Share

0

/5

(

0

)

The foreign exchange market, or Forex, is a dynamic and ever-evolving landscape. As a broker, you constantly strive to navigate a sea of competitors, all vying for the attention of potential clients. Standing out in this crowded space requires a clear value proposition, exceptional customer service, and a deep understanding of your target audience.

However, traditional methods of managing client data and interactions often fall short. Scattered spreadsheets make it difficult to track client activity and preferences. Fragmented communication channels hinder your ability to deliver timely and personalised updates. Limited data analysis restricts your ability to identify trends and tailor your offerings accordingly. Here's where a Forex CRM (Customer Relationship Management) tool becomes a game-changer.

Key Takeaways

Forex CRM software empowers you to build stronger client relationships through personalised communication and data-driven insights.

Streamlined workflows and automated tasks free up your team's time to focus on closing deals.

Data analysis and reporting enable informed decision-making, leading to improved conversion rates and revenue growth.

The Forex Sales Landscape - Challenges and Opportunities

The Forex market is fiercely competitive, with numerous Forex brokers offering a variety of trading platforms, educational resources, and account types. Standing out in this saturated environment requires a multi-pronged approach. You need a clear value proposition that differentiates your brokerage from the competition.

This could be through unique features on your trading platform, exceptional customer support, or specialised educational content tailored to specific client needs. A high degree of customer satisfaction is another crucial element for success. Clients expect prompt and professional assistance, especially when navigating the complexities of the Forex market.

However, traditional methods of managing client data and interactions often hinder your ability to achieve these goals. Scattered spreadsheets make it difficult to track client activity and preferences over time. Fragmented communication channels, like email and phone calls, create information silos and make it challenging to deliver timely and personalised updates.

Limited data analysis restricts your ability to identify trends in client behaviour and market movements. This lack of insight makes it difficult to tailor your offerings and marketing messages to resonate with your target audience.

What is a CRM tool, and Why is It Crucial in Forex?

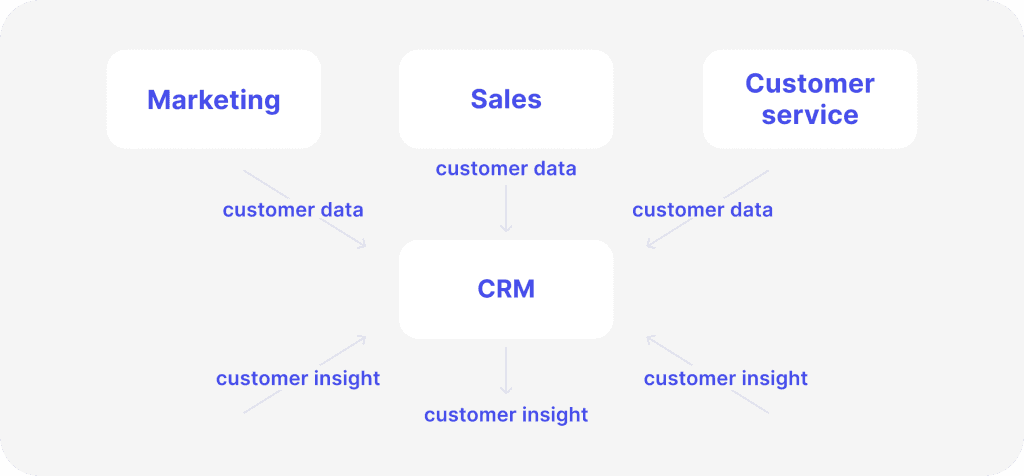

A CRM, or Customer Relationship Management tool, is a centralised platform that streamlines how you manage your client interactions. It consolidates all client information in one secure location, including contact details, trading volume through history, risk tolerance levels, and communication preferences. This fosters a 360-degree view of your clients, allowing you to tailor communication and marketing efforts to their specific needs and interests.

Imagine being able to send targeted market updates based on a client's preferred currency pair or educational content tailored to their risk tolerance level. This personalised approach strengthens trust and loyalty. Furthermore, CRMs automate repetitive tasks such as data entry, report generation, and email follow-ups.

