Share

0

/5

(

0

)

ECN brokers are changing how financial markets operate, opening up trading to be more transparent and direct. Before, trading could feel like a closed-off, exclusive club, but now ECN brokers link you directly to major market players, cutting out the middleman. This approach simplifies the process, giving you the clear, straightforward path you need, almost like having a savvy friend guiding your trades.

This guide explains the meaning of an ECN broker, its benefits in Forex trading, and how to start one in 2025. Aspiring entrepreneurs will find actionable insights on setting up an ECN Forex broker and thriving in the competitive equity and currency markets.

Key Takeaways

An ECN broker connects traders directly with liquidity providers through an electronic communication network. It offers competitive pricing, faster execution, and transparency in trading.

Starting an ECN brokerage requires market research, licensing, reliable trading platforms, and partnerships with different liquidity providers to create seamless ECN trading experiences.

While the financial markets present growth potential for ECN brokers, regulatory compliance and initial investment challenges demand strategic planning and robust technology solutions.

What is an ECN Broker?

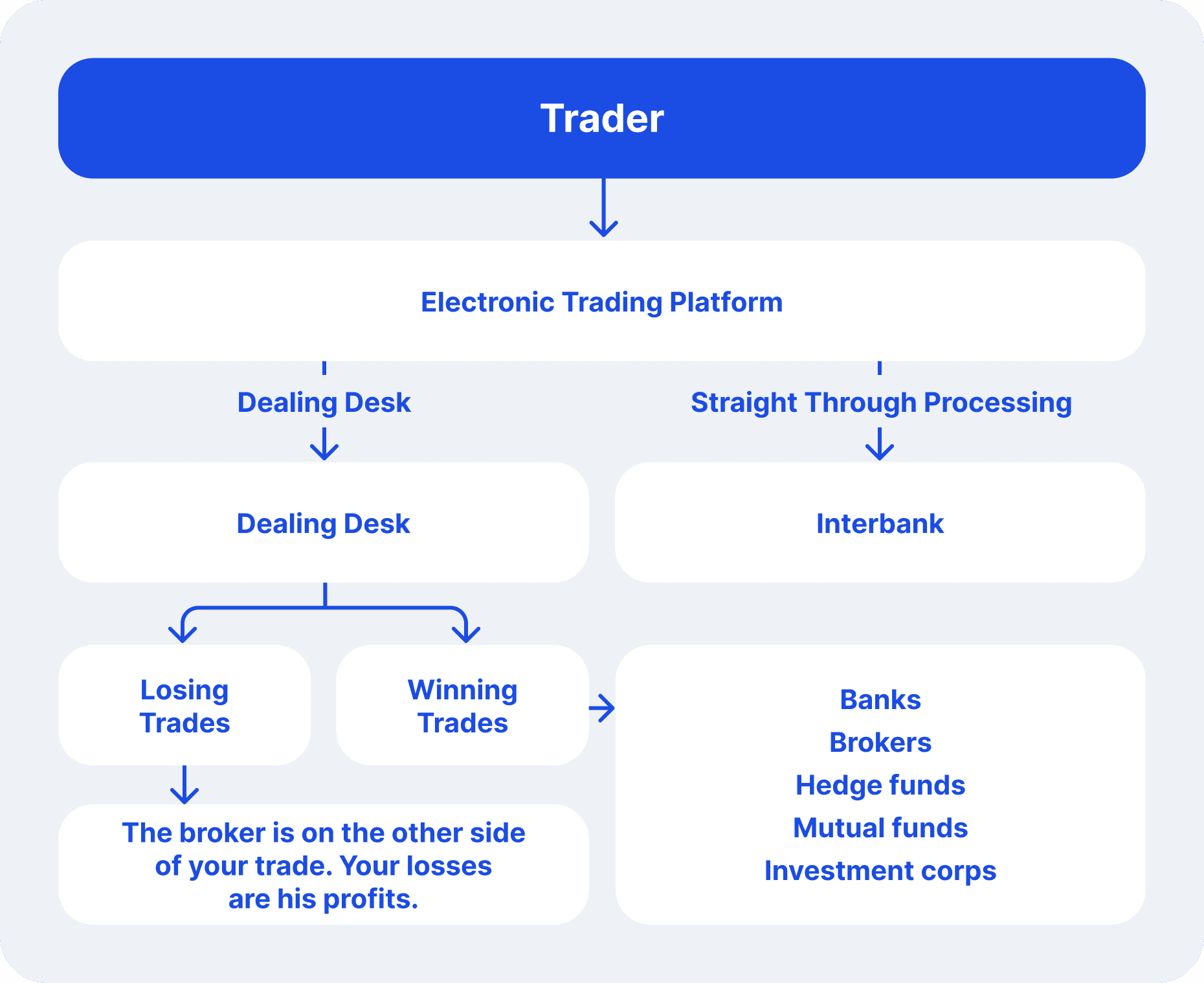

ECN stands for Electronic Communication Network. An ECN broker acts as a facilitator, connecting traders directly with other foreign exchange market participants. Traders gain direct market access to execute buy and sell orders at competitive prices. Unlike traditional brokers, who may act as market makers, ECN brokers don't take opposite positions on client trades.

Here's how it works:

A trader places a buy or sell order for a currency pair on the ECN broker's platform.

The ECN network automatically searches for the best available counter-offer from other market participants (liquidity providers) within the network.

If a matching offer exists, the trade is executed instantly at the market price. This eliminates the potential conflict of interest present in traditional dealing desk models.

ECN spreads reflect actual incremental price fluctuations, unlike marked-up spreads used by other brokers. This appeals to traders who value precision and fairness in their trades.

