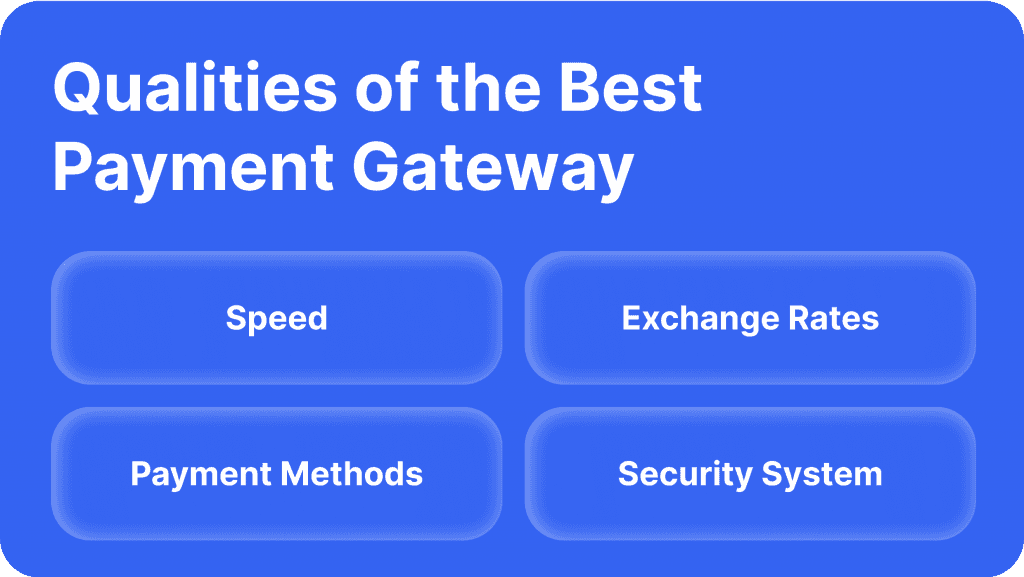

Given the wide array of gateways and systems you can choose from, a broker must look for certain characteristics in the payment gateway they want to adopt. These factors can be crucial for running the business and getting the job done in quality and efficiency.

Speed

Opening an account and depositing the money on the go is at the top of the priority list. FX trading platform must integrate a gateway that processes transactions fast and minimises downtime.

Currency Conversion Rate

If you run a business in the Forex industry, then you definitely know there are hundreds of currencies out there, and traders can be making money and paying fees in different currencies.

Therefore, finding a payment gateway that offers multiple currency options and a reasonable exchange rate is essential. Otherwise, these spreads might eat your profits.

Payment Methods

A reliable Forex payment gateway is flexible and offers multiple payment options.

Especially when operating a Forex trading firm with clients worldwide, where each location has its payment systems, your platforms must adapt to their payment choices so no one feels excluded from trading with you and attract as many clients as possible.

Security System

The safety of funds and the security of personal information are essential. These are the main concerns for any new user, and assuring them that their money is safe with a robust security system helps you retain clients as long as possible.

Best Forex Payment Gateways

As we mentioned previously, there is a huge selection of payment gateways that you can choose from. One way to find the gateway that suits you is by trial and error, which can be a time-wasting process.

Otherwise, you can find our chosen three payment integrations that you can add to your trading platform.

B2BinPay

B2BinPay is a growing payment processor that supports crypto and fiat money for merchants sending and receiving payments, such as FX brokers, e-commerce, marketing agencies, travel companies, and more.

B2BinPay takes pride in providing instant settlements and implementing zero transaction fees for outbound payments and multiple pricing options that fit your needs. The prices depend on your chosen payment method, transaction processing time, and business size.

Besides enterprise blockchain wallet solutions, B2BinPay offers merchant accounts for a wide range of industries, including a payment gateway for FX businesses or an e-commerce shop on Shopify, and more, which makes this online payment provider flexible and reliable.

PayPal

PayPal is an online payment service that has been around for many years, with a robust security system and well-designed payment gateway supporting different payment methods.

PayPal offers a merchant account with advanced reporting, invoicing, payment processing and other features. Its platform supports multiple currencies and languages and is adopted by many merchants.

It is one of the most secure FX payment solutions and follows strict regulations against fraud and money laundering. Setting up a broker’s merchant account may require much information, but it is a reliable payment gateway in the long run.

Skrill

Skrill Wallet is a famous payment gateway provider for e-commerce and online payments, including FX trading platforms. This payment gateway occasionally updates its exchange rates for multiple currencies to find the rates for your business.

This Forex payment processing solution offers fraud prevention tools, including chargeback protection, a rising issue for dealing with fraud in high-risk businesses.

Conclusion

Finding the best payment system for your Forex trading business is challenging because many providers offer similar services. However, an in-depth understanding of the services you want and the features you prefer will help you find a reliable payment gateway.

Ensure you find a service provider with a quick transaction process and multiple foreign currency support because these can highly affect your business.

Read also