This frees up your valuable sales team's time, allowing them to focus on building relationships with clients, addressing their concerns, and ultimately closing more deals. Advanced analytics capabilities provided by Forex CRMs deliver valuable insights into client behaviour and market trends. Analyse trade history and client profiles to identify potential risk factors and implement proactive risk management strategies. Additionally, CRMs provide comprehensive reports on client acquisition costs, conversion rates, and revenue generated by different marketing campaigns. This data is vital for tracking progress towards sales goals, identifying areas for improvement, and optimising your overall sales strategy for long-term success.

How Forex CRM Solutions Elevate the Forex Brokerage Capabilities

Forex-specific CRMs offer additional functionalities that enhance your capabilities in two key areas: client relationships and data-driven decision-making.

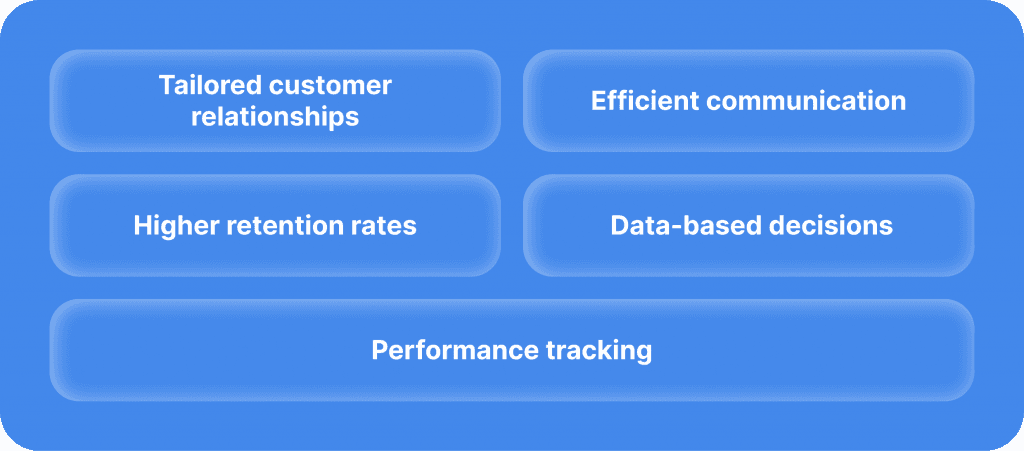

Enhanced Client Relationships and Retention

CRMs foster stronger client bonds by facilitating personalised communication. Imagine sending targeted market updates on a client's preferred currency pair, educational content tailored to their risk tolerance level, or special offers relevant to their trading style. This custom approach leads to higher client retention rates and a more profitable brokerage. Studies by Gartner Group show that companies implementing CRM strategies experience a 20% increase in customer engagement and retention.

Data-Driven Decision Making and Performance Tracking

Forex CRMs integrate with market data feeds, allowing you to monitor trends and make informed recommendations to clients based on real-time market conditions. This empowers you to offer timely insights and potentially improve client trading performance, fostering trust and loyalty. Additionally, CRMs analyse trade history and client profiles to identify potential risk factors. This allows you to implement proactive risk management strategies, such as margin alerts or educational resources on portfolio diversification.

This not only protects clients but also fosters a sense of security and trust in your brokerage. Furthermore, CRMs provide comprehensive reports on key metrics like client acquisition costs, conversion rates, campaign performance, and revenue generated by different marketing initiatives. This data is vital for tracking progress towards sales goals.

By identifying areas for improvement, you can optimise your overall sales strategy for long-term success. For instance, analysing conversion rates for different marketing campaigns allows you to pinpoint the most effective strategies and allocate resources accordingly.

[aa quote-global]

Fast Fact

CRM systems are actively progressing with AI, allowing brokerages to automate numerous tasks and receive more refined client information instead of raw data.

[/aa]