Benefits of ECN Trading

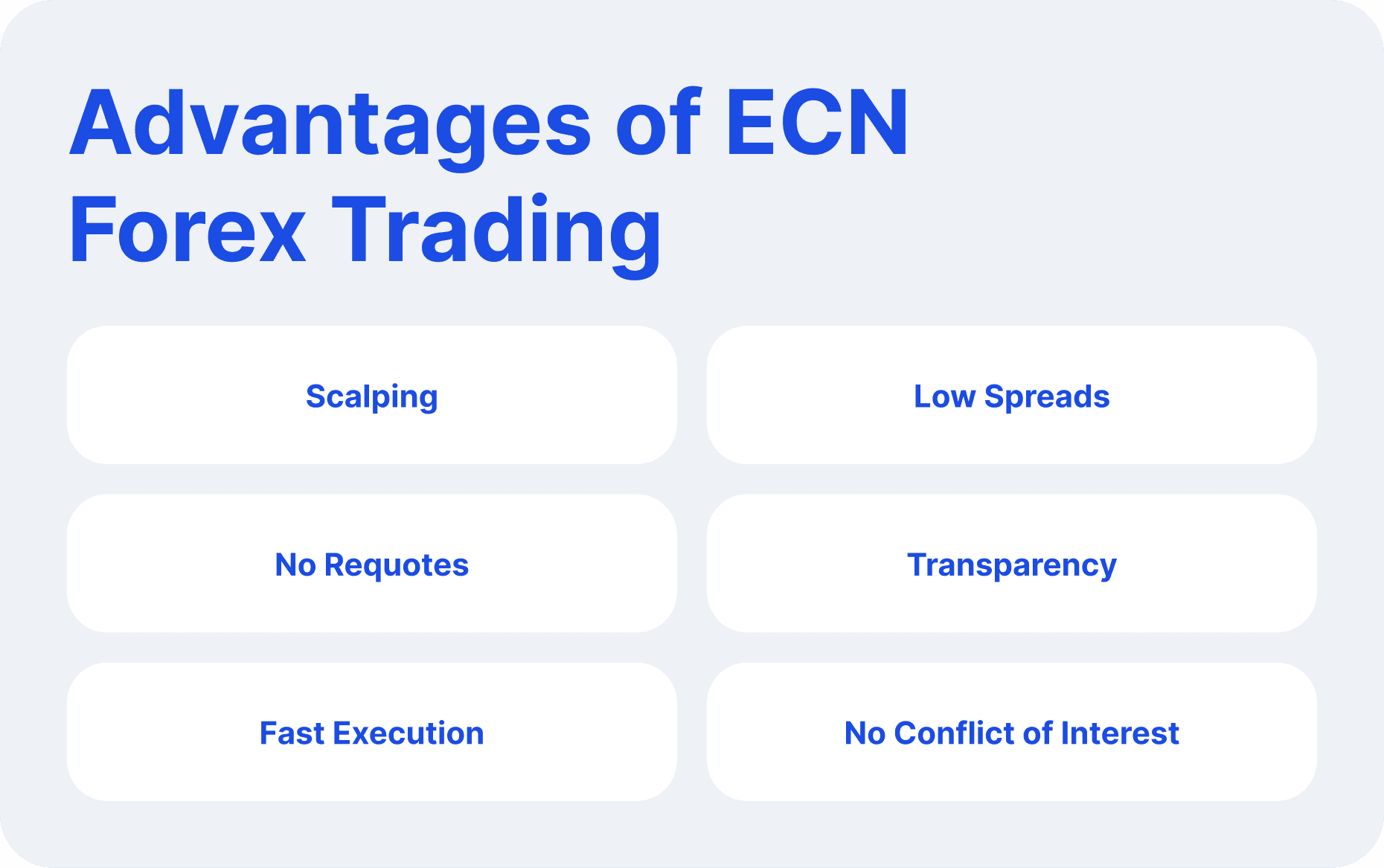

The growing demand for transparent trading conditions, competitive pricing, and lower transaction costs makes launching an ECN Forex broker a lucrative business opportunity. Entrepreneurs entering this field benefit from the following:

Tight Spreads: Since ECNs aggregate quotes from different liquidity providers, they offer the most competitive pricing.

Transparency: Orders are matched at the best market price without interference, ensuring fairness.

Direct Access: Traders enjoy access to the interbank market, enabling seamless order execution.

Scalping and Automated Trading: ECN platforms suit traders who use short-term strategies, such as scalping and algorithms.

[aa quote-global]

Fast Fact

NASDAQ was integral in transitioning stock trading from traditional floor trading to electronic trading. In 1971, the Financial Industry Regulatory Authority (FINRA), formerly the National Association of Securities Dealers (NASD), launched it as the first electronic stock exchange.

[/aa]