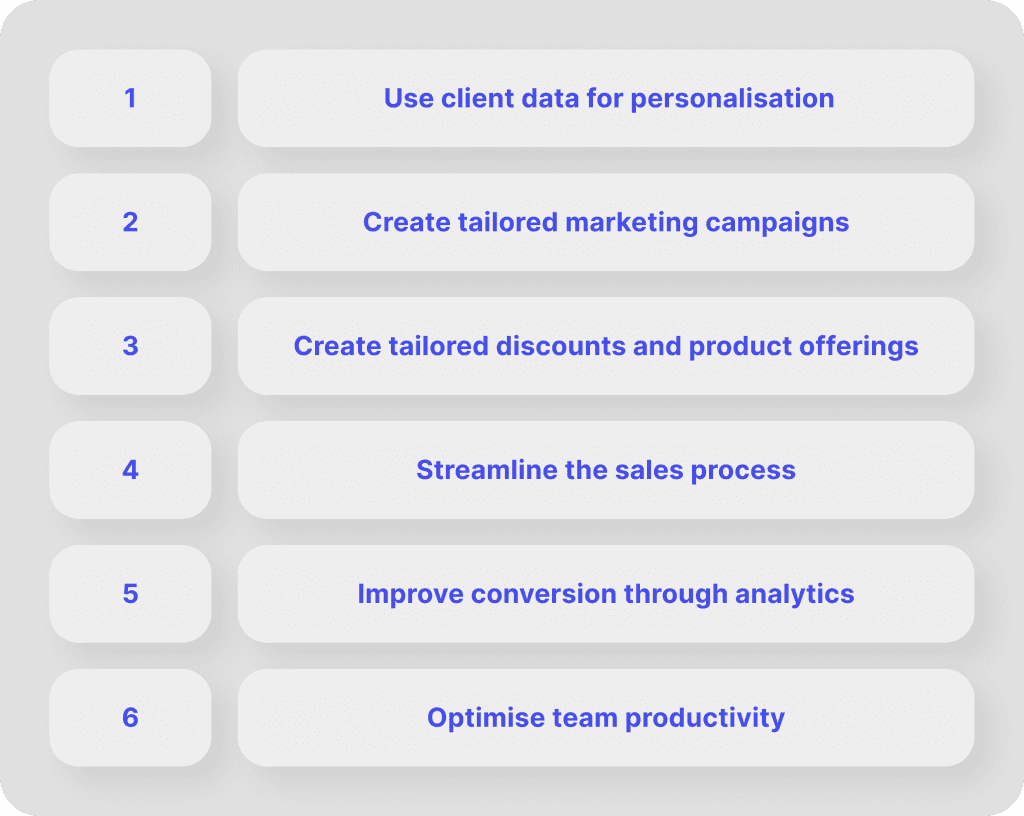

Top Strategies to Increase Revenue Through CRM

By leveraging the power of your CRM, you can implement several key strategies to boost your sales and revenue in the Forex market.

Leverage Client Data for Personalised Sales and Marketing

CRM data reveals valuable insights into your clients' interests, preferences, and trading behaviour. Utilise this information to segment your client base and create targeted campaigns. Imagine crafting email sequences with relevant educational content based on a client's experience level. Develop personalised trading recommendations based on their risk tolerance and preferred currency pairs. This data-driven approach significantly increases engagement and conversion rates. Studies by the Aberdeen Group show that companies that personalise their marketing campaigns experience a 50% increase in sales leads.

Streamline the Sales Process and Improve Conversion Rates

CRMs automate lead capture, qualification, and nurturing with dedicated workflows. This ensures timely follow-up with potential clients, reduces manual workload for your sales team, and qualifies leads faster. Ultimately, this accelerates the sales cycle and leads to closing more deals.

Additionally, opportunity management features within the CRM provide a centralised platform to track sales opportunities, manage proposals, and monitor progress. This improves team visibility and collaboration, facilitating faster deal closures and higher revenue.

Optimise Internal Processes and Team Collaboration

CRMs automate repetitive tasks like data entry, report generation, and email follow-ups. This frees up valuable time for your sales reps, allowing them to focus on building relationships with clients, addressing their concerns, and ultimately closing more deals. Additionally, CRMs create a shared platform where sales and marketing teams can collaborate effectively.

Sharing data on lead behaviour, campaign performance, and customer needs fosters data-driven decision-making and optimises marketing efforts for better lead generation and conversion. Improved communication and collaboration within sales teams through internal notes and real-time activity updates further enhance productivity and sales success.

Final Thoughts - How CRM Goes Hand-in-Hand with Your Brokerage

In today's competitive Forex market, a robust CRM is essential software for any broker looking to elevate their sales capabilities. By fostering strong client relationships through personalised communication, streamlining the sales process with automation, and optimising internal operations for better collaboration, Forex CRMs empower you to make data-driven decisions and achieve sustainable revenue growth.

With the right CRM systems and strategies in place, you can attract high-value clients, secure their loyalty, and uplift your Forex brokerage business to new heights. So, consider your options carefully and choose a CRM system that is well-suited for your Forex broker needs, scope considerations and business flow.

Read also