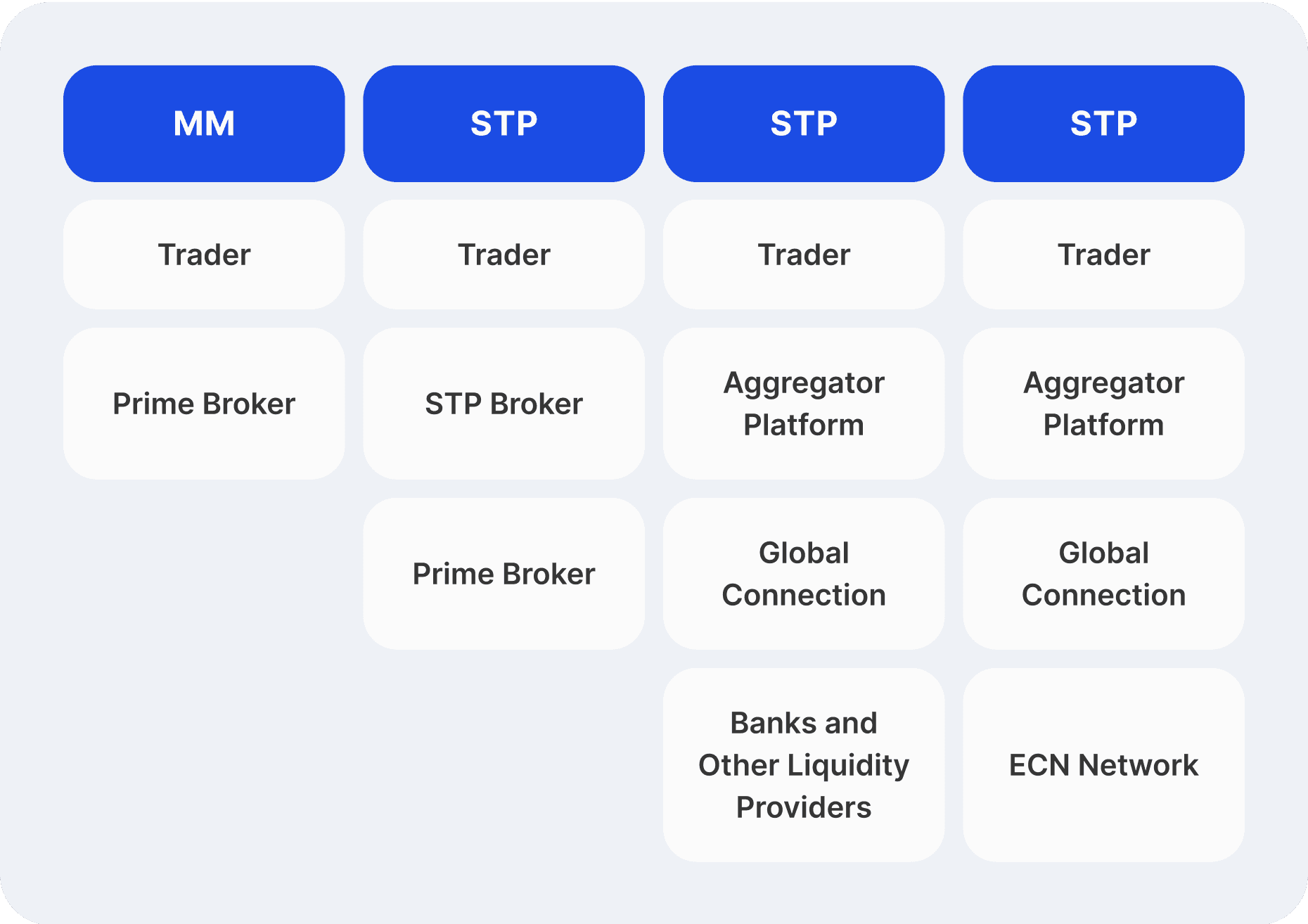

Difference Between ECN and STP Brokers

While both ECN and STP brokers offer direct market access, there are subtle differences. ECN brokers connect traders to a pool of liquidity providers within their network, while STP brokers route orders directly to a single liquidity provider. This can influence the available spreads and execution speed.

ECN Brokers:

Connect you directly to multiple trading sources

Show you actual raw market prices

Charge a small fee for their awesome service

100% transparent about everything

STP Brokers:

Work with just one trading source

Might add a little extra to their prices

Less transparent pricing mechanism

Simpler technological infrastructure

How profitable is ECN Broker?

ECN brokers' primary income source is commission-based revenue. Traders are charged a transparent fee for each transaction, typically ranging between $2 and $10 per standard lot traded. This commission structure varies depending on multiple factors, including trading volume, specific financial instruments, and account types. The beauty of this model lies in its straightforward nature—brokers earn money regardless of trade outcomes, creating a win-win scenario for both the platform and its users.

While pure ECN models aim to minimize spreads, some brokers implement subtle spread markup strategies. These involve adding a minimal amount—usually between 0.1 and 0.5 pips—to the interbank spread. This approach generates a modest additional revenue stream without significantly impacting trader experience or competitiveness.

Let's consider a realistic scenario. A medium-sized ECN broker with 500 active traders and an average monthly trading volume of 10,000 lots could potentially generate around $50,000 in commissions monthly. This translates to an annual revenue potential of approximately $600,000 before accounting for operational expenses.

Steps to Start an ECN Broker in 2025

Starting an ECN brokerage requires a substantial initial investment, typically between $500,000 and $1.5 million. Annual operating costs can fluctuate between $250,000 and $750,000, reflecting the complex technological and regulatory infrastructure required. The potential yearly revenue is equally impressive, with successful ECN brokers generating between $500,000 and $3 million annually.

Here's a roadmap to consider if you're serious about launching your own ECN platform in 2025:

1. Understand the Market

Research the Forex market and identify your target audience, such as Forex traders, scalpers, or institutional investors. Analyze competitors, such as the best ECN brokers, to learn about trading conditions and the features they offer.

Develop a comprehensive business plan outlining your target market, service offerings, revenue model, and technology infrastructure needs.

2. Acquire Licensing and Compliance

Secure the necessary licenses in your jurisdiction. Regulatory requirements vary across regions, so ensure compliance with foreign exchange trading laws.

3. Choose a Reliable Trading Platform

Invest in robust trading platforms with features like market execution, customizable charts, and integration with liquidity providers. Platforms supporting direct market access and ECN accounts ensure seamless trading for clients.

4. Build Relationships with Liquidity Providers

Collaborate with different liquidity providers to offer competitive spreads and deep liquidity. This strengthens your ECN trading ecosystem, benefiting your clients.

5. Design an Attractive Fee Structure

Focus on transparency. Charge fees based on trading volume rather than marking up spreads, ensuring you cater to individual trading styles and attract interested investors.

6. Implement Advanced Technology

Integrate solutions for automated trading, advanced analytics, and risk management tools to enhance client satisfaction and operational efficiency. Utilise advanced risk management tools to manage margin calls and stop-loss orders.

7. Develop a Marketing Strategy

Promote your broker as a trusted ECN Forex broker offering clients direct access to the market. Highlight benefits like competitive pricing and transparency in campaigns targeting Forex traders and institutional investors.

Provide exceptional customer support to foster long-term client relationships.

8. Improve Everyday

Monitor market trends and client feedback regularly to identify areas for improvement. Invest in research and development to enhance your trading platform and services. Adopt innovative technologies and strategies to stay ahead of the competition.

Challenges in ECN Broker Operation

Starting an ECN broker comes with several challenges, as any business in modern reality.

Financial Challenges

Financial hurdles represent a significant initial barrier, with substantial investments required in technological infrastructure that can easily run into hundreds of thousands of dollars. Imagine spending a small fortune on technology that becomes outdated faster than your smartphone.

The technological ecosystem demands continuous evolution, requiring brokers to consistently upgrade systems, implement cutting-edge cybersecurity protocols, and develop robust trading platforms that can handle millisecond-level executions.

Regulatory Challenges

Regulatory compliance presents another formidable challenge as financial markets become increasingly scrutinized globally. If you take one wrong step, you could face massive fines.

ECN brokers must navigate a complex web of international financial regulations, obtain licenses from multiple jurisdictions, implement stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, and maintain transparency that meets increasingly strict global standards.

Competition Challenges

Competition in this industry is intense. Envision a market where every participant competes for the same customers while working with profit margins much tighter than those in typical retail. To truly stand out, it’s not enough to be good—you must be exceptional. This demands continual innovation in your trading tools, platform speed, and the variety of trading options you offer.

In this landscape, technology is a double-edged sword. A small glitch can drive traders away as swiftly as a fire alarm. Systems must process trades in milliseconds, defend against cyber threats, and maintain flawless operation 24/7. Any downtime, even briefly, can lead to significant losses in customers and reputation.

Liquidity Challenges

Liquidity management emerges as another critical challenge. Brokers must develop and maintain relationships with multiple tier-1 liquidity providers, and they need multiple partners who can provide consistent, competitive pricing.

Client Retention

Customer acquisition and retention represent ongoing challenges that require sophisticated marketing strategies and exceptional service quality. This involves attracting traders through competitive offerings and providing educational resources, advanced trading tools, and responsive customer support that builds long-term trust and loyalty.

The psychological and operational challenges of managing trader expectations are critical when it comes to client retention. Traders demand perfection, instant results, and complete transparency. Their moods can swing rapidly—from satisfaction to frustration, sometimes leading to lengthy complaints.

Conclusion

Ultimately, starting an ECN broker can be a lucrative business opportunity, but as the industry matures, the competition grows. In 2025, success in the ECN brokerage would mainly demand a holistic approach that balances technological innovation, regulatory compliance, financial strategy, and exceptional customer experience.

Read also